Crypto analyst Miles Deutscher expects the 2024 decentralized finance Ponzi narratives won’t reoccur despite the rise of the restaking industry. He adds, however, that the EigenLayer airdrop, which is the largest drop In 2024, may cause the yield-hunting frenzy of previous DeFi Ponzi schemes.

Aside from the restaking narrative, Deutscher is betting on artificial intelligence, BRC-20, real-world asset tokenization, gaming NFTs, and decentralized infrastructure projects as the most lucrative narratives to watch.

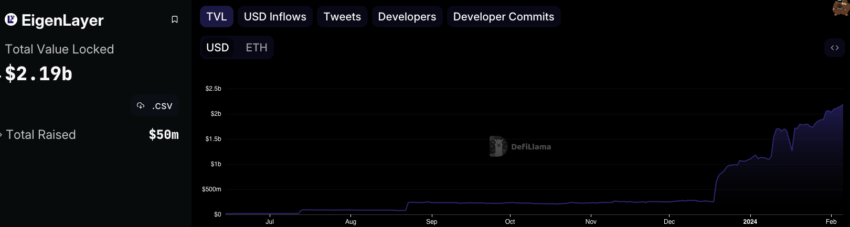

EigenLayer Pulls $2B in Restaking Volume

Deutscher said projects like EigenLayer encourage crypto staking on multiple blockchains, making staking coins more capital-efficient. The user can secure multiple blockchains at once and receive rewards from all. For example, staked Ethereum on liquidity platforms like Lido can be restaked on restaking apps on EigenLayer, allowing what Deutscher calls yield-stacking.

Read more: What Is Liquid Staking in Crypto?

However, projects like EigenLayer, based on the explanation of tokenomics, seem like Ponzi schemes at face value, Deutscher said. Their sustainability is also up for debate.

“I see restaking as the next version of the DeFi Ponzis…The re-staking narrative in my opinion is very reminiscent of the 2021 DeFi Ponzi protocols. When people take on more risk, they searching for yield, they’re hungry for opportunity on chain, and that is what really saw the DeFi Ponzi Mania of 2021[and] 2022.”

Read more: Yield Farming vs. Staking: Which One Is Better?

EigenLayer TVL | Source: DeFi Llama

Critics have pointed out that DeFi investors chase yields before getting paid. Nonetheless, restaking platforms have already accrued $2 billion since their launch.

Popular apps include KelpDAO, ether.fi, and Renzo on EigenLayer. On their own, these three projects have so far attracted $800 million.

DeFi Crypto Crime Caused Ponzi Label

Forbes likened DeFi staking to a Ponzi scheme in 2022. Forbes observed that the project is only sustainable when more investors drive up the price of the staking token.

“Because the majority of participants are also staking, the staking rewards amount to token inflation, which drives the price down. [Therefore] the ecosystem must experience a significant increase in new investors to offset the increasing supply. Because it relies on new investors to maintain its value, it is similar to other Ponzi schemes.”

Last year, the US Commodity Futures Trading Commission slammed Opyn, ZeroEx, and Deridex for illegal transactions. At the time, the agency criticized using advanced technology to conceal crypto crime. The agency has called for stricter rules around DeFi.

“Somewhere along the way, DeFi operators got the idea that unlawful transactions become lawful when facilitated by smart contracts.”

The US Justice Department charged the founders of DeFi project Forsage for a $340 million Ponzi scheme in 2023. Friend.tech, the Web3 social media platform, has also attracted criticisms for its resemblance to a pyramid scheme.

BeInCrypto has contacted Miles Deutscher for comment but has yet to hear back.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.