- Bitcoin and Ethereum recorded a decline in volatility over the last few days

- Bearish sentiment retained dominance across the market

After noting massive fluctuations in terms of price over the last few weeks, both Bitcoin [BTC] and Ethereum [ETH] saw a period of stagnancy on the price front.

Calm before the storm?

In fact, Bitcoin trading calmed down significantly this week, with volatility dropping on the back of trading volumes being compressed from 70% to 50%.

When a market is consolidating, many traders prefer to accumulate long positions. Despite this trend, however, most traders have decided to be bearish as far as BTC and ETH are concerned.

One of the reasons for the same is that the market seems to be anticipating further delays in the U.S Securities and Exchange Commission’s (SEC) approval of a spot Ethereum ETF. This is reflected in the deepening negative skew of ETH risk reversals, which now stand at -13% in the front-month contract. A negative skew means that put options are more expensive than call options for the same strike price and expiry.

In this context, a negative skew of -13% in front-month contracts suggests a stronger preference for puts. This indicates that investors are more worried about potential price declines than they are excited about price surges in the near future.

Source: QCP

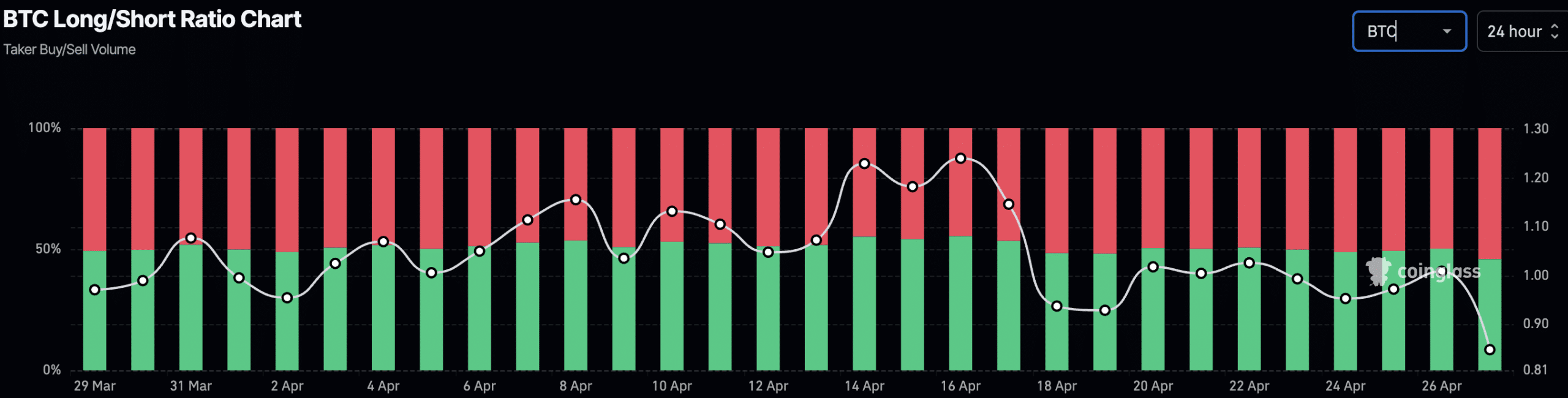

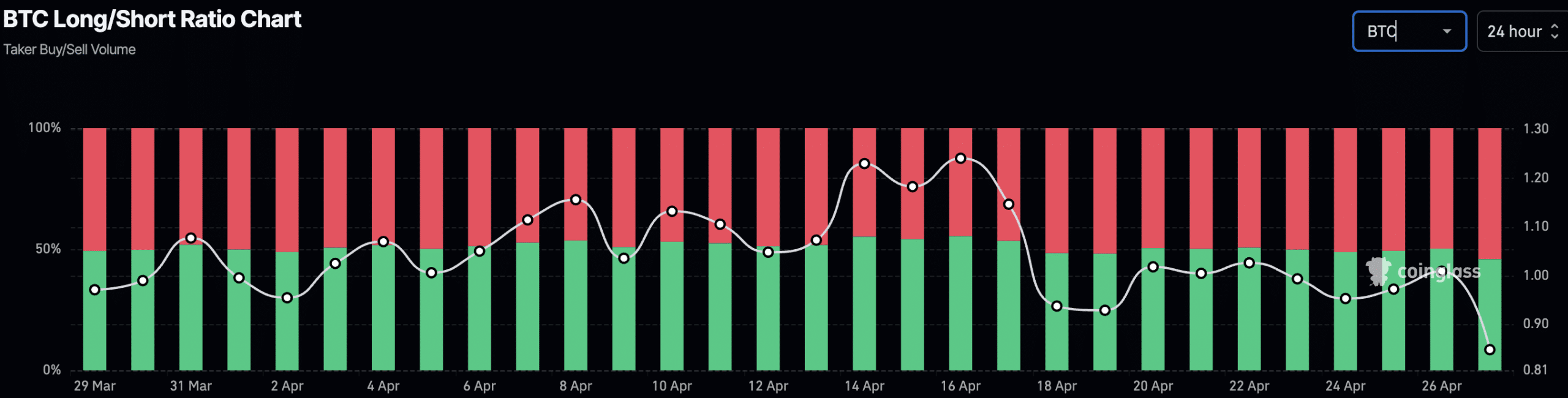

For Bitcoin, the percentage of short positions taken against BTC has risen from 49% to 54% in the last 24 hours.

Source: Coinglass

However, there’s a potential bright spot on the horizon next week. The launch of Hong Kong-based spot ETFs for both BTC and ETH could serve as a gateway for institutional capital inflows from Asia.

This may help turn the tides in favor of both BTC and ETH and the bearish sentiment around both these cryptos could fall.

A tale of two coins

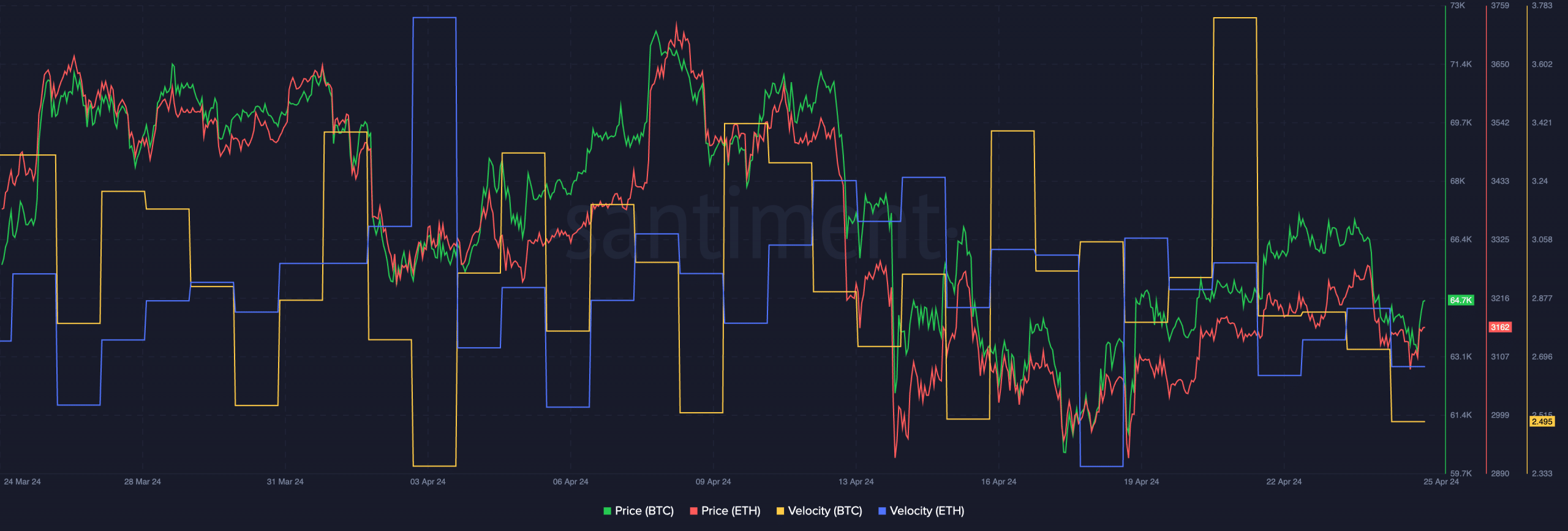

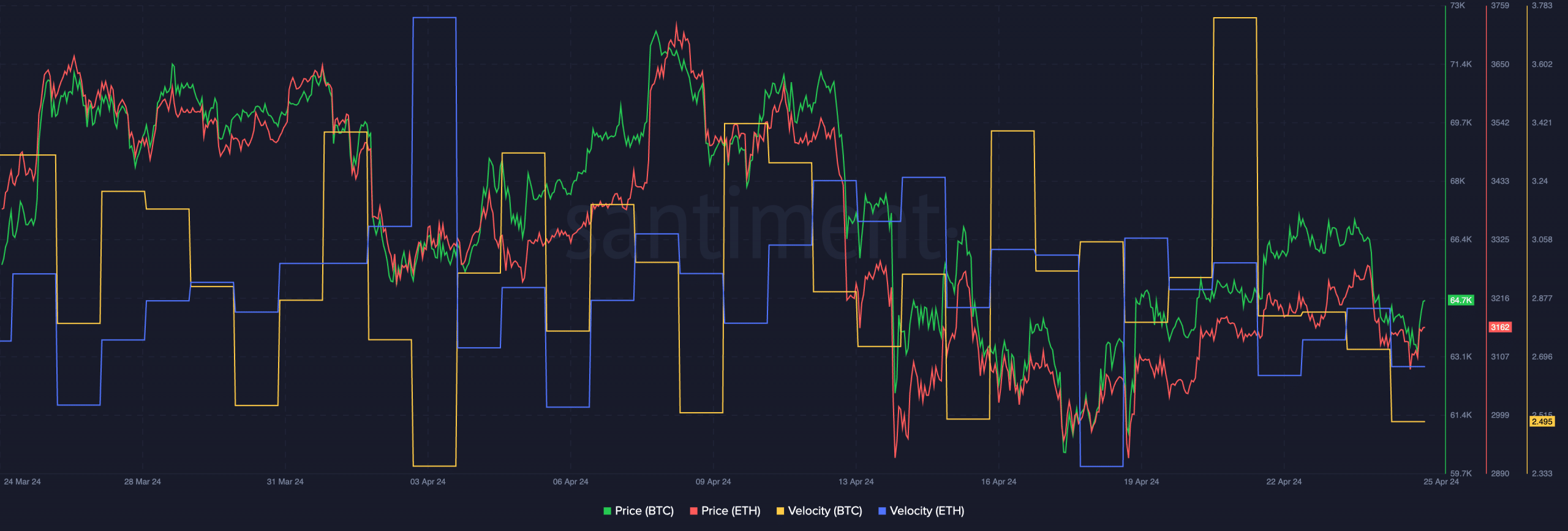

Over the last few weeks, the price movements of BTC and ETH have been heavily correlated. Both the coins have seen some corrections over the last few days which have added to the bearish sentiment around these cryptocurrencies. Additionally, the velocity at which both these cryptos were trading at has also declined lately.

Simply put, the frequency at which BTC and ETH were being traded fell on the charts.

Source: Santiment

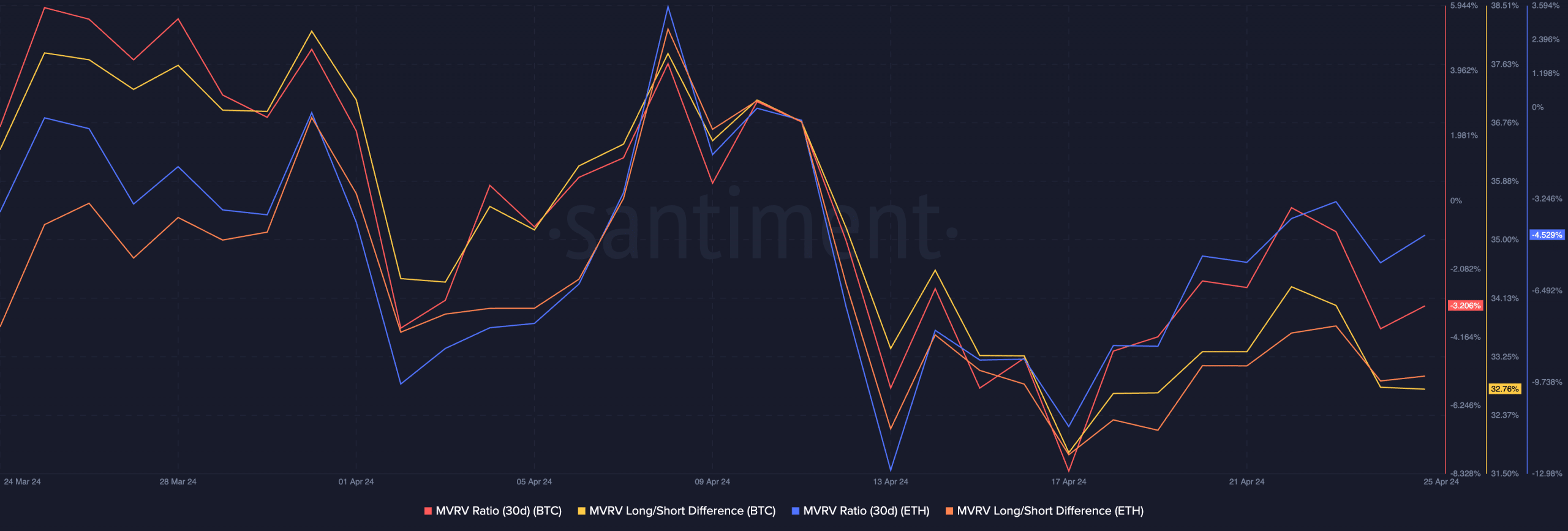

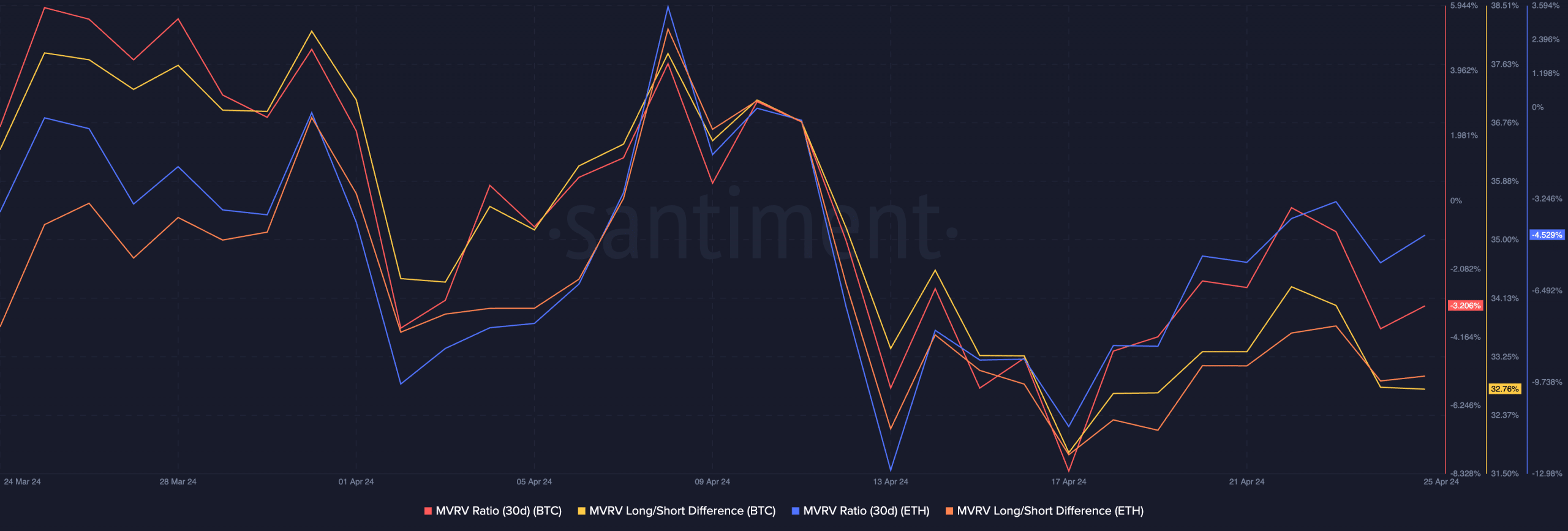

Finally, the MVRV ratio for both BTC and ETH hiked, indicating that the profitability of most addresses holding these coins was relatively high.

Additionally, the Long/Short difference for these coins also surged – Signaling that there was an increase in number of long-term holders of BTC.

Is your portfolio green? Check out the BTC Profit Calculator

Source: Santiment