Once again, there is hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency expert, has spotlighted the potential for the crypto asset’s price to reach a new all-time high before the highly anticipated Halving event commences.

One Final All-Time High For Bitcoin Before Halving

The price of Bitcoin is presently exhibiting new bearish activity, which might trigger negative sentiments in the market over the next few days. Despite the notable decline, Michael Van De Poppe is optimistic that BTC will attain a new height prior to Bitcoin Halving expected to occur this month’s end.

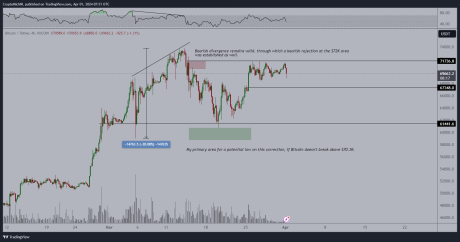

According to the analyst, the digital asset is currently in a consolidation zone. He further identified two distinct crucial levels within the lower timeframes such as the $67,000 threshold as a support level and the $71,700 mark as a final break out towards the peak.

It is worth noting that Michael Van De Poppe previously forecasted that Tuesday is probably when the real moves are expected to begin as Bitcoin consolidates. Thus, if the coin holds the $67,000 level, he will propose a one-last peak test ahead of the halving.

Poppe seems to be confident about his prediction now as he asserts that if one of the two aforementioned crucial levels develops, it will determine the direction of Bitcoin. Due to this, he believes BTC will experience one final pre-halving all-time high.

The post read:

Bitcoin is calmly consolidating. Crucial levels (lower timeframes): $67,000 to hold for support, $71,700 for a final breakout towards the ATH. If either of the two happens, probably direction is chosen. I think we will have one final ATH test before halving happens.

Following the recent decline, Poppe has issued a warning to the crypto community on how to interact with the price action. “You do not want to chase those massive green candles,” he stated.

He advocates entering the market when BTC‘s price is down by 15% to 40%. Additionally, he addressed those considering investing in altcoins, urging them to invest when altcoins are down by 25% to 60%.

Possible Triggers For The Correction

As of press time, Bitcoin’s price is trading at $65,843, demonstrating a decline of over 5% in the daily timeframe. Its trading volume has seen a significant uptick of 66% in the past day, while its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the price of Bitcoin has dropped by nearly 10%. One factor considered to have contributed to the retracement was the influx of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since started to calm down gradually.

Data from Wu Blockchain revealed that the products saw an overall net outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a net inflow of $165 million, while Grayscale ETF GBTC experienced a single-day net outflow of $302 million. Presently, the historical cumulative net inflow for the BTC spot ETFs is pegged at $12.04 billion.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.