- Ethereum fundamentals reach all-time highs, yet the price rally remained inconsistent.

- Analyst Boomer Saraga predicted that Ethereum’s price will soon reflect its strong on-chain activity.

Ethereum [ETH] has remained inconsistent with its bullishness, even despite the recent launch of its spot exchange-traded funds. So far, the asset has continued to see an increase that ends up being shortened.

For instance, although the asset is up 8.3% in the past week, it was in a decline at press time, down by 3.7% in the past 24 hours with a current trading price of $2,624.

Is Ethereum’s price lagging?

Boomer Saraga, the founder and CEO of Khelp Financial, recently shed light on Ethereum’s price performance in an interview with Schwab Network on the 14th of August.

According to Saraga, Ethereum was seeing all noticeable positivity in terms of fundamentals, however, its price was “lagging.”

Saraga particularly pointed out that Ethereum’s on-chain activities suggested that it was functioning at peak level, but the asset has continued to be unable to produce significant new wealth as it once did.

However, according to the CEO, delay might not be a denial for ETH. Indicating his optimism that Ethereum will surpass its previous all-time high of above $4,800.

Saraga noted,

“From a fundamental standpoint, Ethereum is reaching all-time highs, and I expect the price to follow.”

ETH’s fundamental growth

When looking at Ethereum’s fundamentals, it is worth noting Saraga’s statement that Ethereum’s price is lagging is evident in its on-chain activity.

Source: DefiLlama

Data showed that Ethereum’s network was reportedly securing more collateral—referred to as total value locked (TVL)—than ever before, with current figures from DefiLlama showing a TVL of $48.30 billion.

This was a substantial rise from less than $30 billion in September of the previous year.

Read Ethereum’s [ETH] Price Prediction 2024-25

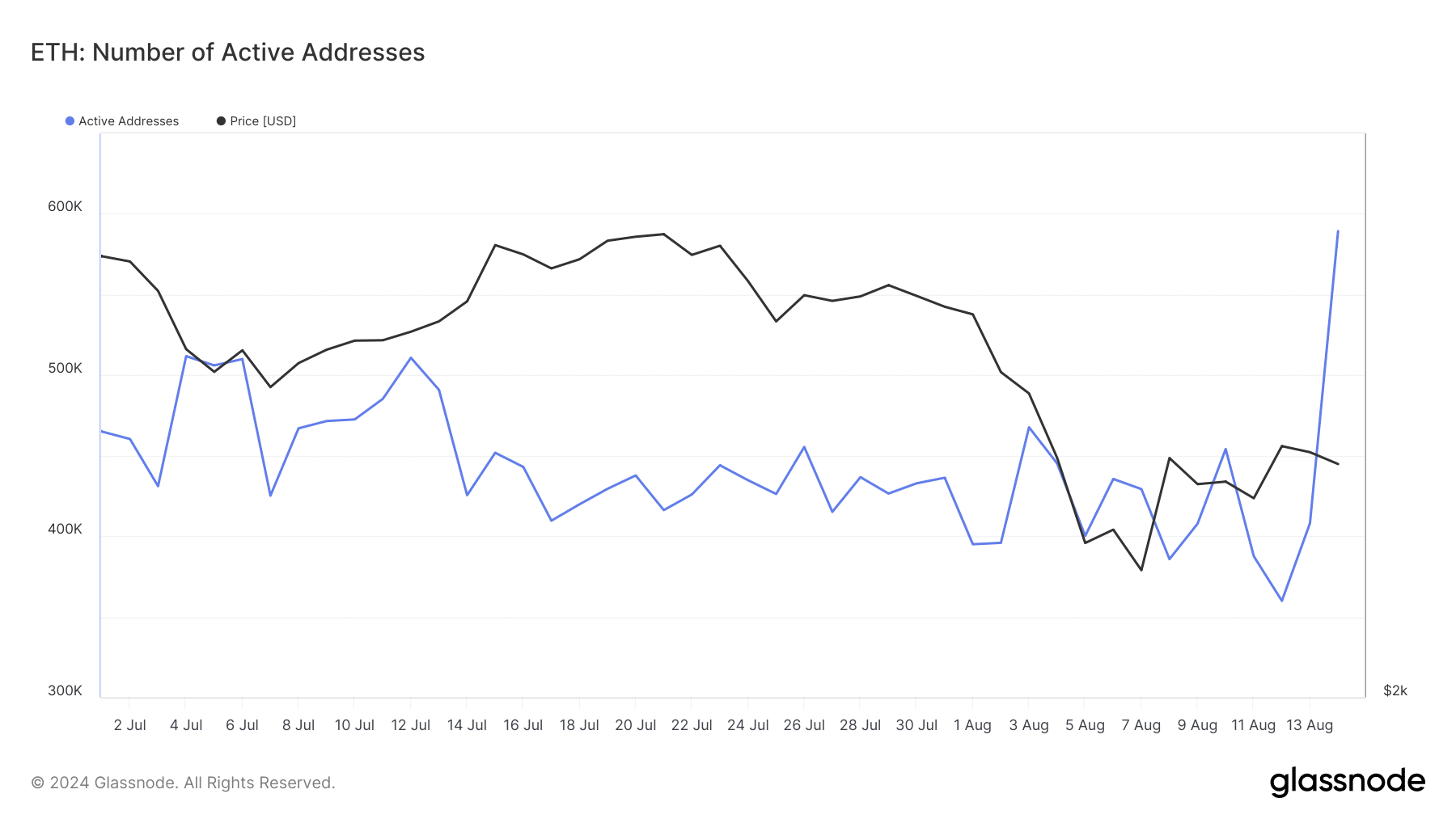

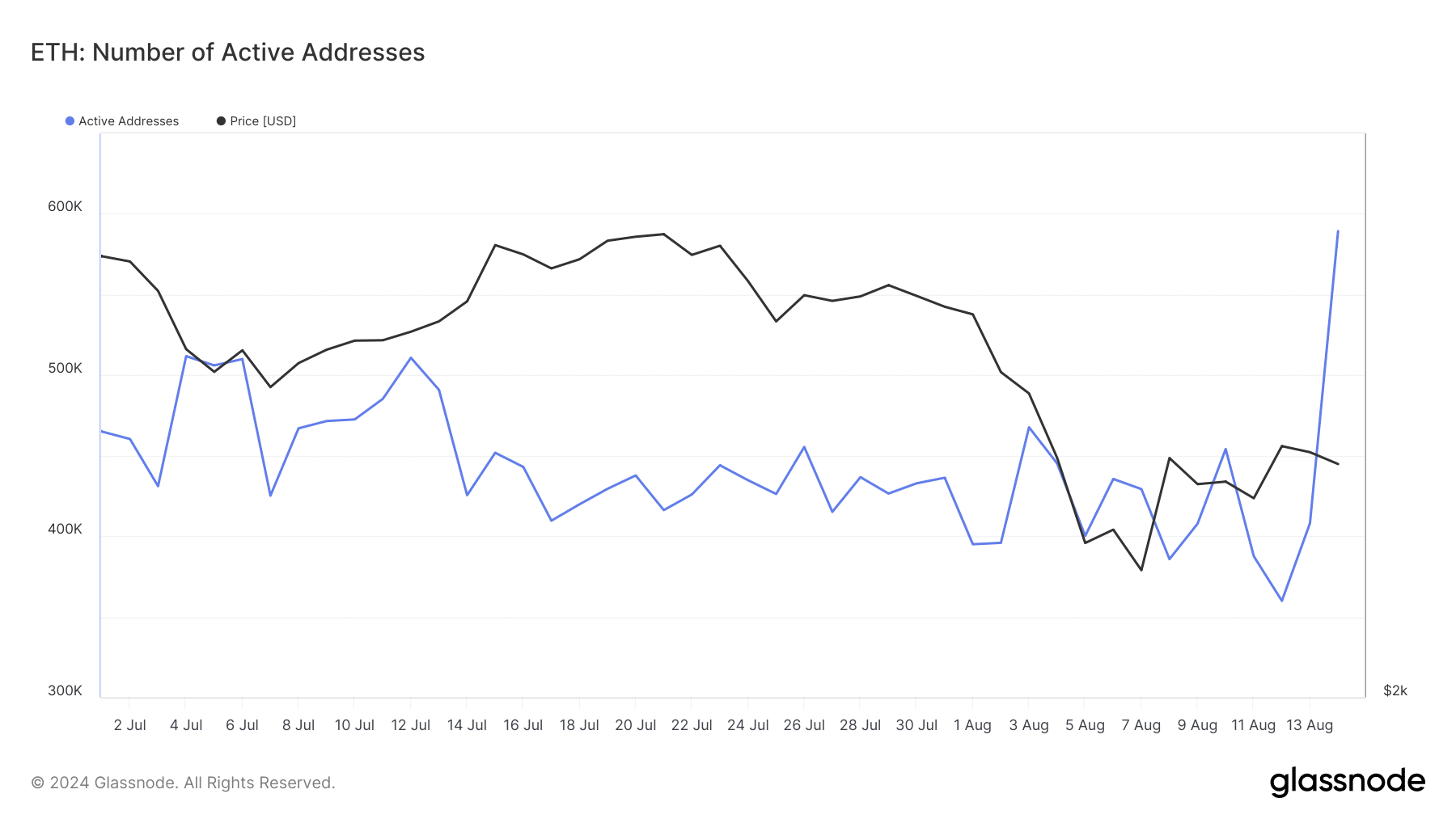

Ethereum’s number of active addresses has also experienced a dramatic increase, surging from less than 400,000 earlier in the week to nearly 600,000 at press time.

Source: Glassnode

This growth in active participation is a strong indicator of Ethereum’s ecosystem, despite the price setbacks. It reflects a broader engagement with the platform, likely driven by both speculative interests and genuine utility.