- BTC and ETH traded below their maximum pain points, suggesting that traders might face severe losses

- Implied Volatility dropped, implying a lack of bullish expectations going forward

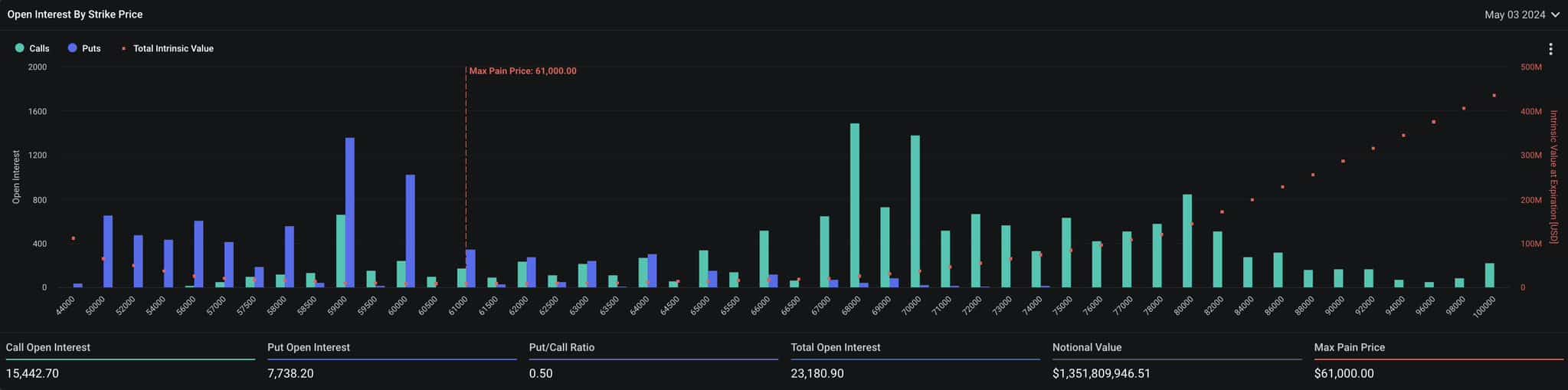

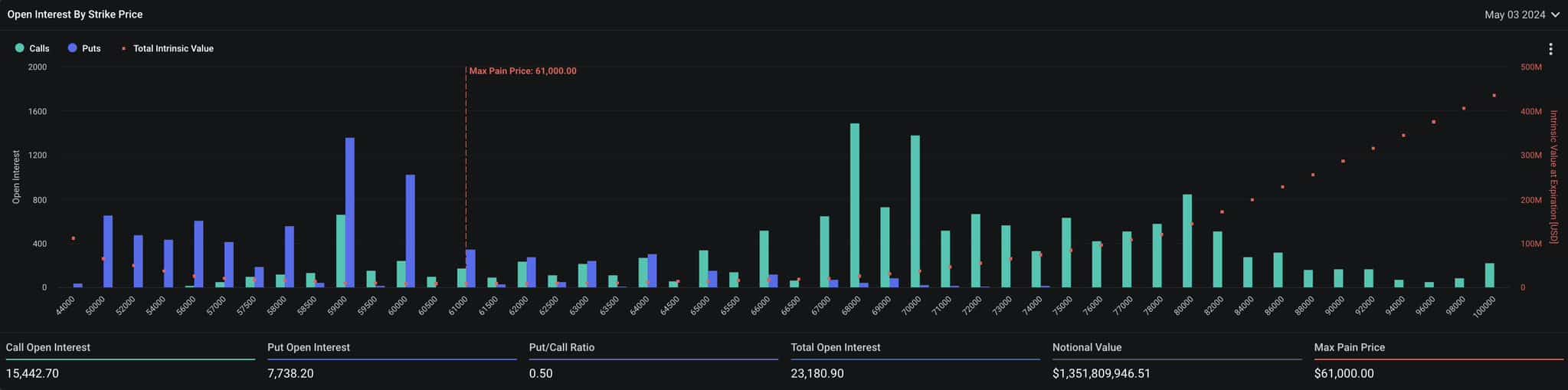

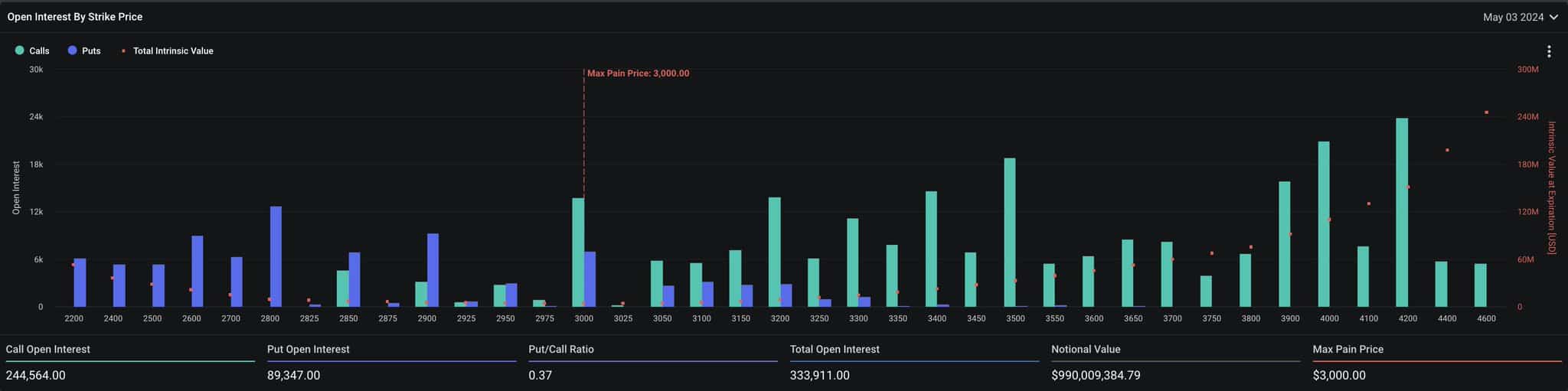

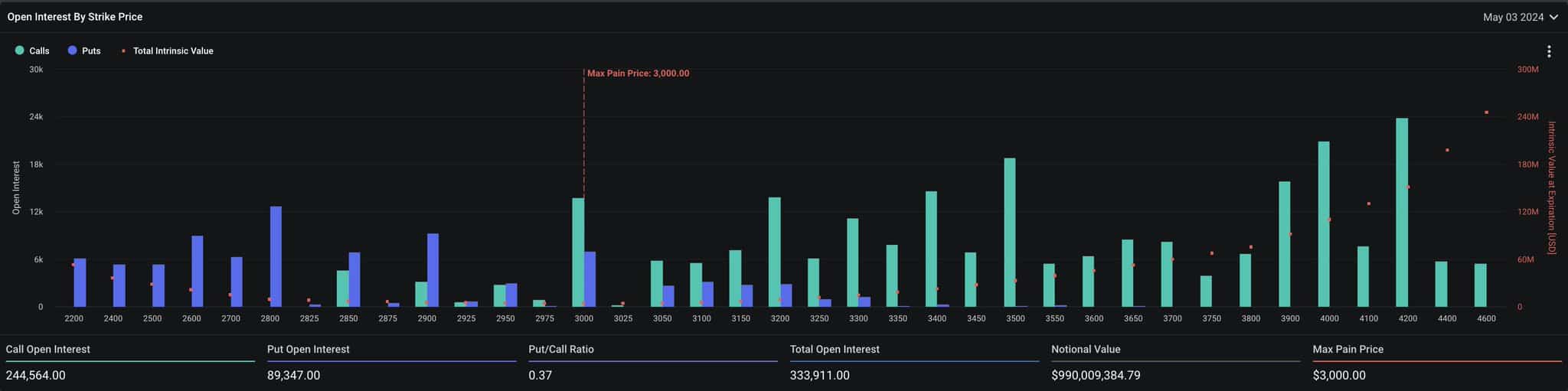

Bitcoin [BTC] and Ethereum [ETH] options contracts worth about $2.3 billion are set to expire on Friday, 3 May. According to Deribit Exchange, the Bitcoin options are valued at $1.35 billion. ETH contracts, on the other hand, are worth $990 million. The value of these contracts seems to be lower than the figure AMBCrypto reported last week – $9.3 billion.

The decline could be attributed to the price action of both cryptocurrencies. For most of the week, BTC and ETH recorded severe declines before recent appreciation. As a result, traders have been cautious about opening more positions.

At the time of writing, Bitcoin’s put/call ratio (PCR) was 0.50. This ratio gauges the overall market mood. A PCR higher than 1 suggests that traders are buying more puts than calls— A sign of bearish sentiment.

Source: Deribit

Anarchy looms as traders gear up for results

However, if the PCR is lower than 0.70, it implies more calls than puts, meaning that the broader sentiment is bullish. Simply put, the reading suggests that traders expect Bitcoin to end the week stronger than how it started.

For Bitcoin, the maximum pain point was $61,000 on the charts. This means that if Bitcoin drops to this price, most options traders will suffer intense losses.

In Ethereum’s case, its PCR was 0.37, implying that there were more bullish bets than bearish ones. The maximum pain point for ETH was $3,000. As such, traders might need to hope that the altcoin trades above this level before the day ends.

Source: Deribit

At press time, both Bitcoin and Ethereum were valued at levels below the max pain point. If this remains the case by the time the contracts expire, the day could be a “red one” for many traders.

There are a few reasons why BTC and ETH might end the week on a bearish note. Greeks.live, the notable Options trading handle on X, explained,

“The Hong Kong ETF listing failed to bring much incremental volume, the US BTC ETF continued to flow out, the weakness of the market led to weakening market confidence. The current point of sustained sideways trading is unlikely, no rebound is bound to be a downward relay, the giant whale on the lack of confidence in the market.”

Volatility falls: Will BTC and ETH follow?

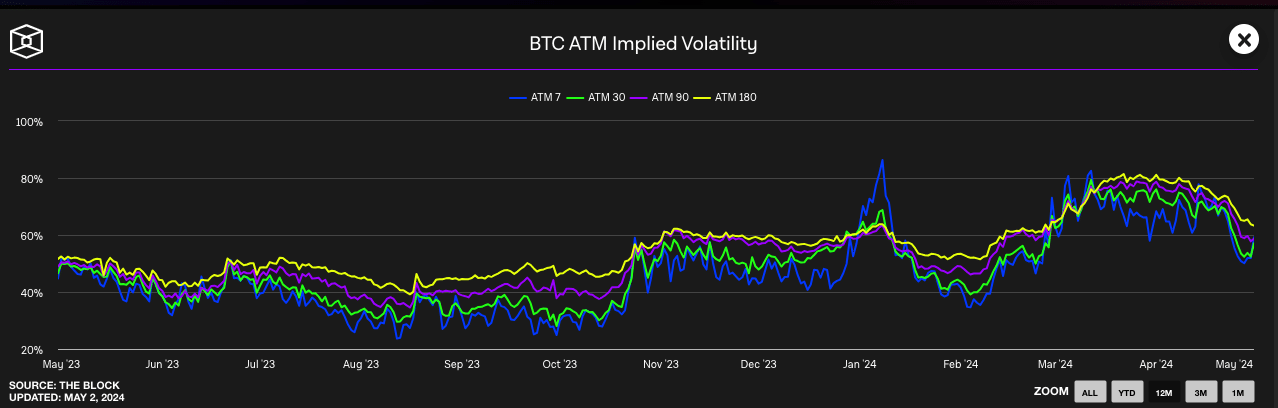

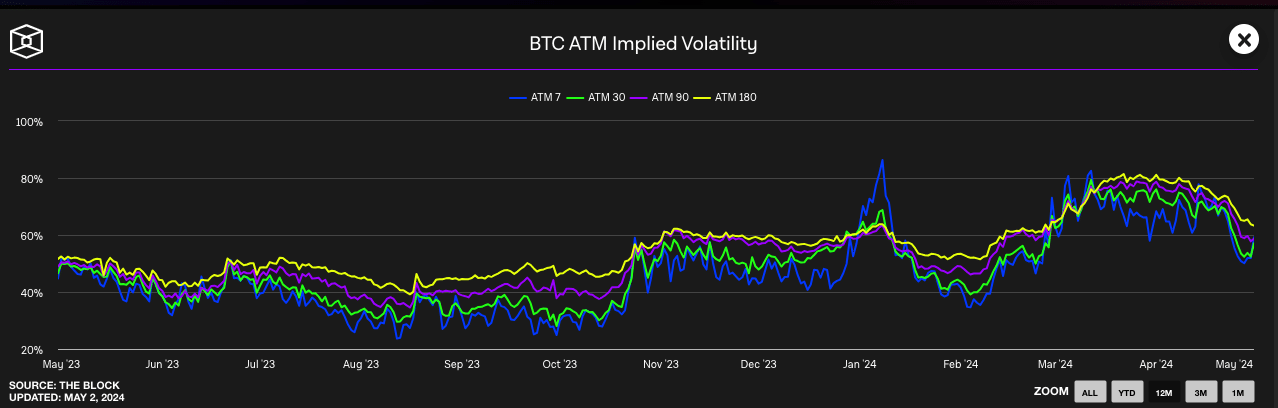

In addition, AMBCrypto looked at Bitcoin’s Implied Volatility (IV). The IV shows the level of confidence in the market, and if it would be a good idea to buy call/put options going forward.

If the IV increases, market participants are uncertain where the next prices might move. However, if the metric declines, it means traders are unwilling to pay an additional fee to safeguard their existing positions.

Source: TheBlock

Given the price of Bitcoin and ETH, the IV declined, suggesting that traders have been uncertain that their bullish bets would pay off.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Should this sentiment play out, ETH’s price might slip below $2,900 again. For BTC, it might start trading at a lower value than $59,000 again.