- Ethereum traded in a massive triangle at press time, with analysts predicting a possible double bottom pattern.

- Whale transactions and active addresses increased, signaling potential upward momentum for ETH’s price.

Ethereum [ETH] has faced significant challenges in recent weeks, continuing its downward trajectory in both price and market sentiment. Following a price slump last month, ETH continued to experience a bearish market trend.

Over the past 24 hours, the asset has seen an additional decline of 4.5%, bringing its trading price to $2,399, marking a further 2.3% dip in the broader market context.

Amid this ongoing bearish sentiment, some analysts remained optimistic about Ethereum’s future price action.

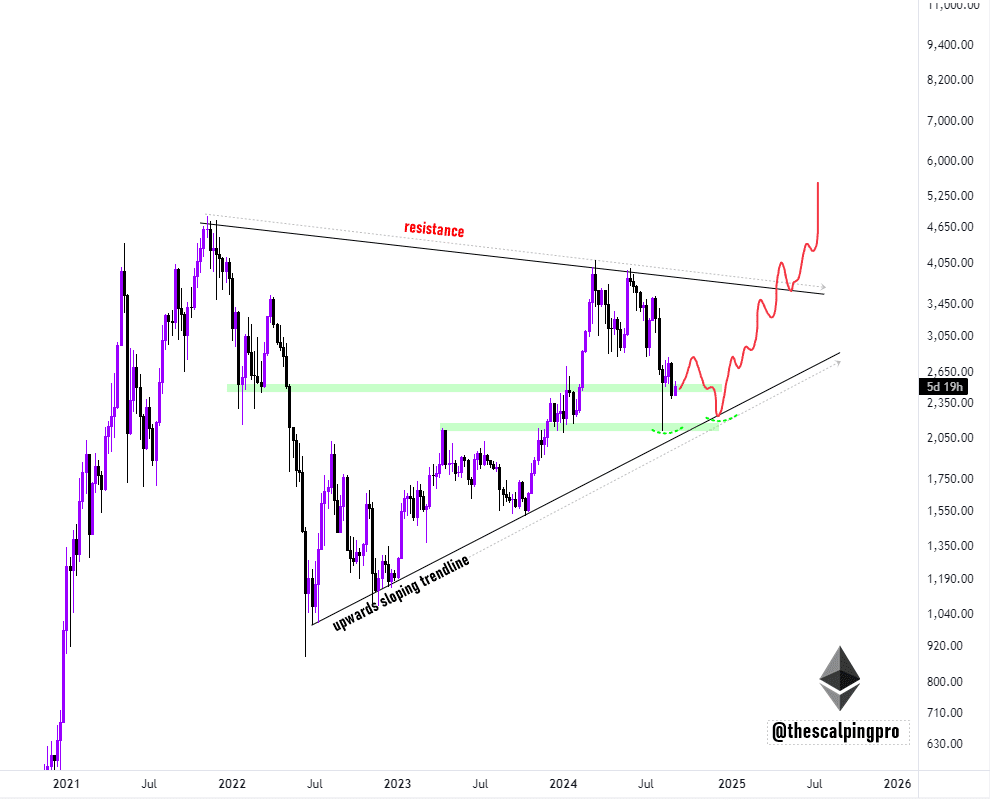

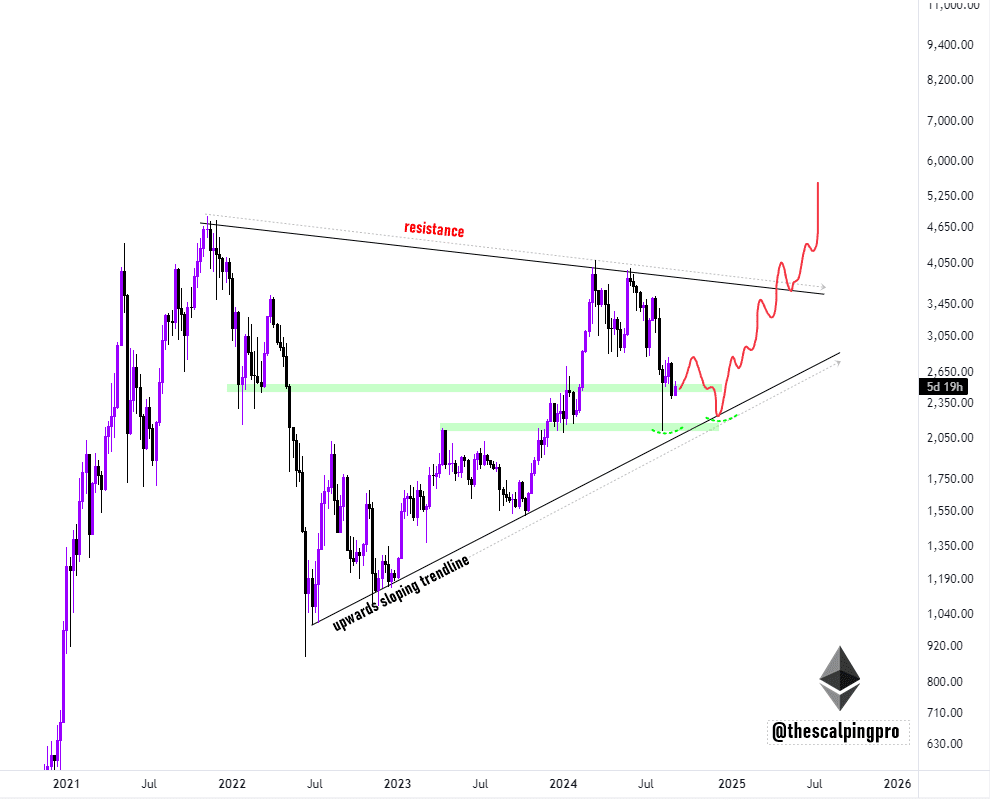

Crypto analyst Mags, on X (formerly Twitter), recently shared his perspective on Ethereum’s potential to reverse its downward trend.

Ethereum’s possible recovery?

In his post, Mags noted,

“Ethereum is trading inside a massive triangle, and we could see a double bottom formation near the upward-sloping trendline support before it heads higher.”

This analysis indicated that ETH may be approaching a pivotal moment, with the potential for a bullish reversal on the horizon.

In technical analysis, a double bottom formation is a bullish reversal pattern, which suggested the asset’s price was approaching a low point and may be ready to rise again.

This pattern forms when the price falls to a support level twice, with a slight upward movement between the two lows.

If Ethereum’s price follows this pattern, as Mags suggests, we may witness a significant upward shift after the current bearish phase.

Source: Mags/X

Ethereum’s technical indicators supported the possibility of a rebound, with the asset trading near critical support levels at press time.

Should the double bottom pattern play out, Ethereum could break free from its prolonged downward trend and begin a new rally.

However, this scenario remains speculative, it is worth noting to stay cautious as Ethereum approaches these key price levels.

Whale transactions and active address rebound

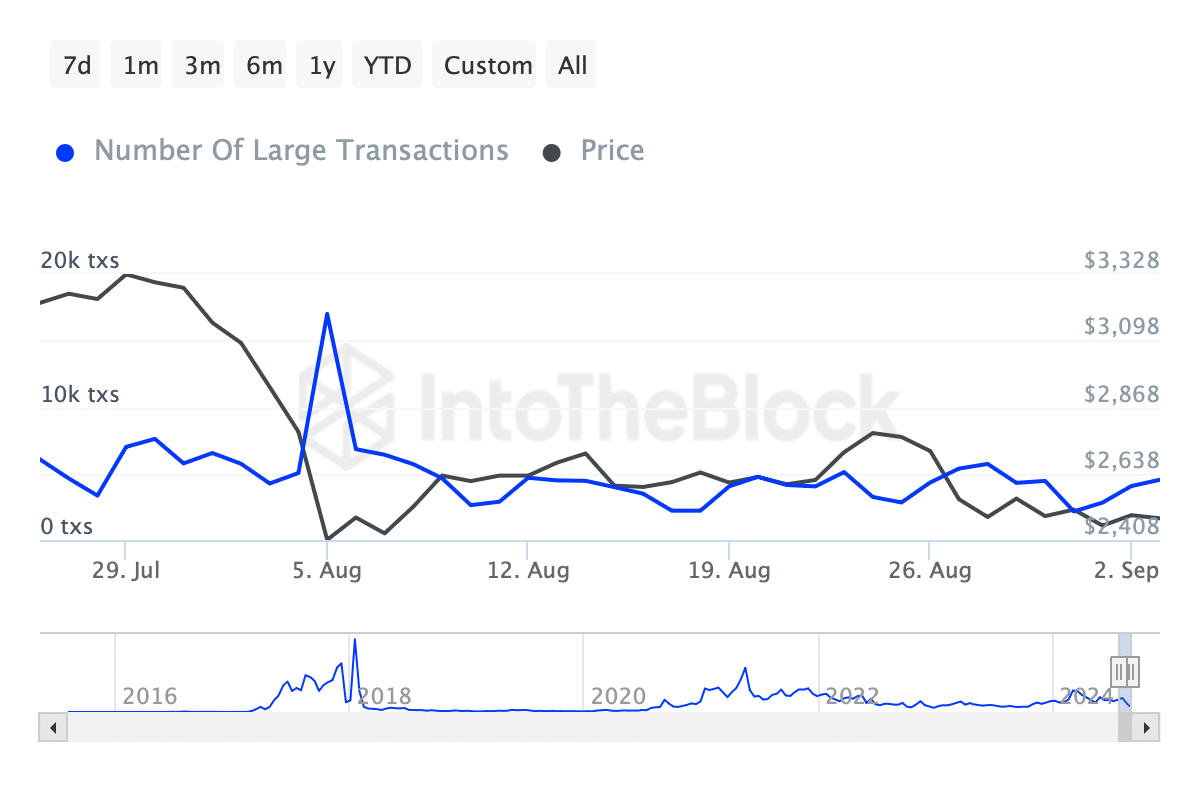

Interestingly, despite Ethereum’s price decline, some of the asset’s underlying fundamentals have begun to show positive signs.

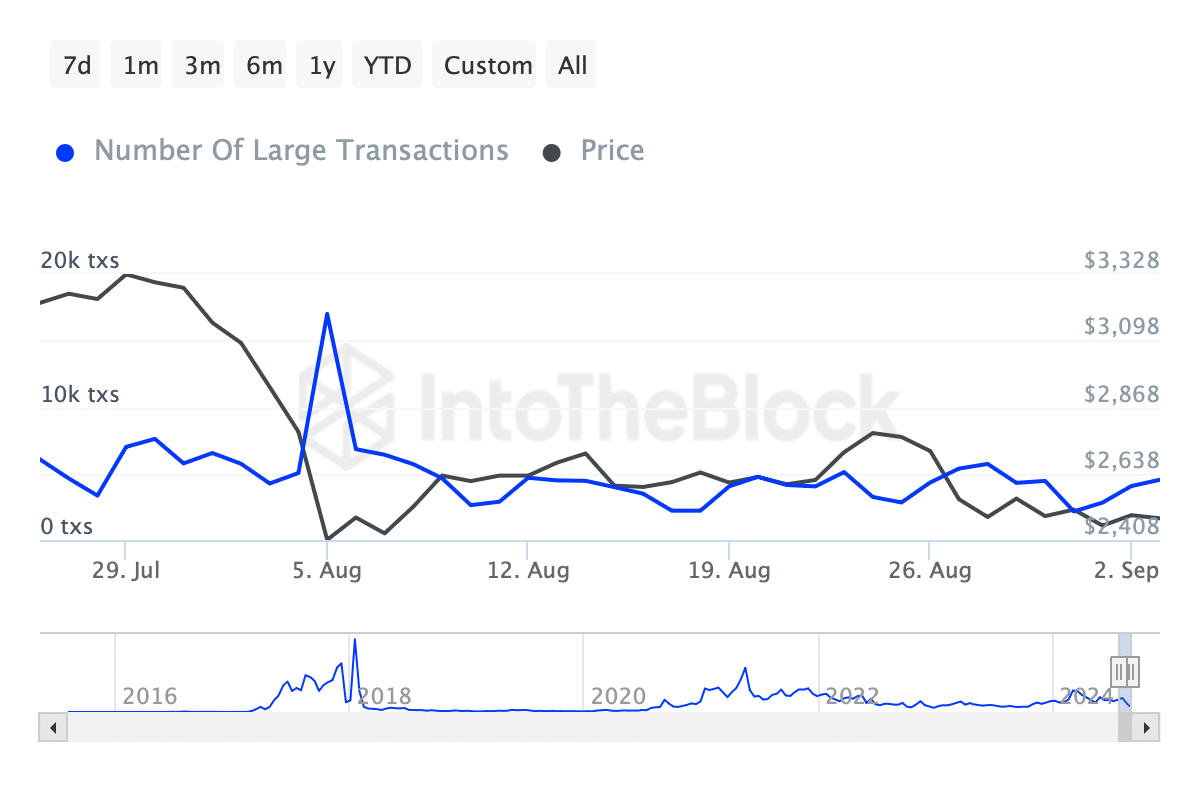

For instance, data from IntoTheBlock revealed that Ethereum’s whale transactions—those exceeding $100,000—have started to recover after a significant drop earlier in August.

On the 5th of August, these transactions peaked at over 16,000 before plunging to approximately 2,210 on the 10th of August. More recent data indicated a recovery, with whale transactions sitting at 4,530 at press time.

Source: IntoTheBlock

This rebound in whale activity suggested that large investors may be positioning themselves for a potential recovery in Ethereum’s price.

A rise in whale transactions is typically seen as a positive indicator, as it signals increased interest from deep-pocketed investors, which could fuel a broader market rally.

Read Ethereum’s [ETH] Price Prediction 2024–2025

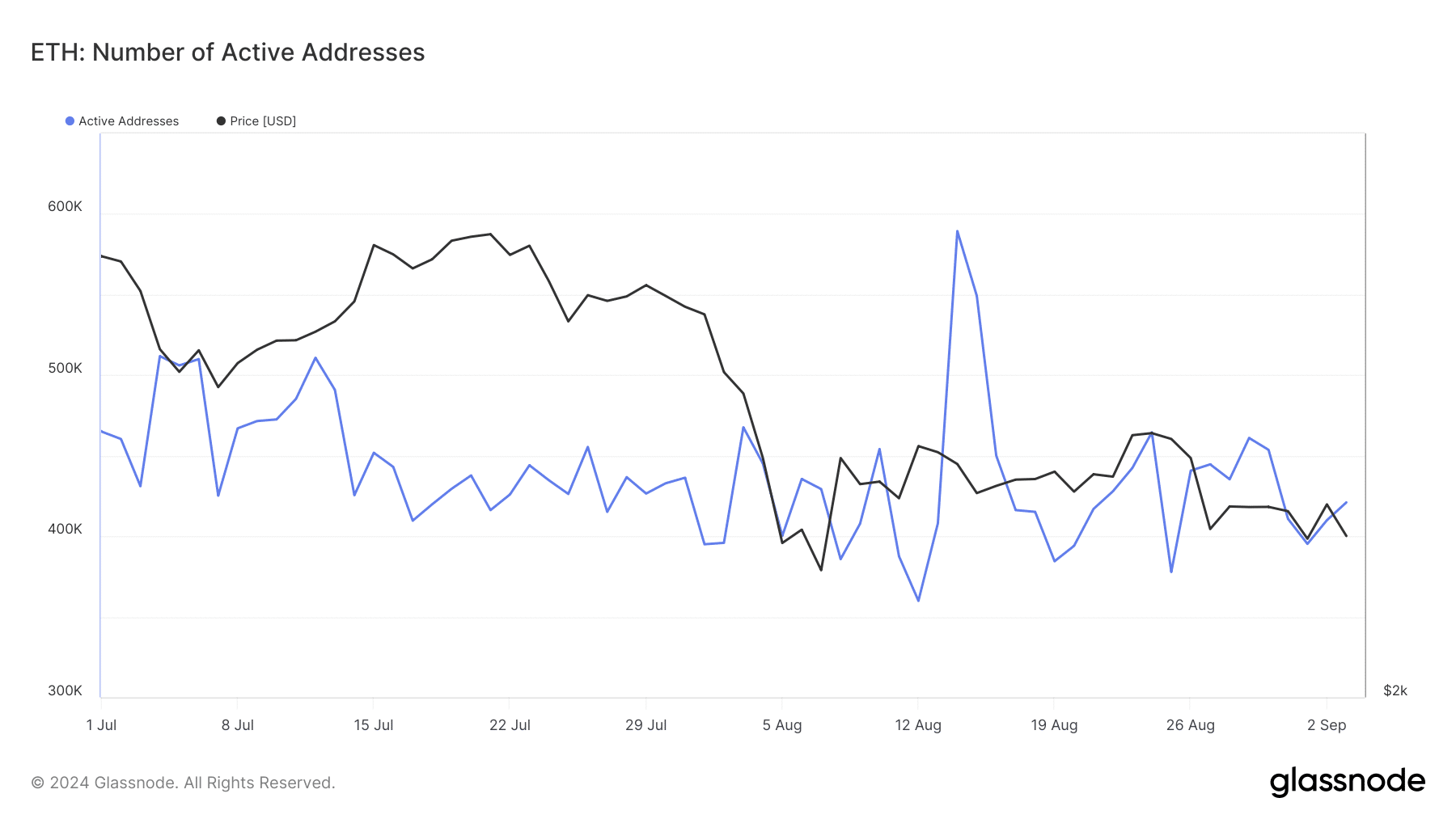

In addition to whale transactions, data from Glassnode highlighted a recovery in Ethereum’s number of active addresses. While the number of active addresses peaked at 589,000 on the 14th of August, it fell below 400,000 last week.

Source: Glassnode

As of press time, this metric has risen again to 420,000. A surge in active addresses typically reflects growing user activity on the network, which could also contribute to upward price movement.