- Crypto market is crushing at high rates than envisioned.

- Here’s a look at three reasons causing the cryptocurrency market dip.

The last 24 hours have seen the largest crypto market crash in recent months. Bitcoin’s [BTC] decline from $50k to $60k has pushed the crypto market to a massive decline.

With BTC’s extreme volatility amidst increased global financial market uncertainty, altcoins have been hit the most. Spectator Index reported that cryptocurrency markets have witnessed about $ 1 billion liquidation over the past 24 hrs.

The decline has left traders and analysts wondering what’s causing such a massive drop. AMBCrypto has found three major reasons for crypto markets crashing over the past 24 hrs.

Altcoins decline to high lows

With the increased crypto decline, most altcoins have experienced the largest hit, making high lows. Over the past seven days, most altcoins have faced bearish sentiment, thus entering a bear market.

Source: X

Amidst this decline, all major altcoins have been hit hard. For starters, ETH was trading at $2326 at press time after a 19.85% decline on daily charts and a 30% decline on weekly charts.

This drop has impacted ETH’s market cap extensively. The Ethereum market was $410 billion 2 weeks ago, and now it’s at $280 billion. That’s a $127 billion haircut, which is more than the entire market cap of Solana and BNB.

Equally, BNB has declined by 15% on daily charts and 24% on weekly charts to trade at $446. Also, Solana has experienced a massive decline to $121 after a 36% drop on weekly charts and 14.77% on daily charts.

What’s causing the crypto dip?

Source: X

Three major reasons are pushing crypto markets down.

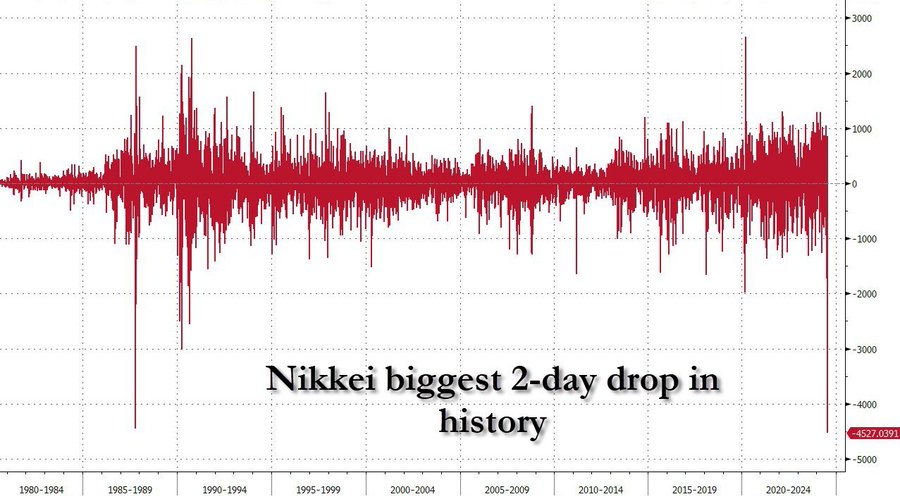

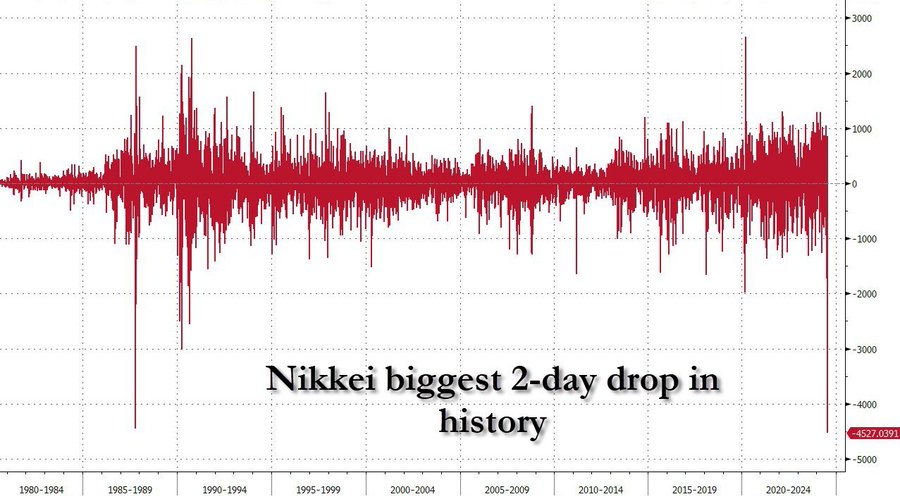

Firstly, the Japanese stock market crash has impacted the wider crypto industry. Japan’s stock market is reporting the worst 2 day decline in its recent history.

Zerohedge states the decline is larger than the Black Monday crash of 1987.

Thus, negatively affects traders who have purchased cheap yen to leverage their positions in the stock market. Adam Khoo addressed the development, noting that,

“Japanese stocks (Nikkei 225) plunging over 25% from their highs to 30,900 support. If this support can hold, a nice bounce could come.”

Accordingly, the Japanese stock market has declined for various reasons. Firstly, BoJ is hiking interest rates to control inflation and is expected to continue hiking. Secondly, as noted by Adam Khoo,

“The spike in Jap Yen (JPY) will potentially make Japanese large-cap multi-national companies exports less competitive and reduce profits from overseas revenue.”

The Japanese market has caused panic selling, thus affecting other markets, including Taiwan and South Korea. Equally, the U.S. FED is rumored to announce rate cuts to cushion markets against any ripple effect from Japanese markets.

Source: X

Increased geopolitical tensions

The current geopolitical tensions affected the wider crypto markets as well, sending traders into panic selling.

Over the last week, tensions in the Middle East have caused concerns over a wider regional war. Since the Israel killing of the Hamas leader in Iran and military activities in Lebanon, there have been increased worries of all-out war, with the U.S. military sending reinforcements to the region.

Through his X page, Patrick Bet David noted that regional tension is a factor that affects markets. He noted that,

“Rumors of an underground bunker in Jerusalem where senior leaders can remain for an extended period during a war has been prepared by the Shin Bet security service and is fully operational, the Walla news site reported on Sunday, amid fear of attacks on Israel from Hezbollah and Iran.”

Undoubtedly, the possibility of a regional war would crash the crypto markets and the wider financial markets.

Market uncertainty

Since the Fed failed to announce any rate cuts, the market has experienced a moment of uncertainty. With the U. S debt hitting past $35 trillion, the markets have reacted with panic as fears grow over inflation and FED’s stand on rate cuts.

Therefore, the growing stock market panic has created rumors that FED will announce cuts in response to current situations.

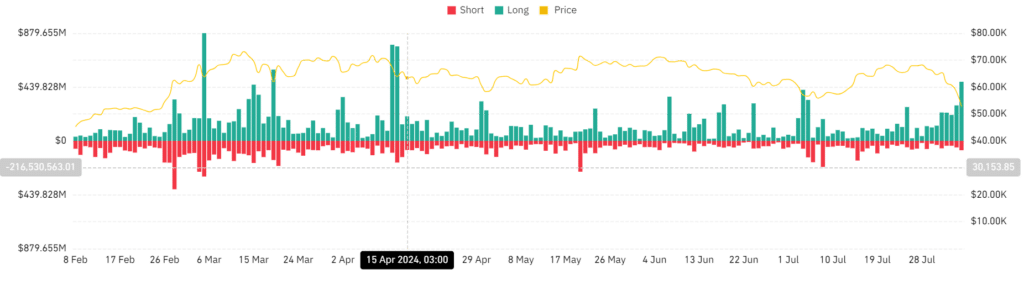

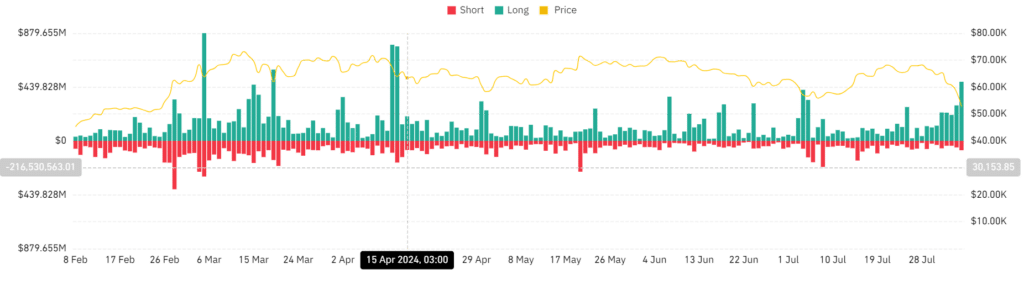

Source: Coinglass

Equally, increased market uncertainty has resulted in increased crypto liquidations over the past 24 hours.

According to Coinglass, total liquidations for Crypto markets have increased from $269.4 million to $482.5 million on daily charts. Other reports from Spectator Index report over a $1 billion liquidation in crypto markets.

The rise in liquidations shows investors are uncertain over crypto’s future and thus refuse to pay premium to hold their positions, forcing them out of these positions.

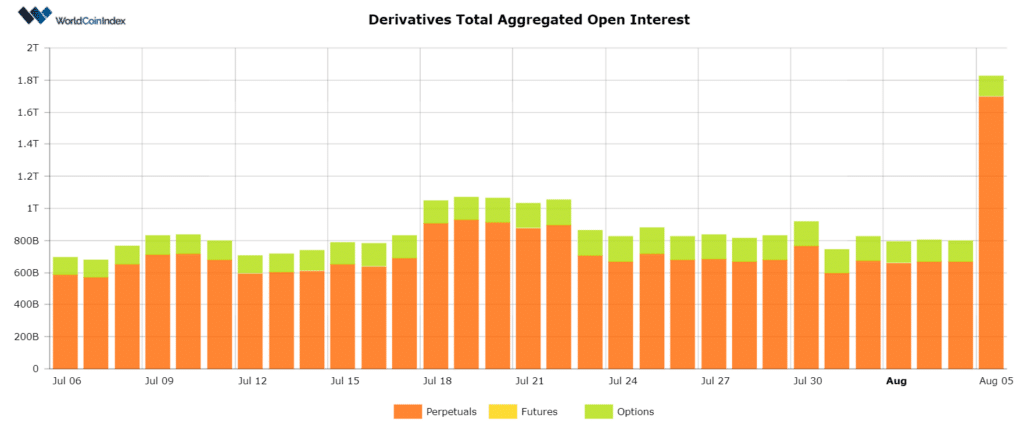

Source: Worldcoinindex

Finally, according to the Worldcoin index, the accumulated open interest of crypto derivatives has increased from $667.2 billion to $1.7 trillion.

When derivatives aggregated open interest rises with declining prices, it implies those entering the markets are betting against price increases as they expect markets to drop further.