Analysts at research and brokerage firm Bernstein have raised their year-end price target for bitcoin to $90,000 from $80,000 amid improved market dynamics.

Ultimately, the analysts expect bitcoin to target $150,000 as the 2024-2025 cycle high, with Bitcoin  BTC

BTC

+4.15%

’s upcoming halving event having less impact on miners than in previous years.

“Given general bull market conditions with strong ETF inflows, low miner leverage, and robust network transaction fees this cycle, the halving impact seems relatively mild on the miners, with dollar revenues cushioned,” Gautam Chhugani and Mahika Sapra wrote in a note to clients on Thursday.

Bitcoin’s next halving is estimated to occur on April 20, according to The Block’s Bitcoin Halving Countdown page. The event will see the reward for miners on the network drop from 6.25 BTC to 3.125 BTC per block, meaning some mining operations may no longer be viable.

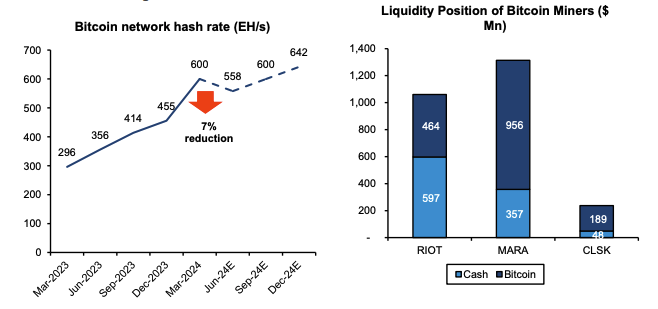

Previous Bitcoin network hashrate declines post-halving have been in the 15-20% range. However, the analysts estimate miner shutdowns to be lower this time around, with a hashrate reduction estimate of around 7% — revised from 15%, and the bull market aiding balance sheets.

More efficient Bitcoin miners to benefit

Chhugani and Sapra expect this to benefit more efficient, lower-cost miners such as CleanSpark and Riot Platforms the most, enabling them to gain relative market share post-halving.

The analysts anticipate Riot and CleanSpark to emerge as category leaders in the space as the largest miners with the most self-mining capacity. However, they also highlighted Marathon Digital’s potential, given its transition to a self-mining model and high liquidity position.

Bitcoin network hashrate and miner liquidity positions. Image: Bernstein.

Investing in Bitcoin miners remains the best equity proxy for the cryptocurrency, according to the analysts, with the top three U.S. listed miners controlling around 10% of the total network hashrate and a combined market cap of around $13 billion, with increased capacity coming in 2024/2025.

Bernstein rates CleanSpark and Riot stock outperform, with price targets of $30 (48% to the upside) and $22 (77% to the upside), respectively. The analysts give Marathon a market-perform rating targeting $23 (3% to the upside).

Bitcoin vs Bitcoin miners. Image: Bernstein.

‘Dip buying opportunity’

On Tuesday, the Bernstein analysts said bitcoin’s recent $10,000 retreat from all-time highs of more than $73,000 to below $63,000 represents a temporary “dip buying opportunity” ahead of the halving.

“We expect the market to consolidate prior to the halving and then expect the overall bull markets to continue,” they said.

Bitcoin is trading at $66,845 as of this writing, according to The Block’s price page. The cryptocurrency is up 5% over the past 24 hours, but down 6.5% over the past week, gaining around 58% year-to-date.

BTC/USD price chart. Image: The Block/TradingView.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.