Although crypto mining is not as popular or profitable as it once used to be, it can still be worth your time as long as you approach it in the right way. If you don’t want to splurge on a whole warehouse full of mining rigs, then you might instead start mining on a smaller scale or even potentially participate in cloud or pool mining.

Hello everyone, I’m Zifa. For over two years, I’ve been navigating the dynamic world of cryptocurrencies, providing my readers with insightful coverage on all things crypto. In this article, we will take a look at some of the best Bitcoin mining software options and briefly examine Bitcoin mining as a whole and how profitable it is in the current day and age. Let’s dive in!

What Is Bitcoin Mining?

Bitcoin mining is the process of verifying and adding new transactions to the blockchain, a public ledger containing all transactions in the Bitcoin network. Miners use powerful computers to solve complex mathematical problems to validate these transactions. In return for their work, they are rewarded with newly minted Bitcoins, as well as transaction fees.

The mining process serves two main purposes. First, it ensures network security by making it difficult for malicious actors to alter transaction data. Second, it releases new Bitcoins into circulation, acting as a decentralized issuance mechanism.

Bitcoin, naturally, isn’t the only crypto asset that can be mined. Litecoin, Dogecoin, Grin, and others are also popular among users that enjoy mining cryptocurrency. Ethereum mining used to be incredibly popular but is now impossible as the coin switched to a proof-of-stake consensus mechanism.

To mine BTC, you will also need to get a Bitcoin wallet. There are many different crypto wallets out there — you can learn more about them here.

Bitcoin Mining Types

There are three primary types of Bitcoin mining: solo, pool, and cloud mining.

- Solo mining is the process of mining Bitcoins independently, without joining any mining pools. This approach can be more rewarding if you successfully mine a block: you’d be entitled to receive the entire block reward then. However, due to the immense competition in the mining space, solo mining has become increasingly difficult, and the probability of successfully mining a block as a solo miner is rather low.

- Pool mining involves joining a group of miners who work together to solve blocks and share the rewards proportionally based on each miner’s contributed computing power. This approach offers more frequent, smaller rewards, making it an attractive option for many miners, especially those with limited resources. Lots of companies offer access to mining pools — for example, Bit Mining.

In my opinion, pool mining is a reasonable choice for most individuals. As rewards are shared among the pool participants, it may seem a less lucrative option than solo mining. Nevertheless, it is a more stable one. This is a good choice if you have moderate resources and want more predictable payouts.

- Cloud mining is a type of mining that utilizes virtual machines operating in the cloud. This process enables miners to lease computing power from external providers, thus allowing them to mine Bitcoins without investing in their own hardware.

As my expertise in the field shows, no matter which method you choose, you should make sure you’re informed about the potential risks and rewards, and you should only invest what you can afford to lose. Remember that while cryptocurrency mining can be profitable, it can also lead to significant losses due to its volatile nature.

Why Do You Need Software for Mining?

Bitcoin mining is a complex and time-consuming process that requires specialized software to make it easier and more profitable. Mining software helps to simplify the best practices for the management of the Bitcoin mining process by leveraging the graphical processing unit (GPU) of computers for easier block discovery. These solutions provide aspiring Bitcoin miners with monitoring capabilities, analysis of network hash rate, worker performance, and information on expected earnings from an operation, as well as other useful tools.

By obtaining up-to-date information about the growing popularity of Bitcoin through these types of solutions, miners can assess their potential returns and adjust their strategies accordingly to maximize profitability. Furthermore, some mining software solutions offer features such as automated payouts that provide investors with a steady flow of income without needing to monitor progress constantly. This minimizes administrative overhead and increases efficiency significantly. Additionally, these platforms come with guides that walk you through the entire setup process, which can be daunting for newbies unfamiliar with how these systems work.

Now that you have a basic understanding of Bitcoin mining and its types, let’s delve into the main topic of this article: the best Bitcoin mining software apps.

The Best Bitcoin Mining Software: Top 5 Applications

Selecting the right cryptocurrency mining software is essential for optimizing your mining operation and maximizing profitability. We’ve analyzed numerous options and narrowed them down to the top 5 mining software programs. Other apps you can check out include Awesome Miner, HiveOS, and Kryptex Miner.

NiceHash

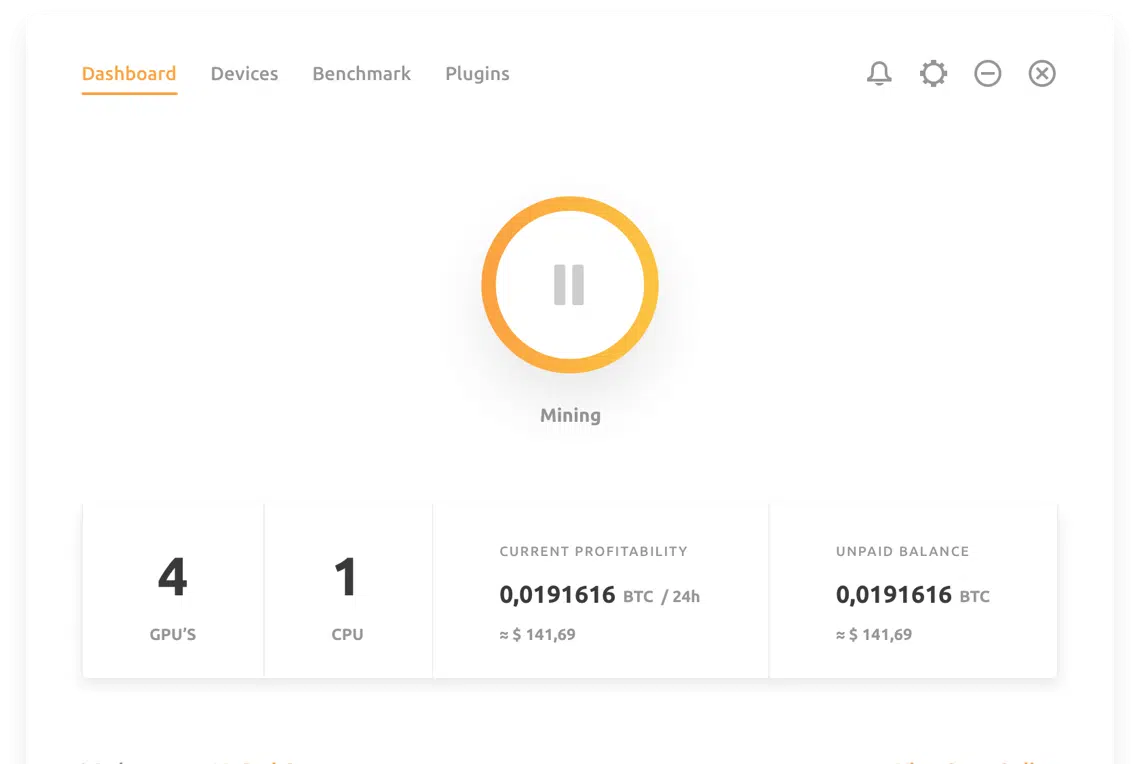

NiceHash is popular mining software that allows users to mine various cryptocurrencies, including Bitcoin, by utilizing their computers’ processing power. It has a simple and user-friendly interface, making it an excellent choice for beginners and experienced miners alike.

Pros:

- Supports multiple algorithms and cryptocurrencies

- Automatic algorithm switching to mine the most profitable coin

- User-friendly interface

- Payouts in Bitcoin

Cons:

- High fees (2% for mining and 5% for withdrawals)

- Centralized platform, which may be less secure than decentralized alternatives

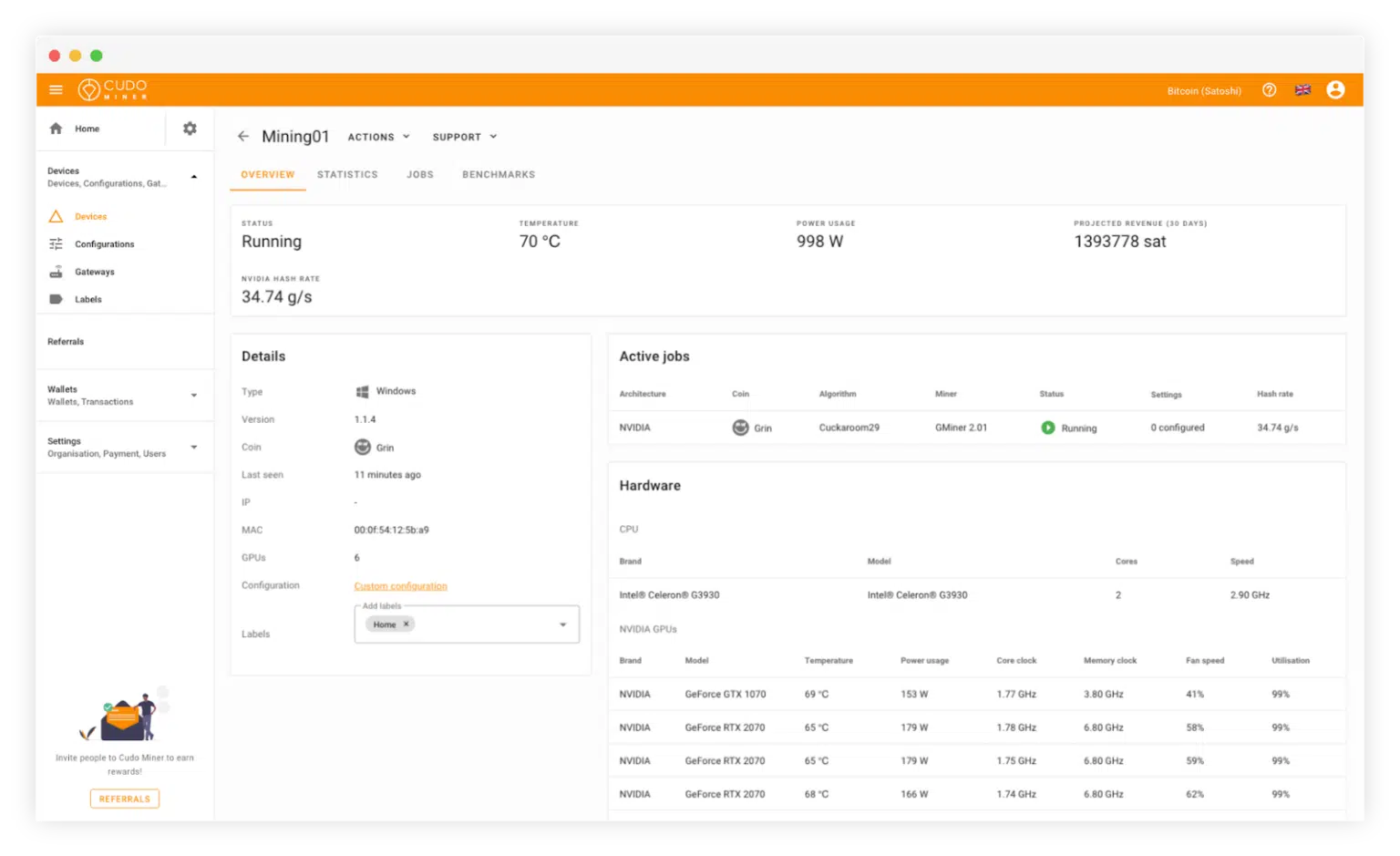

Cudo Miner

Cudo Miner is another versatile mining software that supports Bitcoin as well as multiple other cryptocurrencies. It is designed to maximize mining profitability by automatically adjusting mining settings based on your hardware and market conditions.

Pros:

- Automatic coin switching for maximizing profits

- Supports GPU and CPU mining

- User-friendly interface

- Advanced settings for experienced miners

- Lower fees compared to NiceHash (1.5% for mining)

Cons:

- Payouts only in Bitcoin, Ethereum, or Cudo tokens

- Centralized platform

CGMiner

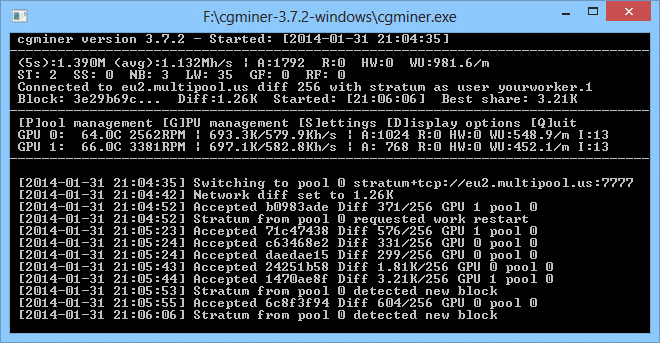

As CGMiner is open-source mining software that has been around since 2011, it is one of the most well-established apps in the space. It is a command-line application, meaning it requires some technical knowledge for effective usage. However, its range of features and compatibility with various mining hardware solidify it as a popular choice among experienced miners.

Pros:

- Highly customizable

- Supports various mining hardware, including ASICs, GPUs, and FPGAs

- Cross-platform compatibility (Windows, macOS, and Linux operating systems)

- The open-source software that is well-maintained by the community

Cons:

- Command-line interface, which may be challenging for beginners

- No automatic algorithm switching

BFGMiner

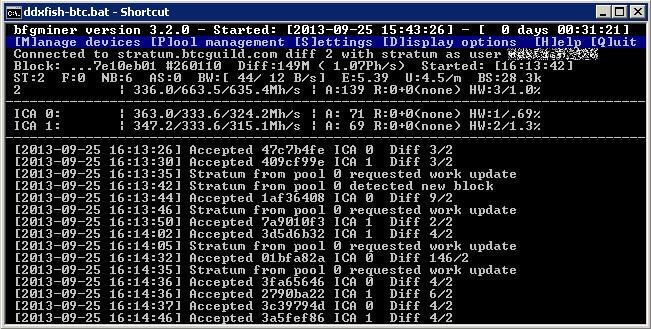

BFGMiner is another open-source free Bitcoin mining software similar to CGMiner, but with a few key differences — it is designed specifically for ASICs. Just like the CGMiner, it also offers a variety of features suitable for advanced miners.

Pros:

- Designed for ASIC mining

- Highly customizable

- Cross-platform compatibility (Windows, macOS, and Linux operating systems)

Cons:

- Command-line interface

- Not suitable for GPU or CPU mining

- No automatic algorithm switching

EasyMiner

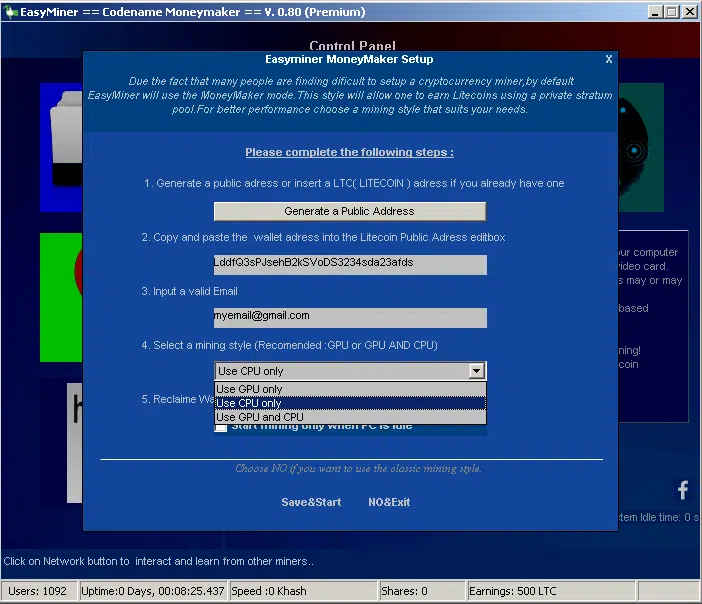

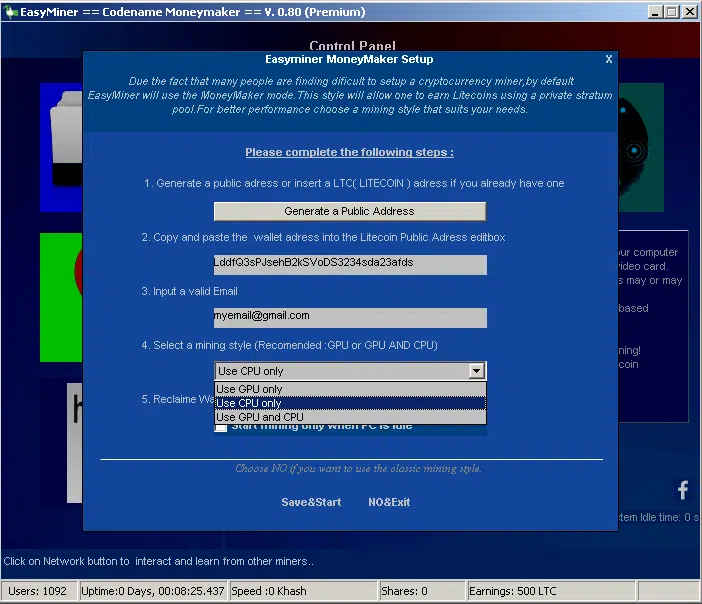

EasyMiner is a user-friendly graphical front end for mining software like CGMiner and BFGMiner. It is designed to make mining more accessible to beginners while still offering advanced features for experienced miners.

Pros:

- Graphical user interface (GUI) for easier setup and management

- Supports both solo and pool mining

- Compatible with CGMiner and BFGMiner

- Cross-platform compatibility (Windows, Linux, and Android)

Cons:

- Limited compatibility with mining hardware (mainly GPUs)

- No automatic algorithm switching

- Not available for macOS

Bitcoin Mining Hardware

The efficiency of your mining operation is heavily influenced by the type of mining hardware you use. There are three main categories of mining hardware:

- CPU mining: The earliest form of Bitcoin mining uses a computer’s central processing unit (CPU). This approach is no longer viable due to the increased mining difficulty and competition.

- GPU mining: Graphics processing units (GPUs) offer higher computational power compared to CPUs, making them more suitable for mining. Due to their versatile nature, GPUs can be used to mine various cryptocurrencies. However, their efficiency for mining Bitcoin has diminished over time due to the rise of specialized mining hardware.

- ASIC mining: Application-specific integrated circuits (ASICs) are custom-built chips designed specifically for Bitcoin mining. They offer the highest efficiency and hash rates compared to CPUs and GPUs. However, they are more expensive and have a limited use case, as they can only mine cryptocurrencies based on the same algorithm. Some examples include ASIC Antminer S19 (Pro, XP), Bitmain S19J Pro, etc.

When selecting hardware, consider factors like hash rate, power consumption, and the initial investment cost. ASIC miners are the top choice for mining Bitcoin, but they may not be suitable for everyone due to their high cost and limited flexibility.

How Profitable Is Bitcoin Mining?

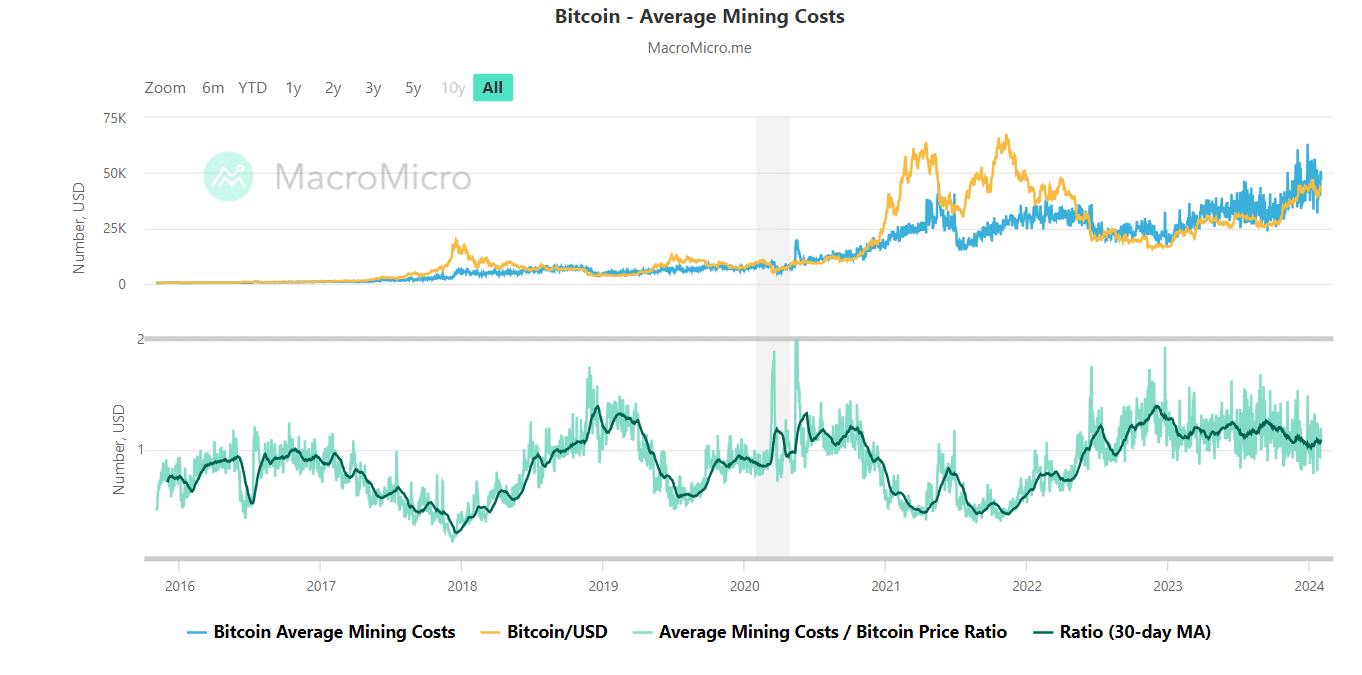

Bitcoin mining profitability hinges on several key factors. The cost of the necessary mining hardware and electricity are primary considerations, as they directly influence the operational costs of mining.

Another critical factor is mining difficulty, referring to how complex it is to solve cryptographic puzzles to validate Bitcoin transactions. With the Bitcoin blockchain experiencing a substantial increase in the hash rate in 2023, mining difficulty has escalated. In fact, the global Bitcoin mining difficulty rate leaped from 35 T at the start of 2023 to 72 T by the year’s end, more than doubling within a 12-month period. This rise in difficulty means more computational power and electricity are needed, which can affect profitability.

The current market price of Bitcoin is also a significant determinant of mining profitability. When Bitcoin prices are high, the potential returns from newly mined coins increase, making the venture more lucrative.

In recent times, the profitability of mining has seen a downturn due to factors like increased mining difficulty, fluctuating crypto prices, and the dominance of large-scale mining farms. Despite these challenges, Bitcoin mining can still be profitable, particularly for those with access to cheap electricity and advanced mining rigs. However, it’s important to carefully assess whether the potential returns justify the investment and effort required.

For those considering Bitcoin mining, online calculators like WhatToMine or CryptoCompare can be invaluable. These tools offer tailored profitability estimates based on individual circumstances and objectives, such as electricity costs and hardware efficiency.

The Risks and Benefits of Bitcoin Mining

Just like any other activity, Bitcoin mining has inherent risks and benefits that you should consider before signing a mining contract or buying hardware/installing software.

Benefits:

- Income generation. Successful mining operations can generate income through block rewards and transaction fees.

- Supporting the network. Miners contribute to the security and stability of the Bitcoin network by verifying and validating transactions.

- Learning opportunity. Engaging in Bitcoin mining can be an excellent way to learn more about cryptocurrencies, blockchain technology, and computer hardware.

Risks:

- Initial investment. Although most Bitcoin mining software is free, hardware isn’t. Mining often requires a substantial upfront investment, which may cause you to end up with a loss.

- Electricity costs. The energy consumption of mining equipment can be high, leading to increased electricity bills.

- Fluctuating profitability. Mining profitability depends on factors like Bitcoin’s market value and mining difficulty, which can be volatile and unpredictable.

- Competition. The mining landscape is highly competitive, with large-scale mining rigs and operations dominating the market, making it progressively difficult for smaller individual miners to compete.

- Obsolescence. Mining hardware can become outdated quickly due to rapid technological advances, potentially diminishing returns on investment.

Hardware Mining vs. Cloud Mining

In this article, we’re diving deep into hardware mining, but it’s important to note that there’s an alternative: cloud mining. While hardware mining requires buying and maintaining your own physical mining equipment, cloud mining lets you rent mining power from a data center located remotely. This way, you can mine cryptocurrencies without the hassle of owning or managing hardware.

Hardware mining’s main advantage is complete control over the mining process and the hardware itself. This control can lead to potentially higher profits. However, the substantial initial investment in hardware, along with ongoing electricity and maintenance expenses, can be significant drawbacks.

Cloud mining, in contrast, attracts with its simplicity. It’s a great option for those who lack technical know-how or want to avoid the high upfront costs associated with hardware mining. That said, it does come with its own set of challenges, including limited control over the mining operations and a heightened risk of fraud and scams within the cloud mining sector.

When choosing between hardware and cloud mining, factors like technical expertise, initial cost, and degree of control over the mining process become crucial. If you have the technical skills and resources to manage hardware, hardware mining might be more profitable for you. On the other hand, if you’re looking for a less hands-on approach with a smaller upfront investment, cloud mining could be the way to go.

For a more in-depth look at cloud mining, check out our dedicated article.

FAQ

What is the most used Bitcoin mining software?

The most widely used Bitcoin mining software is currently CGMiner. Having been around since 2011, this open-source mining software is compatible with a wide range of operating systems, including Windows, Linux, and macOS. CGMiner is known for its flexibility and ability to work with a variety of hardware, making it a popular choice among miners. It also supports multiple mining algorithms, including SHA-256 and Scrypt, and allows for remote monitoring and control of mining rigs. However, there are several other mining software options available, and the choice ultimately depends on the miner’s specific needs and preferences.

Can I mine Bitcoin on my computer?

Yes, you can mine Bitcoin on your computer, but it’s less feasible and profitable now due to increased mining difficulty. Effective Bitcoin mining typically requires specialized ASIC hardware. Mining with a regular computer may lead to high electricity costs and minimal earnings. Cloud mining offers an alternative if you don’t feel like investing in specialized hardware: it allows you to rent mining power without managing physical equipment.

Besides, if you’re not planning to buy mining hardware but are still interested in cryptocurrency mining, consider other cryptocurrencies that are more viable to mine using a PC. For more information, check out our article on alternative cryptocurrencies suitable for PC mining here.

Can I mine Bitcoin on a software?

Yes, you can mine Bitcoin using software, but it’s important to clarify what this means. Bitcoin mining software connects your hardware to the Bitcoin network and manages the mining process. This software is essential whether you’re using a personal computer or specialized ASIC hardware. However, the software alone is not enough; it needs to work in conjunction with appropriate mining hardware to effectively mine Bitcoin.

Can I mine Bitcoin for free?

Technically, you cannot mine Bitcoin for free. Mining Bitcoin requires computational power, which, in turn, consumes electricity. This means there are always costs involved, primarily for electricity and mining hardware. Additionally, using personal computing resources can lead to increased wear and tear on your devices, which is another form of cost. Be wary of any service claiming to mine Bitcoin for free, as these are often scams or involve hidden costs.

Can you mine 1 Bitcoin daily?

Mining 1 Bitcoin per day is extremely challenging and practically unattainable for individual miners using personal or small-scale setups. The Bitcoin network’s mining difficulty is very high, and the rewards are distributed based on computational power. To mine 1 Bitcoin daily, you would need a large-scale operation with substantial investment in high-end ASIC miners and the infrastructure to support them, including significant electricity resources. This level of mining is typically only achievable by large mining pools or industrial-scale mining operations.

Is there any legit mining app?

Yes, there are legitimate mining applications available. Cudo Miner is a good example of a legit miner app that allows you to mine various cryptocurrencies, not just Bitcoin. Thanks to remote access, you can easily monitor and control your mining operations from anywhere. Nonetheless, I cannot stress enough the importance of ensuring that these apps are downloaded from trusted sources to avoid any fraudulent software.

How much does it cost to mine 1 Bitcoin?

The cost to mine 1 Bitcoin varies depending on several factors, including the cost of electricity in your area, the efficiency of your mining hardware, and the current difficulty of mining. Additionally, you should consider the withdrawal fees imposed by cryptocurrency exchanges when calculating the total cost. Due to these variables, pinpointing an exact cost can be challenging, and I would recommend using a mining profitability calculator for a more precise estimate, given your specific situation.

How long does it take to mine one Bitcoin?

The time it takes to mine one Bitcoin depends on the miner’s computational power, known as the hash rate, and the overall mining difficulty. On average, it takes approximately 10 minutes for a miner to find a new block and receive the associated block reward.

However, due to the highly competitive nature of Bitcoin mining and the increasing mining difficulty, solo miners with limited resources are unlikely to mine a full Bitcoin within a reasonable timeframe. Joining a mining pool can improve the chances of earning rewards, but the payouts will be divided among pool participants.

Is Bitcoin mining legal?

The legality of Bitcoin mining varies from country to country. In many jurisdictions, mining is considered legal, provided that miners comply with local laws and regulations, such as obtaining necessary permits and paying taxes on mining income.

That said, some countries have imposed restrictions or outright bans on Bitcoin mining, often due to concerns about energy consumption, environmental impact, or the potential for illicit activities. Before engaging in mining activities, it’s essential to research and understand the legal landscape in your jurisdiction.

You can learn more about the legal status of Bitcoin mining in this article.

What are the best Bitcoin miners?

Choosing the right mining hardware is essential for maximizing your mining operation’s efficiency and profitability. Here’s a list of some of the best Bitcoin miners on the market:

- Bitmain Antminer S19 Pro: This ASIC miner is known for its high hash rate and energy efficiency, so it is no surprise that it is a top choice for serious miners. However, it comes with a high price tag.

- MicroBT Whatsminer M30S++: Another popular ASIC miner with impressive hash rates and energy efficiency. It is considered a strong competitor to the Antminer S19 Pro.

- Bitmain Antminer T19: A slightly more affordable option compared to the S19 Pro, the T19 offers a good balance between performance and cost, making it suitable for smaller mining operations.

- Canaan AvalonMiner 1246: This ASIC miner from Canaan offers competitive performance and energy efficiency. It also has a more appealing price compared to Bitmain’s offerings.

When selecting a mining rig, consider factors like hash rate, power consumption, and initial investment costs to find the best fit for your needs and budget.

How to mine cryptocurrency on a laptop?

While it’s technically possible to mine cryptocurrencies on a laptop, it’s generally not recommended. Laptop hardware is not designed for the intense computational work required for mining, leading to lower mining efficiency and increased risk of hardware damage due to overheating.

If you’re still interested in mining cryptocurrencies on a laptop, consider mining altcoins with lower mining difficulty and less competition than Bitcoin. Some options include Monero, Electroneum, or Verge. Keep in mind that mining on a laptop may yield minimal returns and increase the risk of hardware damage.

To mine on a laptop, follow these steps:

- Research and choose a suitable altcoin to mine.

- Download and install mining software compatible with your chosen altcoin and laptop hardware (CPU or GPU mining).

- Join a mining pool for your chosen virtual currency to increase your chances of earning rewards.

- Configure the mining software according to the pool’s instructions and your laptop’s capabilities.

- Monitor your laptop’s temperature and performance to prevent overheating and hardware damage.

Can I mine Bitcoin on a mobile phone?

While it’s technically possible to mine Bitcoin using a phone, the returns will be negligible, and the risks of damaging your phone due to overheating or excessive resource consumption are high.

Mobile devices lack the computational power required for efficient mining. Therefore, mining Bitcoin on the phone would yield minuscule returns, if any, compared to the costs incurred from increased energy consumption and potential device damage.

If you are interested in getting involved in cryptocurrency mining, but your resources are limited, think of exploring cloud mining services or investing in a mining engine specifically designed for mining purposes.

Conclusion

Mining Bitcoin can be an exciting and potentially rewarding endeavor, yet it requires a strategic approach, careful planning, and an understanding of the various factors that influence mining profitability.

Selecting the best Bitcoin mining software is a fundamental aspect of optimizing your mining operation. Each program offers unique features and benefits, so you should consider your specific needs and goals when making a choice.

Equally important is choosing the right hardware. While ASIC miners are the most efficient option for mining Bitcoin, they may not be suitable for everyone due to their high cost and limited flexibility. Consider factors like hash rate, power consumption, and initial investment cost when selecting mining equipment.

Lastly, assess the profitability of mining by factoring in electricity prices, mining difficulty, and the current price of Bitcoin. Use online Bitcoin mining calculators like WhatToMine or CryptoCompare — they can help you make a more informed decision.

By contemplating these facets and choosing the best Bitcoin mining software and hardware for your needs, you can increase your chances of success in the world of cryptocurrency mining. Good luck on your mining journey!

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.