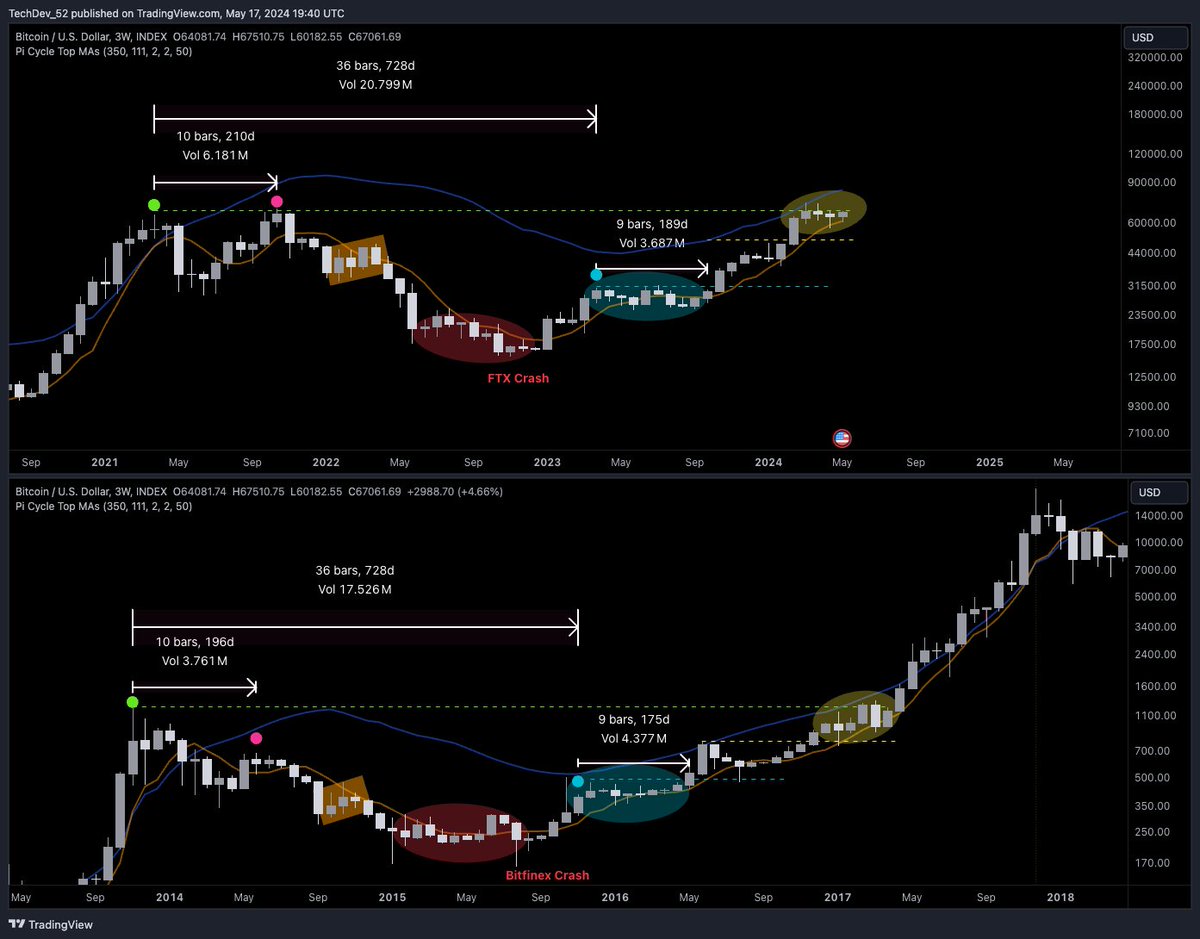

Bitcoin’s (BTC) current market structure looks similar to 2017, just before its massive 1,200% rally to its previous record high of $20,000, according to widely followed crypto analyst TechDev.

The pseudonymous analyst shares with his 450,000 followers on the social media platform X a chart that suggests the current market cycle has been strikingly reminiscent of the 2017 Bitcoin bull run.

TechDev’s chart highlights that both bear markets bottomed out during the crash of two major crypto exchanges, followed by repeated rallies and consolidation phases.

“The more things change, the more they stay the same.”

Looking at the trader’s chart, he seems to suggest that BTC is currently in a consolidation phase similar to 2017 when it was trading at around $1,500 before a parabolic run to a cycle high of $20,000.

At time of writing, Bitcoin is worth $67,060.

The analyst also looks at Bitcoin’s relative strength index (RSI), which aims to gauge the momentum of an asset. According to TechDev, Bitcoin has historically topped out when its RSI reaches the top of a long-term channel, which has not yet occurred.

“You’re in the green zone. Don’t waste it.”

TechDev is also looking at the OTHERS chart, which tracks the market cap of all crypto excluding the top 10 digital assets and stablecoins. Specifically, he’s looking at the chart’s stochastic RSI, moving average convergence divergence (MACD) and logarithmic Bollinger Band indicator.

The MACD is traditionally used to pinpoint reversals based on the convergence or divergence of moving averages, and the Bollinger Bands are meant to identify periods of impending sharp price movements based on volatility contraction.

According to the analyst, OTHERS, which is often used to gauge the strength of altcoins, has reached a “max compression” zone, suggesting that a big move to the upside is on the horizon. He also notes that the setup coincides with the return of “Roaring Kitty,” the leader of the movement that pumped the price of Gamestop (GME) in 2021.

“Roaring Kitty returns as this alt setup reappears.

There are no coincidences.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3