- AKT witnessed a correction after its price surged significantly in the last few days.

- Sentiment around the token remained positive as development activity increased.

In the past 24 hours, there has been a significant drop in the price of the token belonging to Akash Network[AKT], a decentralized cloud computing platform.

What goes up, must come down

This decline in price came in after its price rallied and surged by over 50% after it got listed on the South Korean exchange known as Upbit. Upbit is the largest cryptocurrency exchange in South Korea by trading volume.

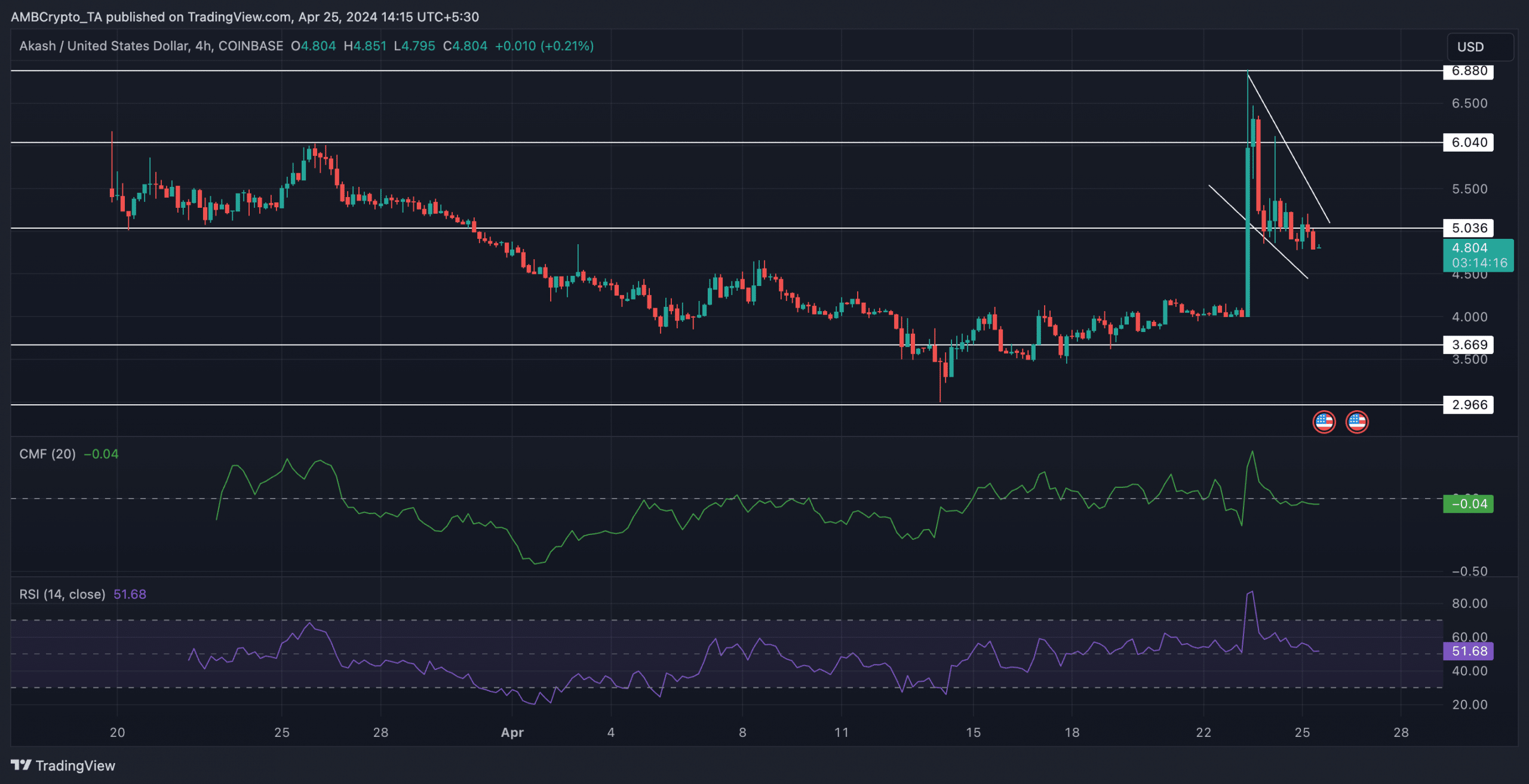

The price rallied to $7 during this period. However, the surge was short-lived. At press time. AKT was trading at $4.82 and its price had fallen by 5.05% in the last 24 hours.

The CMF (Chaikin Money Flow) for AKT was at -0.04. This suggests that the money flow for AKT had declined significantly in the last few days.

Moreover, the RSI for AKT also fell, which implied that the buying momentum for AKT had decreased. Even though the technical indicators of AKT were not painting a positive picture for the token, there were other factors that may help the price of AKT.

One of them was the bullish flag pattern being formed over the last few days. If there is a resurgence in interest in AKT in the coming days, the price of AKT may surpass the $6.040 level and could retest the $6.880 level in the future.

Source: Trading View

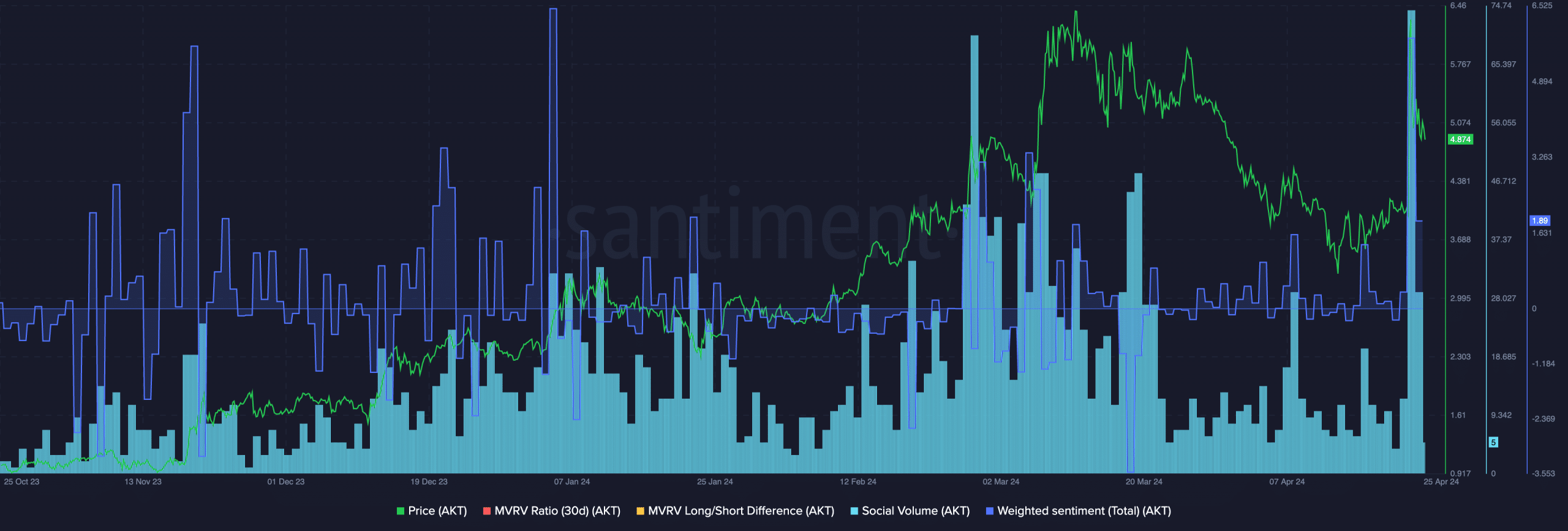

Another factor that could play a role in AKT’s rise would be its social media standing.

In the last 24 hours, the social volume for AKT surged materially. This indicated that the number of comments around AKT on social media had grown significantly.

Adding to that, the weighted sentiment around AKT also grew implying that the positive comments around AKT had outnumbered the negative ones in the last few days.

Source: Santiment

Read Akash Network[AKT]’s Price Prediction 2024-25

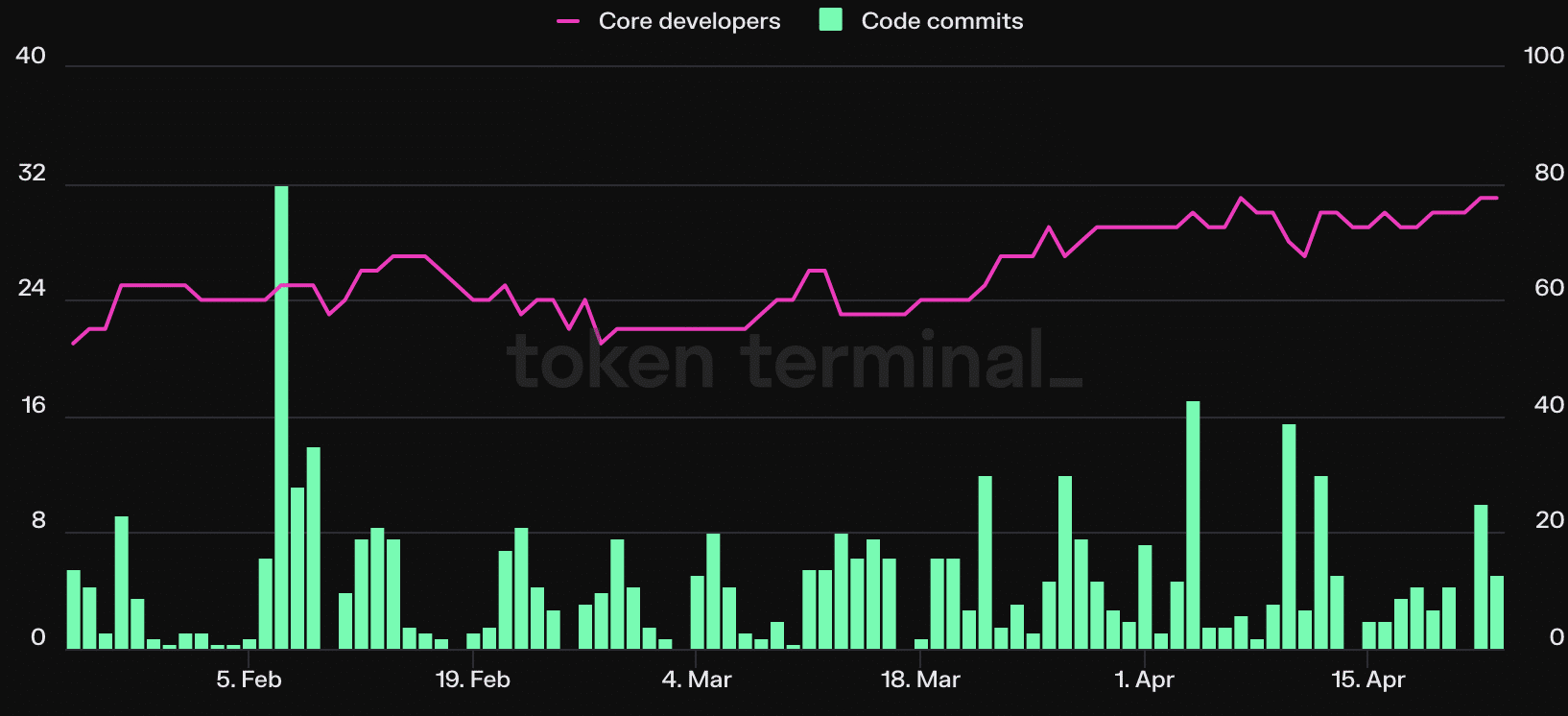

Consistent development

Coming to the overall state of the network, it was seen that the number of core developers working on the Akash network had surged. Coupled with that, the number of code commits on the network had also surged.

The steady developments being made on the network can help the protocol push new upgrades and updates faster. This in turn could help the overall sentiment around the network and may help price action around the token as well.

Source: token terminal