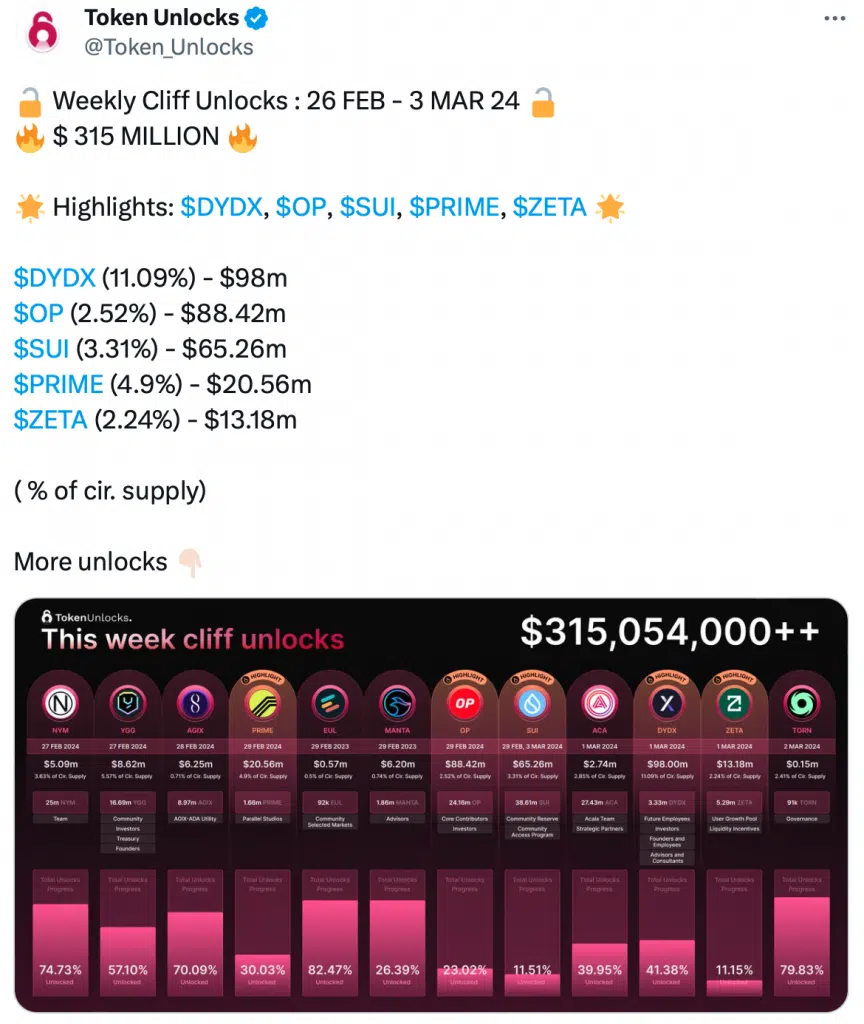

- OP to unlock tokens worth over $88 million on the 29th of February.

- Most market indicators and metrics looked bearish on OP.

Over the last seven days, Optimism’s [OP] price witnessed a major setback as its value dropped by over 6%. However, there was a possibility for the token to bounce back as its price was in a bullish pattern.

Optimism investors are worried

The last week was somewhat disastrous for investors as the token’s value dropped by over 6.9%. The dark days did not end as the token’s daily chart continued to remain red.

According to CoinMarketCap, at press time OP was down by more than 1.2% in the last 24 hours alone. Things can get worse as Optimism is expecting its next token unlock on the 29th of February.

Token unlocks are often followed by price drops as they increase the circulating supply. For starters, when supply increases and demand drops, it pushes an asset’s value down.

Though the aforementioned dataset looked bearish, a new analysis suggested otherwise. As per the tweet, OP’s price was moving in an ascending triangle pattern, which generally results in a bull rally.

Therefore, to check whether that’s possible, AMBCrypto took a closer look at OP’s state. If the token manages to test that pattern, investors might witness a bull rally.

But as of now, the odds of the token starting a bull rally seem thin. In fact, sentiment around the token remained bearish, which was evident from the dip in its weighted sentiment over the last week.

Another bearish signal was Optimism’s development activity, which dropped over the last seven days.

What to expect?

To better understand which way OP might go. AMBCrypto checked its daily chart. Our analysis revealed that its Relative Strength Index (RSI) registered a downtick.

Optimism’s Chaikin Money Flow (CMF) also followed a similar declining trend, indicating that the chances of a price decline were high. Additionally, its MACD displayed the possibility of a bearish crossover.

Read Optimism’s [OP] Price Prediction 2024-25

If the Bollinger bands are to be believed, OP’s price was entering a less volatile zone, further decreasing the chances of a northbound price breakout.

Considering all the aforementioned metrics and the upcoming token unlock, the chances of OP initiating a bull rally soon looked unlikely.

However, since the crypto market is infamous for its unpredictable nature, which direction OP moves in the coming days is a question only time can answer.