In today’s digital age, an increasing number of individuals and businesses are diving into the digital asset economy, prompting many to ask, “what crypto should I buy?” The surge in cryptocurrency investments has become a mainstream trend. With a plethora of options available and prices that can swing dramatically, pinpointing the best value can be a challenge. But worry not, we’re here to guide you through the intricate realm of digital assets and highlight which cryptocurrencies hold significant promise given the current market values.

Read on for our top picks of the best crypto to buy now!

This article does not constitute investment advice. Before making a decision to invest in a crypto project (especially the new ones which haven’t had a chance to prove themselves), we urge you to do your due diligence: look through the official pages of the project, explore some reliable information resources, read independent reviews of the project, and of course, never invest more than you can afford to lose.

What Is Cryptocurrency?

Cryptocurrency is a form of digital money that gives users control over their own finances. It is not tied to a central bank or government and enables secure and anonymous transactions that don’t require a middleman.

Cryptocurrency works by using advanced encryption technologies that allow it to exist in its own network of computers. These computers work together to verify each transaction conducted with extra layers of security and anonymity. Since it’s completely virtual, there is no physical money exchanged, which means you can make purchases with cryptocurrency wherever it’s accepted as payment.

With more people beginning to rely on digital forms of payment, cryptocurrency could be the new standard in our ever-changing world economy.

Best Cryptocurrency to Buy in 2024

2022 was a rough year for the crypto market. The market valuation of the sector has fallen by two-thirds, and most currencies have lost between 70% and 90% of their peak prices.

However, these turbulent times also offer a great opportunity to expand your cryptocurrency investment portfolio. The cryptocurrency markets are at levels they haven’t seen in years, making the greatest crypto assets available at exceptionally low prices.

In this part, we outline our top picks for the best cryptos to invest in now and discuss their advantages. So, do you wanna get ready for the next crypto market rally? Let’s get going!

Maker (MKR)

What is Maker?

In essence, MakerDAO is a DeFi giant and a decentralized peer-to-peer organization that focuses on creating technology to make it easier to store, borrow, and lend money.

How does Maker work?

MakerDAO provides depositors with the opportunity to earn interest on DAI stored in the DAO’s bank. Dai tokens are held in a DSR (DAI Savings Rate) contract and continue to yield Dai based on the DSR interest rate.

Reasons why you should buy MKR

MakerDAO is stepping into the competitive arena with the introduction of Spark Lend, poised to rival Aave, a leading decentralized finance (DeFi) platform on Ethereum. As per a recent announcement on the MakerDAO forum, Spark Lend is set to debut as the inaugural product of Spark Protocol, which is derived from Aave’s version 3 (v3). This service will present a user-friendly interface, facilitating interactions with DAI (a stablecoin pioneered by the Maker Foundation) for activities like borrowing, lending, and staking. This development has already given a boost to the token’s market value. If Spark Lend’s launch garners positive traction, it could significantly bolster the MakerDAO token (MKR) value. For those looking to invest in crypto, such evolving landscapes and innovations offer intriguing opportunities to consider.

Quant (QNT)

What is Quant (QNT)?

Quant (QNT) is a revolutionary blockchain technology that connects different blockchain systems, allowing them to operate together. Quant’s primary product — Overledger — was launched in 2018. It is a blockchain operating system designed to facilitate the development of multi-chain applications (MApps).

How does Quant work?

Quant’s Overledger creates a unique network layer that enables communication across different blockchains, essentially acting as an operating system for blockchains. This approach allows developers to build applications on top of multiple blockchains simultaneously, leveraging the strengths of each while bypassing their limitations.

Reasons why you should buy Quant (QNT)

Quant’s vision is anchored in its capacity to bridge the gaps between diverse blockchains, a pivotal step for achieving broad blockchain integration. Through its platform, Overledger, developers are empowered to craft cutting-edge solutions that tap into the advantages of multiple blockchains. As the appetite for these integrative solutions grows, there’s a potential for QNT’s value to see an uptick. For those scouting the market for the best coins to invest in, such technological advancements and their implications on the broader ecosystem can be pivotal points of consideration.

Binance Coin (BNB)

What is Binance Coin (BNB)?

Binance Coin (BNB) is the native cryptocurrency of the Binance platform, one of the world’s leading centralized exchanges. Initially launched on the Ethereum blockchain in 2017, it has since migrated to its own blockchain, known as the BNB Chain. The coin, integral to the Binance ecosystem, is used for a variety of purposes, such as transaction fees, token sales, and more.

Considering its broad utility and robust ecosystem, Binance Coin (BNB) might be the best crypto to invest in if one seeks both stability and potential growth.

How does Binance Coin work?

BNB operates on the BNB Chain, an independent blockchain that supports the creation of smart contracts and dApps. As a utility token, BNB can be used to pay transaction fees on the Binance platform, participate in token sales, and for a variety of other use cases within the Binance ecosystem. The Binance platform also periodically uses a portion of its profits to buy back and burn BNB, reducing the total supply and potentially increasing the coin’s value over time.

Reasons why you should buy Binance Coin (BNB)

BNB stands out for several reasons. Its affiliation with Binance, a leading global exchange, offers stability and utility. The coin’s role in reducing transaction fees and its use in token sales adds to its appeal for regular users. Additionally, strategic coin burns and the shift to the BNB Chain suggest potential long-term value growth. For those seeking the best coin to buy now, BNB deserves a closer look.

yPredict (YPRED)

What is yPredict?

yPredict is a new crypto project developing trading and investing solutions. The platform offers three primary features: a crypto marketplace, trading tools, and revenue-sharing pools.

How does yPredict work?

yPredict intends to bridge the gap between cryptocurrency market participants and data-driven insights, helping the former overcome the challenges of the increasingly complex financial sector. yPredict.ai’s ecosystem brings together insights from traders, investors, financial advisers, and AI/ML experts to offer its consumers the most thorough and precise financial information. It incorporates analytical tools, forecasting platforms, and indicators to support users in making wise trading and investment decisions.

Reasons why you should buy YPRED

yPredict has a lot of potential as a platform that offers sophisticated yet incredibly simple-to-use features. That gives its native token a chance to increase in value in the future.

Mina Protocol (Mina)

What is Mina Protocol?

Formerly known as Coda Protocol, Mina Protocol is a project that develops a very lightweight blockchain with many use cases, including the creation of decentralized applications. In the ecosystem, these applications are known as zkApps.

How does Mina Protocol work?

Mina, the world’s lightest blockchain with a size of just 22KB (that’s the size of a couple of tweets!) as opposed to Bitcoin’s 300GB, is made to host dApps smoothly. While the protocol’s native coin, MINA, serves as a utility currency and a means of exchange, native verification on the blockchain is made possible via zk-SNARKs. Verifiers, block producers, and snarkers — these are just a few user roles that handle certain tasks on the network, which results in a robust economy that is continuously expanding and improving.

Reasons why you should buy MINA

In the future, zero-knowledge technology is likely to be a major trend in the cryptocurrency and blockchain industries, and Mina Protocol may be well-positioned to benefit from it. Additionally, the Mina blockchain’s lightweight architecture makes it simpler to join the network, which is important for mobile devices in particular. Due to this, Mina might be a strong candidate to be one of the next cryptocurrencies to explode.

Solana (SOL)

What is Solana?

Solana is a high-performance blockchain known for its exceptional speed and efficiency in processing transactions. It emerged as a strong competitor in the decentralized finance (DeFi) and decentralized applications (dApps) space. Despite the challenges of the 2022 crypto bear market, SOL managed to maintain a significant presence, often ranked within the top 15 cryptocurrencies by market cap.

How does Solana work?

Solana’s main draw is its hybrid consensus mechanism, combining Proof of History (PoH) with Proof of Stake (PoS). This unique approach enables Solana to process thousands of transactions per second with minimal fees, addressing the scalability issues faced by many blockchains.

The Solana ecosystem hosts a wide range of applications, from DeFi to NFT marketplaces, making it a hub for innovation and growth.

Reasons why you should buy Solana

Solana is one of the safest crypto to invest in. Its ability to process transactions rapidly and at a lower cost makes it an attractive platform for developers and users alike. Its growing ecosystem, strong community support, and continuous development suggest its potential for long-term success. Investing in SOL could be a wise decision for those looking to diversify into a blockchain that balances speed, efficiency, and a robust developer ecosystem.

SOL has also been one of the most profitable cryptocurrencies in 2023, gaining more than 500% over the year. You can buy SOL now on Changelly.

Having fun with this article? Join our weekly email right away if you’re interested!

Best Crypto to Invest in: Best Web 3.0 Crypto Coins to Buy

A new generation of cryptocurrencies called web3 cryptos is dedicated to realizing the decentralized web3 concept. In order to give consumers control over their data and enable transactions without intermediaries, they combine blockchain technology with smart contracts. Web3 tokens provide unique use cases by exploiting decentralized protocols.

Here’s the list of web3 crypto coins with the most potential for 2024.

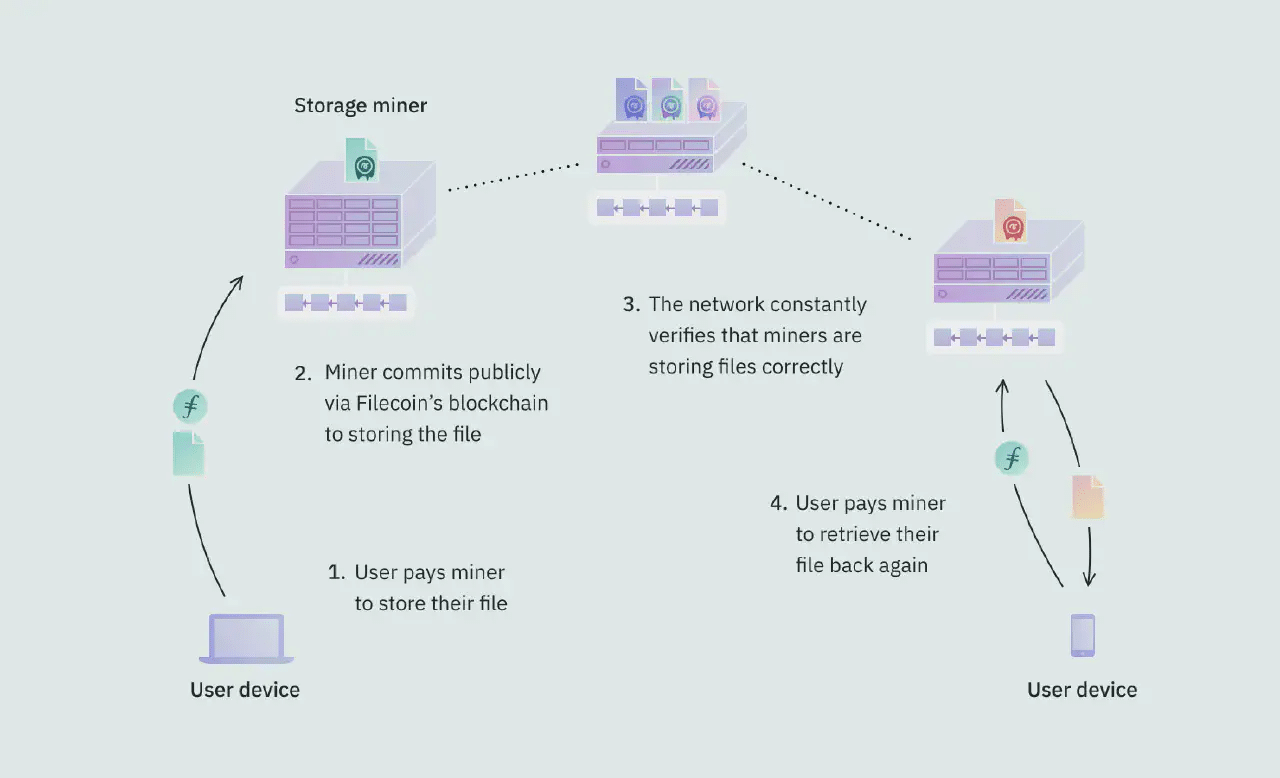

Filecoin (FIL)

What is Filecoin?

Filecoin (FIL) is a blockchain project developing a decentralized storage network.

Designed to work seamlessly with Web3 and DeFi protocols, Filecoin makes permanent data storage truly and fully decentralized.

The network, which supports organizations and projects in finding affordable, decentralized, and secure data storage solutions, is powered by a large variety of storage providers and developers.

How does Filecoin work?

Filecoin’s blockchain is built on the base technology of its parent project IPFS — a decentralized peer-to-peer network for file storage that lets users run their own nodes and store files anonymously.

Additionally, network users can generate more tokens and obtain transaction fee discounts by providing the Filecoin network extra storage.

Reasons why you should buy Filecoin

Filecoin has the potential to help millions of people looking for decentralized digital storage space: up until now, there hasn’t been a mechanism to entice individual IPFS nodes to allow others to utilize their space. The project capitalizes on transparency and open market provided by blockchain technology — something you would never obtain from centralized organizations.

IOTA (MIOTA)

What is IOTA (MIOTA)?

IOTA (MIOTA) is a unique cryptocurrency that stands out for its utilization of the Tangle technology, rather than the conventional blockchain. Developed in 2015, IOTA was designed specifically to support and enable the future of the Internet of Things (IoT), providing secure, feeless microtransactions for this ever-growing ecosystem.

How does IOTA work?

Unlike traditional blockchains that consist of transactions bundled in blocks and added in linear, sequential order, IOTA’s Tangle is a directed acyclic graph. Each transaction in the Tangle confirms two previous transactions, eliminating the need for miners and ensuring transactions remain free. This design makes IOTA scalable and ideal for machine-to-machine interactions in the IoT.

Reasons why you should buy IOTA (MIOTA)

IOTA, with its emphasis on IoT—a sector on the brink of explosive expansion—offers immense prospects for those wondering which crypto to buy. Its ability to handle feeless transactions paves the way for microtransactions, essential for seamless machine-to-machine interactions. Moreover, IOTA’s collaborations with leading corporations underscore its technological prowess and the anticipation of its integration in future ventures.

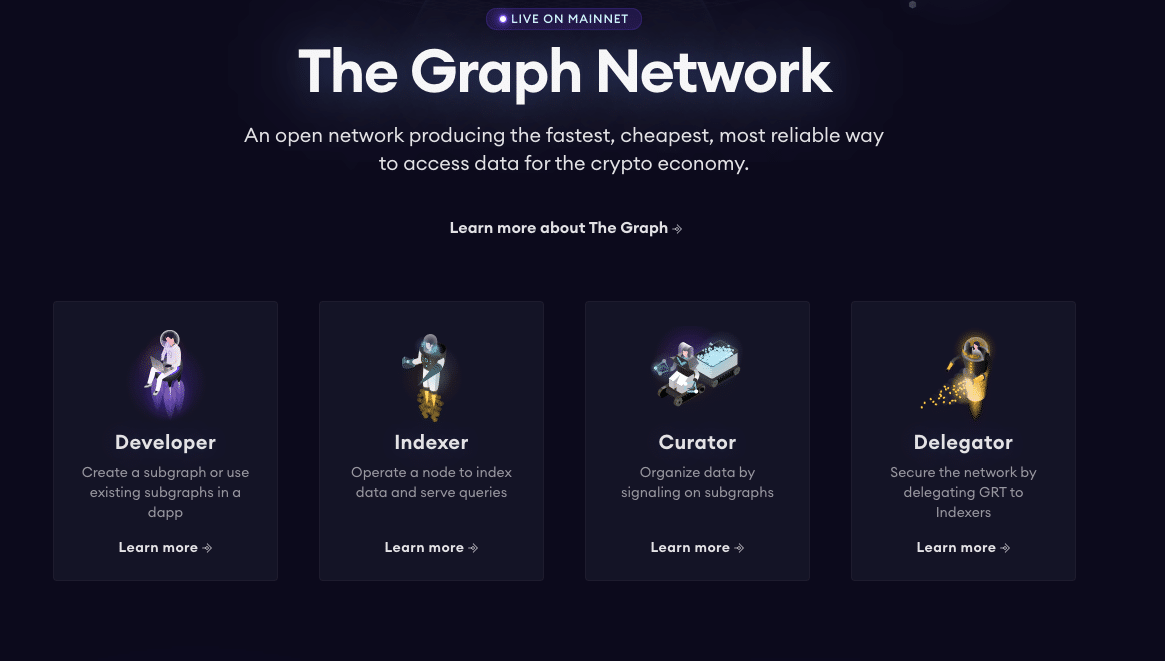

The Graph (GRT)

What is the Graph?

An open-source software named the Graph is used to gather, process, and store data from multiple blockchain apps to make it easier to retrieve information.

The Graph’s goal is to assist programmers in using pertinent data to boost the effectiveness of their decentralized applications.

How does The Graph work?

In order to enable any application to make a query to its protocol and obtain an instantaneous response, the Graph gathers and analyzes blockchain data before storing it in multiple indexes, known as Subgraphs.

So-called indexers and delegators — Graph users who offer network services — assist in processing the data and transferring it to end users and applications.

Data security within the Graph’s network is guaranteed by the use of its own cryptocurrency, GRT. Any user, whether they are delegators, curators, or indexers, must stake GRT to fulfill their responsibilities and get payment from the network.

Reasons why you should buy GRT (The Graph token)

According to some researchers, the Graph became an essential part of the DeFi infrastructure: popular Ethereum dApps like Aave, Curve, and Uniswap already employ this decentralized blockchain network.

Ethereum Name Service (ENS)

What is ENS?

The Ethereum Name Service, or ENS, enables users to generate a single pseudonym that can be used for all of their public addresses and decentralized websites. This solution serves to simplify cryptocurrency and decentralized financial spaces. As opposed to long illegible strings for each crypto address, users are given a single ENS domain (for example, “Madison.eth”), where they can receive any type of crypto and NFTs.

How does ENS work?

ENS is built on two Ethereum smart contracts: the ENS registry and the resolver. The first stores the crucial information about each registered domain, and the latter converts the domain names to machine-readable addresses and vice versa.

Reasons why you should buy ENS

Simply put, Ethereum Name Service (ENS) stands as the web3 answer to the traditional Domain Name Service (DNS). ENS offers a decentralized alternative to the standard DNS system, addressing the vulnerabilities associated with its singular point of failure. For those who are bullish on the future of crypto, ENS exemplifies the kind of cryptocurrency you should invest in.

Avalanche (AVAX)

What is Avalanche?

Avalanche is a layer-one versatile, open-source platform for launching decentralized applications and enterprise blockchain deployments. Known for its high throughput and low latency, Avalanche has carved out a significant place in the cryptocurrency market. It’s frequently listed among the top 20 cryptocurrencies by market cap, and made it to the rankings even amid the 2022 bear market downturn.

How does Avalanche work?

Avalanche distinguishes itself with its unique consensus protocol, which is highly scalable and energy-efficient. The platform is divided into three interoperable blockchains, each serving different purposes: the Exchange Chain (X-Chain), the Platform Chain (P-Chain), and the Contract Chain (C-Chain). This tri-fold structure allows Avalanche to achieve a balance between speed, security, and decentralization.

Reasons why you should buy Avalanche

Avalanche’s innovative structure and ability to facilitate fast, low-cost transactions make it an appealing choice for developers and investors. Its growing ecosystem of dApps and strategic partnerships, coupled with ongoing development efforts, position Avalanche as a strong contender in the blockchain space.

Investing in AVAX could be a strategic move for those seeking exposure to a cutting-edge and rapidly evolving blockchain platform. You can get AVAX with fiat on Changelly.

Best Cryptocurrency to Buy: DeFi Projects

Decentralized Finance (DeFi) projects have been an important part of the cryptocurrency movement, aiming to bring all financial instruments to the blockchain. Many believe DeFi will revolutionize the world of finance by making traditional banking services, such as borrowing and lending, accessible to anyone with a digital wallet.

Since participants record their trade directly on the public ledger, this new way of handling financial transactions would increase transparency and eliminate intermediaries.

Here’re the DeFi tokens with the most potential for 2024.

DeFi Coin (DEFC)

What is DEFC?

DeFi Swap is a recently introduced decentralized exchange that provides a wide selection of cryptocurrency-focused goods and functions. The native currency of the DeFi Swap DEX is DeFi Coin (DEFC), which was introduced in 2021.

How does DEFC work?

DEFC uses the Binance Smart Chain and supports the protocol to fulfill its decentralized finance-related objectives.

Reasons why you should buy DEFC

DEFC had a 40x bull run in 2021: its price went from $0.1 to $4. Some crypto users are sure that DEFC can become the next DeFi coin to explode.

Looking to invest in some of the top picks we’ve discussed? Don’t wait, enrich your investment portfolio today! With Changelly, you’re afforded seamless access to sought-after coins like Ethereum and BTC, along with a plethora of more than 450+ other crypto assets. Take advantage of our minimal fees and rapid transactions. Experience the ease of crypto trading with Changelly today — there’s no better time than now to dive in!

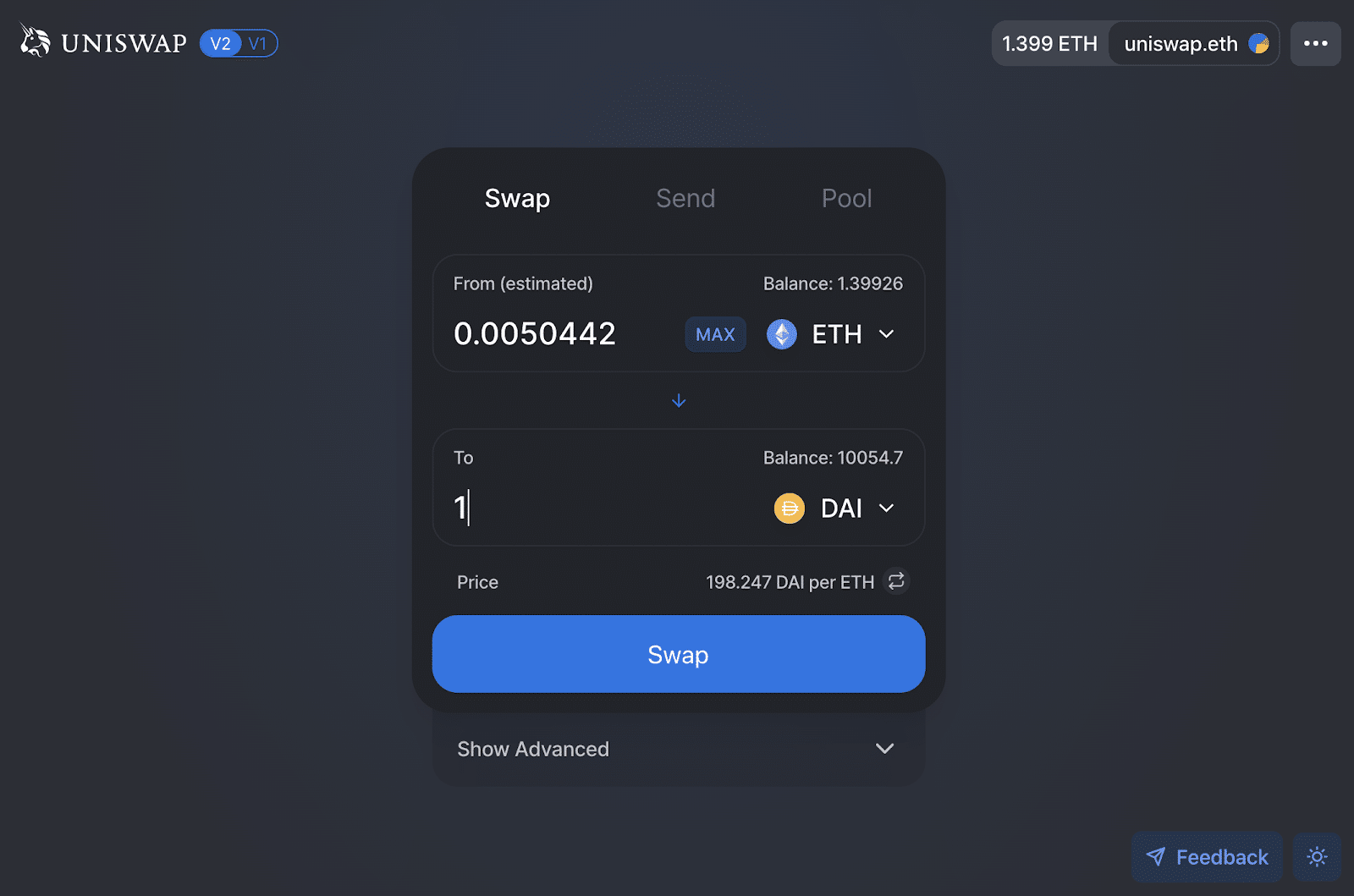

Uniswap (UNI)

What is Uniswap?

Uniswap (UNI), one of the largest cryptocurrency exchanges, is among the crypto assets you should watch in 2024.

Uniswap is a decentralized cryptocurrency exchange that executes trades using a series of smart contracts (liquidity pools). The protocol is supported by the Ethereum blockchain.

How does Uniswap work?

Uniswap does not adhere to advanced trade engineering conventions — it operates without an order book. The use of the Constant Product Market Maker Model as an assessment method distinguishes Uniswap from other DEX platforms.

Reasons why you should buy UNI

In recent years, the Uniswap platform has become a popular destination for those interested in cryptocurrencies and decentralized finance. The secret to Uniswap’s success is the platform’s user-centric policy and continuous improvement.

Terra LUNA Classic (LUNC)

What is LUNA Classic?

LUNA Classic (LUNC) is the original Terra LUNA blockchain’s native token.

How does LUNA Classic work?

A decentralized, open-source, and publicly accessible blockchain technology called Terra Classic uses a proof-of-stake consensus algorithm to support stablecoins (which are usually backed by fiat currencies like U.S. dollars), which enables people to make easy international transfers. LUNA Classic (LUNC) helps stablecoins within the Terra ecosystem maintain their prices and avoid high volatility.

Reasons why you should buy LUNC

LUNC is currently surrounded by a lot of uncertainty. The project is really ambitious, and its goal is great, but it’s not apparent how it will affect the LUNA token specifically. There are many crypto analysts who believe 2024 may become a great year for LUNC. Should this come true, it will set a precedent for a failed crypto’s comeback and growth.

Yearn.finance (YFI)

What is Yearn.finance?

Yearn Finance is a set of Decentralized Finance (DeFi) solutions that offer blockchain services like lending aggregation, yield generation, and insurance.

How does Yearn.finance work?

Yield farming, where users lock up their crypto funds in a DeFi protocol in order to create interest (typically in the form of crypto), is how Yearn.Finance generates the majority of its activities. The Yearn.Finance platform is controlled and governed by the platform’s native ERC-20 token YFI.

Reasons why you should buy YFI

Yearn.Finance is dedicated to streamlining DeFi investments and associated tasks such as yield farming, making them more user-friendly. The platform continually rolls out new features to ensure its sustained value, marking it as a noteworthy crypto to invest in for those exploring the digital asset landscape.

Best Cryptocurrency to Invest in: Layer 2 Coins

Layer 2 is an overlooked but integral part of cryptocurrency and blockchain technology. It is the second layer of the protocol, which runs on top of the main blockchain network.

What is Layer 2?

Decentralization, security, and scalability — these 3 features (also called “the blockchain trilemma”) are not all accomplishable at the same time. For example, Ethereum can only effectively deploy two out of these three properties. That’s why it needs a little help with scalability from side projects.

Layer 2 allows for enhanced scaling and speed through solutions such as sidechains, payment channels, and lightning networks. Layer 2 solutions help to facilitate bigger transaction throughput and accelerate transaction speed while reducing transaction fees and eliminating the burden on the main blockchain. Thanks to layer 2 solutions, crypto networks can process hundreds or even thousands of transactions per second without compromising security or decentralization.

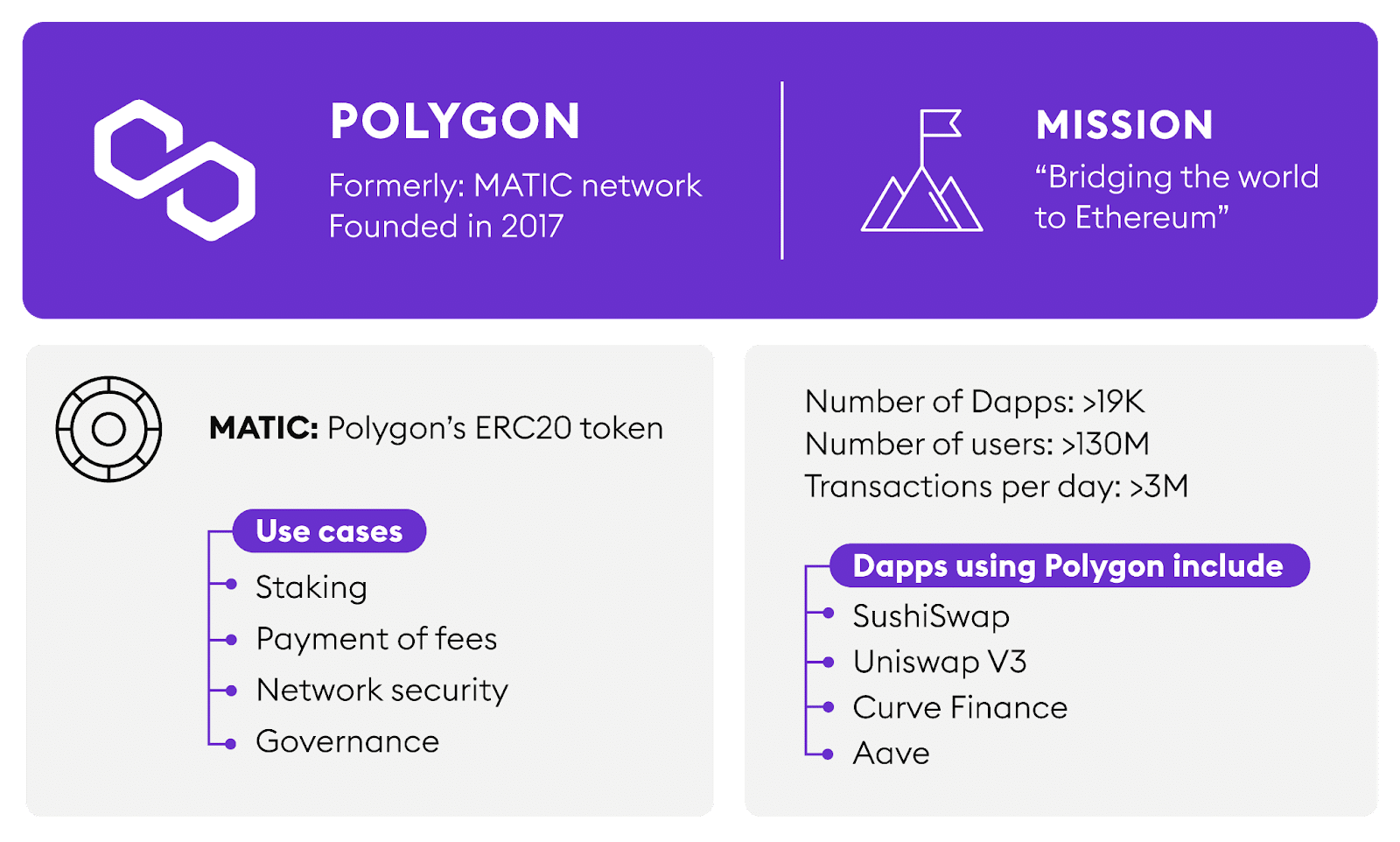

Polygon (MATIC)

What is Polygon?

Previously known as the Matic Network, Polygon is an Ethereum layer 2 scaling solution that seeks to offer a variety of tools to increase the speed, lower the cost, and simplify transactions on blockchain networks.

How does Polygon work?

With numerous sidechains, Polygon constitutes a multi-level platform that intends to scale the Ethereum blockchain by unclogging the main platform in an efficient and effective way.

Reasons why you should buy MATIC

Those who believe in layer 2 solutions for enhancing the Ethereum Network may also look to purchase Polygon’s native token, MATIC, and include it in their portfolio. Here’s our Matic price prediction.

Optimism (OP)

What is Optimism?

Optimism is another layer 2 scaling solution for Ethereum, which contributes to the reduction of gas fees and transaction times on the Ethereum blockchain.

How does Optimism work?

Optimism processes transactions outside of the Ethereum blockchain while utilizing Ethereum’s infrastructure. During a transaction, Optimism communicates with Ethereum’s layer 1 to ensure that it continues to provide the highest level of security and decentralization guarantees. layer 1 is in charge of security, decentralization, and data availability, whereas layer 2 is in charge of scaling.

Reasons why you should buy OP

Optimism is supported by a strong team, a sizable community, and a number of devoted investors. Many experts do not doubt that OP will achieve its goal of dominating layer 2 scaling for Ethereum far sooner than anticipated if there is another bull run.

Starkware (STRK)

What is Starkware?

Israel-based company Starkware creates L2 blockchains for Ethereum using zk-STARKs for computational security. The founders of ZK-STARK and Zcash’s founding scientists created StarkWare in 2018. Its two solutions, StarkEx and StarkNet, intend to increase blockchain scalability and privacy.

How does Starkware work?

StarkWare has created a unique instrument — zk-STARKs — that enables one party to show to another that it is in possession of specific information without having to divulge the information itself.

Reasons why you should buy Starkware

In addition to its innovative technology, StarkWare has drawn significant attention because of its employees, investors, and advisers, one of them being Vitalik Buterin himself.

Loopring (LRC)

What is Loopring?

Loopring’s goal is to give programmers the tools they need to build order book-based, non-custodial marketplaces on the Ethereum blockchain.

How does Loopring work?

Loopring uses zero-knowledge rollups to enable exchanges to build on top of it rather than processing transactions directly on Ethereum, avoiding the sluggish transaction speeds and high fees associated with Ethereum exchanges. Loopring charges a transaction fee of 0.25% for each swap and has the ability to process up to 3,000 TPS (transactions per second).

Reasons why you should buy Loopring LRC

LRC is a tested currency with a solid market cap. Check out our LRC price prediction here.

Top Crypto to Buy: Metaverse and NFT Crypto Projects

The Metaverse and non-fungible tokens (NFTs) are currently the talk of the town in the crypto community. The Metaverse offers digital spaces where users can craft, purchase, and trade content. In contrast, NFTs are unique digital assets on blockchain networks, ensuring undeniable ownership. Together, they’re reshaping our interaction with digital worlds, offering tangible benefits like tradable assets and one-of-a-kind experiences.

As the crypto landscape evolves, projects that tap into the Metaverse and NFTs are set to pioneer industry innovations. If you’re asking, “what crypto to invest in” within this dynamic sector, stay tuned for our top recommendations.

Quint (QUINT)

What is Quint?

Quint is a recently announced cryptocurrency project set to bridge the gap between the real world and the metaverse.

How does Quint work?

In addition to the NFT marketplace, DeFi services, and other things, its decentralized ecosystem provides “Super-staking Pools” with tangible returns: luxurious prizes, exclusive lifestyle benefits, and real-world rewards.

Reasons why you should buy QUINT

QUINT, the flagship token of the Quint Ecosystem, is a first-of-its-kind token with unique real-world incentives and tangible asset creation.

The Sandbox (SAND)

What is The Sandbox?

The Sandbox is a metaverse and a gaming ecosystem developed by Pixowl on the Ethereum platform. Creators can produce, distribute, and trade in-world assets in the decentralized, community-driven virtual world.

How does the Sandbox work?

The Sandbox metaverse is the only one of many blockchain-based virtual worlds seeking to alter the dynamics of the gaming industry and compensate creators for the value they provide through user-generated content. In the Sandbox, users’ in-world creations are completely theirs to own.

Reasons why you should buy the Sandbox

The Sandbox and its partners are laying the groundwork for a brand-new gaming industry in which metaverse users control the results of their creative labor and are compensated for the significant value they provide for platform operators.

Metacade (MCADE)

What is Metacade?

Boasting a variety of casual and competitive gaming experiences across a selection of games, Metacade aims to grow into the largest on-chain arcade. Every game in the Metacade is going to have earning mechanisms that will give players MCADE token rewards for completing stages and moving forward in each game.

How does Metacade work?

The goal of the Metacade project is to establish a single hub for all things GameFi. According to the development team, players will have access to a wide variety of P2E games and will be able to start earning MCADE tokens as soon as they sign up for the platform.

The innovative Create2Earn concept is a crucial effort to promote community involvement: users will receive MCADE tokens in exchange for their participation in the community, which can take the form of providing knowledge, reviewing games, and connecting with other users. Through its another key feature, the Compete2Earn function, the Metacade plans to give gamers the option to test their skills when competing against other gamers from all over the world.

Reasons why you should buy MCADE

The MCADE token presale is creating waves in the GameFi market and might result in significant rewards for early investors, making Metacade (MCADE) the greatest cryptocurrency to invest in during 2024.

Enjin (ENJ)

What is Enjin?

Enjin is a piece of software that enables developers to build and operate digital assets on the Ethereum network. Each newly created asset can be altered to meet the target platform and is documented in a smart contract. Due to this approach, assets are enhanced with the benefits of cryptocurrencies, such as speed, cost, and security.

How does Enjin work?

Enjin’s primary application is managing and storing virtual items for video games. The system was specifically designed with gamers in mind because blockchain technology may make it possible for digital property ownership to be verified, which is a beneficial feature for in-game items.

Reasons why you should buy Enjin

Enjin gives in-game items real-world liquidity, opening the door for gaming systems driven by blockchain and cryptocurrencies as well as gamified real-world environments. Enjin’s strong use case and the token’s inherent scarcity produce a fantastic value proposition for the project as a whole.

ApeCoin (APE)

What is ApeCoin?

The Bored Ape Yacht Club collection, one of the most well-known and expensive NFT collections, served as the inspiration for ApeCoin (APE), a cryptocurrency created to aid in the creation of decentralized Web3. APE is an Ethereum blockchain-based ERC-20 token.

How does ApeCoin work?

APE is intended to serve as a utility token in web3 projects like games and metaverses in addition to its function in network governance.

Reasons why you should buy ApeCoin

The acceptance of ApeCoin in the actual world will determine its long-term success. The token seems to be in a position to gain from expanded usage in Web3, particularly if initiatives from game developers like Animoca Brands, NWayPlay, and others are released.

Decentraland (MANA)

What is Decentraland?

Decentraland is an Ethereum-based metaverse project that enables users to participate in a communal digital experience: they can mingle, play games, trade collectibles, and purchase and sell wearables and digital real estate through Decentraland.

How does Decentraland work?

Decentraland is supported by MANA, an ERC-20 token that serves as the system’s native currency. Members of the Decentraland community can use MANA to purchase LAND, a virtual piece of the VR platform that Decentraland stands for.

Reasons why you should buy MANA

Decentraland’s inherent value is derived from its technical potential and capacity. Additionally, the project’s singularity increases the value of Decentraland and its two tokens, LAND and MANA.

Best Crypto to Buy Now: Next Cryptocurrency to Explode

There are and have always been some projects that remain relevant no matter what: Ethereum, XRP, Bitcoin. There are many others, however, that only had one or two chances to shine — or none at all (yet).

The crypto market is extremely volatile, and cryptocurrencies that make it big can become shitcoins not a week later. However, some of those crypto coins and tokens manage to stay on top. Most crypto investors are always on the lookout for surging cryptocurrencies, regardless of where those digital assets end up after their trip to the moon.

The next cryptocurrency to explode can be something that isn’t even out yet (like a Bitcoin ETF token or presale tokens), an old but forgotten gem with a high true market value, or even a big coin that is going to have a new rally soon. Here are 5 cryptocurrencies that might explode in the near future.

SingularityNET (AGIX)

What is SingularityNET?

SingularityNET (AGIX) is an innovative platform designed to create, share, and monetize artificial intelligence services at scale. Launched in 2017, SingularityNET is built on the Ethereum blockchain and focuses on providing a decentralized marketplace for AI services. Its vision is to democratize access to AI technology, allowing for seamless collaboration and exchange of AI capabilities.

How does SingularityNET work?

SingularityNET operates by allowing AI developers to offer their AI services in exchange for AGIX tokens. These services range from machine learning to data analytics, accessible via a decentralized, blockchain-based platform. This setup ensures a democratic and open-access ecosystem for AI tools and services, reducing barriers to entry and fostering innovation in the AI field.

Reasons why you should buy SingularityNET (AGIX)

For crypto enthusiasts contemplating what could be the next crypto to explode in the next bull market, SingularityNET offers a compelling case. The platform’s unique focus on AI integration into the blockchain space positions it uniquely in the market. With an increasing demand for AI solutions in various sectors, the potential growth in AGIX’s value and its relatively limited token supply could make it an attractive investment. As the nexus of AI and blockchain continues to evolve, SingularityNET’s role could become more significant.

Toncoin (TON)

What is Toncoin?

Toncoin (TON) is the native cryptocurrency of the Open Network, formerly known as Telegram Open Network. This blockchain platform, initially developed by the Telegram team, has evolved into a community-driven project. Toncoin aims to provide high-speed, low-cost transactions and is designed to facilitate a range of blockchain-based applications, including decentralized finance (DeFi) and Web3 services.

How does Toncoin work?

Toncoin’s underlying infrastructure, the Open Network, is built for scalability and efficiency, enabling rapid transaction processing at minimal costs. This is achieved through a unique multi-blockchain architecture, which allows the network to handle a high volume of transactions without congestion. Toncoin serves as the fuel for transactions and operations within this ecosystem, incentivizing participation and network security.

Reasons why you should buy Toncoin (TON)

As the search for the next crypto to explode intensifies among crypto enthusiasts, Toncoin stands out due to its robust technology and strong community backing. The coin’s potential in the next bull market is underscored by its innovative multi-blockchain approach, which could see increased adoption in DeFi and other blockchain applications. Furthermore, Toncoin’s limited token supply may drive its value up as demand increases in the expanding ecosystem.

Shiba Inu (SHIB)

What is Shiba Inu?

Shiba Inu (SHIB) is a decentralized cryptocurrency that began as a meme token but has since developed into a full-fledged ecosystem with its own decentralized exchange, ShibaSwap. Inspired by Dogecoin, Shiba Inu was created in August 2020 and has gained a massive following for its vibrant community and novel approach to tokenomics.

How does Shiba Inu work?

Shiba Inu operates on the Ethereum blockchain, leveraging the security and functionality of the Ethereum network. SHIB, its native token, is used within its ecosystem for transactions, staking, and participation in various DeFi activities through ShibaSwap. The project has also introduced additional tokens, such as LEASH and BONE, to enhance its ecosystem’s utility and governance.

Reasons why you should buy Shiba Inu (SHIB)

For investors looking for the next crypto to explode, Shiba Inu presents an intriguing option. Despite its origins as a meme token, SHIB has garnered significant attention and adoption, hinting at potential growth during the next bull market. The enthusiastic community and the expanding utility of its ecosystem, coupled with a deflationary token supply model, position SHIB as a candidate for substantial appreciation in value.

Aave (AAVE)

What is Aave?

Aave is a leading decentralized finance platform that offers lending and borrowing services in a trustless manner. Launched in 2017, Aave has become one of the prominent players in the DeFi space, enabling users to lend, borrow, and earn interest on crypto assets without going through traditional financial intermediaries.

How does Aave work?

Aave operates as a decentralized lending pool where users can deposit their cryptocurrencies to earn interest or borrow against their crypto holdings. Interest rates are algorithmically adjusted based on supply and demand dynamics within the platform. AAVE, its native token, plays a crucial role in governance and protocol security, allowing token holders to vote on key decisions and upgrades.

Reasons why you should buy Aave (AAVE)

For those eyeing the “next crypto to explode” in the upcoming bull market, Aave offers a compelling case with its innovative DeFi solutions. Its role as a pioneer in decentralized lending and borrowing, coupled with a robust governance model and limited token supply, positions AAVE for potential growth. The platform’s ongoing developments and increasing adoption in the DeFi space enhance its appeal to crypto enthusiasts looking for promising investments.

PancakeSwap (CAKE)

What is PancakeSwap?

PancakeSwap is a decentralized exchange (DEX) running on the Binance Smart Chain (BSC), known for its low transaction fees and fast transaction speeds. Launched in September 2020, PancakeSwap has rapidly grown to become one of the leading DEXs, offering a range of services, including trading, yield farming, and staking.

How does PancakeSwap work?

PancakeSwap uses an automated market maker (AMM) model, allowing users to trade cryptocurrencies directly from their wallets without the need for traditional order books. Users can also participate in liquidity pools to earn rewards, and CAKE, its native token, is used for governance voting, staking, and participating in various yield farming opportunities.

Reasons why you should buy PancakeSwap (CAKE)

Crypto enthusiasts consider PancakeSwap a top contender for the “next crypto to explode” title, particularly in the upcoming bull market. Its strategic position on the Binance Smart Chain offers advantages in terms of lower fees and faster transactions compared to Ethereum-based DEXs. With a diverse array of services and a limited token supply, CAKE is poised for potential growth as the platform continues to expand and attract more users.

Other Top Crypto to Buy Now

We have already listed a lot of promising crypto assets that could always become a great addition to your portfolio. However, now let’s look at some more general crypto projects, those that can be less risky while still being interesting.

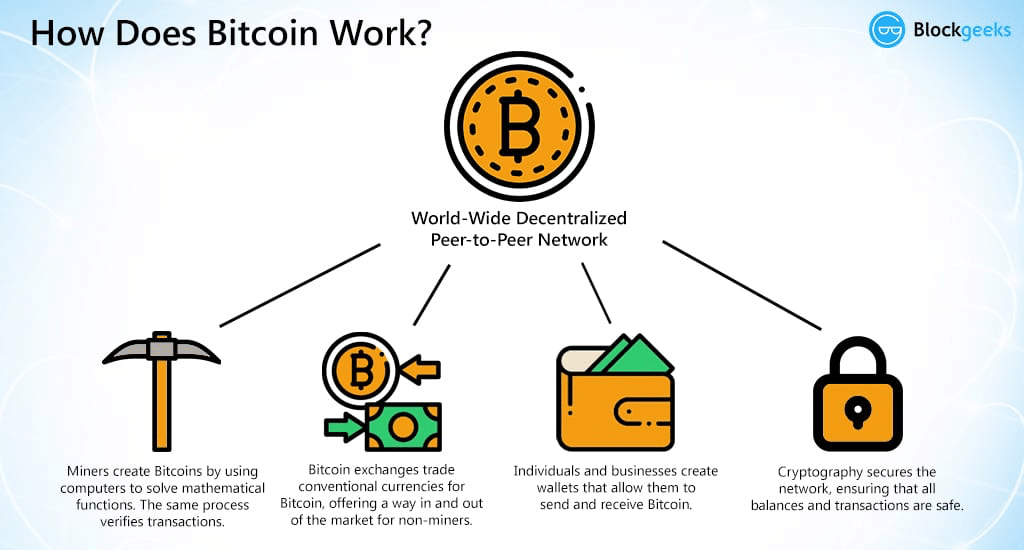

Bitcoin (BTC) – The Most Popular Cryptocurrency

What is Bitcoin?

Bitcoin… Does this cryptocurrency even need an introduction? It is undeniably seen by many as the best crypto to buy. However, a lot of crypto investors also seem to want to avoid it. But why?

Well, the reason for that is simple: many experts prefer investing in coins that have functionality beyond being a store of value or a payment method. Bitcoin isn’t a crypto token that has a curious project behind it. Its transactions are also fairly slow, making it a less-than-ideal way to pay for assets and services.

Still, Bitcoin remains the world’s most popular cryptocurrency, and that already makes it one of the best crypto assets to add to your portfolio.

How does Bitcoin work?

Bitcoin is a proof-of-work cryptocurrency that uses the SHA-256 hashing algorithm. It turns to miners to verify transactions on its blockchain, and they use the computing power of their mining rigs to solve complex math puzzles to get some BTC as an incentive.

There isn’t really anything special about Bitcoin. By today’s standards, its transaction speed is pretty slow, and the coin doesn’t really offer any innovative features.

Reasons why you should buy Bitcoin

Bitcoin is the best crypto to buy for beginners or crypto investors who don’t want to spend a lot of time on their portfolios. It is one of the most reliable cryptocurrencies to get and is available on most crypto exchanges.

Overall, BTC is definitely one of the best introductions to the crypto world and a good crypto asset to even out the risks of one’s portfolio. It is also accepted as a payment by many services, so it could be a good — but not the best — choice if you need crypto for making everyday payments.

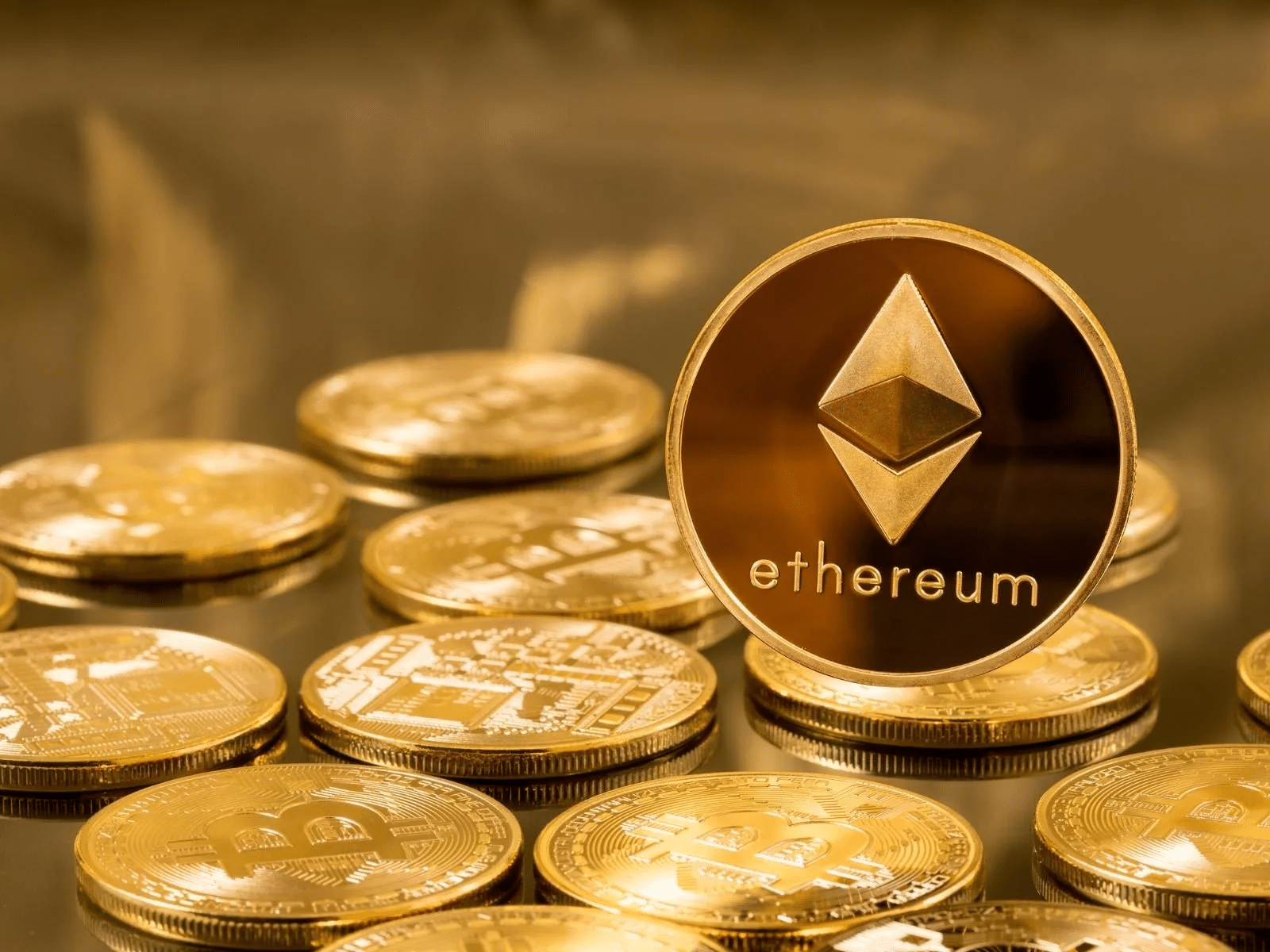

Ethereum (ETH) – The Most Promising Crypto

What is Ethereum?

Ethereum is another big name in the crypto industry. Some people might even rate it far above Bitcoin: after all, this network’s smart contract technology and willingness to innovate are both incredible.

One of the so-called major cryptocurrencies, Ethereum is the second-largest cryptocurrency after Bitcoin in terms of market capitalization. This cryptocurrency and the whole Ethereum network offer users access to a wide range of features and applications. Additionally, the Ethereum platform has a lot of value when it comes to exchange process automation. Ethereum smart contracts minimize bureaucracy and allow two parties to make a deal without intermediaries while maintaining security and benefiting from low transaction latency.

How does Ethereum work?

Although ETH can be used as a payment method and a store of value, the Ethereum blockchain is primarily seen as a network for creating and interacting with decentralized applications, or dApps. It uses smart contract technology to achieve this.

A smart contract is a self-executing contract that writes the terms of agreement between two parties directly into code, eliminating the need for any intermediaries.

Ethereum is a proof-of-stake cryptocurrency. This means that ETH can be staked but not mined. One of the most interesting features Ethereum has is its layer 2 — a scaling solution in the form of separate blockchains that can frequently and easily communicate with the main Ethereum chain. This lets Ether satisfy its users’ needs without sacrificing either security or decentralization.

Reasons why you should buy Ethereum

Many crypto experts and enthusiasts believe that due to this project’s high fundamental value and its well-thought-out and ambitious roadmap, the asset is likely to continue to grow in 2024 and beyond. Such attributes highlight its potential as a top contender in the realm of best cryptocurrency to invest in.

Just like Bitcoin, Ethereum is also available on most exchanges — but it is even more versatile. After all, it can be easily exchanged into any native token as long as its project is based on the Ethereum network.

If you are interested in DeFi and dApps, ETH can be a great investment option. After all, it’s the biggest platform for decentralized applications. Additionally, even if they’re not as popular anymore, many NFTs are also based on this blockchain — and with Ethereum’s functionality, it could very well be that the next big thing in the crypto industry will be connected to ETH, too.

Cosmos (ATOM)

What is Cosmos (ATOM)?

Cosmos (ATOM) is a decentralized network of independent parallel blockchains, each powered by classical BFT consensus algorithms like Tendermint. It aims to solve key issues in the blockchain space: scalability, usability, and interoperability.

How does Cosmos (ATOM) work?

Cosmos uses a unique model where multiple blockchains coexist and interoperate in a decentralized way. Its Inter-Blockchain Communication protocol allows these blockchains to communicate and transact with each other, while Tendermint Core provides a robust consensus mechanism.

Reasons why you should buy Cosmos (ATOM)

Cosmos stands at the forefront of addressing blockchain interoperability, a significant challenge impeding widespread blockchain integration. With its emphasis on user-friendliness and scalability, Cosmos emerges as a potential backbone for the next wave of decentralized applications. As the network garners attention from developers and institutional players, its native token, ATOM, holds promise for value growth, making it an intriguing prospect for those delving into crypto investing.

Aptos (APT)

What is Aptos?

Aptos may not be as famous as Bitcoin or Ethereum, but this cryptocurrency is incredibly popular — and successful — in its own right. At the time of writing, APT was within the top 100 on CMC by market cap.

APT is a native token of a project run by Aptos Labs, a team of technical experts who want to revolutionize Web3 and redefine the way users interact with it. It is a highly active project that has already achieved some of its goals, like launching a testnet. At the time of writing, they already had three products running: Aptos Names, Aptos Explorer, and Aptos Wallet.

How does Aptos work?

True to the vision of its developers, Aptos is a quick and efficient blockchain. It uses Block-STM technology, BFT consensus, and the Move programming language, which makes it one of the most unique crypto projects out there. Aptos can — in theory — reach up to 160,000 transactions per second, which is around 30 times more than the maximum TPS of Solana (SOL).

The Aptos blockchain has an in-built mechanism that allows it to become more reliable than many other crypto projects: if the leader node in the chain fails, one of the other ones can take over. Although it doesn’t make Aptos as reliable as Ethereum, it’s still a nice feature that, unfortunately, comes with the cost of slightly increasing the project’s hardware requirements.

Reasons why you should buy Aptos

Aptos has had a lot of investments, which shows that not only a dedicated community but also industry giants support the project. As a web3-related project, it has the potential for longevity, and its fundamentals seem solid so far.

The APT token is already supported by many major crypto exchanges, so it can be a safe bet if you’re looking for an interesting blockchain-based project to invest in.

Chiliz (CHZ)

What is Chiliz?

Chiliz is an innovative platform that aims to build bridges between sports and entertainment fans and their favorites. They achieve this by creating various exclusive events, merch and ticket sales, and communication channels — all facilitated by fan tokens.

How does Chiliz work?

Chiliz provides fans with fan tokens — a digital currency that enables them to enhance their interaction with their favorite teams or celebrities. Fan tokens are distributed via Fan Token Offerings (FTOs) held on Socios, a separate platform. They can only be purchased with the CHZ token, an ERC-20 utility token.

Fan tokens actually have a capped max supply, so they are a scarce resource. They let fans participate in exclusive sales, fan-led decisions, and more. The more tokens a user has and the more they participate in the community, particularly voting, the more power they will hold. As they rise through the ranks, they might even be able to reach VIP status.

Reasons why you should buy Chiliz

Chiliz and Socios are making significant strides in broadening their platforms, already boasting partnerships with globally renowned sports entities such as FC Barcelona. With CHZ consistently securing a spot within the top 60 by market cap on sites like CoinMarketCap, it’s evident that the cryptocurrency garners significant backing. Whether you’re eyeing a potential return on investment or keen on leveraging the unique services it provides, CHZ stands out as a top crypto to buy in the current landscape.

The Best Cheap Crypto to Buy Now: Under $1

There are quite a few cheap cryptocurrencies out there, but not all of them are worth investing in. Let’s take a look at the ones that will be the best additions to your crypto portfolio.

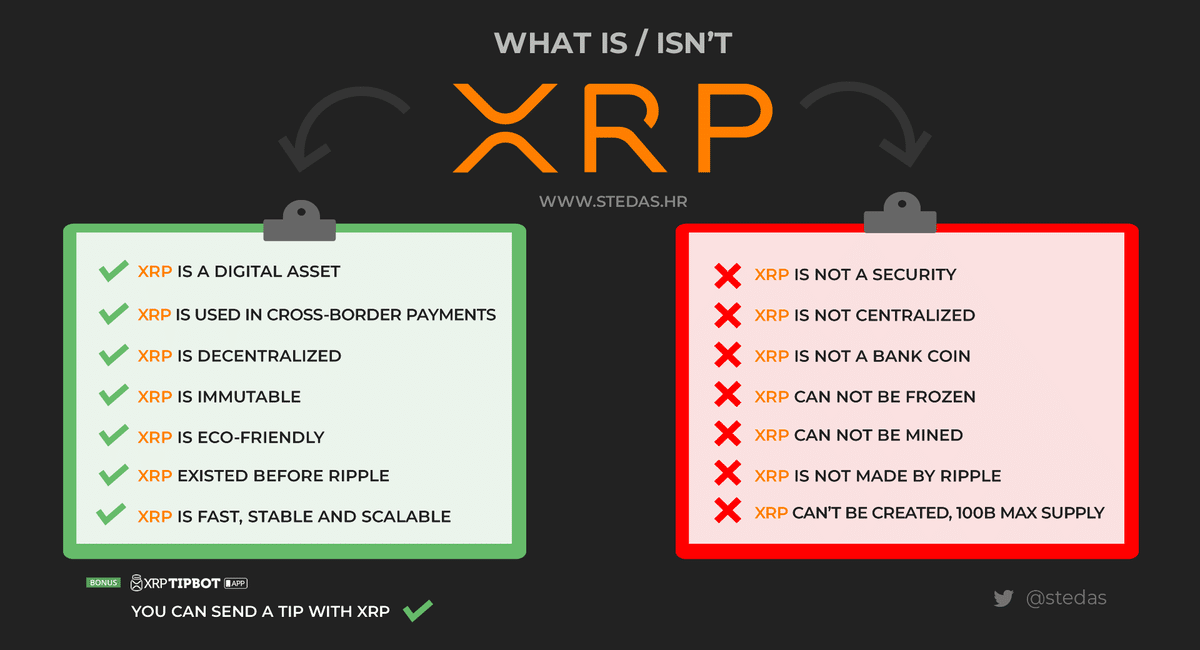

Ripple (XRP) – Top 10 Cryptocurrency with Huge Potential

What is XRP?

Despite being one of the biggest cryptocurrencies in the world by market cap and in terms of popularity, XRP is still fairly cheap. But don’t let its price deter you from investing in this coin: it is incredibly promising and has proven to be a worthwhile investment.

How does XRP work?

XRP is the native cryptocurrency of the XRP Ledger, an efficient, scalable, and sustainable blockchain. It offers users really low costs and high transaction speed alongside being relatively eco-friendly.

Not only is it great for making transactions, the XRP Ledger is also an amazing platform for crypto project development.

Here are some of the features XRP offers:

- Easy cross-country payments

- A high-performance decentralized exchange

- Secure and fast micropayments

- All cryptocurrencies (other than XRP) and non-crypto assets can be represented on the XRP Ledger as tokens

Reasons why you should buy XRP

Maintaining a steady position in the top 10 cryptocurrencies by market cap, XRP retains its popularity among institutional and retail investors and has a truly loyal and robust community. It doesn’t depend on hype figures like Elon Musk to drive its worth, still showing significant price fluctuations and potential for significant growth.

As a touted alternative to SWIFT, if XRP achieves its aim to become a global decentralized payment system, its price could skyrocket. The ongoing legal battle between XRP and the SEC, expected to conclude in 2024, is closely watched by many crypto investors. Given a positive outcome and favorable market conditions, XRP could potentially surge to $3.10.

Stellar (XLM)

What is Stellar?

Stellar, a hard fork of XRP, has been providing people with access to blockchain services since 2014. It is an open network that facilitates global transactions and offers a more efficient way to store value.

How does Stellar work?

The asset’s blockchain is known to the crypto community for its incredibly fast processing speed. The hybrid protocol can significantly reduce the verification time of both transactions and smart contract execution.

| Ethereum | Stellar | |

| Transaction confirmation time | Up to 5 minutes | 3–5 seconds |

| Average fees | Varies, around $2 | 0.00001 XLM |

| Transactions per second | 10–15 | 3000+ |

What sets the Stellar network apart from other blockchain projects is its transaction fee structure: every transaction costs exactly 0.00001 XLM, no matter its size. Considering XLM is a cheap cryptocurrency worth less than a dollar, Stellar transactions are unprecedentedly cheap.

Reasons why you should buy Stellar

As the cryptocurrency world becomes more mainstream, there will arise a need for cheaper transactions. And Stellar, with its solid technological foundation and established reputation, is one of the best candidates for taking advantage of that need. XLM responds well to the rise and fall of cryptocurrency prices on the crypto market and will most likely continue to be a worthwhile investment opportunity.

Given long-term partnerships with large companies and financial institutions aimed at a wide audience, the project could become more and more popular. As a result, the asset’s price could multiply.

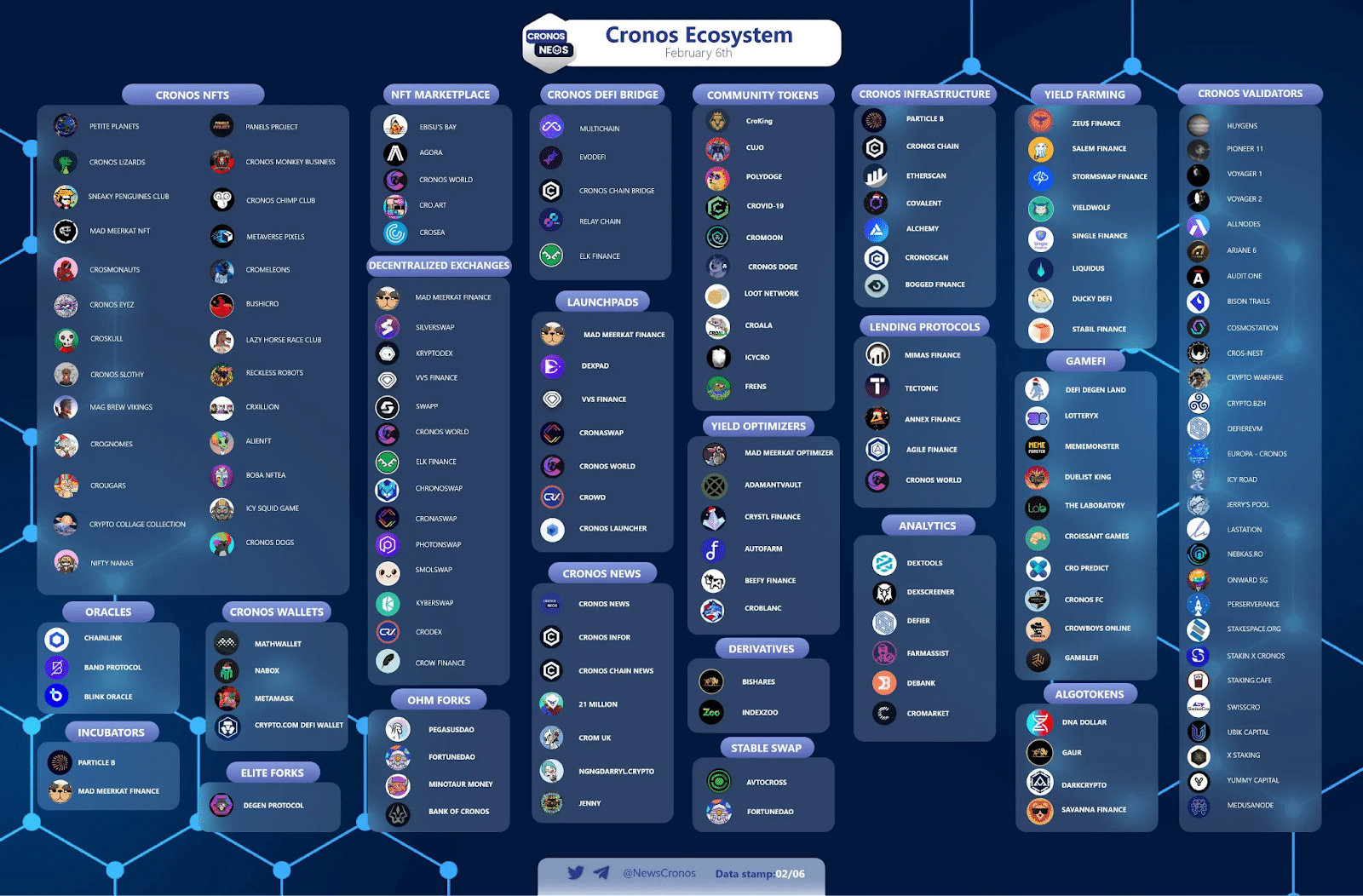

Cronos (CRO)

What is Cronos?

Formerly known as the Crypto.com Coin (or Crypto.org Coin), CRO is the native token of the Cronos Chain, an open-source blockchain developed by Crypto.com. It is one of the various projects made by the company to promote crypto and mass adoption.

The Cronos Chain’s primary function is powering the Crypto.com app for mobile payments.

How does Cronos work?

The Cronos Chain is compatible with Ethereum and the EVM, meaning it can run the latter’s dApps. Cronos is meant to support crypto creators, encouraging them to produce dApps and DeFi solutions using the platform. Cronos also has interoperability with the Cosmos ecosystem.

Cronos is a bustling system that slowly but surely expands into the GameFi/metaverse fields.

Reasons why you should buy Cronos

CRO can be staked, so you can buy this crypto token to earn passive income from it.

One of the reasons Cronos rebranded its name is because its growth was so explosive — that already should say enough about the value of this project. Cronos also makes sure to follow its roadmap (a rather ambitious one) very closely and delivers on its promises. This is a good sign of the longevity of this project and CRO.

At the end of the day, this cryptocurrency will always be backed by a huge crypto platform and company — Crypto.com. That already gives it more guarantees than what 90% of the crypto market can afford. If you believe in this project, it can be worth investing in.

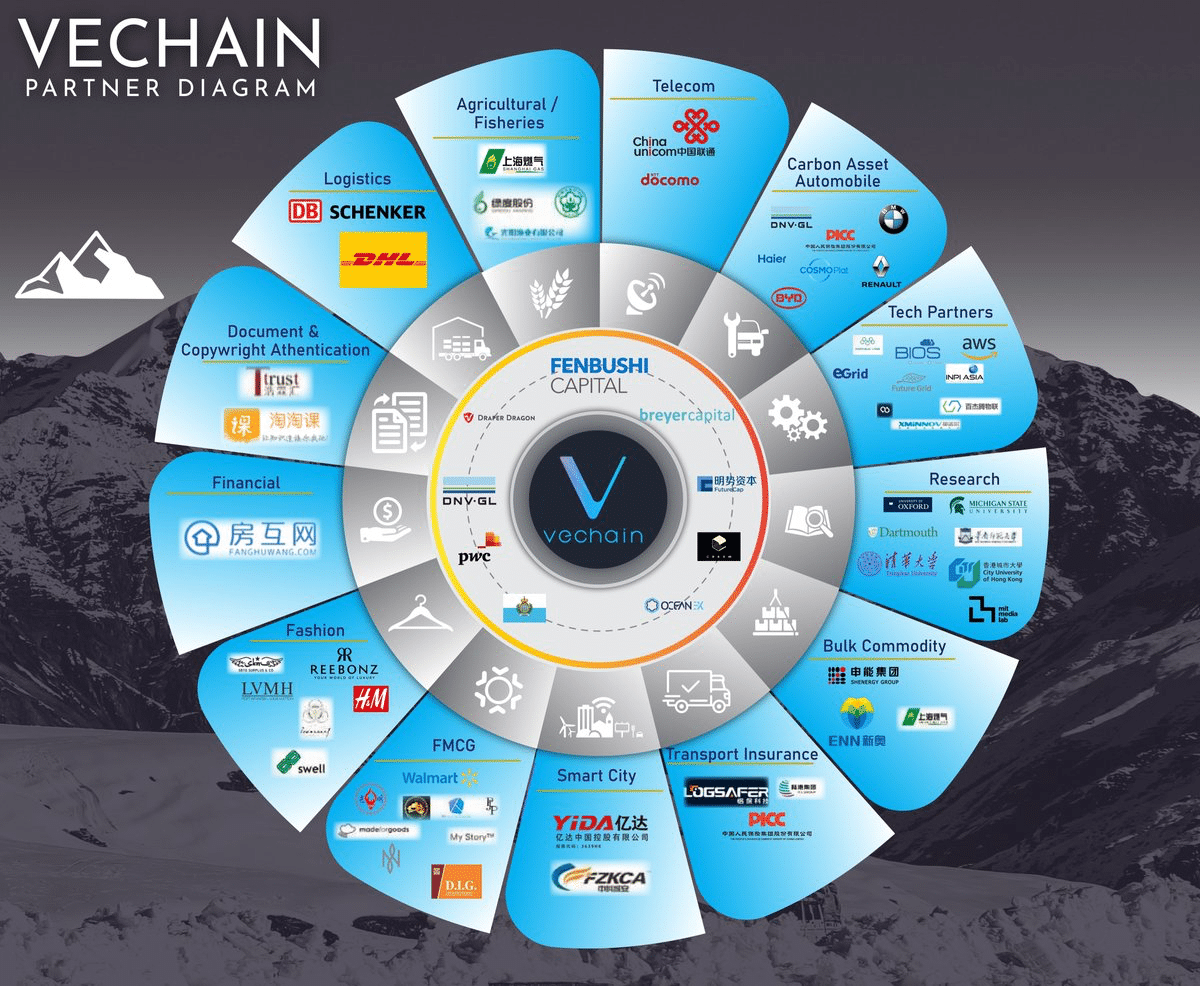

VeChain (VET)

What is VeChain?

VeChain is the premier supply chain cryptocurrency. It was designed to secure and simplify processes like verifying product safety, identifying counterfeit goods, tracking packages across their supply line, and more.

VET has been hit rather hard by the 2022 crypto bear market, but it managed to hold on to its high position in the market cap ranking — VET stayed within the top 40.

How does VeChain work?

VeChain assigns unique identifiers to each product that goes through its system. It is both stored on the blockchain and on the product itself using a QR code or another tag form. This identifier is then used to track the product and make sure its condition and journey are all up to par.

VeChain uses a dual token system, with VET acting as a way to store and transfer value. It is also used to generate the second utility token, VTHO.

VeChain has significantly boosted transparency in supply chain management, and its contributions to the industry have already been recognized by the numerous partners it has.

Reasons why you should buy VeChain

Supply chain management is an industry that is bound to remain relevant for a very, very long time. Therefore, there will always be a need for projects that solve its issues. VeChain does it really well and already has made a name for itself, so if you’re after crypto projects with a solid purpose and execution, VET can be a good crypto to buy now.

Hedera (HBAR)

What is Hedera?

Hedera is a sustainable, enterprise-grade network that makes it possible to create powerful dApps. One of its main aspirations was to remedy issues like instability or slowness plaguing other crypto projects.

At the moment, it is still one of the biggest cryptocurrencies in the world, even though its price has never crossed the $1 mark.

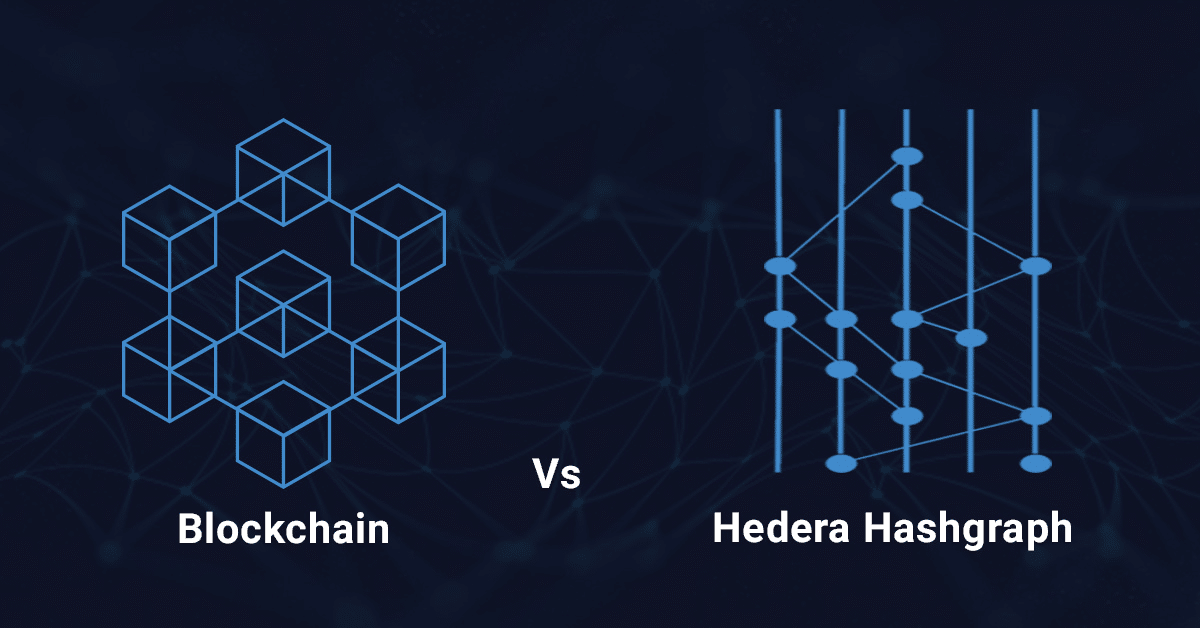

How does Hedera work?

Hedera is a rather unique cryptocurrency: instead of a traditional blockchain, it is built on top of Hashgraph — a type of distributed ledger technology. This enables Hedera to be much more cost-effective, scalable, and faster than many other crypto assets. Its fees average out somewhere around $0.0001. According to its team, Hedera can handle up to 10K TPS.

The native token of the platform is HBAR. It fuels various elements of the network, like smart contracts or file storage. It can also be staked to secure the Hedera ecosystem.

Additionally, the Hedera network offers some major services, like minting and configuring non-fungible and fungible tokens, various smart contract tools, decentralized file storage, and more.

Reasons why you should buy Hedera

Hedera still has much potential as an interesting project. It has a lot of advantages over its competitors and is already an established brand name.

Many experts predict that HBAR will have positive price dynamics in the future. Considering how unique it is, this crypto asset might always have its own niche and can thus be worth buying.

Best Coins to Invest in: Five Best Cryptos Under $5

A cryptocurrency does not have to cost a lot to be a worthwhile investment. Many prominent digital assets never even reached $1 — for example, Dogecoin.

Here are the best penny crypto assets that you can get for less than $5.

Basic Attention Token (BAT)

What is Basic Attention Token?

BAT, or Basic Attention Token, was launched back in May 2017, over 5 years ago. It is quite a well-established project in the crypto industry, with BAT being ranked within the top 100 cryptocurrencies by market cap despite being a penny cryptocurrency. Its niche is blockchain-based digital advertising.

How does Basic Attention Token work?

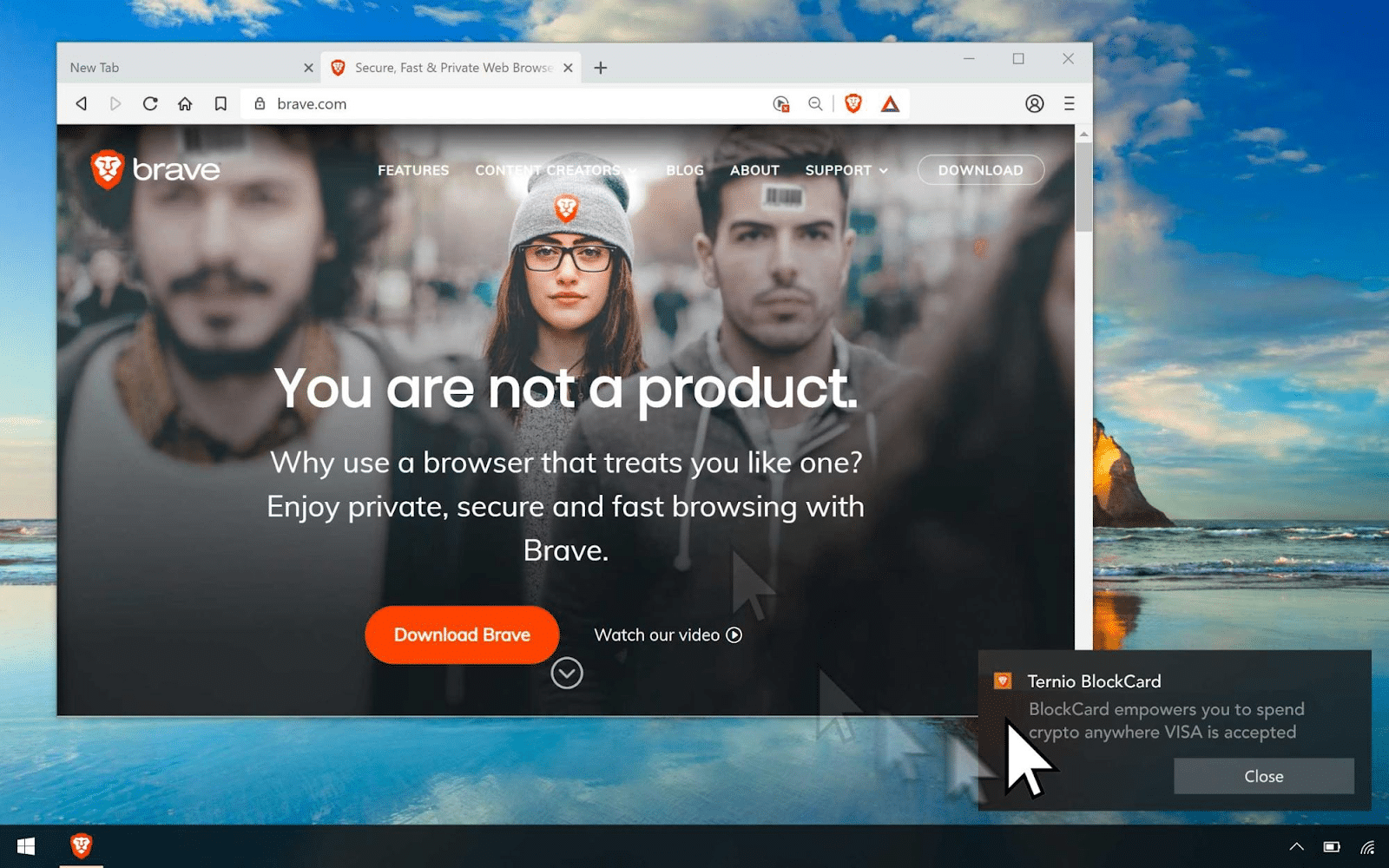

Built on the Ethereum network, Basic Attention Token (BAT) powers an innovative digital advertising platform that uses blockchain technology. BAT creates a balance between better returns for advertisers and fair rewards for users’ time and attention.

BAT works via the Brave Browser, which was tailor-made to reward users for watching ads. They get rewarded in the BAT token, which can be freely exchanged between all network participants.

Unlike regular ads, the ones in the Brave Browser don’t invade users’ privacy, upholding the typical crypto industry values.

Reasons why you should buy Basic Attention Token

Basic Attention Token has a good reputation, a purpose, an active community, and a good team — all the things that usually spell out success for crypto projects. It does well in terms of crypto price and market cap and provides a product that genuinely solves some of the longest-standing issues in the digital advertising sphere.

This can be the best crypto to buy if you genuinely believe in this project, but don’t forget to research it before you buy BAT on crypto exchanges.

Theta Network (THETA)

What is Theta Network?

Another top 50 cryptocurrency, Theta Network is a penny cryptocurrency that aims to conquer the web3 niche. The project’s team is advised by many prominent people in the digital industry, like Steve Chen who co-founded YouTube.

Theta is a blockchain-based video streaming platform set to challenge the poor infrastructure and high costs present in the industry and deliver a better experience for both content creators and viewers.

How does Theta Network work?

Theta Network wants to decentralize video streaming and data delivery, which, in turn, should make these activities a lot more efficient and less costly. The project has its own blockchain and two tokens: THETA, the project’s native token, which performs governance tasks, and TFUEL, which powers the platform and its economy.

Theta makes streaming more lucrative not only for the streamers themselves but also for their viewers: they can earn TFUEL crypto tokens for watching content and other activities on the network.

Theta Network reduces costs by operating on thousands of nodes and moving some of its content over to peer-to-peer networks. This also additionally secures the platform.

Reasons why you should buy Theta Network

Theta Network is an innovative blockchain platform backed by many industry giants and a team of experts who previously worked on other mainstream streaming services. Additionally, their goals extend beyond just decentralized streaming: they want to create a launchpad for dApps, too.

THETA token is an important part of the Theta Network ecosystem and a reliable cryptocurrency in its own right. As long as the project team continues to be innovative, THETA will definitely remain a good digital asset to pick up on crypto exchanges.

Cardano (ADA)

What is Cardano?

Aiming to create fair and transparent communities across the globe, Cardano (ADA) is another project that can be considered one of the “faces” of the crypto market.

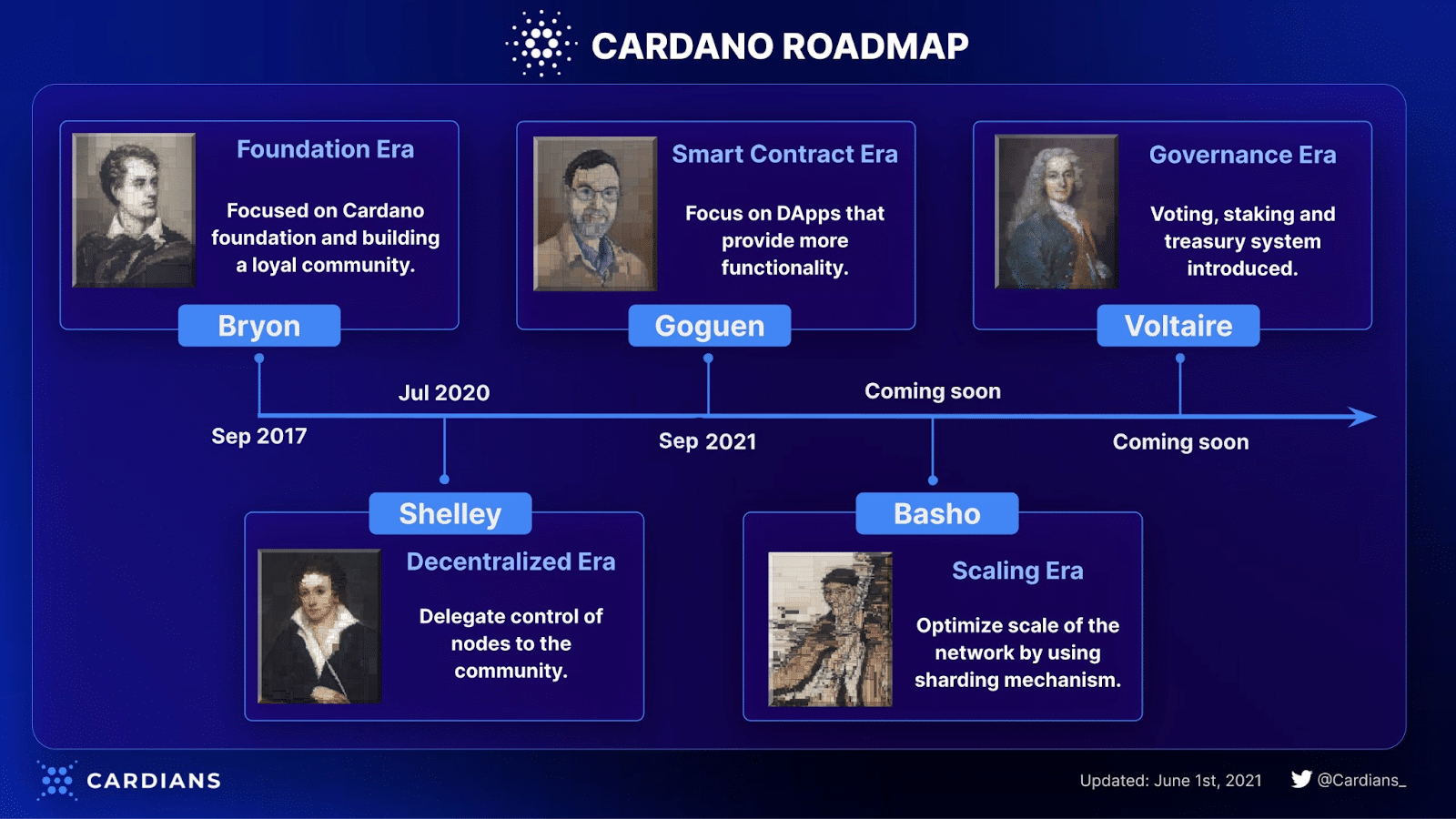

How does Cardano work?

Cardano cryptocurrency gained smart-contract functionality in 2021 following a hard fork. Its developers use a scientific and methodological approach to create new technologies and constantly expand the platform’s functionality.

Here are some of the goals that Cardano is pursuing:

- Creating a truly secure voting system for token holders

- Using mathematics to further secure blockchains

- Creating an infinitely scalable consensus mechanism

These are achieved in part with the help of Cardano’s unique consensus mechanism Ouroboros. It is a proof-of-stake protocol that achieves incredible mathematical security without sacrificing the efficiency of ADA transactions.

Reasons why you should buy Cardano

ADA, consistently ranking within the top 10 by market capitalization, has showcased remarkable price appreciation. Its potential positions it as a strong contender for those looking to invest in crypto. The trajectory of its value in the forthcoming years will hinge on the broader acceptance of blockchain technology and the strategic alliances Cardano forges.

The project has a lot of support and hired experts to do scientific research in the fields of cryptography, engineering, and blockchain technology.

Unlike many other projects in the cryptocurrency space, Cardano has real-world utility and delivers on its promise to make the world a better place. For example, it is used in agricultural supply chains to track counterfeit goods. In addition to its functionality, Cardano is also relatively eco-friendly as it uses the proof-of-stake consensus mechanism.

These factors make the ADA coin attractive for short-term and long-term investments.

Polygon (MATIC)

What is Polygon?

Polygon is the first easy-to-use platform for Ethereum (ETH) scaling and infrastructure development. To put it simply, Polygon allows the Ethereum blockchain to essentially transform into a full-fledged multi-chain network similar to that of Polkadot.

How does Polygon work?

The Polygon network connects Ethereum-based projects. It does this while increasing their individual scalability, sovereignty, and flexibility without sacrificing security. Polygon uses a proof-of-stake consensus mechanism, meaning its token MATIC can be staked.

Polygon is capable of

- enabling communication between Ethereum and other blockchains and

- making existing blockchains compatible with Ethereum.

MATIC is an ERC-20 token that runs on the Ethereum blockchain. It secures the platform and allows its holders to vote on governance proposals. It is also used to pay transaction fees.

Reasons why you should buy Polygon

Besides having incredible value and working with the Ethereum network, Polygon is backed by two crypto industry giants — Coinbase and Binance.

Ethereum is one of the most promising crypto projects out there, and Polygon’s connection to it is undoubtedly a huge benefit. Multi-chain functionality will become increasingly important as cryptocurrencies enter the mainstream, so this crypto platform has much potential.

Fantom (FTM)

What is Fantom?

Fantom is a top-100 cryptocurrency designed to be an open-source permissionless smart contract platform for decentralized apps (dApps) and digital assets. It can be seen as a competitor to Ethereum.

How does Fantom work?

In order to support the creation and smooth operation of decentralized applications on its platform, Fantom uses its own aBFT consensus protocol called Lachesis. It is amazingly scalable, secure, and fast. Here are some of its characteristics:

- Leaderless

- Byzantine Fault-Tolerant

- Asynchronous

Overall, it promotes decentralization and democratization. All transactions on Fantom are also confirmed very quickly — in just 1–2 seconds — so there’s no need to wait for block confirmations.

FTM, the network’s utility token, is used for governance, payments, and fees. It can also be staked to further secure the chain.

Reasons why you should buy Fantom

FTM is a cheap cryptocurrency that can fit many people’s investment portfolios. Although the project it powers may not seem that different from other similar platforms at first glance, it has managed to carve out a niche for itself and has become home to many dApps. Additionally, Fantom is compatible with the EVM — Ethereum Virtual Machine — which makes it easy to port Ethereum-compatible dApps to Fantom.

Overall, this can be a great penny crypto asset to buy. It is issued as both an ERC-20 and a BEP-20 token. One can easily buy FTM on major centralized crypto exchanges and decentralized exchanges.

How to Identify the Best Crypto to Buy Right Now

New cryptocurrencies appear on the crypto market every day. At this point, there are thousands of projects out there, and crypto investors manage to profit even from those ranked below 1000 by market cap.

The cryptocurrency market is wildly unpredictable, so there’s no certain way to predict which coin or token is going to hit it big next. However, there are some signs you can look out for.

Crypto Price, Volume, and Market Cap

Out of these two, the second factor is probably a lot more important — after all, as XRP has proven, a cryptocurrency can still be relevant even if it costs less than $1. Volume, particularly daily trading volume, on the other hand, tells a different story. It can show not only how many transactions are made with an asset but also how consistent the interest in a particular cryptocurrency is over a period of time.

Keep in mind, however, that sometimes a high daily volume can be attributed to the same wallets sending crypto coins or tokens back and forth — or transactions between different wallets belonging to the same people. The latter case is particularly hard to expose. The best way to do that would be to look at social media and online communities to see how many real people are discussing the project in question.

The market capitalization of the cryptocurrency and its popularity among both experts and crypto newbies are also of great importance when choosing an investment asset to add next to your crypto wallet.

Past Performance

It is essential to pay attention to the asset’s past performance. It is better to invest in a project that has shown mostly positive growth dynamics over the past six months or even a year. After all, this indicates it has at least some stability and some bulls that believe in it.

If there was a bear market, then you should see how the asset’s crypto price has behaved in the past: it can be a bad sign if it stayed dormant while the rest of the crypto market was out rallying.

Prospects of Adoption

“Adoption” for crypto assets has long since stopped being just about widespread use as a general payment method. These days, it’s more about practical usage, like NFTs or payment mediums in blockchain-based projects.

Generally speaking, it is better to invest in a project that has a fundamental market value and whose prospects are more or less clear. It should offer a solution to an urgent problem for a particular crypto ecosystem or even provide some new technology or mechanism.

Market Conditions

If you are just about to start investing in cryptocurrencies, don’t forget to read, observe, compare, and follow the latest crypto news. Crypto prices are very dependent on hype and demand, so it helps to be up to date with the latest trends in the industry, like decentralized finance or Web3 or even something related to AI.

How many competitors does a project have? This is also a serious factor because if a project doesn’t stand out too much or is up against established digital currencies, it can be harder for it to find its audience.

Conclusion – Best Crypto to Buy Now

There are a lot of digital currencies on the market, and it can be hard to choose what crypto to buy. While it may be tempting to chase the highest — or lowest — crypto price or the latest trendy token, that does not always guarantee you good profit or profit at all. The best crypto to buy now (or at any time) will always be one that can become a fitting part of a balanced portfolio.

That said, there’s nothing wrong with focusing on just one project or asset type. There are many ways to invest in crypto and get coins and tokens nowadays, from airdrops to playing games. Buying crypto is still the easiest way to obtain it, but don’t be afraid to explore and discover uncharted territories in the crypto space — you might find a compelling crypto project you would have never noticed otherwise.

And if you don’t care about any of that, just choose tried-and-tested options like Ethereum, Bitcoin, Cardano, or any other crypto from our list. Just don’t forget that every investment carries inherent risks. Always prioritize conducting your own due diligence before deciding on the best cryptocurrency to invest in today. Good luck, and have fun!

Best Cryptocurrencies to Invest in: FAQ

What is the best cryptocurrency to invest in right now?

The best crypto to buy now will depend on the rest of your portfolio. If you don’t have any other cryptocurrencies, Ethereum or Bitcoin could be the best choice. Otherwise, it depends on your risk appetite.

Which crypto has the most potential?

THETA, MATIC, and VET all seem like interesting projects with good potential. However, BNB, ETH, and BTC will always be some of the most reliable high-potential cryptocurrencies out there.

Which crypto will boom in 2024?

This year is shaping up to be dominated by meme coins, with new entrants in the field capturing significant attention. If meme coins pique your interest, be sure to check out newcomers like PEPE. Beyond meme coins, another cryptocurrency that is creating a significant buzz in the market is BTC20. As with any investment, research these prospects thoroughly to understand their potential and risks.

Which is the best cryptocurrency to buy for beginners?

If you’re a newcomer to the crypto space, buying crypto that has proven to be reliable, like BTC or ETH, would be the best choice. If you plan on testing out other coins and tokens down the line, getting Tron, Ether, or BNB would be the best option since they all open up doors to thousands of tokens on their networks.

Which crypto has the best future?

If you want a boring yet the most realistic answer, it’s likely Bitcoin or Ethereum, the two crypto giants. Otherwise, quite a few smaller projects, like DYDX or FLOW, look promising, too.

Don’t forget to DYOR before investing in any crypto asset.

What cryptocurrency should I invest in for long-term?

When looking for cryptocurrencies that have the potential to survive long-term, avoid projects whose communities exist solely on 1–2 Discord servers and consist mainly of people looking to make a quick buck. Projects with an established reputation — like Ethereum, Cardano, or Bitcoin — have the biggest chances of surviving long-term.

What is the best new crypto to buy?

Generally, projects like Polkadot and Internet Computer — crypto platforms dedicated to crypto ecosystem development — have been doing very well lately in the crypto sphere. Utility tokens of decentralized apps and decentralized exchanges like UNI tend to do well, too, so you can look out for them. Even though meme coins can also have explosive growth potential, they are an incredibly risky investment. Metaverse and NFT cryptocurrency projects are still popular as well despite not being as big of a trend anymore and could be one of the best cryptos for the next bull run.

Overall, crypto as an asset class is known to be high risk and high reward, so there are often different coins going up. Many investors prefer to buy a variety of digital assets instead of looking for just one specific “best new crypto.”

Which crypto is the next Bitcoin?

While Bitcoin remains the titan in the cryptocurrency realm, it’s hard to envision any other digital asset surpassing its prominence, relevance, and market cap—barring any unforeseen circumstances. However, Ethereum, Solana, and XRP are among the few that show promise and have the potential to approach Bitcoin’s stature. If you’re pondering the “Best Crypto to Buy Now,” these contenders certainly merit consideration.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.