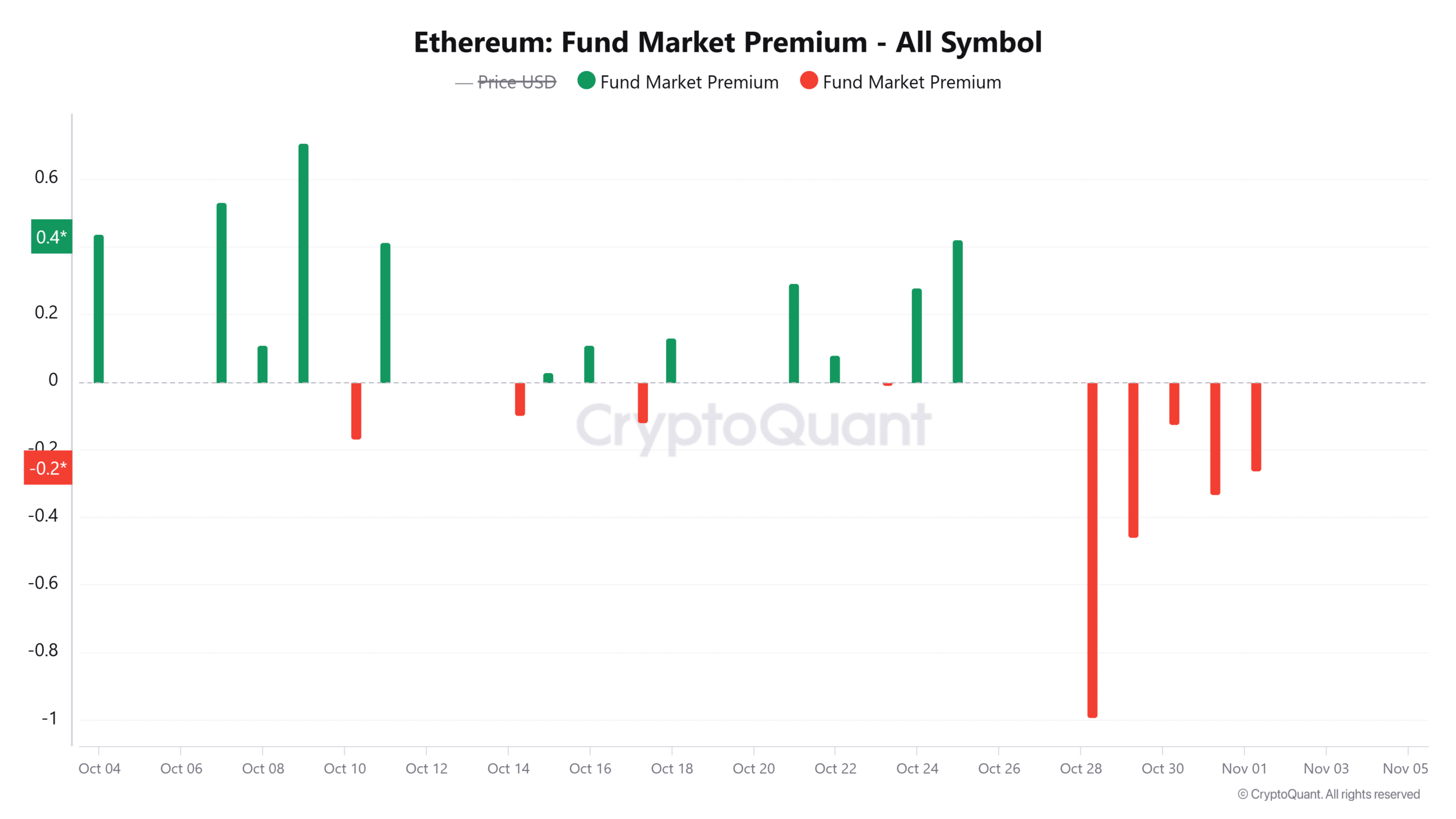

- The Ethereum Fund Market Premium flipped negative, showing weak institutional demand for ETH products

- Nate Geraci believes staking for Ethereum ETFs could happen sooner under the Trump administration

Ethereum (ETH) has dropped by 10% in the last two weeks amid bearish pressure. Due to its underwhelming performance compared to Bitcoin (BTC), ETH’s dominance has plunged to range lows of below 13% too.

One factor contributing to Ethereum’s lack of gains is weak institutional demand. This can be seen in the suppressed inflows to spot ETH exchange-traded funds (ETFs). Ethereum ETFs have seen only four weeks of total positive netflows since launch according to SoSoValue. This lack of demand has led to a declining fund market premium.

In fact, data from CryptoQuant revealed that the Ethereum fund market premium was predominantly negative last week. This can be interpreted as a sign that ETH has been trading at a discount on the ETF market.

(Source: CryptoQuant)

The negative data further revealed that there is selling pressure and weak demand for ETH in the ETF market. This pointed towards bearish sentiment as large investors have remained cautious.

However, given that Bitcoin ETFs continue to post strong numbers with more than $2 billion in inflows last week alone, why are Ethereum ETFs underperforming?

Here’s why Ethereum ETFs are struggling

Nate Geraci, President of ETF Store, shared his insights on some factors that could be driving weak inflows to ETH ETFs, apart from the bearish market sentiment.

He noted that since Bitcoin ETFs launched first, they had a first-mover advantage and “stole some thunder” from Ethereum.

Additionally, outflows from the Grayscale Ethereum Trust (ETHE) ETF have also dampened the outlook of ETH ETFs. Since its launch, ETHE has posted $20 billion in outflows. Geraci also said there is inadequate advisor education around ETH. As such, institutions are less drawn towards the asset.

“Think only a matter of time before spot ETH ETF inflows start picking up. Just might take a while.”

A Trump win is good for ETH ETFs

Geraci further opined that if former U.S President Donald Trump wins the 5th November elections, it could bode well for Ethereum ETFs.

Before the U.S Securities and Exchange Commission (SEC) approved Spot ETH ETFs, it ordered issuers to remove the provision around staking. However, Geraci believes that staking would likely be allowed under the Trump administration.

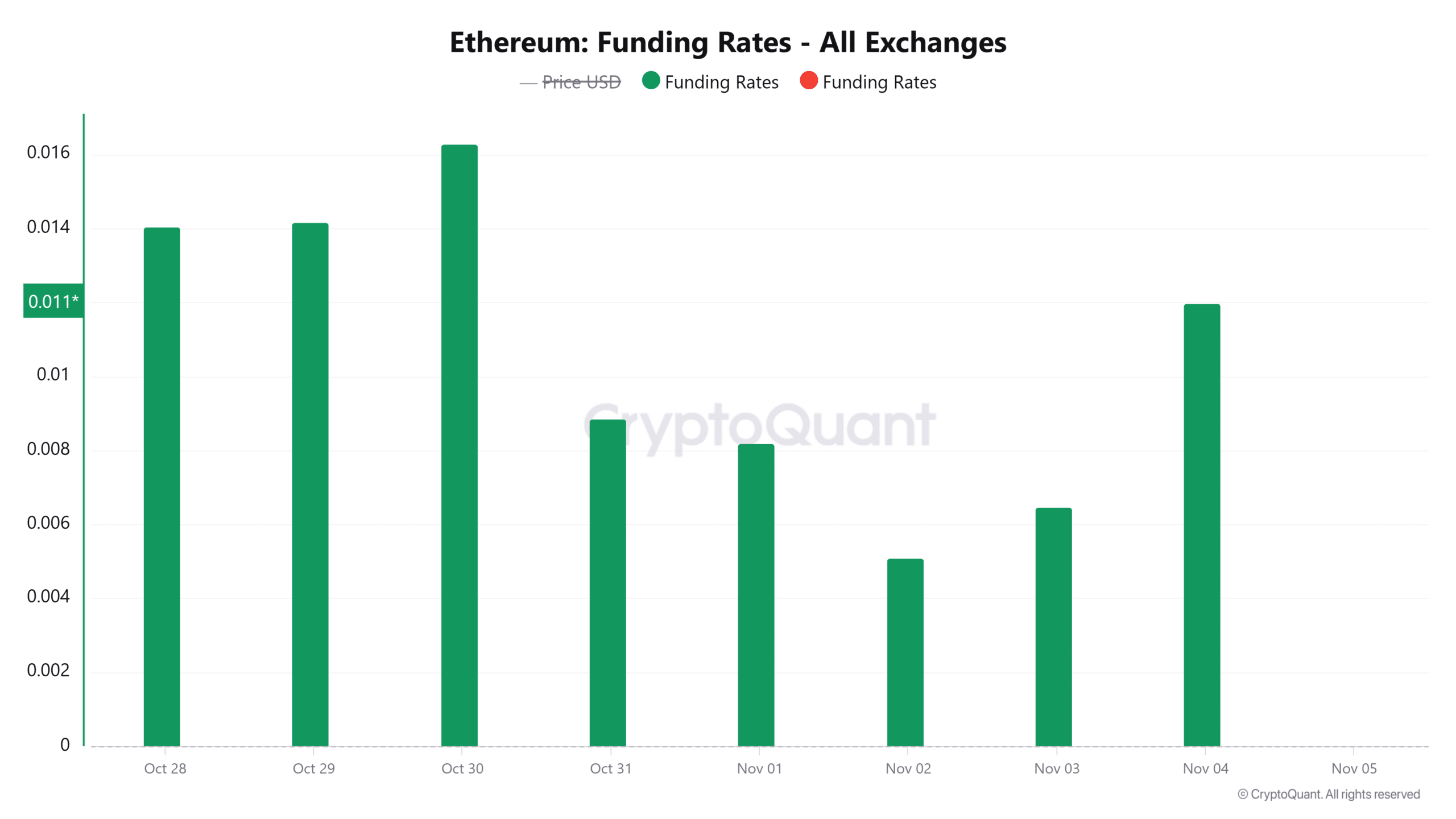

Ethereum traders appear to be pricing in a Trump win for the U.S presidency. At press time, Ethereum funding rates had risen by 85% to 0.0119. This suggested rising bullish sentiment in the Futures market where the demand for long positions has been high.

(Source: CryptoQuant)