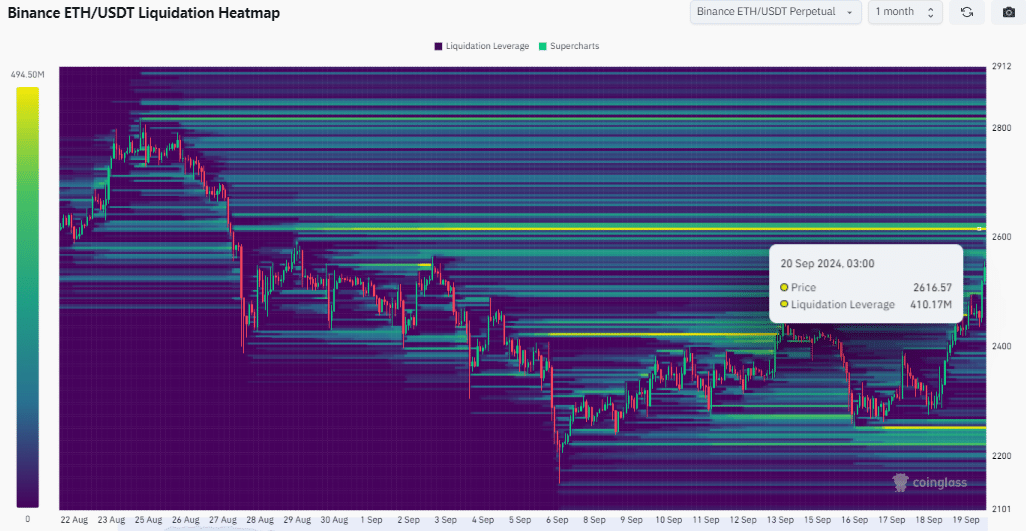

- A cluster of $410 million worth of ETH could be liquidated.

- Ethereum price action and whale activity are bullish.

Ethereum [ETH] has shown notable strength over the past two weeks. As the largest altcoin by market capitalization and a key player in the blockchain space, Ethereum’s performance significantly impacts the broader crypto market.

According to data from Coinglass, $410.17 million worth of ETH could be liquidated if it reaches the $2,616.57 price level. This was because price often gravitates toward zones with high liquidity, where larger traders, or “whales,” can execute trades at more favorable prices.

These zones of concentrated liquidation levels often exert pressure on the buy or sell sides. With these factors in mind, the possibility of Ethereum hitting the $2616.57 mark becomes more likely as it seeks to pick up liquidity in this zone.

Source: Coinglass

Can the road to this massive liquidation fuel ETH to reach $3000 after its recent past two weeks gains?

ETH price action shows momentum

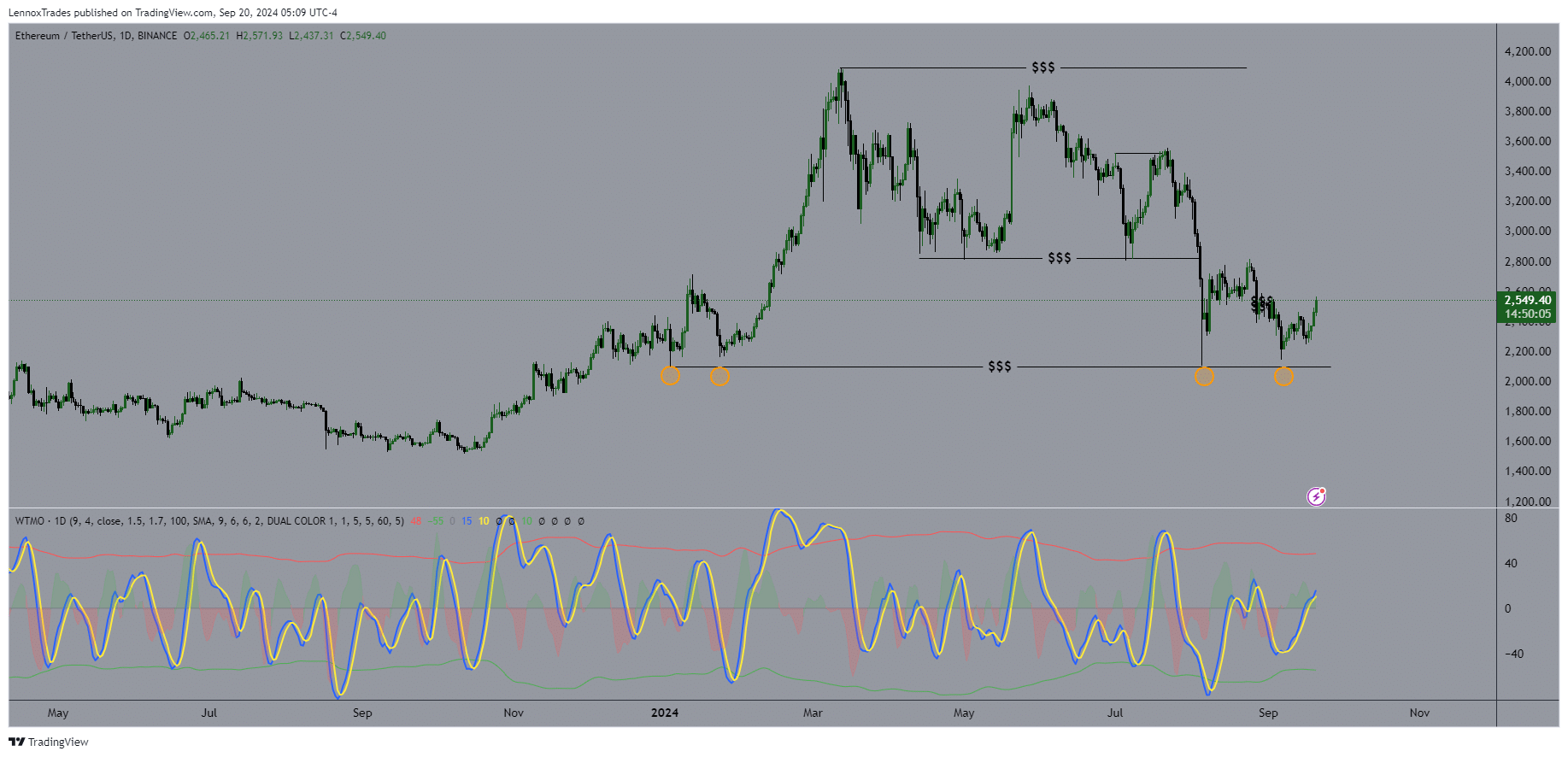

Examining Ethereum’s price action, especially in the ETH/USDT pair, reveals a recurring pattern on the daily timeframe chart.

The Wave Trend Momentum Oscillator (WTMO) shows that when the lows of the oscillator align, ETH often experiences rallies. This pattern has resulted in price surges of over 76.38% in the past.

Currently, the liquidity zone above $2,616 presents a critical magnetic level. The coin has been steadily pushing higher for two weeks, despite four red days, which were quickly corrected.

Source: TradingView

Price is now aggressively approaching the $2,616 mark. If it breaks this level, the liquidation of orders resting above it could fuel even higher prices, possibly closing above $3,000.

Whale activity fuels momentum

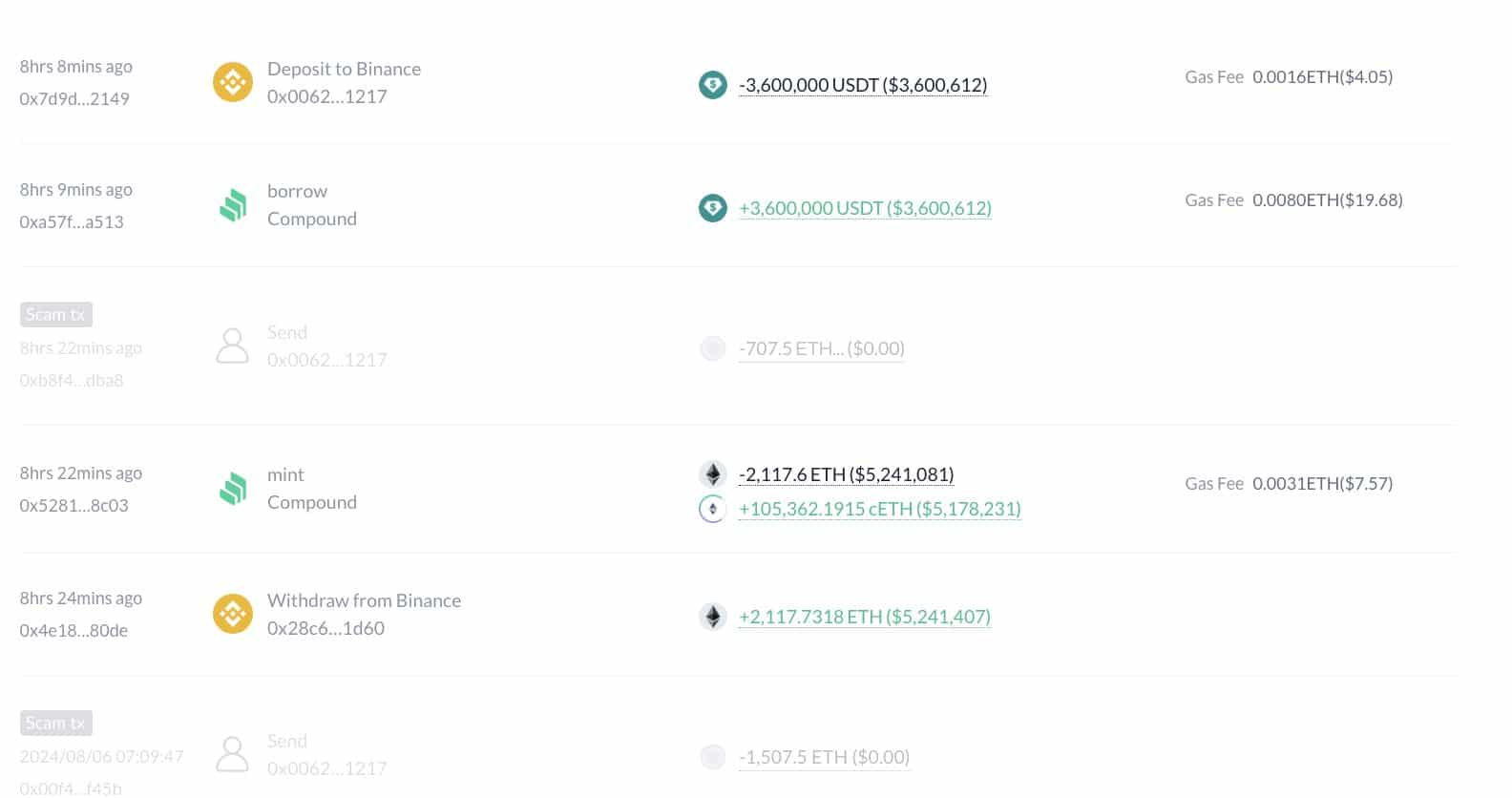

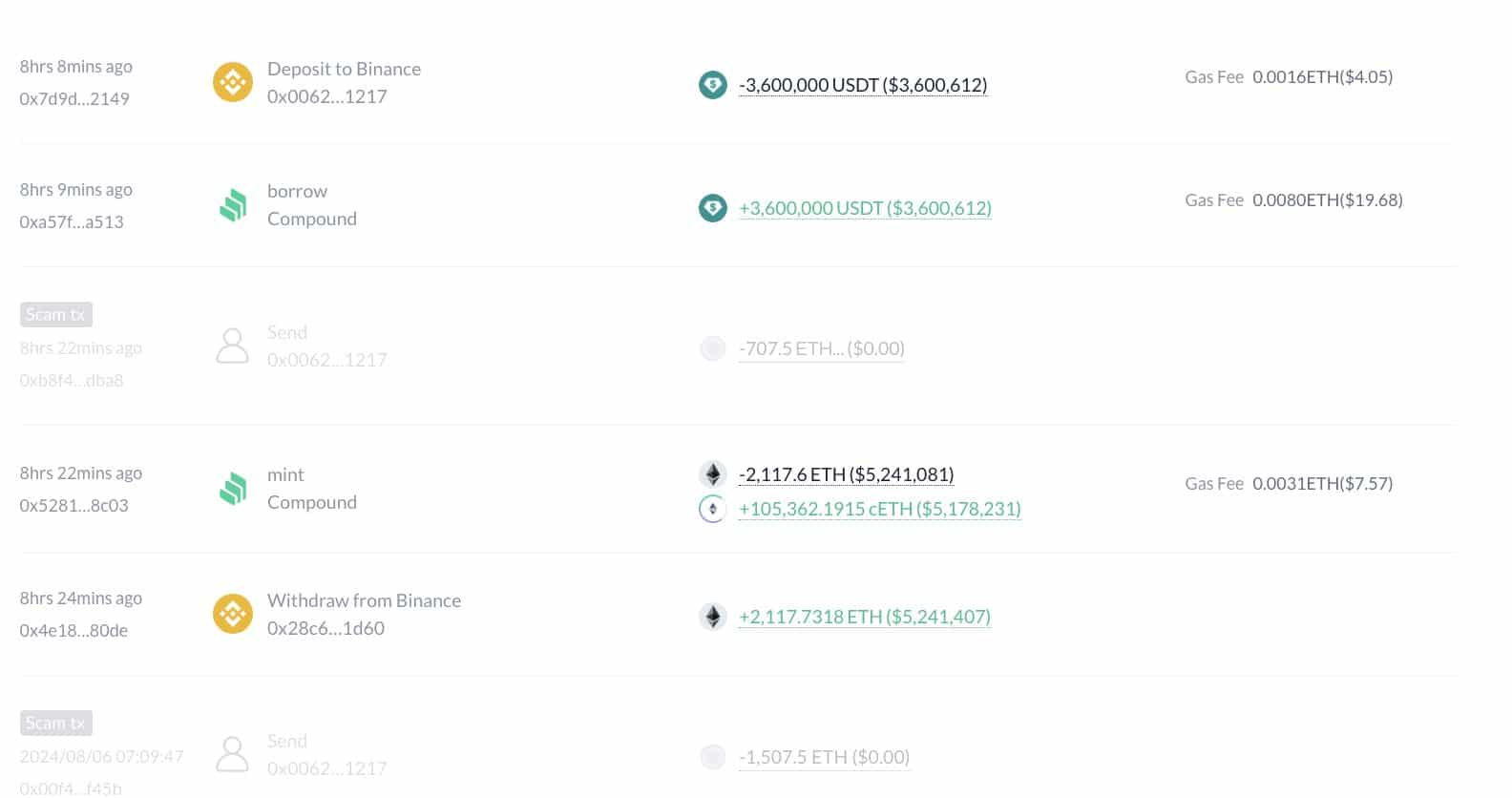

Whale activity on the Ethereum network has also been on the rise, further supporting the possibility of higher ETH prices.

Recently, a whale purchased 2,117.7 ETH worth over $5.17 million after ETH prices rose. This whale went long through circular borrowing.

However, the same whale previously lost 6,078 ETH, worth $14.7 million, when the market plummeted on August 5. Over the past six months, the whale lost $13 million by going long on ETH, winning only one out of five attempts.

Source: Lookonchain

While this whale’s win rate is just 20%, if more whales increase their holdings, it could push ETH beyond the $2,616 level and even higher in the near term.

Ethereum’s future outlook

Lastly, Vitalik Buterin outlined Ethereum’s 2024 prospects in a video circulating on X, formerly Twitter.

He emphasized Ethereum’s focus on scaling, usability, and zero-knowledge (ZK) infrastructure, which will expand the range of on-chain possibilities.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Vitalik envisions these technological advancements driving the creation of apps that could serve billions of users.

With its strong foundation and growing adoption, Ethereum is poised to play a significant role in shaping the future of blockchain technology.