- Biden’s 44.6% capital gains proposal raises questions in the crypto community about its impact.

- Perspectives vary on Biden’s tax hike: some fear, while others remain unconcerned.

As the US election is almost around the corner, all eyes are on President Biden’s Fiscal Year 2025 budget proposal. Biden has put forth a proposal to raise capital gains rates to a staggering 44.6%.

If passed, this would set a new record for the highest federal capital gains rate ever.

Looming concerns in the crypto community

The news has certainly stirred a lot of speculation worldwide, as evident from the crypto community’s reaction. One prominent voice in the fray is Bill Ackman, CEO of Pershing Square, who expressed his thoughts on X (formerly Twitter) and said,

“For anyone who is still confused on the topic, I am not voting for Biden.”

Reiterating the same, Jason A. Williams, aka “Parabolic Guy”, an entrepreneur and Bitcoin maximalist said,

“It’s difficult to describe how insane a 25% tax on unrealized capital gains is. Not an exaggeration to say it could single-handedly crush the economy.

He even claimed,

“I will leave the United States at the passing if this.”

This might deter some investors from entering or staying in the crypto market, particularly those in states with high combined tax rates.

Contrasting views

However, in contrast, Matthew Walrath, founder of Crypto Tax Made Easy, highlighted in a conversation with Cointelegraph that it’s not a significant concern for most individuals.

He believes that even if these proposals were to become law, they wouldn’t have a significant impact on the majority of people in the crypto space.

“For 99.9% of people, it’s a big, fat nothing burger because it’s essentially just a proposal.”

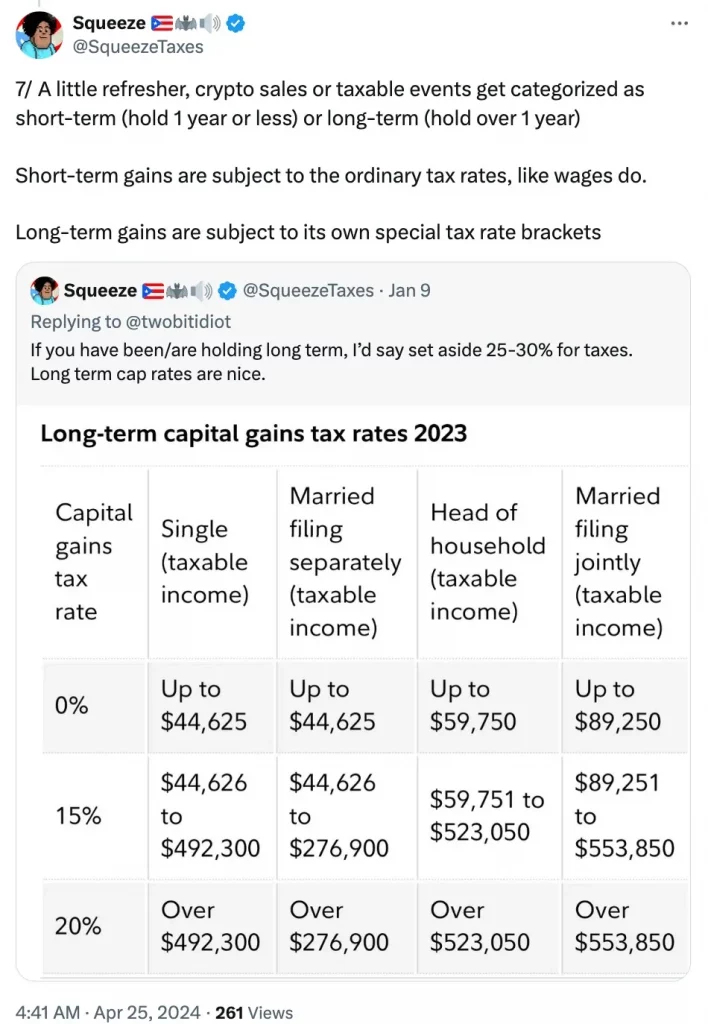

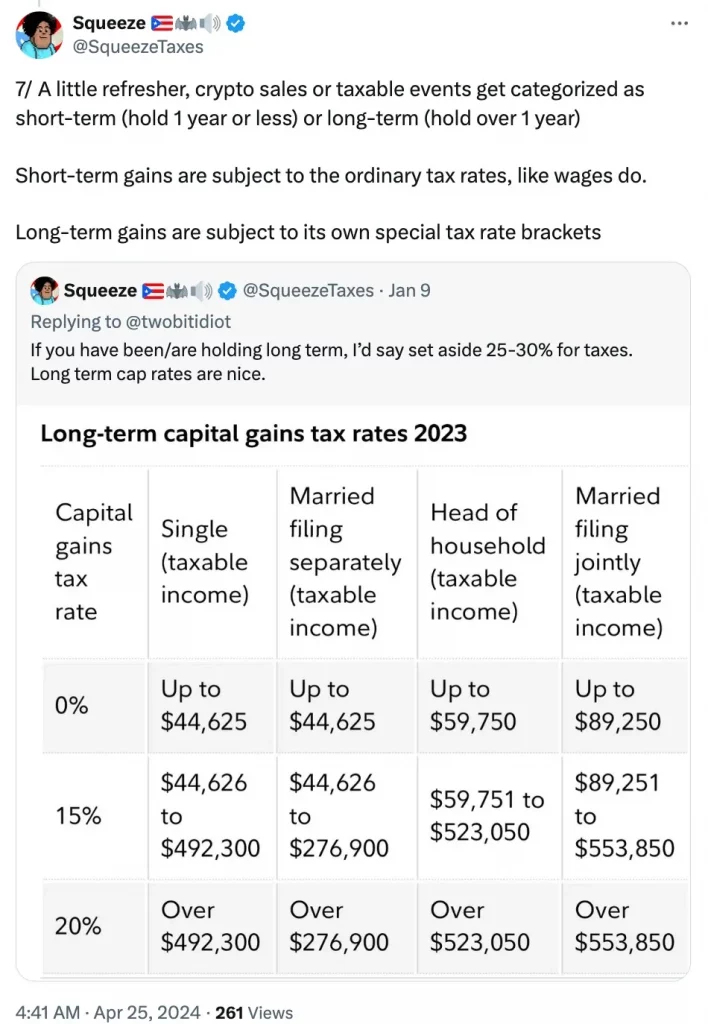

Echoing similar sentiments, an X user, @SqueezeTaxes, in a recent post, dissected the implications of the proposed policies for crypto investors.

Source: SqueezeTaxes/ Twitter

This highlights that the impact of Biden’s tax proposals won’t be felt by the average income earner. These measures are specifically aimed at high-income individuals, targeting those earning $400,000 or more on one end and $1 million or more on the other.

What lies ahead?

In conclusion, the absence of inflation indexing for capital gains may lead to taxation on gains that aren’t entirely real, increasing tax liabilities.

Furthermore, potential double taxation, especially from stock or ETF investments, could complicate tax planning and reduce returns.

Overall, these tax changes may prompt crypto investors to reconsider their strategies and seek ways to minimize tax exposure as noted by Eve Maina, Managing Partner at ARG Ltd Kenya.

Source: Eve Maina/Twitter