- At press time, ETH was caught in a 4-hour symmetrical triangle, showing no clear directional trend.

- On-chain data suggested that a potential rally could be on the horizon.

Market activity for Ethereum [ETH] has been subdued, showing only a slight increase of 2.45% in price, now trading around the $2,600 level.

This kind of price behavior is typical when an asset is trading within a symmetrical triangle—a pattern characterized by converging diagonal upper and lower lines.

Previous instances of such trading patterns have often led to significant price movements, either upwards or downwards.

Analyst forecast for ETH

In a recent tweet, crypto analyst Carl Runefelt highlighted that ETH was at a crossroads, facing a decision that could either trigger a drop to new lows.

It could potentially wipe out bullish momentum or propel ETH it to a new monthly high.

Runefelt shared a 4-hour chart to outline potential price targets, depending on the direction ETH takes:

“Potential bullish target: $2,800

Potential bearish target: $2,350.”

At such a critical point, it’s important to identify additional confluences. To this end, AMBCrypto has embarked on further analysis.

‘In the money’ traders can drive ETH higher

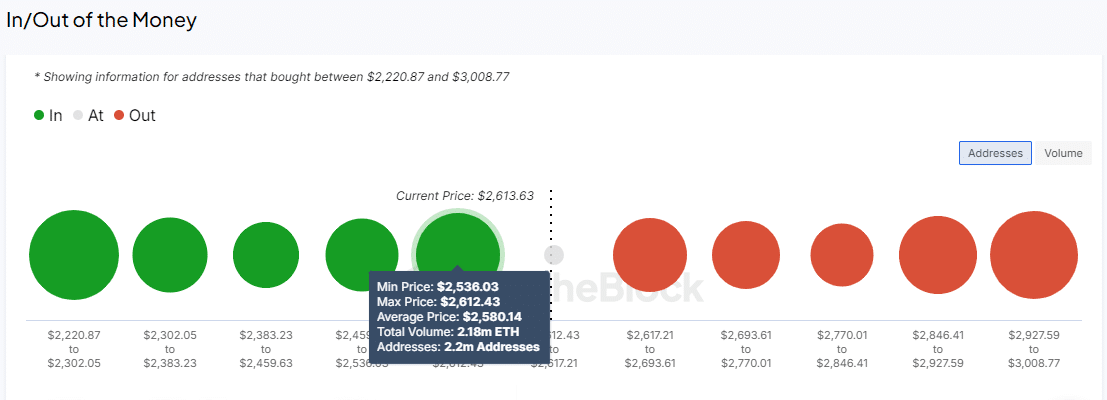

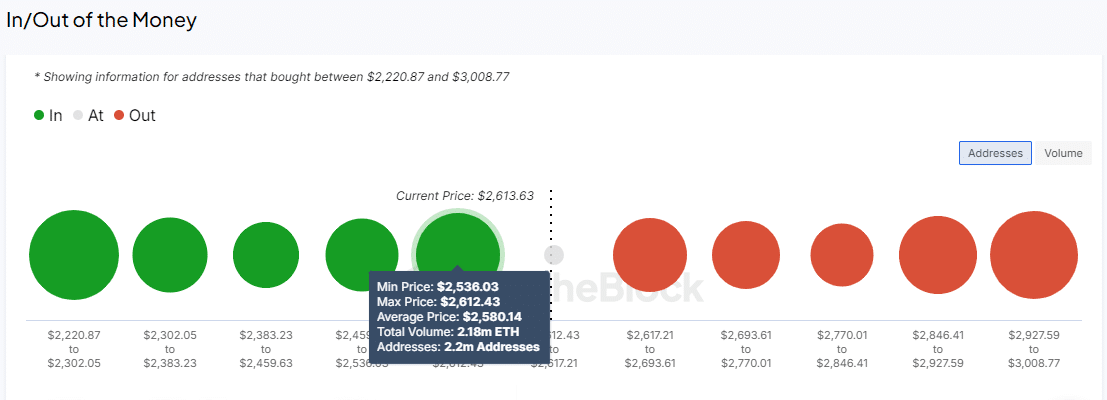

Using the In and Out of Money Around Price (IOMAP) indicator, AMBCrypto analyzed whether traders in profit (in the money) or at a loss (out of the money) could influence Ethereum’s price direction.

“In the money” indicates that trades are currently profitable and act as a support zone, while “out of the money” denotes unprofitable trades, serving as resistance.

According to IntoTheBlock, ETH has rebounded from the $2,597.37 support, with transactions involving 2.39 million addresses holding over $8 billion in ETH.

Source: IntoTheBlock

This level is essential for potentially propelling the price upward. However, significant resistance from traders that are out of the money is anticipated at $2,677.33, $2,760.00, and $2,831.77.

Although these resistance levels pose challenges, the press time bullish momentum, which outweighed selling pressure, suggested ETH may trend toward or exceed $2,800.

Buyers are interested in ETH

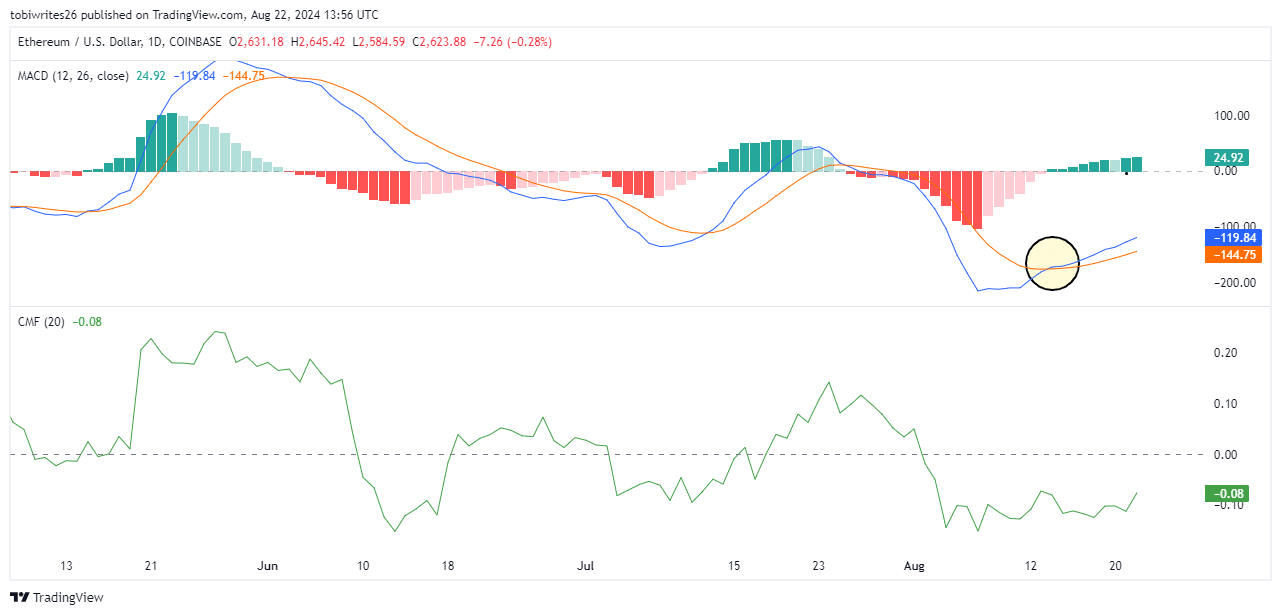

Momentum among Ethereum traders is increasing, as indicated by the Moving Average Convergence and Divergence (MACD).

This tool tracks the relationship between two moving averages of ETH’s price, helping to spot changes in momentum and direction.

Recently, the MACD signaled a bullish crossover, suggesting that buyers are actively entering the market and may continue to push the price upward.

Additionally, Ethereum’s momentum has been on the rise, with the MACD trending toward positive territory. This suggests a strong likelihood of continued price increases.

Source: TradingView

Is your portfolio green? Check out the ETH Profit Calculator

The Chaikin Money Flow (CMF) also supports this bullish outlook. It has been rising since the 18th of August, indicating that buying pressure was mounting.

If this trend persists, it could further propel ETH’s price higher to the $2,800 target.