So, what happens when you combine two already extremely volatile ways of making money? You get double the risk and double the rewards, of course!

(Well, not exactly double. But the potential is there!)

Crypto day trading can be a great way to earn some money, but please beware that it is not for everyone — there is a lot of risk involved. Unless you have some experience with day trades or have learned a lot about them and crypto, you should not consider it as a primary source of income.

But before learning how to maximize your gains, you should first familiarize yourself with what day trading entails and how it works, particularly in the crypto markets. So, let’s explore what it means to day trade digital currencies!

Hi, my name is Zifa. I am a long-time crypto enthusiast, and I understand the challenges individuals face when diving into the complex world of crypto day trading. The potential for both risk and reward is substantial, and having navigated this landscape for quite some time, I’m here to guide you through the nuances and strategies that can make your foray into crypto day trading more informed and, hopefully, more successful. So, let’s get started!

Please note that this article does not constitute investment advice.

What Is Crypto Day Trading?

Day trading is the act of buying and selling an asset in a single day. Crypto day trading is exactly the same, but with one exception: the asset here is a cryptocurrency or a crypto pair. Day traders typically buy and sell multiple times throughout the day in order to take advantage of short-term fluctuations in crypto prices. This can be a highly profitable activity, but it also comes with many risks.

By selling and buying assets in rapid succession, traders aim to capitalize on short-term price fluctuations in the cryptocurrency market instead of long-term trends. Because of this, day trading is an entirely different beast from regular investment: it requires analyzing prices and crypto assets through another lens.

How to Pick Cryptocurrencies for Day Trading?

When it comes to choosing cryptocurrencies and crypto pairs for day trading, there are a few things you need to look for. Before doing any other research, make sure that the crypto you’re planning to go for has low fees. This way, you can maximize your profits by minimizing your costs — after all, nobody wants to spend all their earnings on trading fees.

Volatility

First and foremost, you will need some volatile cryptos for trading. Volatility means that the asset’s price is constantly changing, and there are a lot of profit opportunities. Although this is often seen as a downside, it is a benefit in day trading, as, without it, there is scarcely any way to make reliable profits.

Volume

Secondly, the cryptocurrencies you choose should have high liquidity and a huge trading volume. In other words, lots of people are trading that crypto, making it easy to buy and sell the asset. When trading crypto pairs with low trading volume, you might encounter sharper price swings but can also get stuck with digital assets you don’t need, being unable to sell them.

Current News

Finally, there’s also news. Recent market and industry developments are less of a factor in crypto day trading strategies than in long-term investment. That’s because day traders make a profit off price fluctuations, not necessarily bullish or bearish trends.

However, current news can still tell you what cryptocurrency or crypto pairs will be trending and, therefore, will have active price movement in the near future. Additionally, you can use the news to predict whether you should open short or long positions.

What are the Best Cryptos to Day Trade?

Now that we know what to look for in a good day trading crypto, let’s take a look at some of the best options out there.

Fantom (FTM)

Fantom is probably the least known cryptocurrency on this list, but it does not make it any less lucrative for day traders. It has all the things one might wish for in a digital asset suitable for crypto day trading: low fees, fast transaction times, and high trading volume.

At the time of writing, it was within the top 60 cryptocurrencies by market capitalization on CMC, which ensures at least a baseline level of liquidity. A big crypto asset like this is also more likely to be listed on various crypto day trading platforms, which allows traders to use advanced trading strategies like arbitrage.

XRP (XRP)

XRP is a great crypto to trade daily for a few reasons. First, it has a very low transaction fee of just 0.000001 XRP, which makes it perfect for those who want to make a lot of trades without having to worry about high fees eating into their profits. Second, XRP is incredibly fast, with transactions taking just four seconds to confirm. This speed is perfect for day traders who need to make quick trades and don’t have to wait around for slow block times.

The XRP native token is also highly volatile, which can lead to big profits if you know how to capitalize on its price movements. Moreover, thanks to its unbelievable popularity, there are always people willing to capitalize on its price swings, making them even more extreme.

Solana (SOL)

If you’re looking for a fast and scalable crypto for day trading, Solana is a terrific option. This coin can handle up to 50,000 transactions per second, which is incredibly fast compared to other blockchains. Additionally, as Solana’s transaction fees are very low, you won’t have to worry about losing money on fees.

Another great thing about Solana is that it’s both popular and future-proof in part thanks to its smart contracts technology. And although potential longevity does not matter much for day traders, it ensures that there are always new (and often inexperienced) traders seeking out this cryptocurrency on any crypto trading platform. This increases its liquidity and profit-making potential even further.

Bitcoin (BTC)

Bitcoin, the largest and most well-known cryptocurrency, has the biggest market cap in the industry. Apart from this, it is the most liquid crypto, meaning there are always buyers and sellers available. Bitcoin has exceptionally huge trading volume and high volatility, and, overall, one can consider it a solid choice for day trading.

Cosmos (ATOM)

If you’re looking for best day trading coins that are volatile and have the potential to make you some serious profits, Cosmos is a great pick. This coin has seen some massive price swings in its short time on the market, and it shows no signs of slowing down. The key to day trading Cosmos is to watch the market closely and take advantage of every opportunity.

Ethereum (ETH)

Ethereum has a really wide price range, which means that there will be plenty of opportunities to buy low and sell high. Additionally, Ethereum is one of the most popular cryptocurrencies, so you’ll always be able to find buyers and sellers.

Another attention-worthy thing about Ethereum is that it’s relatively stable. Unlike some other coins, Ethereum doesn’t experience huge price swings on a daily basis. Although this may seem counterintuitive, this can also be great for day trading — it allows you to go for less risky strategies and walk away with a more reliable profit at the end of the trading day.

Cardano (ADA)

A great crypto for day trading, Cardano is highly volatile and boasts high upside potential. ADA is often compared to Ethereum, but Cardano is actually more scalable and faster. Additionally, Cardano has a strong community behind it that is constantly working on improvements, thus ensuring there will be interest in this crypto.

Polkadot (DOT)

DOT has everything a day trade might need: good liquidity, availability on a wide variety of trading platforms, low fees, and more. This cryptocurrency has an extremely dedicated community and, what matters even most, a solid and innovative functionality that ensures its price movements are worth following.

Overall, with more than enough profit-making opportunities and risks at bay, DOT is a solid pick for day trading.

Dogecoin (DOGE)

Dogecoin (DOGE) is a popular choice for day trading due to its notable volatility and strong community support, which drive frequent price fluctuations. Its widespread recognition and use in transactions enhance liquidity, facilitating swift trades. Moreover, DOGE’s presence in social media and news spikes trading volumes, offering ample opportunities for profit. The low cost per coin also makes it accessible for traders of varying budgets who wouldn’t mind capitalizing on short-term market movements.

Binance Coin (BNB)

Binance Coin (BNB) stands out as a prime candidate for day trading due to its high liquidity and sufficient volatility, making it possible for traders to enter and exit positions smoothly and capitalize on price movements. As the native token of one of the world’s largest cryptocurrency exchanges, BNB enjoys robust demand and utility within the Binance ecosystem, including trading fee discounts and participation in exclusive token sales. This utility not only ensures a steady trading volume but also enhances its appeal by reducing transaction costs for traders on the Binance platform. Additionally, Binance’s practice of regular coin burns can influence price appreciation, adding a unique aspect for traders to consider.

How to Start Day Trading?

There are a few things you need to do before getting into crypto day trading. First of all, you should find a good day trading crypto platform that will have all the features you might need. If you’re new to trading, it could be a good idea to create several accounts on different popular exchanges to try them out before you commit. Most platforms also have demo accounts that let you glimpse into day trading without having to make a deposit.

There’s no one “best crypto day trading platform” — just one that works for you. We recommend looking for centralized exchanges with high liquidity and trading volume, a user-friendly interface, and low trading fees. Crypto exchanges are typically less regulated than their traditional counterparts.

Once you find the exchange you like, you can give day trading a go.

At first, practice with smaller amounts to get a taste for it: many advanced traders use their intuition to make some of their trades, so the experience is invaluable. Once you’ve learned a bit about order types, like the stop-loss, and figured out what goes where on your chosen crypto exchange, you can start thinking about your strategy.

If you are just starting out in the world of crypto, you will first need to get a crypto wallet and buy some cryptos for day trading. You can do that via fiat gateways (for example, you can buy 90+ coins and tokens on our platform) and later get the specific cryptocurrency you need using centralized or decentralized exchanges.

Crypto Day Trading Strategies

The key to being successful at day trading cryptocurrency is to have a strategy in place before you start. This means knowing what you’re looking for in a trade and having an exit plan ready. Once you have these things figured out, you can start looking for trades that fit your criteria.

Whichever day trading strategy and cryptocurrency to day trade you decide to go for, make sure that you have a solid plan in place before you start trading. This will help you minimize your losses and maximize your profits.

There are several known and tested day trading strategies out there — let’s take a look at some of them.

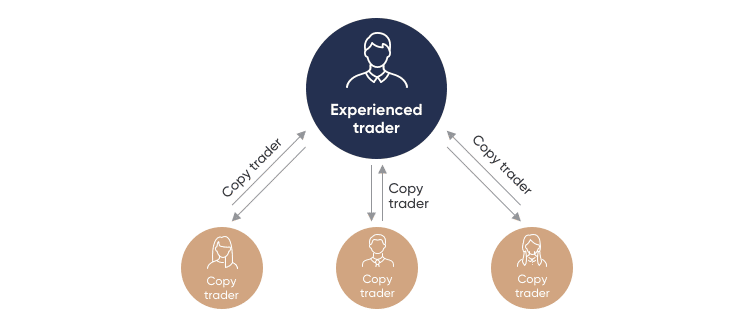

Copy Trading

Copy trading is perfect for beginners or those who want to trade crypto but don’t have the time or knowledge to do it themselves.

Just like the name suggests, copy trading involves basically copying the trades of another crypto trader. When they buy or sell a coin, you do the same. The benefit is that you don’t have to research which coins to trade or keep an eye on things like market sentiment; that’s all done for you. You can simply sit back and watch your account grow… or shrink.

However, there are a few things you need to be aware of before starting to copy trade crypto.

- Make sure you choose a reputable and trustworthy trader to copy.

- Remember that past performance is not indicative of future results. Just because a trader had success in the past doesn’t mean they’ll be successful again in the future.

- Don’t put all your eggs in one basket. Just like you diversify your portfolio by trading multiple different assets, you should follow a wide variety of traders when copy trading. That will allow you to minimize your losses and to capitalize on different market niches.

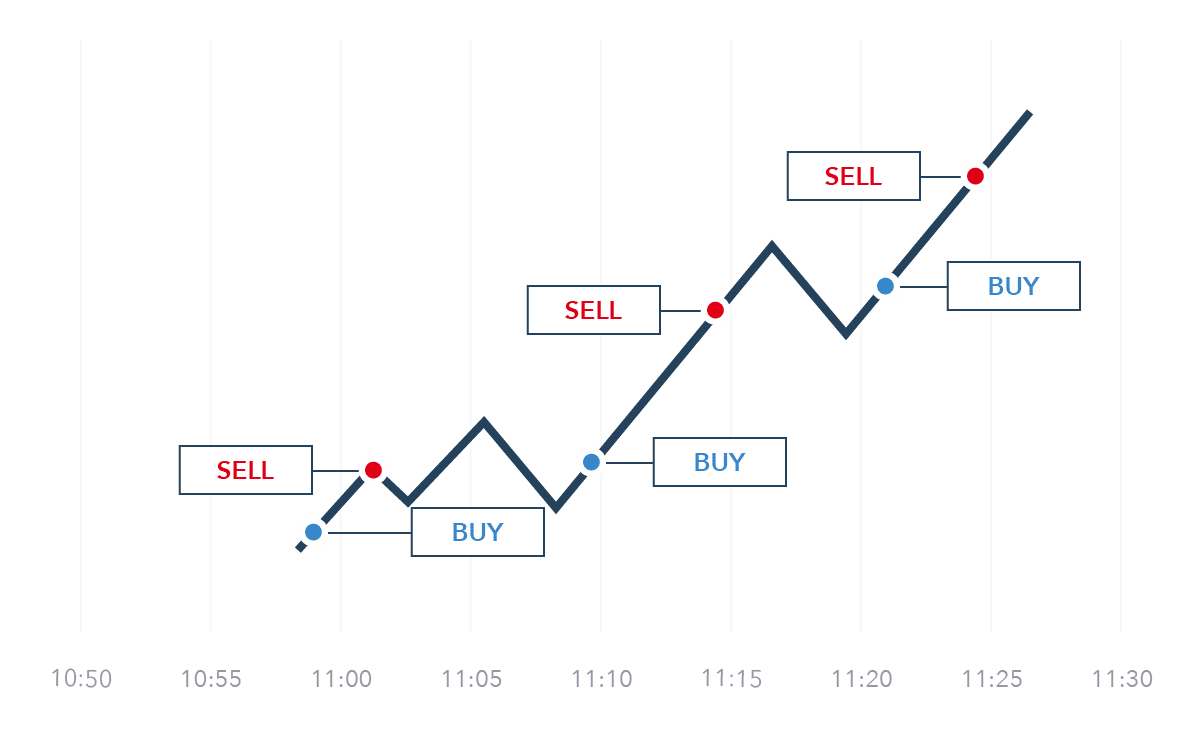

Scalping

Crypto scalping is a trading strategy with the aim of profiting from small price changes. It involves buying and selling crypto assets in quick succession and can be applied to any time frame, though most commonly, this strategy is employed in shorter time frames, such as one minute or five minutes.

Scalpers typically look for coins with high liquidity and low spreads to minimize their transaction costs. Some of the top choices for crypto scalping include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

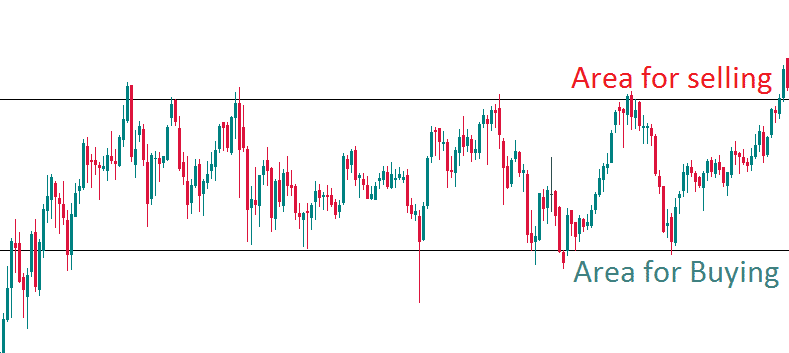

Range Trading

Range trading involves looking for coins that keep bouncing back and forth between two prices. These coins usually have high liquidity, which means there are a lot of people buying and selling them. This makes it easy to get in and out of trades quickly. Additionally, these coins tend to be less volatile than others on the market, which means they’re less likely to experience sudden price swings.

The best crypto pairs for range trading are the ones with high liquidity but relatively low volatility.

High-Frequency Trading (HFT)

HFT is an algorithmic trading strategy that involves using powerful computer programs to make hundreds, if not thousands, transactions per second. It is usually only used by institutional traders as it requires an expensive rig to be profitable: your processing speed needs to be really high.

HFT is highly efficient and can be incredibly profitable, but it is too resource-intensive for most people.

The main aim of HFT is to take advantage of small price movements in a short period of time. This type of trading requires a lot of experience and knowledge about the market as well as good analytical skills.

You can learn more about it here.

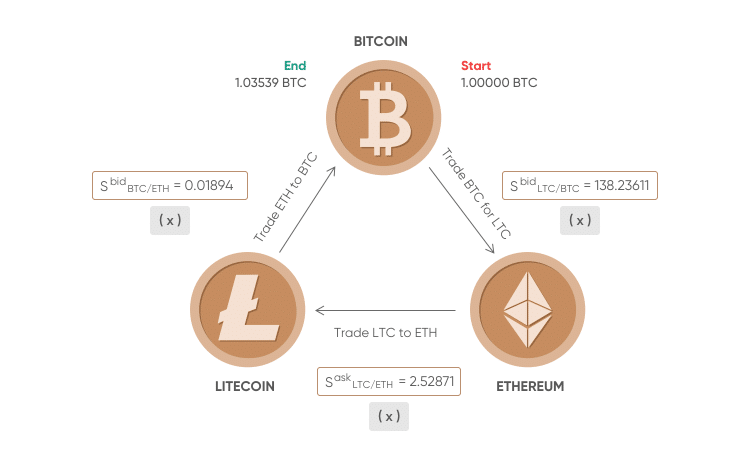

Arbitrage

Arbitrage involves taking advantage of price differences on various exchanges. For example, let’s imagine that Bitcoin is trading for $30K on Exchange X and $31K on Exchange Y. A day trader could buy BTC on Exchange X and then sell it immediately on Exchange Y and get a profit of $1,000.

Arbitrage requires a good understanding of the market and the industry. Above that, you will also need to have accounts on many different platforms and grasp what cryptocurrencies may have wildly different prices on various crypto exchanges. Last but not least, you will have to be really quick to take full advantage of the price spread.

Keep reading — we have a dedicated article on crypto arbitrage.

Crypto Signals for Day Trading Cryptocurrency

A crypto signal is basically a piece of advice or information that tells you when to buy or sell a particular coin. These signals can come from human analysts or from automated bots. There are a lot of different crypto signal providers out there, so it’s important to do your research and find one that suits your needs.

These days, many scammers try to get novice crypto traders to join private telegram groups promising millions of profit for the low price of $9.99. Avoid them like wildfire: in most cases they have no idea what they’re talking about.

If the community of a signal provider is big enough, it can easily manipulate prices on the unregulated crypto market, so beware of that and adjust your strategy accordingly. Sometimes it can be a good idea to follow those signal providers just to get a glimpse of what is going to happen in the crypto market shortly.

Momentum Investing a.k.a. Trend Trading

Momentum investing involves identifying cryptocurrencies that have been showing a strong trend in one direction and then buying or selling those assets in anticipation that the trend will continue. This strategy is based on the idea that assets that have performed well in the recent past will continue to perform well in the short term. Momentum investors look for signals such as high trading volume and significant price movements to make their trades. The key is to enter and exit at the right times to capitalize on the continuing momentum.

Averaging Down

Averaging down is a strategy used by investors to decrease the average cost of a coin holding if an asset drops in price. Essentially, if the price of a cryptocurrency you’ve invested in falls, you buy more of it at a lower price to reduce your average cost per share. This strategy can be risky, especially in the volatile crypto market, as it involves investing more money in an asset that is declining in value. However, if done wisely and with assets with strong fundamentals, it can lower your break-even price and potentially lead to profits if the market rebounds.

Daily Range Day Trading Strategy

The Daily Range Day Trading Strategy focuses on identifying cryptocurrencies that have a consistent daily trading range. Traders using this strategy look for coins that exhibit a predictable pattern of fluctuation between high and low prices within a trading day. By buying at the low end of the daily range and selling at the high end, traders aim to capture small, consistent profits. This strategy requires careful analysis of price charts and patterns to identify suitable entry and exit points.

Fading

Fading is a contrarian crypto day trading strategy that suggests taking a position that goes against the prevailing market trend. For example, if a cryptocurrency has experienced a rapid surge in price, a trader employing the fading strategy might take a short position, betting that the price will fall as other traders begin to take profits. This strategy can be particularly risky, as it involves betting against market momentum, but it can also offer significant rewards if timed correctly.

Crypto Day Trading Robots

Trading bots can be a great help to both beginner and experienced crypto day traders alike. They come in many configurations and forms and can chase different goals — the primary one being making you a profit, of course.

Those robots automate your day trading strategy by executing your trades for you. Learn more about them here.

Where Can You Day Trade Crypto?

There are quite a few platforms out there that support crypto day trading. Some of the most popular ones include Binance, the largest cryptocurrency exchange, Coinbase Pro, Kraken, and Changelly PRO. Some traditional, non cryptocurrency exchanges like Chicago Mercantile Exchange allow their users to day trade crypto as well, but they are usually more heavily regulated than their crypto-focused counterparts.

Benefits and Drawbacks of Day Trading

Day trading is a nuanced investment strategy that offers both enticing opportunities and notable challenges. Investors considering this path must understand its advantages and disadvantages.

Benefits of Day Trading:

- Flexibility: Day trading stands out for its flexibility, allowing traders to quickly respond to market changes by buying and selling securities within the same day. This adaptability is ideal for a range of trading styles and preferences, offering the agility to capitalize on market trends and fluctuations.

- Profit Potential in Various Market Conditions: One of the unique aspects of day trading is the ability to profit in both bull and bear markets. By employing strategic approaches, traders can generate returns even during market downturns, leveraging their knowledge of chart patterns and technical analysis to spot opportunities regardless of the market’s direction.

- Immediate Returns: Unlike long-term investments, day trading offers the potential for quick returns. This strategy focuses on exploiting short-term price movements, providing an avenue for immediate profits and the satisfaction of quick wins.

- Ongoing Learning and Skill Enhancement: Day trading requires a continuous learning process. Traders must stay abreast of market news and trends, honing their analytical skills through both fundamental and technical analysis. This relentless pursuit of knowledge helps traders refine their strategies and improve their market acumen over time.

Drawbacks of Day Trading:

- Emotional and Mental Strain: The fast-paced nature of day trading demands constant vigilance and swift decision-making, which can be mentally taxing. Novices, in particular, may find the stress and potential for burnout challenging as they navigate the volatility and pressures of the market.

- Capital Requirements and Costs: Effective day trading often requires a significant capital outlay to manage risks and adhere to margin requirements. Additionally, the accumulation of transaction costs, such as commissions and fees, can erode profits, underscoring the need for disciplined capital management and risk mitigation strategies.

- Potential for Trading Addiction: The thrill of trading can become addictive, leading to impulsive decisions driven by emotion rather than rational analysis. Cultivating a disciplined approach to trading is critical to counteract the potential for emotionally charged mistakes.

- Risk of Significant Losses: The possibility of incurring substantial losses is a reality of day trading. Missteps can lead to financial setbacks, emphasizing the importance of a robust risk management plan and the use of technical analysis to minimize losses.

- Knowledge and Experience Barrier: Contrary to the notion of quick wealth, successful day trading demands deep market knowledge and experience. Beginners are especially vulnerable to costly errors, highlighting the necessity for comprehensive research, education, and an ongoing commitment to learning and adapting to market dynamics.

In summary, day trading offers an engaging, albeit challenging, avenue for market participation.

Things to Avoid in Crypto Day Trading

While crypto day trading holds allure, awareness of potential drawbacks is a must. Mismanaging asset allocation is a common pitfall, with traders risking significant losses by allocating too much of their portfolio to one cryptocurrency. Understanding chart patterns and incorporating technical analysis is essential for diversifying the crypto portfolio effectively.

The lack of self-discipline in day trading is another challenge, as constant attention and quick decision-making can be mentally taxing. The fast-paced nature of the market may lead to impulsive and emotional trading, heightening the risk of losses. A successful trader in the crypto market recognizes the importance of maintaining a disciplined trading style to navigate market volatility.

Day trading in cryptocurrencies carries the potential for substantial financial setbacks due to the market’s rapid fluctuations. Failure to anticipate these movements correctly can result in significant losses. At the end of the day, technical analysis and close monitoring of chat patterns are key elements in navigating the inherent volatility in the crypto market.

Since constant market attention is a necessity for successful day trading, this activity demands mental and emotional stamina. Staying informed about news, trends, and market movements while continuously monitoring positions is essential. Successful crypto traders incorporate both fundamental analysis and technical analysis into their routine to adapt to the dynamic nature of the cryptocurrency market.

Lastly, compliance with tax regulations is critical in crypto day trading. Failing to properly report and pay taxes can lead to legal issues and financial penalties, underlining the importance of careful tax management. A successful crypto trader recognizes the need for thorough understanding and compliance with tax regulations to mitigate any legal risks associated with their trading activities.

Day Trading vs. HODLing: A Brief Comparison

As we previously discussed, day trading in the cryptocurrency market comes with its benefits and drawbacks. It offers the potential for quick profits but involves high risk and demands constant attention. Now, let’s explore the alternative strategy of HODLing.

HODLing:

Pros:

- Long-Term Potential: Historically, holding onto cryptocurrencies for the long term has allowed investors to benefit from overall market growth.

- Reduced Stress: HODLing requires less active management, reducing the stress associated with constant market monitoring.

- Less Susceptible to Short-Term Volatility: Long-term investors are less affected by day-to-day price fluctuations.

Cons:

- Potential for Opportunity: During periods of high volatility, day traders might seize short-term opportunities that long-term investors may miss.

- Patience Required: Returns may take longer to materialize compared to day trading, and investors need patience during market fluctuations.

Choosing Your Strategy

The decision between day trading and HODLing ultimately depends on your individual preferences, risk tolerance, and investment goals. If you’re comfortable with high risk, enjoy active involvement, and have the time to monitor the market constantly, day trading might be suitable. On the other hand, if you prefer a more hands-off approach, are patient with long-term returns, and seek to reduce stress, HODLing could align better with your investment style. Remember to carefully consider your financial goals and risk appetite before deciding on a strategy, and strive for a balanced approach that suits your unique circumstances.

Final Thoughts

There are a lot more things to learn about crypto day trading strategies: ways to minimize risk, find the best entry and exit points, trading pairs, and much more. We hope this overview has sufficiently introduced you to the wonderful yet (occasionally) stressful world of cryptocurrency day trading.

If you want to go further on your journey, you can read our articles on crypto indicators and the crypto trading glossary — they will be useful to any trader. And if you decide that day trading isn’t for you, check out our overview of all the main ways you can make money with crypto.

FAQ: Best Day Trade Crypto

Is crypto good for day trading?

Yes, crypto can be well-suited for day trading due to its frequent price fluctuations. The dynamic nature of the cryptocurrency market provides ample opportunities for day traders to capitalize on short-term price movements, allowing for potential profits. However, it’s crucial to note that the high volatility inherent in the crypto market also introduces significant risks, requiring traders to be well-informed, disciplined, and attentive to market trends.

Which crypto is best for day trading?

There’s no one crypto that is the best for day trading. As a day trader, you should be ready to engage with many different digital assets, as that’s the optimal way to make a profit. Cryptocurrencies like Bitcoin, Ethereum, Binance Coin, Fantom, and many others can all be great for cryptocurrency trading.

Is crypto day trading profitable?

Crypto day trading is incredibly risky, so naturally, it has high profit potential, too.

How much does the average crypto day trader make?

Typically, experienced traders succeed in about 50% of their trades. However, their exact income depends on the crypto pairs they’re trading and their crypto trading strategies.

Should I buy and sell crypto daily?

That depends on your investment strategy and risk aversion. Day trading is not the only way to make a profit and doesn’t suit every single investor. If you want to maximize your profit, consider researching and making use of a wide variety of financial instruments. Proper risk management strategies are also vital.

Can you do day trading in crypto?

Yes, day trading in crypto is possible, but it requires extensive knowledge and skill to day trade cryptocurrency successfully. Crypto markets are highly volatile, and inexperienced traders can easily find themselves facing heavy losses. It’s important to have a strategy and research the market to decide when to enter and exit trades. Additionally, traders should pay attention to technical indicators, news, and other factors that could influence the price of crypto before attempting day trading.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.