- Whale transactions have risen significantly over the last few weeks

- Steady accumulation supported MKR’s price, with the same hiking by 36% in a month

MKR, the governance token of leading stablecoin lending protocol MakerDAO, has caught the eye of institutional investors.

MKR accumulation on the rise

According to on-chain tracking platform Spot On Chain, as many as 13 wallets withdrew 13,560 MKR tokens, worth nearly $46 million at prevailing market prices, from Binance over the past week. In fact, about 65% of the tokens were withdrawn in the last 24 hours alone.

Additionally, three more wallets carried out test withdrawals and are likely to extract more MKR soon.

Interestingly, all the 16 wallets received funding from one common wallet, which allegedly belonged to Anchorage Digital, a well-known crypto-custodian for financial institutions. This has fueled speculations that all the wallets might belong to one entity.

However, the accumulation trend wasn’t just restricted to a select cohort, but rather represented a broader market phenomenon.

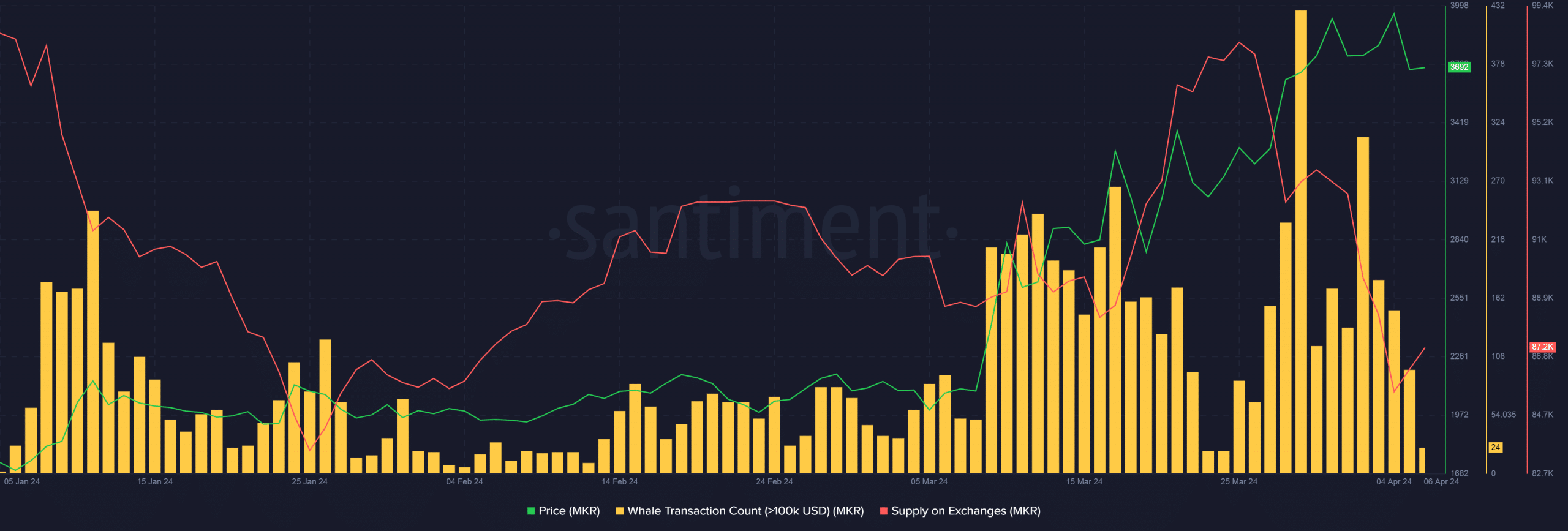

As per AMBCrypto’s analysis of Santiment’s data, whale transactions surged significantly over the last month. The fact that MKR’s exchange reserves depleted in the same time proved that investors have been stacking up.

In fact, the aggressive accumulation helped MKR, pushing its price up by 36% in a month.

Source: Santiment

Is this the reason?

The motivation to HODL comes as MKR’s parent protocol MakerDAO gears up to launch Endgame – An ambitious project introduced by co-founder Rune Christensen. It is aimed at overhauling the governance and tokenomics of the Maker Ecosystem. The launch is scheduled for sometime in summer 2024.

Endgame would see the launch of a new stablecoin and a new governance token, wherein each MKR holder would have the option of upgrading to the new token.

Is your portfolio green? Check out the MKR Profit Calculator

What’s happening in the broader market?

While this factor is specific to Maker’s ecosystem, it is pertinent to observe how the accumulation trend fit with the broader market.

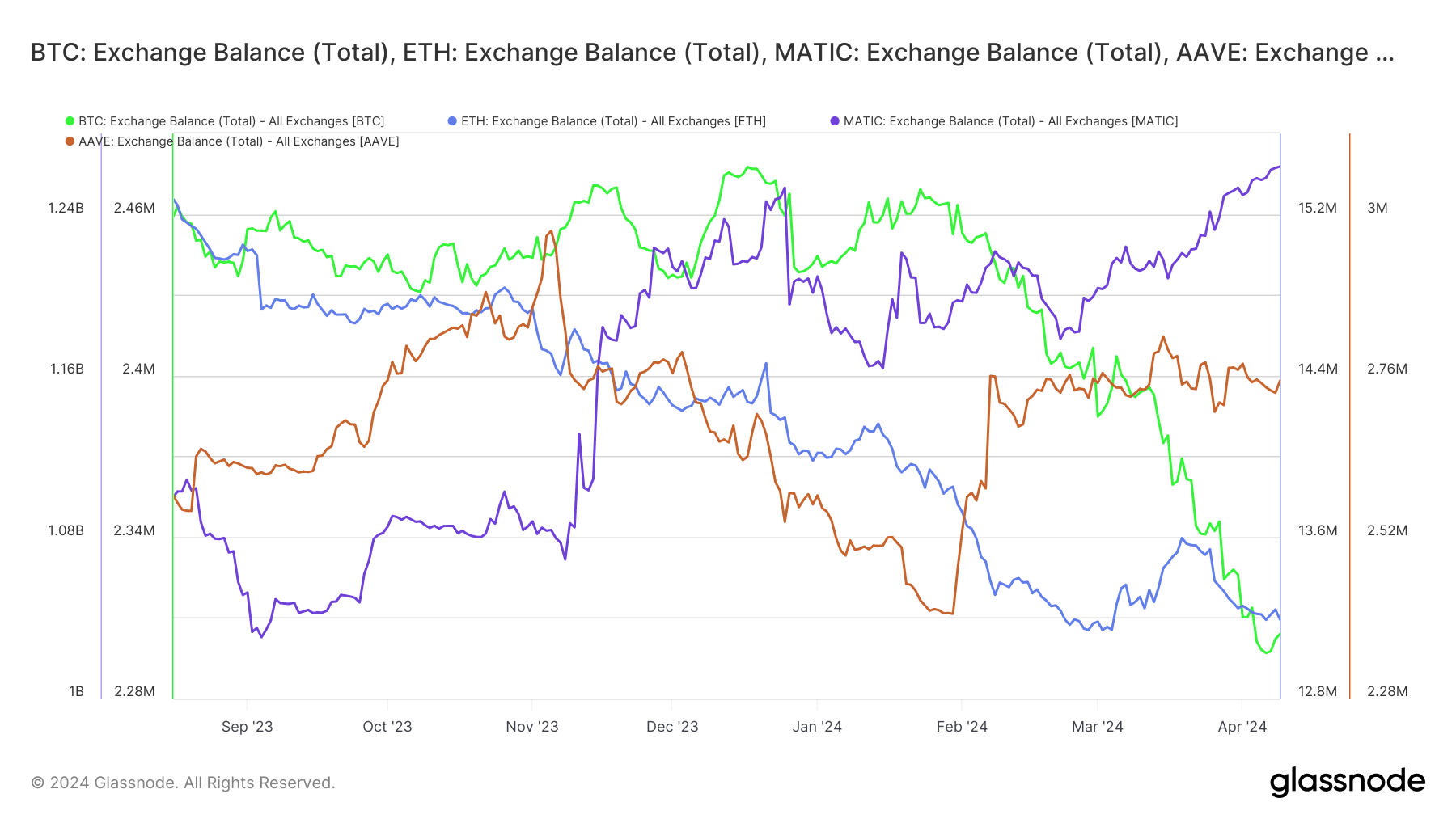

As per AMBCrypto’s analysis of Glassnode’s data, leading market coins like Bitcoin [BTC] and Ethereum [ETH] saw their supply on exchanges plummet in recent weeks, implying accumulation.

However, the supply of layer-2 (L2) coins Polygon [MATIC] and another popular DeFi token Aave [AAVE] increased noticeably – A sign of possible sell-offs.

Source: Glassnode