- BNB network’s metrics showed growth over the last quarter.

- Bearish sentiment around BNB grew as short positions increased.

Binance Smart Chain [BNB] was one network that faced a number of ups and downs over the last few months due to the problems faced by Binance in terms of regulatory scrutiny.

BNB does well

However, despite facing these issues, the BNB network continued to show growth. In the first quarter of 2024, the network saw a massive increase in revenue, totaling $66.8 million, marking a significant 70% rise from the previous quarter’s revenue of $39.2 million.

Q1 of 2024 outperformed any quarter in 2023 in terms of revenue generation. However, this surge in revenue was largely driven by the appreciation in the value of BNB.

Gas fees from DeFi transactions remained the primary source of revenue, contributing 76,200 BNB, a 1.7% increase from the previous quarter.

DeFi transactions accounted for 46% of total revenue. Notably, stablecoins experienced the largest QoQ revenue growth, climbing from 19,500 to 25,100 BNB, a 29% increase.

Conversely, the Gaming and Infrastructure categories saw significant declines in revenue.

In terms of overall activity, a 9% decrease in average daily transactions from Q4 was seen. Average daily active addresses also witnessed a significant 26% increase from 1.0 million to 1.3 million.

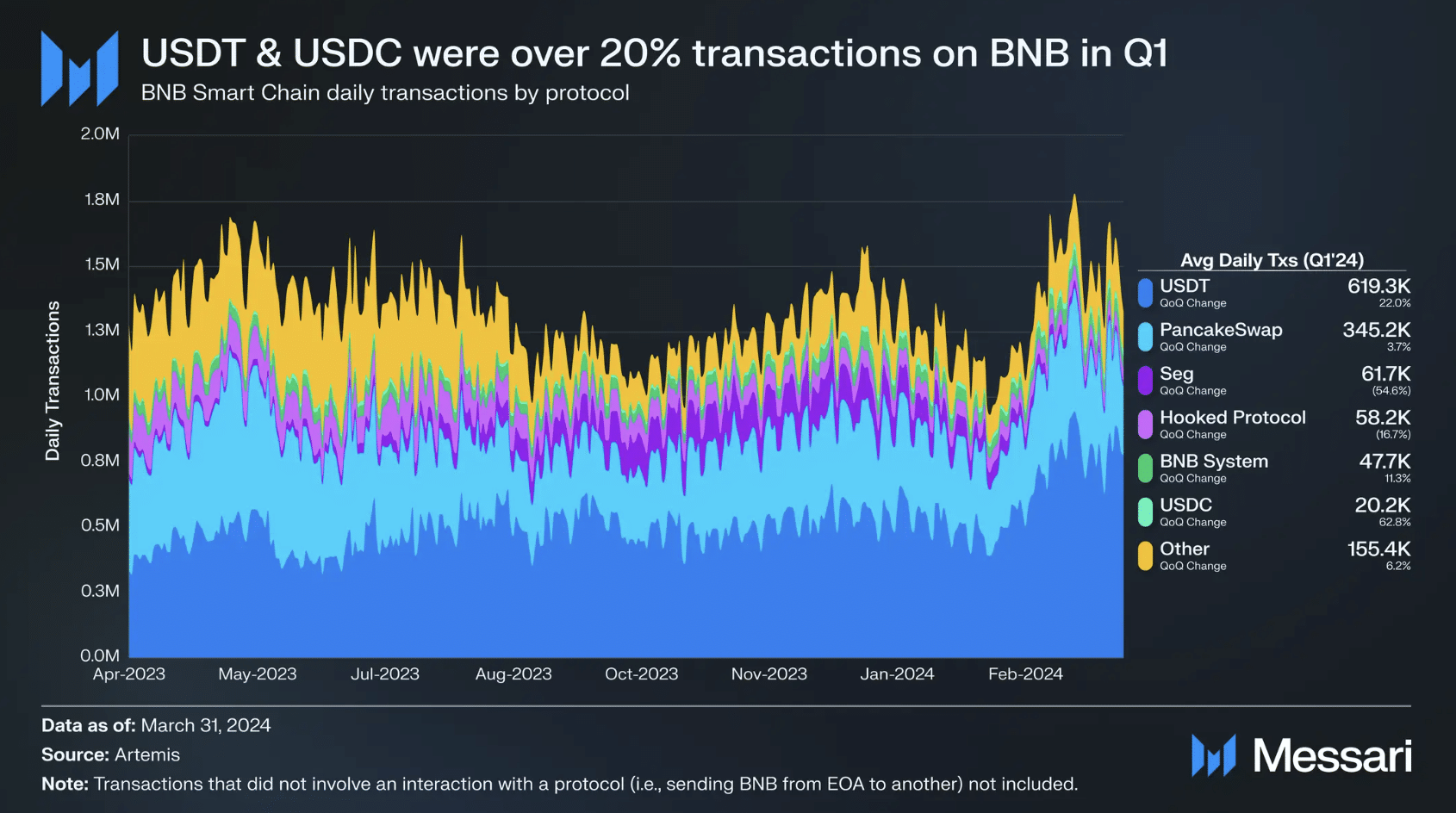

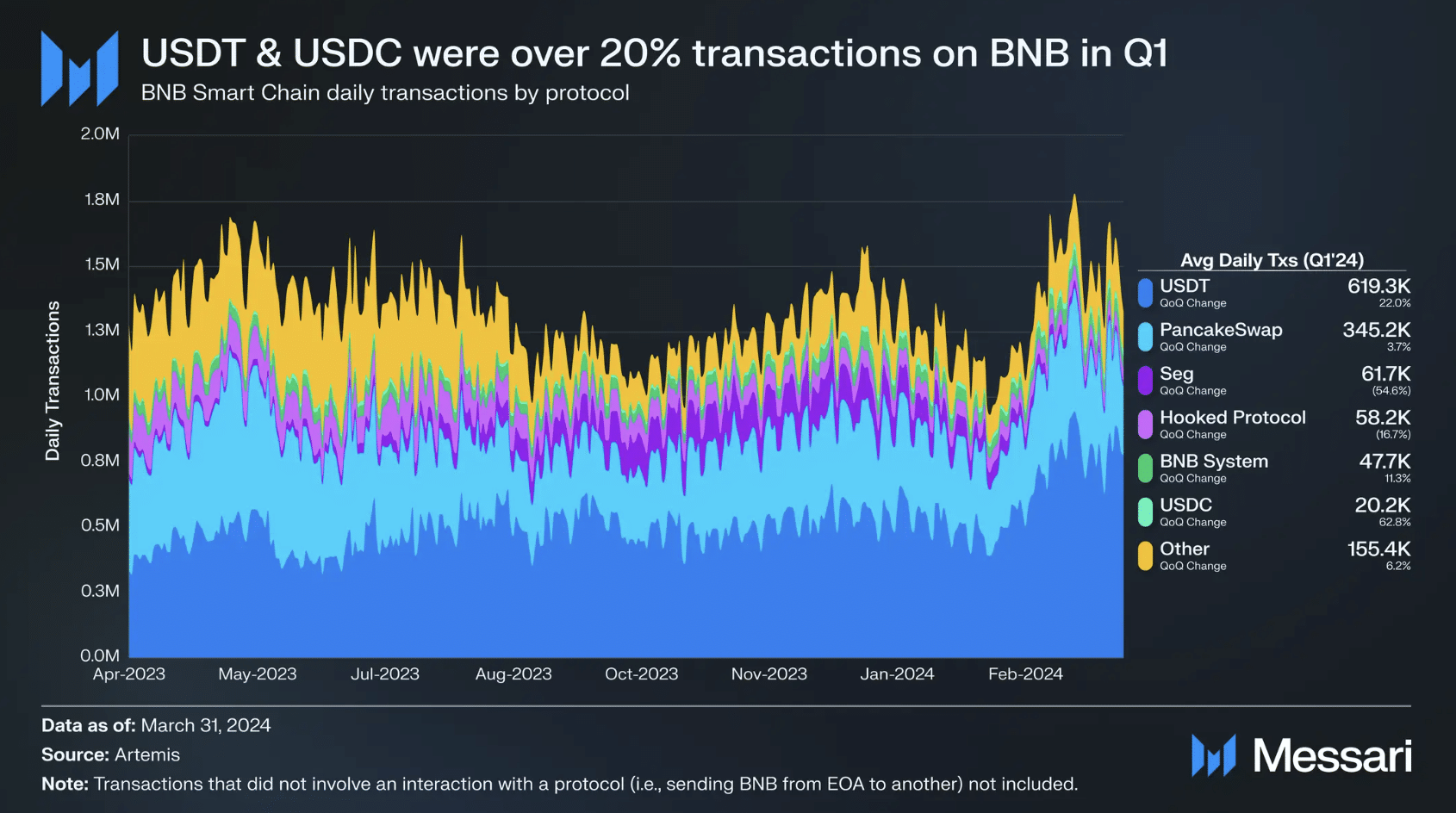

Additionally, several protocols on the BNB Smart Chain experienced upticks in average daily transactions. USDT emerged as one of the stablecoins with 619,300 daily transactions, up 22% from the previous quarter.

It nearly doubled the transactions of the second-ranking protocol, PancakeSwap, which averaged 345,200 daily transactions and was up by 4%.

USDT and PancakeSwap accounted for 74% of protocol transactions, a 10% increase from the previous quarter. Overall, daily average transactions involving protocols increased by 5% from 1.2 million to 1.3 million.

Source: Messari

Appetite for short positions grows

At press time, BNB was trading at $607.05 and its price had declined by 1.41% in the last 24 hours. Additionally, the volume at which BNB was trading at had also fallen by 9% during this period.

Realistic or not, here’s BNB’s market cap in SOL’s terms

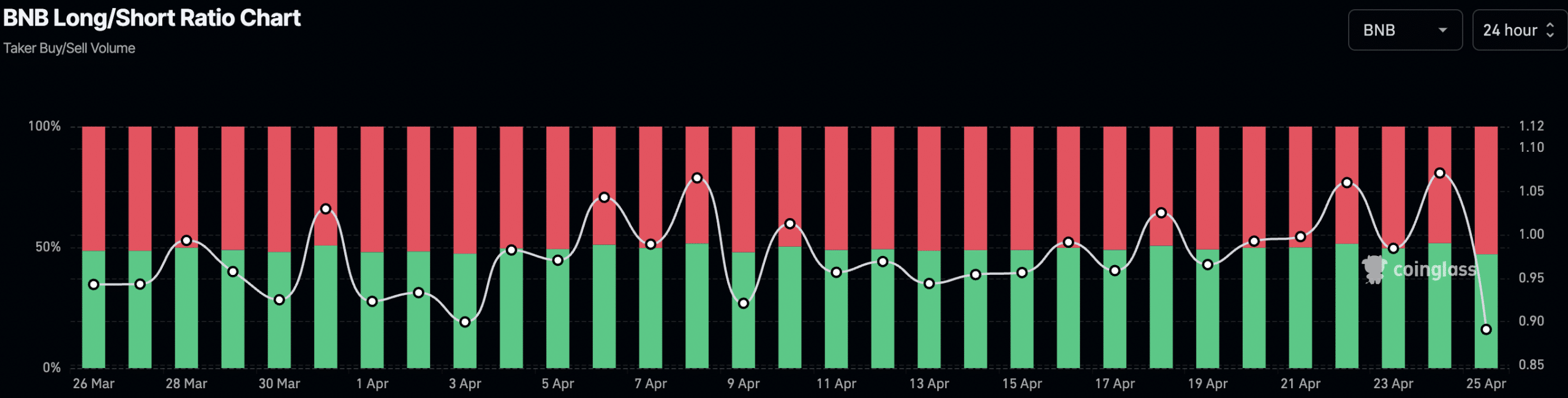

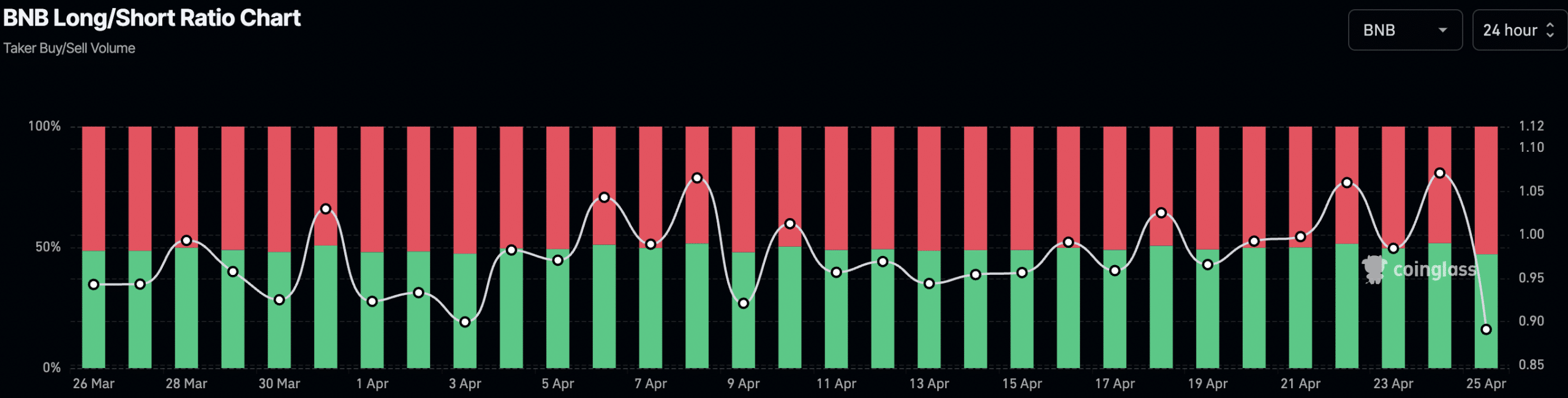

Despite the positive performance showed by the BNB network, the trader sentiment around the BNB token remained cynical. Over the past few days, an overwhelming majority of traders decided to short the BNB token.

The percentage of short positions around BNB had grown to 52%. It remains to be seen whether the bears turn out to be right about BNB’s future.

Source: Coinglass