- Crypto investment products saw $305M outflows, with Bitcoin and Ethereum ETFs showing mixed trends.

- Bitcoin gains post-ETF launch; Ethereum struggles to reach expected price levels.

Amidst a general market upswing, with the global crypto market cap rising by 2.79% over the past 24 hours and most coins gaining over 2%, concerns loomed as weekly charts reveal declines exceeded 5%.

Crypto investment products in danger

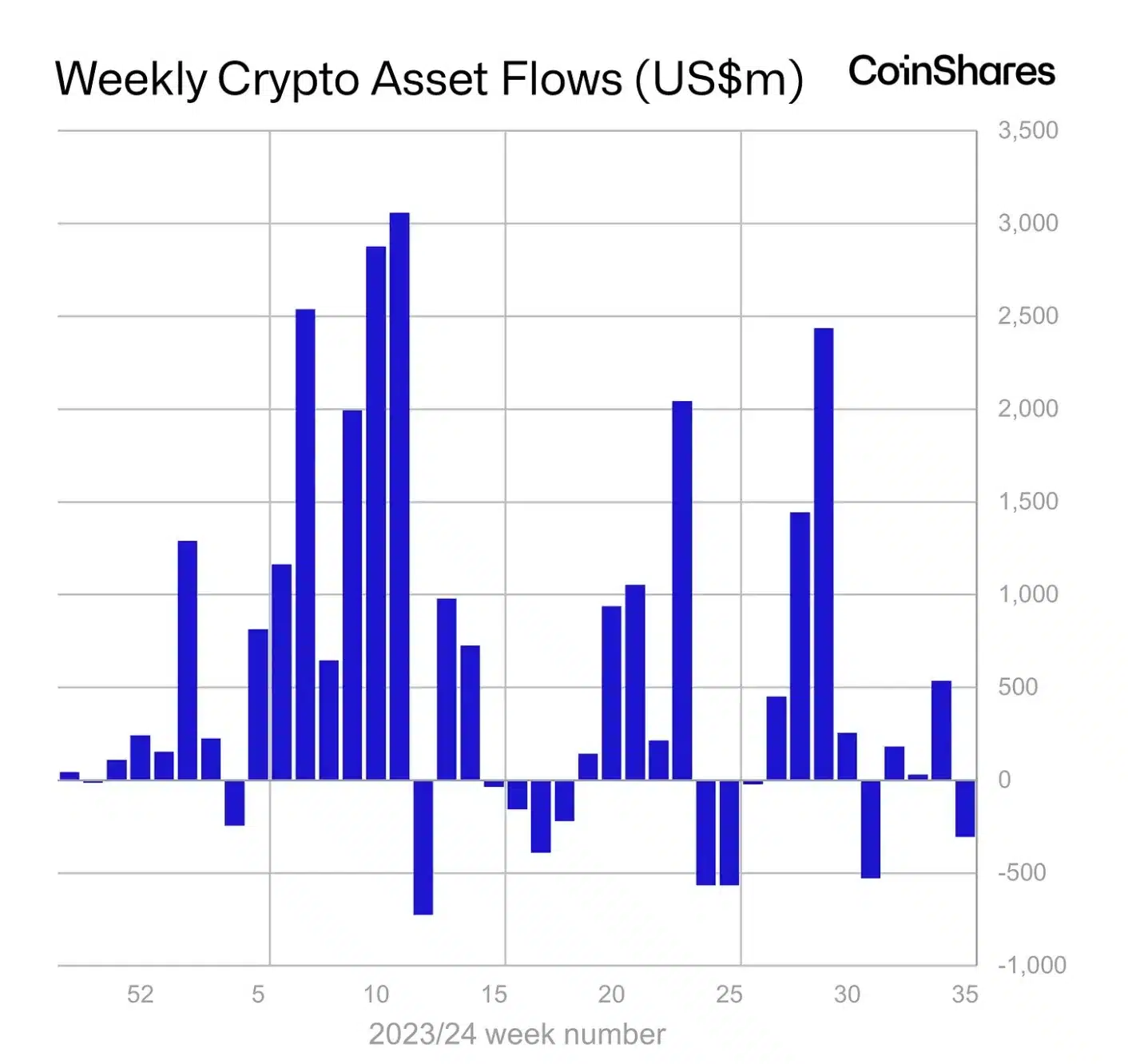

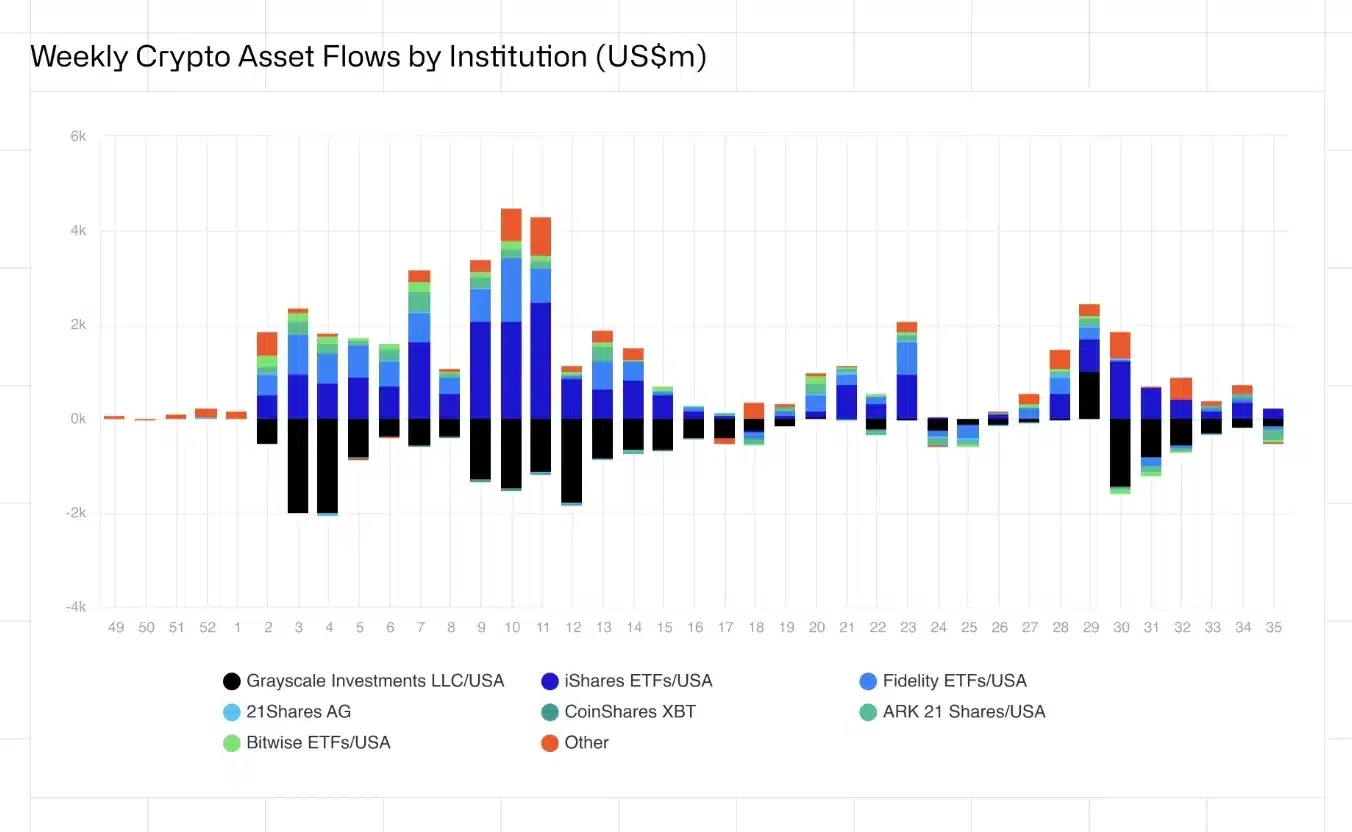

Of greater concern is the significant outflow from cryptocurrency investment products, with a recent CoinShares report highlighting a total of $305 million in outflows during the in-between the 24th to the 31st of August.

This reversal comes after net inflows of $543 million the previous week, impacting major asset managers like Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares, and 21Shares.

Source: blog.coinshares.com

As per the report,

“The negative sentiment was focussed on Bitcoin, seeing US$319m in outflows. Short bitcoin investment products saw a second consecutive week of inflows totalling US$4.4m.”

The analysis further added,

“Ethereum saw US$5.7m outflows, while trading volumes stagnated, reaching only 15% of the levels seen during the US ETF launch week.”

Execs weigh in

Commenting on this unexpected streak of outflows, CoinShares’ Head of Research, James Butterfill, noted,

“We continue to expect the asset class to become increasingly sensitive to interest rate expectations as the Fed gets closer to a pivot.”

Butterfill explained that the outflows were triggered by a pervasive negative sentiment across multiple regions and providers.

This sentiment was fueled by unexpectedly strong economic data from the U.S., which reduced the chances of a 50-basis point interest rate reduction.

The disparity between the two ETFs

Confirming the same, the recent data from Farside Investors highlighted a bearish trend in the Bitcoin [BTC] ETF market, marked by consistent outflows from the 26th to the 30th of August.

Source: blog.coinshares.com

Conversely, Ethereum [ETH] ETFs have exhibited greater stability.

Despite experiencing outflows of $12.6 million during the same period, ETH ETFs are showing indications of a potential rebound.

However, it still struggles to compete with Bitcoin ETFs.

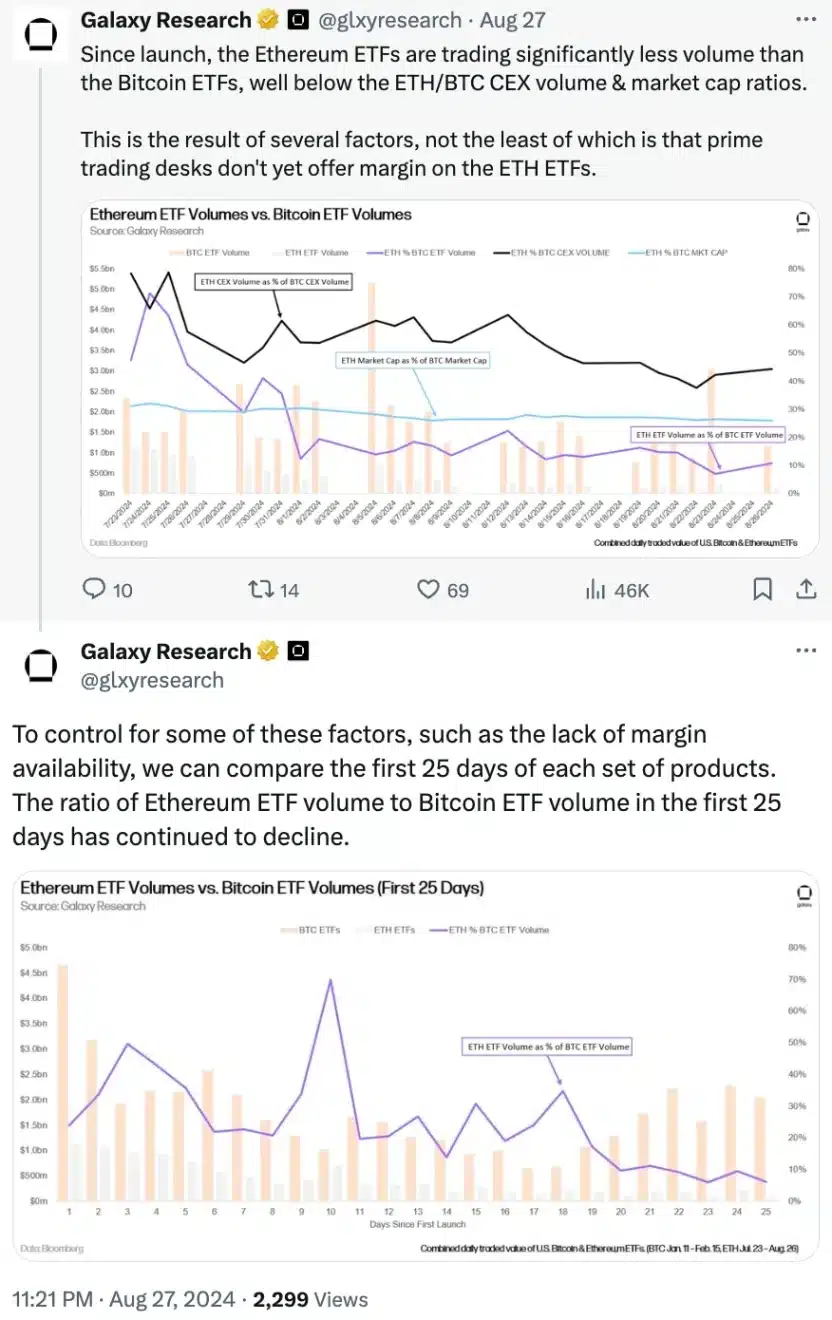

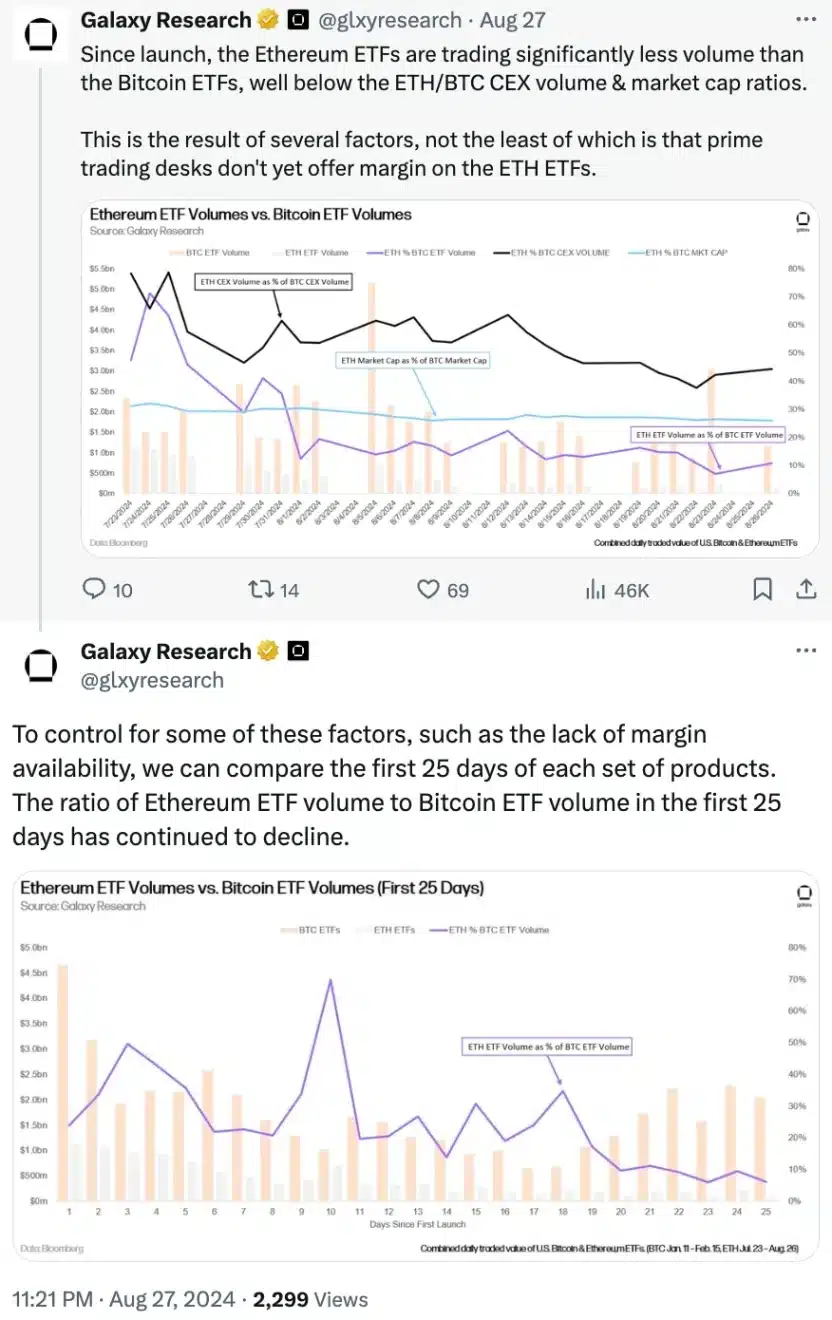

Providing insights on the same, Galaxy Research recently noted that the lower trading volume for Ethereum ETFs compared to BTC ETFs is largely due to the lack of margin trading options, reducing their appeal to institutional traders.

Source: Galaxy Research/X

Impact on prices

On the price front, both BTC and ETH have been on an upward trajectory, with green candlesticks appearing on the daily chart.

In the past 24 hours, Bitcoin saw a rise of 2.22%, while Ethereum increased by 2.67%.

Despite these gains, BTC and ETH were trading at $59K and $2.5K, respectively—below expectations following the ETF launch.

It’s important to note that after the ETF launch, Bitcoin initially surged past $70K in March, reflecting a strong trend.

However, Ethereum has struggled to break the $3K mark, falling short of the anticipated $4K level.