- Bitcoin has seen a rally in buy calls on social media.

- However, the coin remains at risk of a correction in the short term.

Bitcoin’s [BTC] social activity has seen a significant uptick as the cryptocurrency market anticipates the approval of the spot Ethereum [ETH] Exchange-Traded Fund [ETF].

In a recent post on X (formerly Twitter), Santiment noted that the surging social media discussions about the leading cryptocurrency asset have been mostly positive, with the market making more buy calls than sell calls.

When an asset sees a surge in buy calls among its traders on social media, they are expressing positive sentiment about the asset’s continued price growth. Some traders even consider it a good entry point, perceiving prices as low and due for an upswing.

BTC holders must look before the leap

While this may offer a good entry opportunity for some, “paper hands” have been known to sell when an asset’s social activity increases like this.

This is because the surge in BTC buy calls among its traders is often due to speculation and not backed by a corresponding demand for the coin. Therefore, newer investors who need more conviction in the coin’s long-term potential might be hesitant to hold during these periods even with positive social sentiment.

Also, short-term traders often see the surge in buy calls as an opportunity to profit. Hence, a temporary sell-off is possible even amidst overall bullish sentiment.

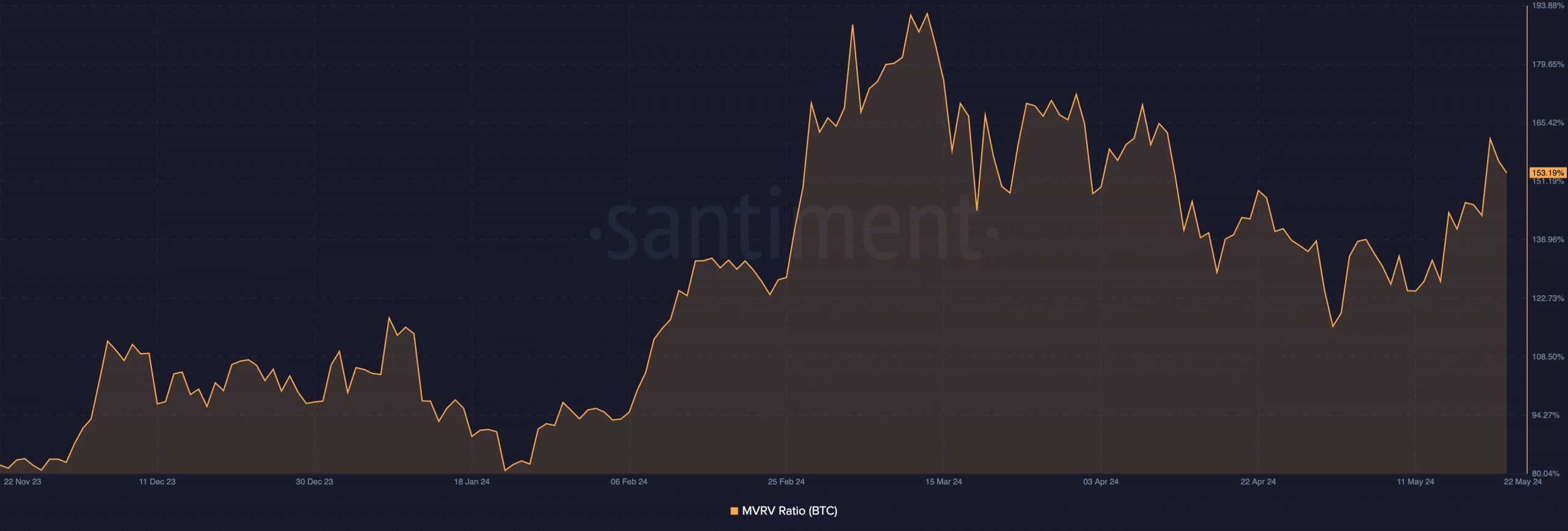

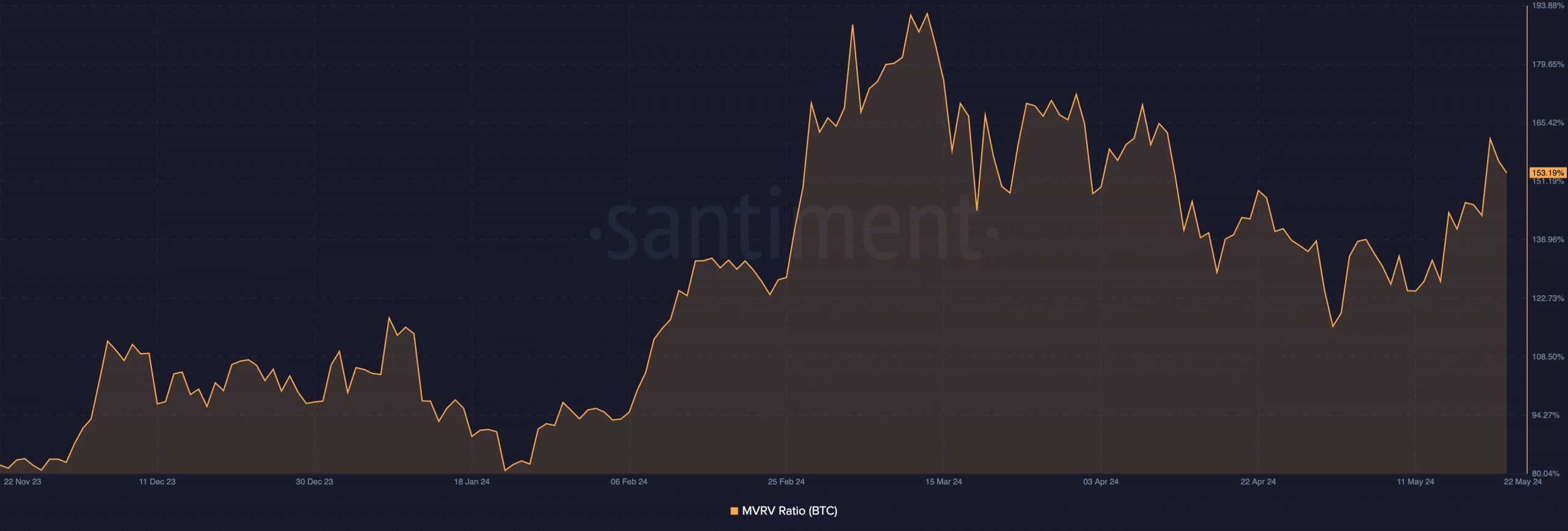

Moreover, BTC’s Market Value to Realised Value (MVRV) ratio returned a high value of 153.19% at press time. The metric tracks the ratio between the coin’s current market price and the average price of each acquired token.

Source: Santiment

When it surges in this manner, the asset is said to be overvalued, and on average, coin holders are sitting on profits. This may lead to a spike in selling pressure as investors are more likely to take profits when the potential return is high.

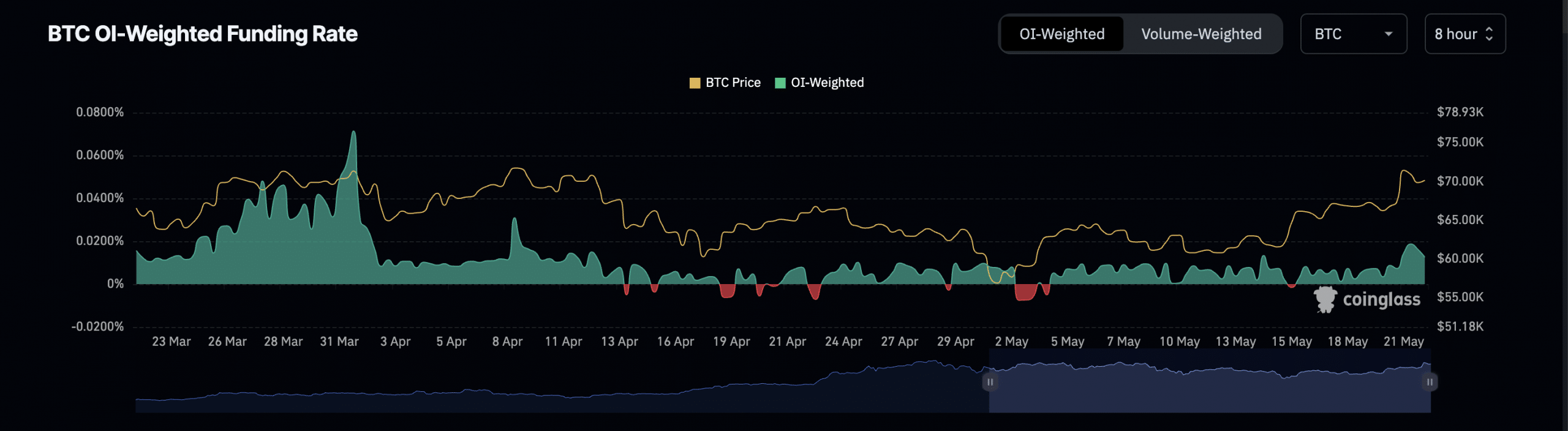

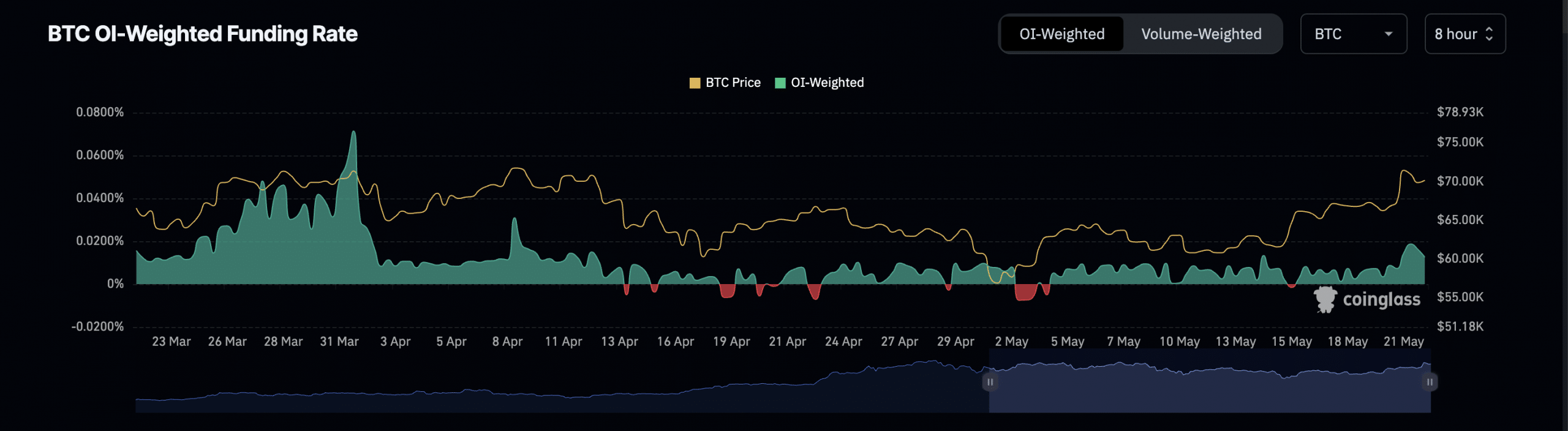

The rise in BTC’s funding rates also heightens the likelihood of a short-term correction in its price. On 21st May, the coin’s funding rate across cryptocurrency exchanges was 0.018%, its highest level in a month, according to Coinglass’ data.

Is your portfolio green? Check out the BTC Profit Calculator

Source: Coinglass

Generally, when an asset’s futures funding rate rallies, it is a bullish signal, suggesting a strong demand for long positions.

However, when it gets too high and becomes unsustainable, it may result in forced selling by leveraged long positions. This may trigger price swings and result in unexpected price drops.