- Binance spot and derivative volumes reached 2021 levels.

- BNB remained above the $500 threshold.

Recent reports indicated that Binance [BNB] has made significant strides in recovering from its recent challenges.

According to data by CCData, Binance has attracted the highest spot and derivative volume in the last three years. Additionally, its native token, BNB, has managed to maintain its position among the top five assets.

Binance regains dominance

Per the report, combined spot and derivatives trading volume on centralized exchanges surged by 92.9% to reach a new all-time high of $9.12 trillion in March.

Specifically, trading volumes for derivatives reached unprecedented levels, soaring by 86.5% to $6.18 trillion.

The report highlights that Binance’s spot trading volume surged by 121% to $1.12 trillion in March, marking the highest spot volumes on the exchange since May 2021.

Similarly, derivatives trading volumes experienced a significant increase, rising by 89.7% to $2.91 trillion, achieving its highest levels since May 2021.

This recent data represented a positive development for Binance, which faced challenges to its dominance following regulatory scrutiny from the U.S. Department of Justice.

BNB stays above the neutral line

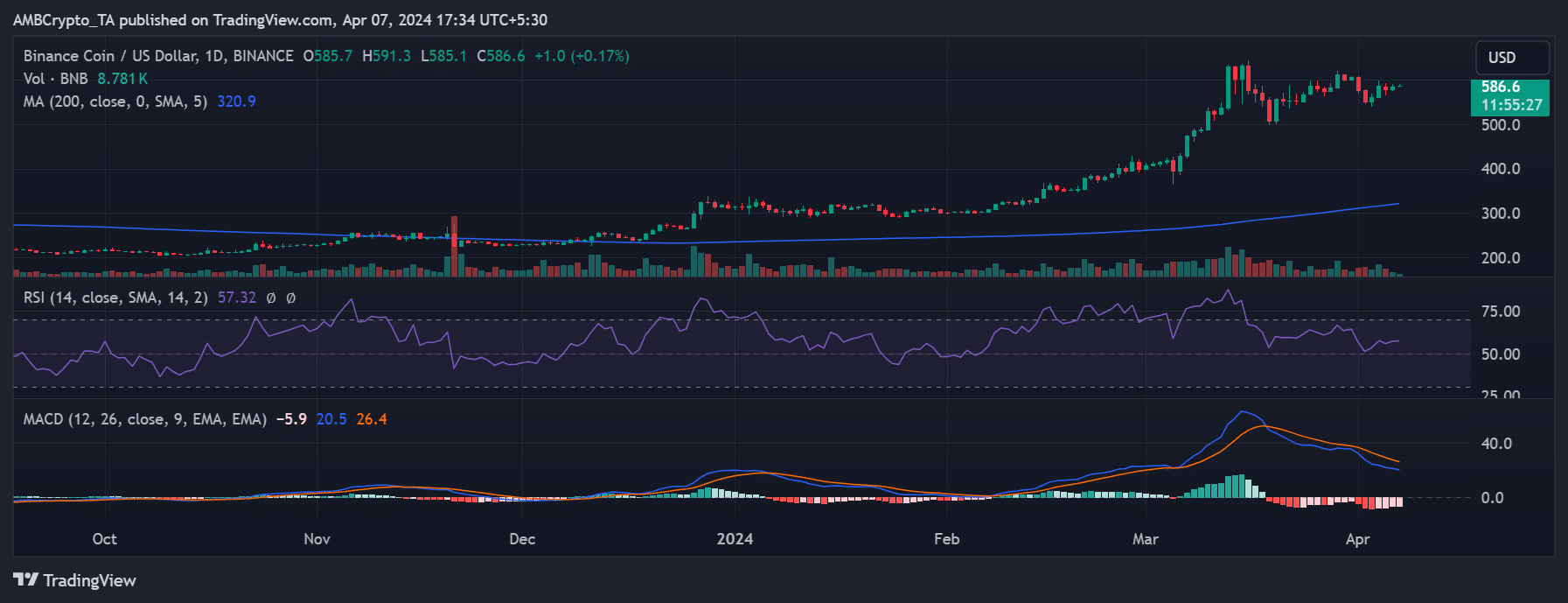

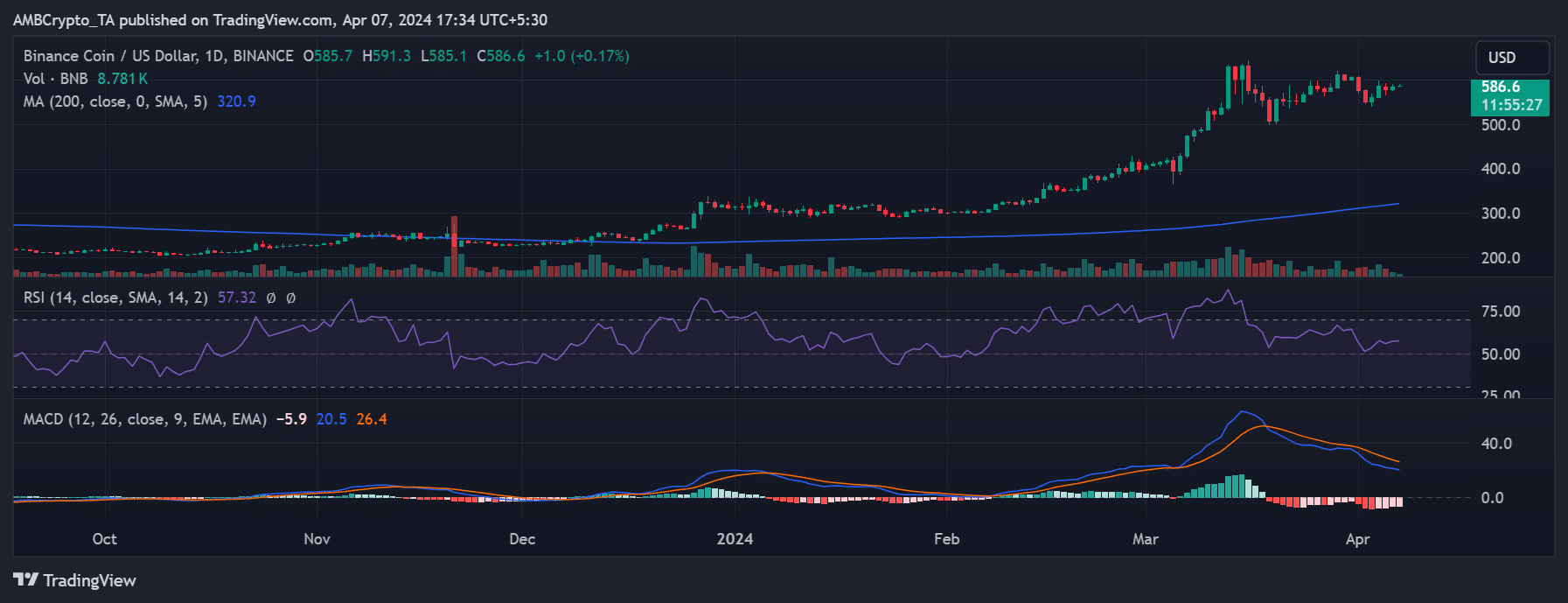

AMBCrypto’s analysis of BNB’s price trend showed an eventful month. On the daily timeframe chart, BNB surged to the $500 price region in March and even traded above $600 at certain points during the month.

At the time of this writing, it was trading at around $586, which marked one of its highest points in history, despite its recent decline.

Source: TradingView

BNB maintained its bullish trend, which began in February, with the Relative Strength Index (RSI) hovering close to 60 at the time of writing.

Additionally, its Moving Average Convergence Divergence (MACD) analysis suggested that the BNB trend is moderately strong.

Realistic or not, here’s BNB’s market cap in BTC’s terms

Binance maintains its top-five ranking

According to data from CoinMarketCap, Binance retained its position as the fourth-largest cryptocurrency asset.

At the time of this writing, its market capitalization was over $87 billion, despite experiencing a price decline.