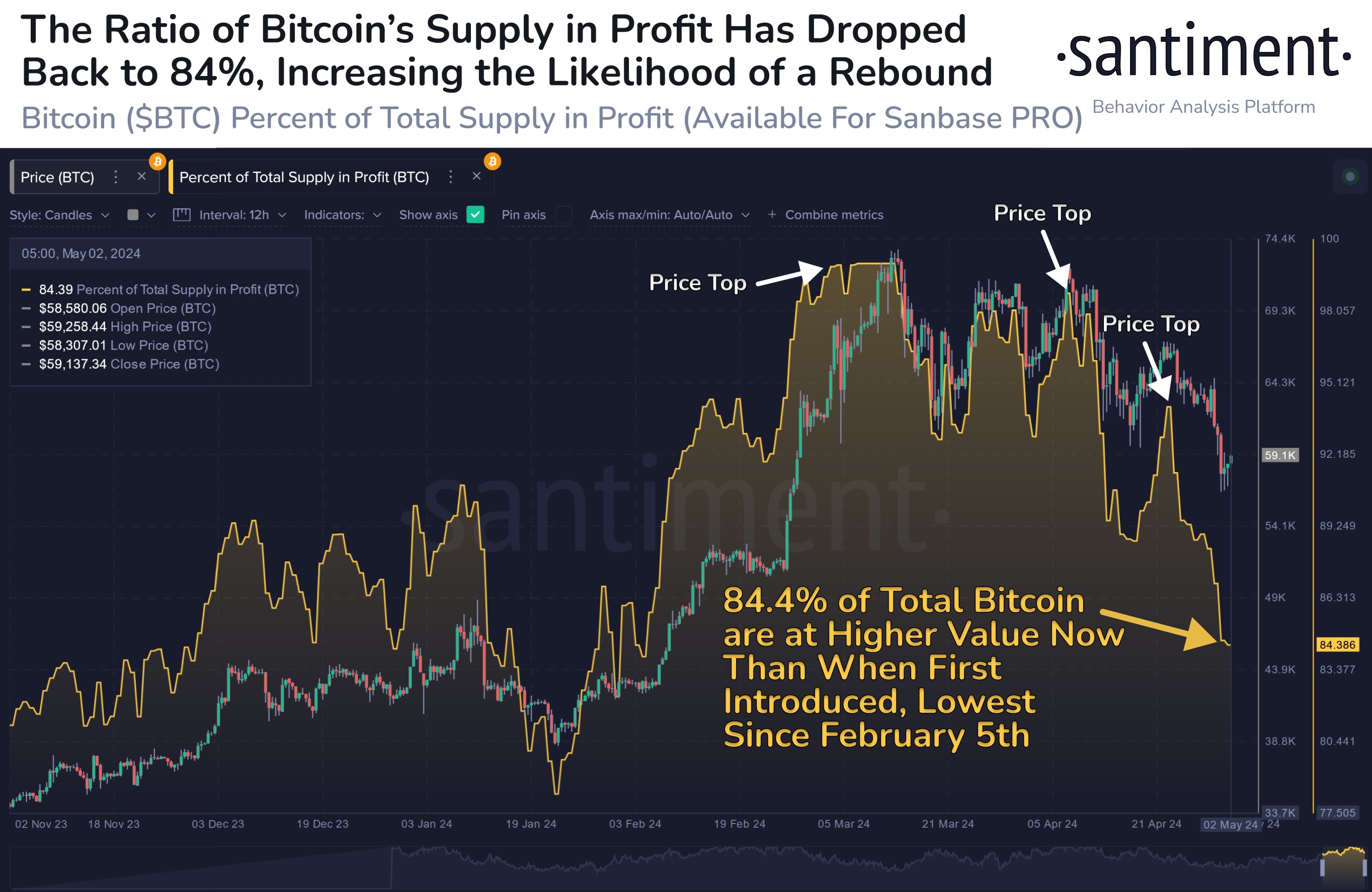

Bitcoin (BTC) is flashing a potentially bullish indicator amid an overall crypto market downtick, according to the digital asset analytics firm Santiment.

The firm notes in a new post on the social media platform X that the percentage of the BTC network’s available supply in profit is 84.4%.

Explains Santiment,

“This BTC ratio is at its lowest level in 2 months. Lower levels generally justify more bullish conditions.”

BTC is trading at $59,170 at time of writing. The top-ranked crypto asset by market cap is up more than 2.5% in the past 24 hours but down more than 8% in the past seven days.

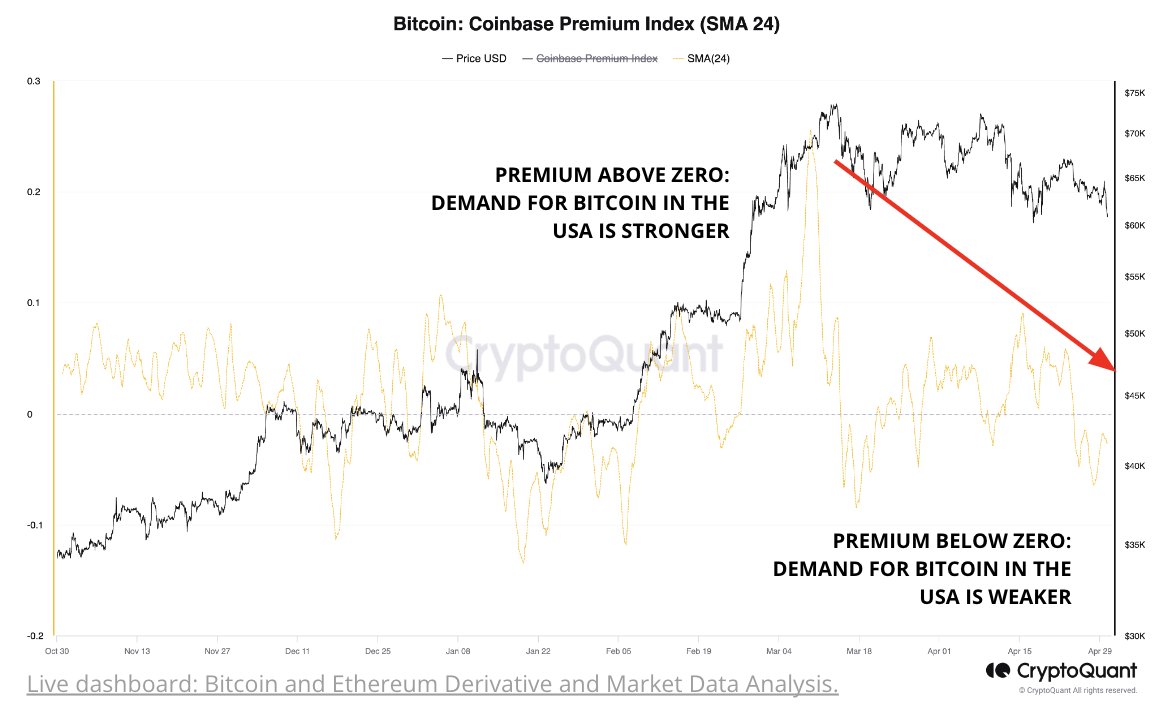

A fellow analytics firm, CryptoQuant, looked into potential factors driving the downtick in the BTC market over the past week.

“Market sentiment towards Bitcoin is waning, evident from negative Coinbase premiums and lesser leverage in futures. This decrease in enthusiasm suggests a cautious approach from traders.

A slowdown in BTC demand from large investors (whales) is evident. The growth peaked at 12% monthly in late March, now down to 6%. Such deceleration affects potential price rallies, which rely on robust whale demand.”

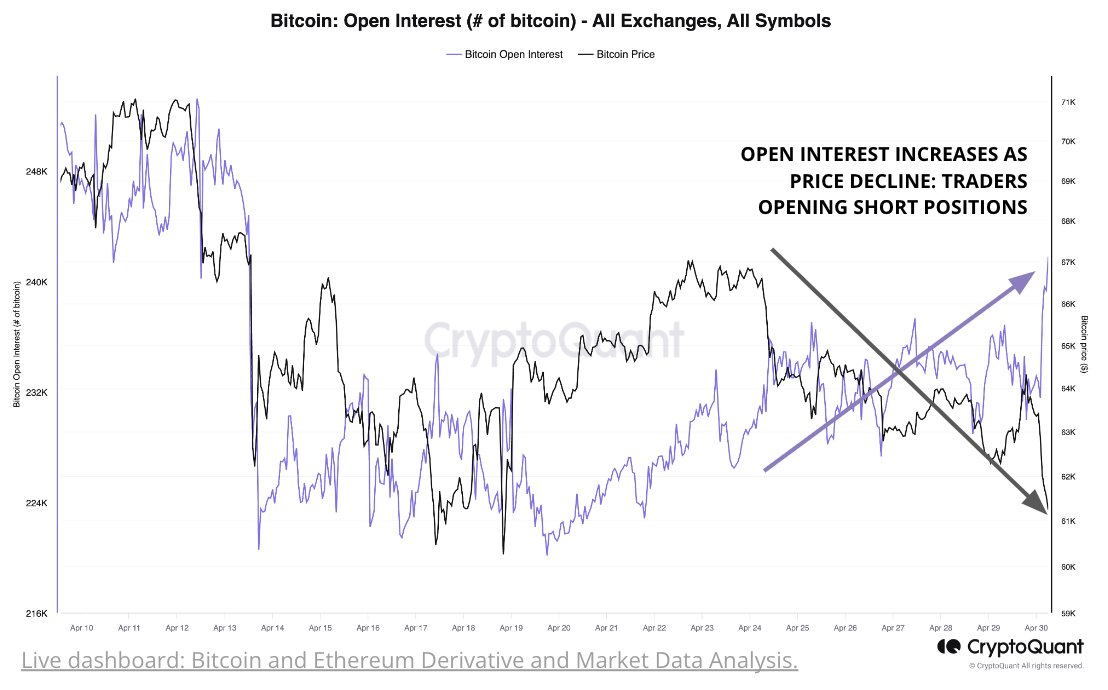

CryptoQuant also notes that miners have been selling off BTC, adding to the market’s supply and “undermining potential price supports.” According to the analytics firm, increased short positions also indicate that traders have been betting on the top crypto asset dropping lower.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney