- AUDIO surged by +60% to $0.27

- However, the rally met a hurdle near $0.3 – Will it clear it?

Audius crypto, a Web 3 equivalent to music streaming platforms like SoundCloud and Spotify, saw its native token, AUDIO, rally by over 65% on Thursday and Friday.

Interestingly, trading volume climbed by 6900% over a 24-hour timeframe too, according to CoinMarketCap. The token rallied on the back of Audius’s listing on Business Insider as one of the top 14 music techs to watch out for.

“Honoured to be named one of @BusinessInsider “14 Music-Tech Companies to Watch”

The upswing flipped the HTF (higher timeframe) market structure to bullish, but the price soon hit a key roadblock. Ergo, the question – Can AUDIO’s bulls clear the hurdle?

Audius crypto bulls’ $0.3 headache

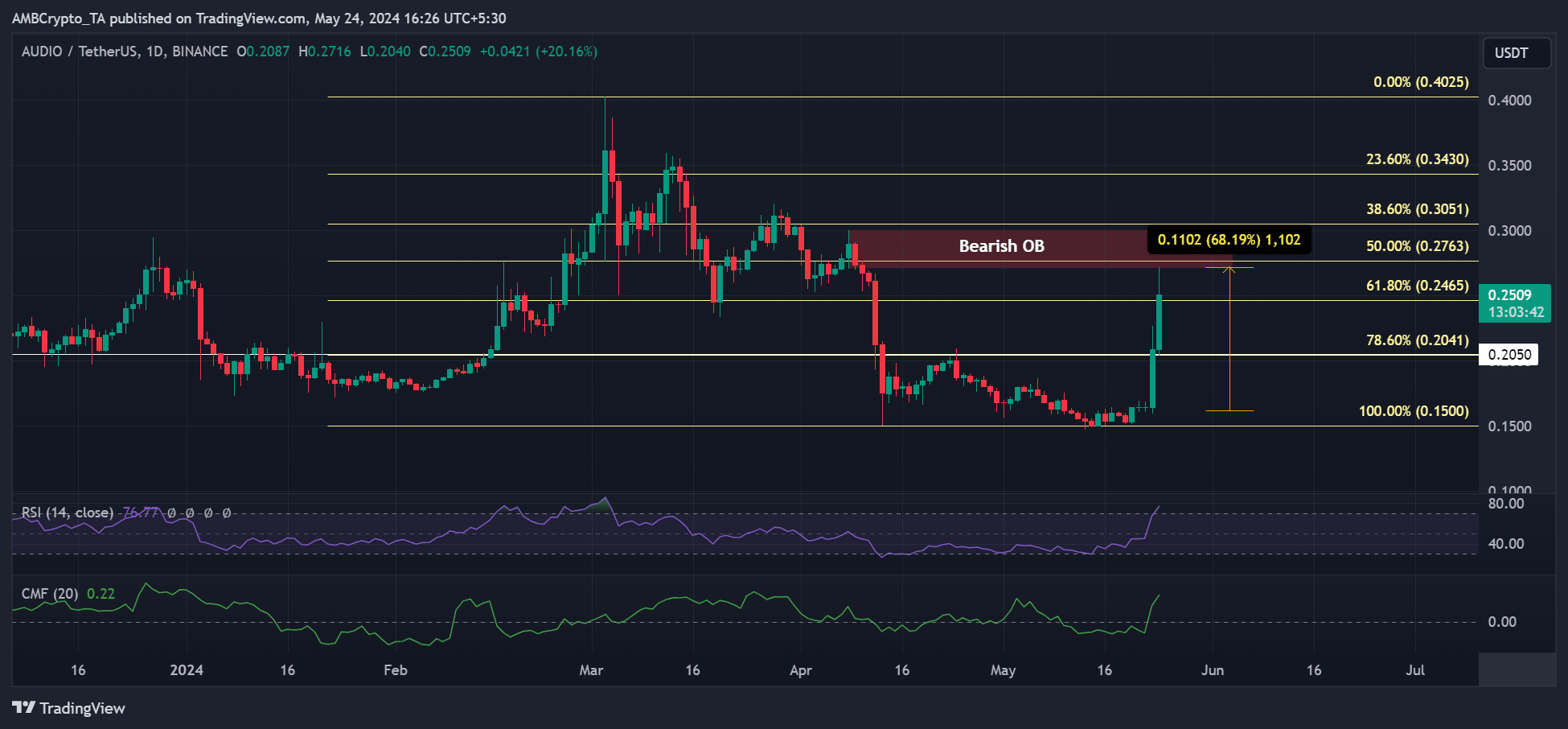

Source: AUDIO/USDT, TradingView

On the daily chart, the hurdle, marked red, was a bearish order block ($0.27 – $0.30) and within the pocket of the 50% Fib and 38% Fib levels.

Despite the move above $0.270, which flipped the market structure bullish, bulls could only establish more leverage if they pushed above the hurdle at $0.30.

If the cool-off from the massive rally extends, AUDIO could ease to $0.25 or $0.20 before attempting to clear the roadblock.

The bullish reading on the RSI (Relative Strength Index) and the CMF (Chaikin Money Flow) supported the rebound scenario. It underscored strong buying pressure and massive capital inflows over the past two days.

Audius crypto liquidity on the lower side

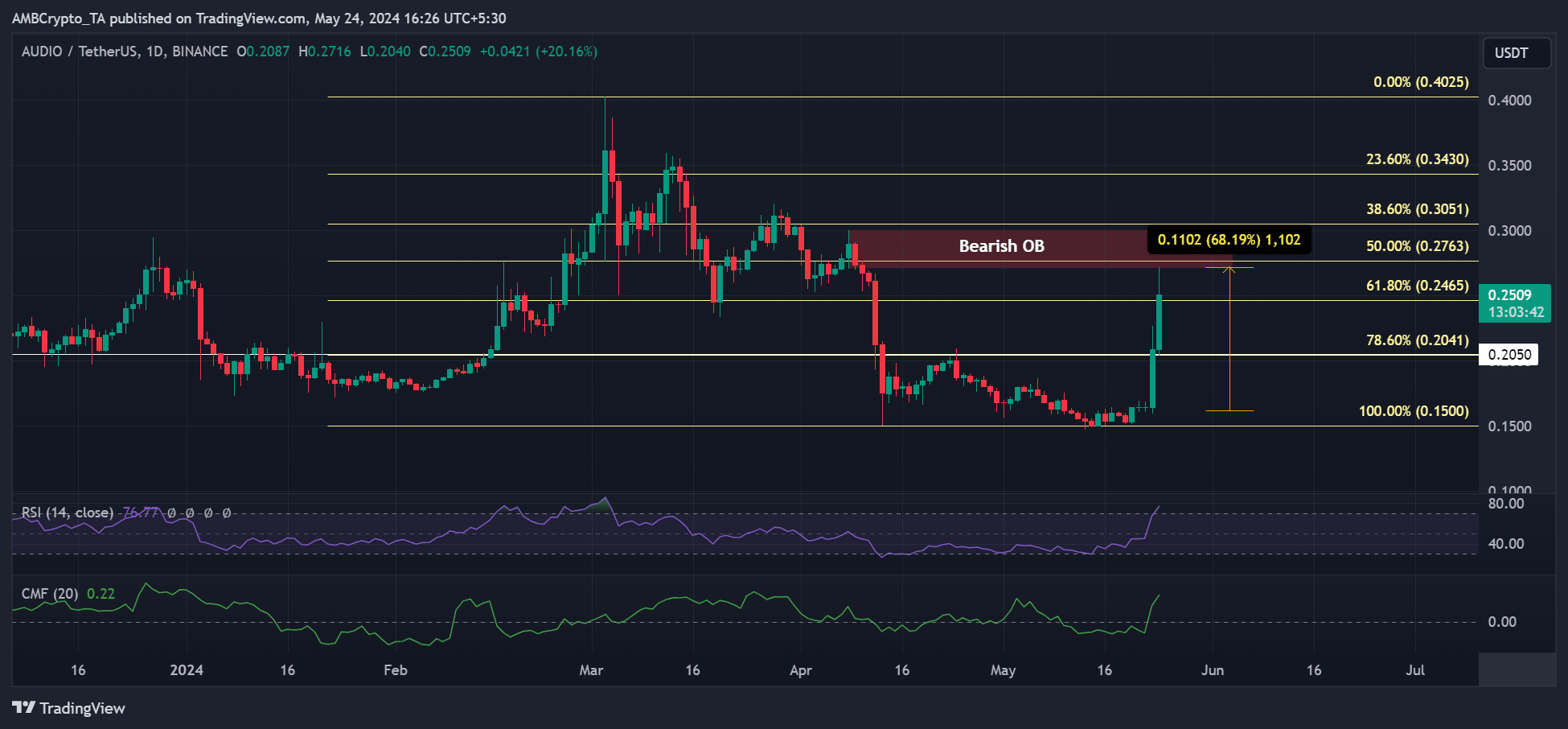

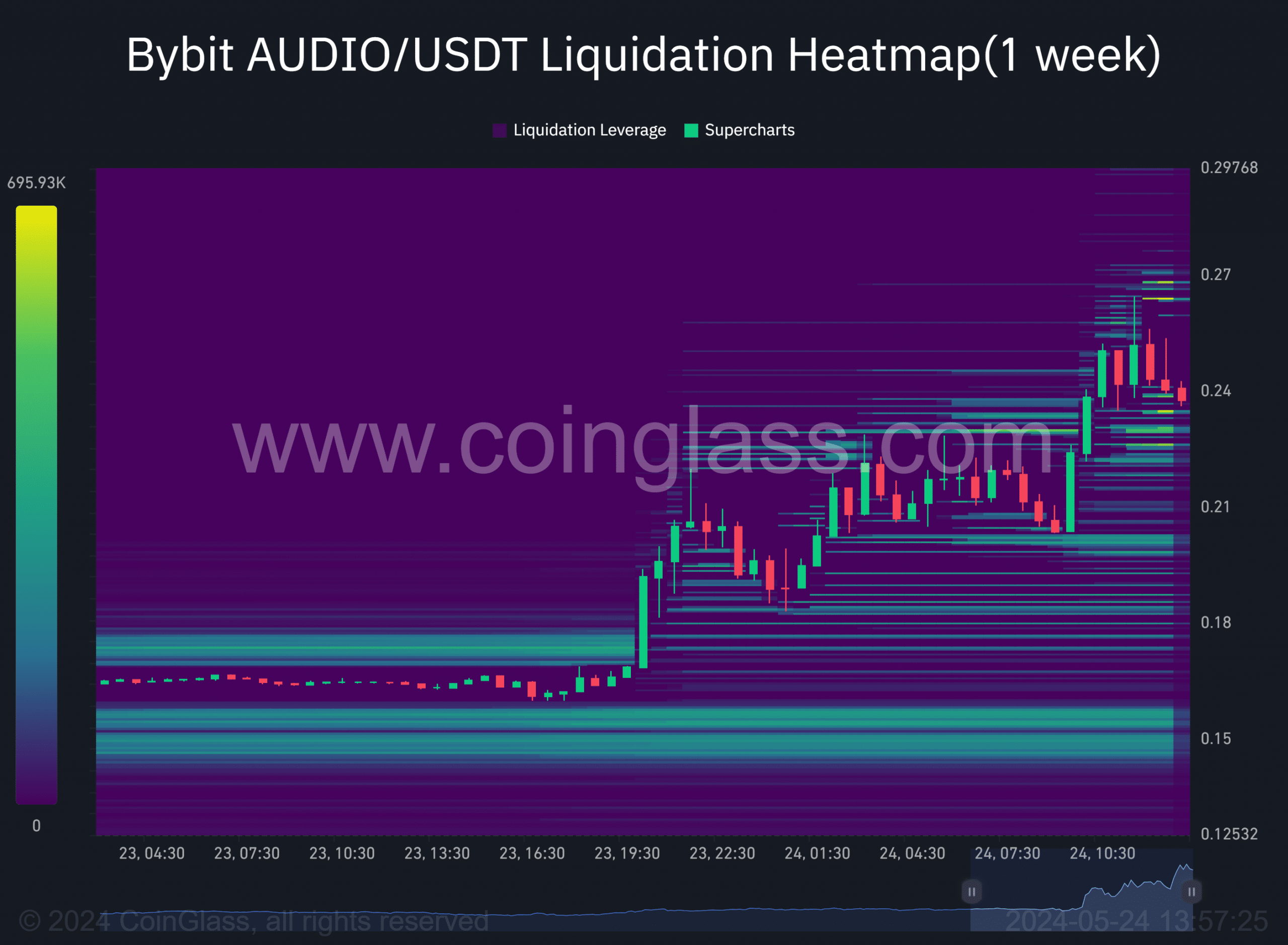

Source: Coinglass

According to Coinglass’ liquidation data, key clusters of liquidity were concentrated on the lower side of the price action, specifically at $0.20 and $0.15.

It meant that the price could drop and collect the liquidity at these key areas, before attempting the rebound move.

Hence, $0.20 and $0.25 are the key price levels to watch in the short term. If the bulls fail to hold on to $0.25% (the 61.8% Fib level), AUDIO could drag itself to $0.20, especially if Bitcoin [BTC] ‘s pullback extends below $66k on the charts.

Read Audius [AUDIO] Price Prediction 2024-2025

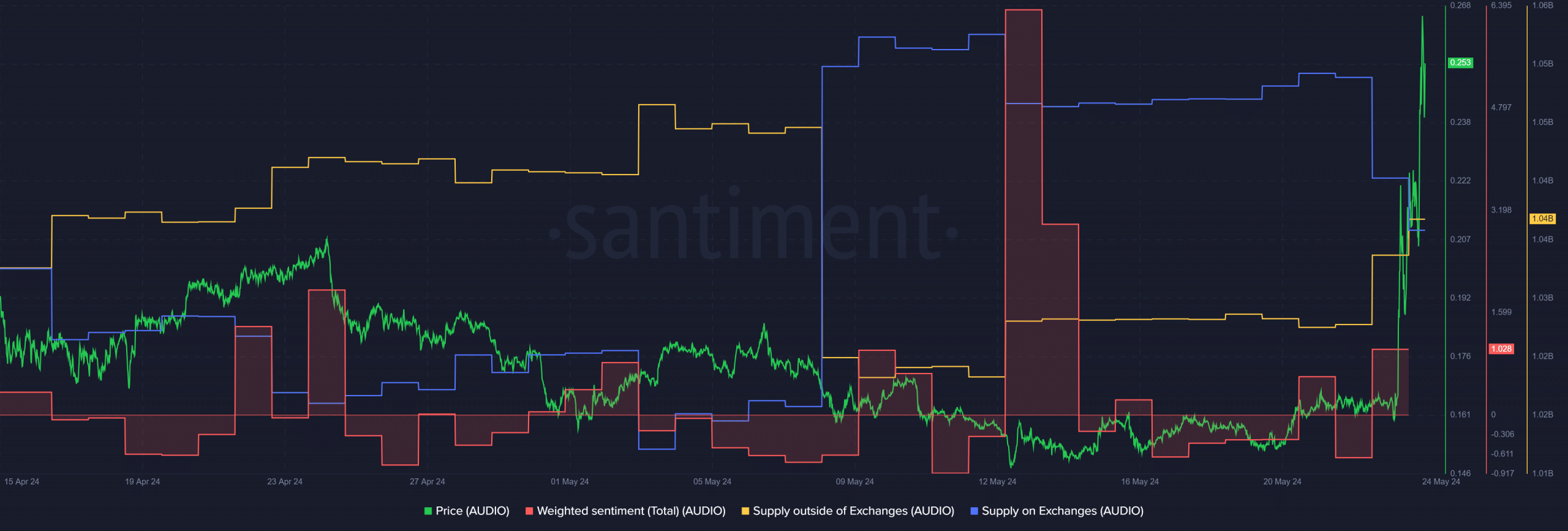

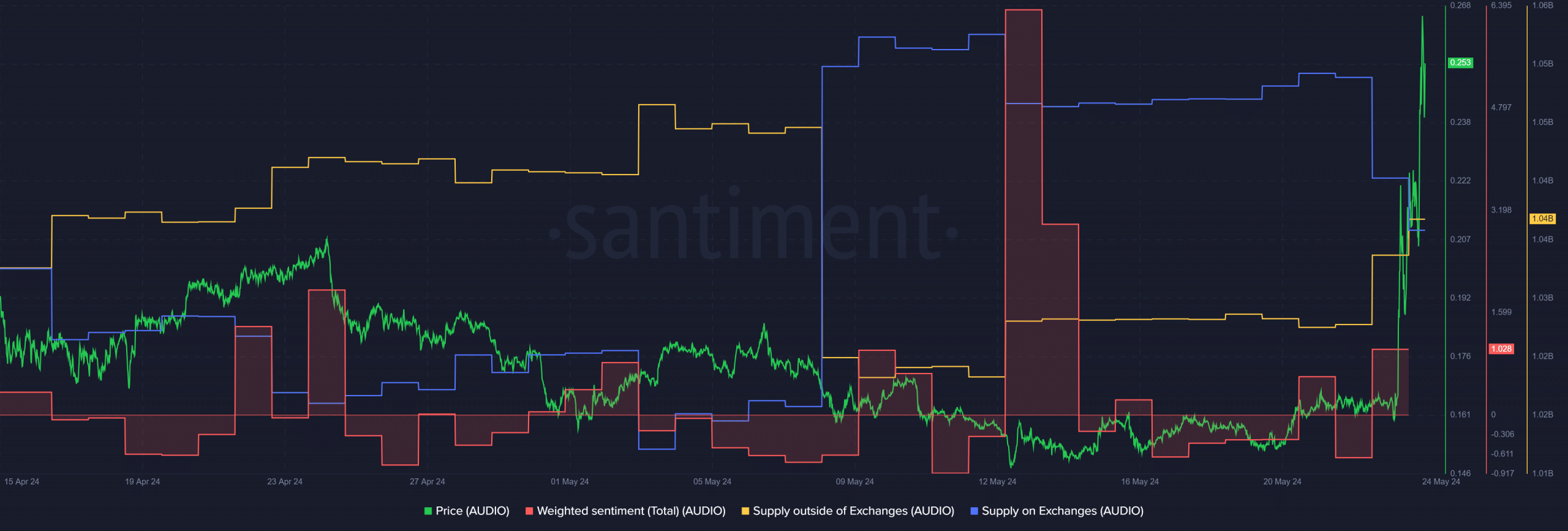

However, it’s worth pointing out that key on-chain metrics flashed bullish signals. For instance, Supply on Exchanges (blue) dipped, and the Supply outside of Exchanges spiked, indicating sell pressure eased and demand for AUDIO surged, respectively.

Source: Santiment

Additionally, the positive Weighted Sentiment reading underscored market participants’ bullish sentiment on the AUDIO market, at press time.

That being said, the market liquidity hunt at $0.20 or below $0.25 remain key actions to watch out for, especially if the $0.3-hurdle is to be targeted again.