- Ethereum whales accumulated over 126,000 ETH worth $440 million in 48 hours.

- Metrics, however, indicated a potential reversal.

Ethereum [ETH] whales have been on a shopping spree over the last 48 hours. These large holders have bought up over 126,000 ETH, worth about $440 million, per analyst ali_charts.

This has created a large influx of buying pressure at a time when the overall cryptocurrency market was showing mixed signals.

Exchange activity heats up

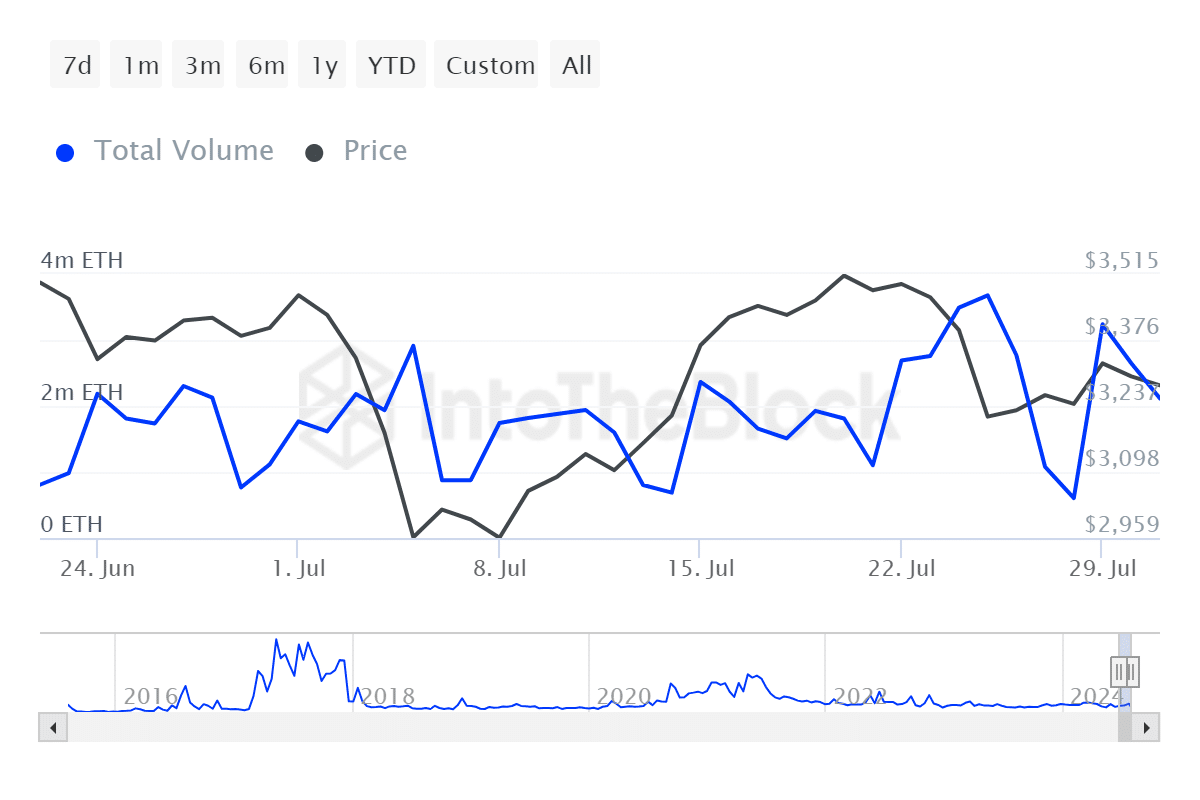

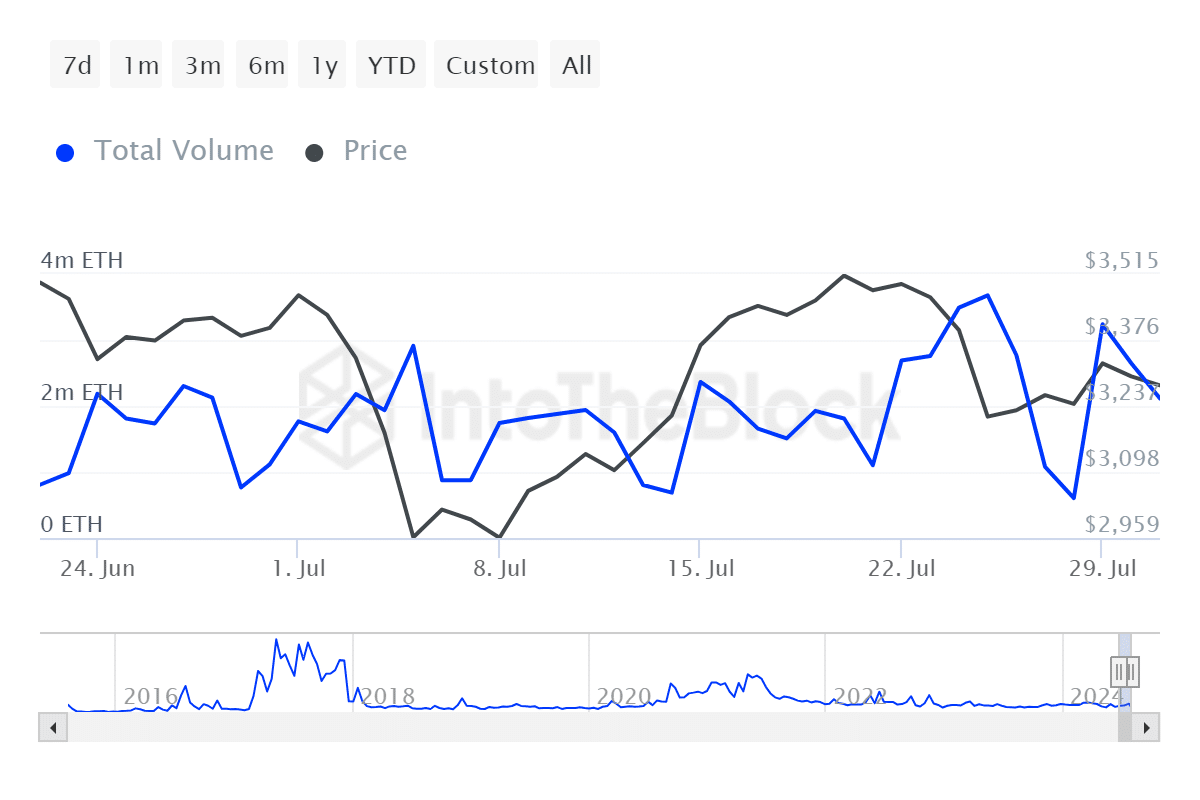

Accompanying whale accumulation, exchanges have recorded an increase in activity. Major platforms showed a rise in ETH trading volumes, according to IntoTheBlock data.

This uptick in exchange action typically occurs before significant price movements as traders set themselves up for potential market shifts.

Source: IntoTheBlock

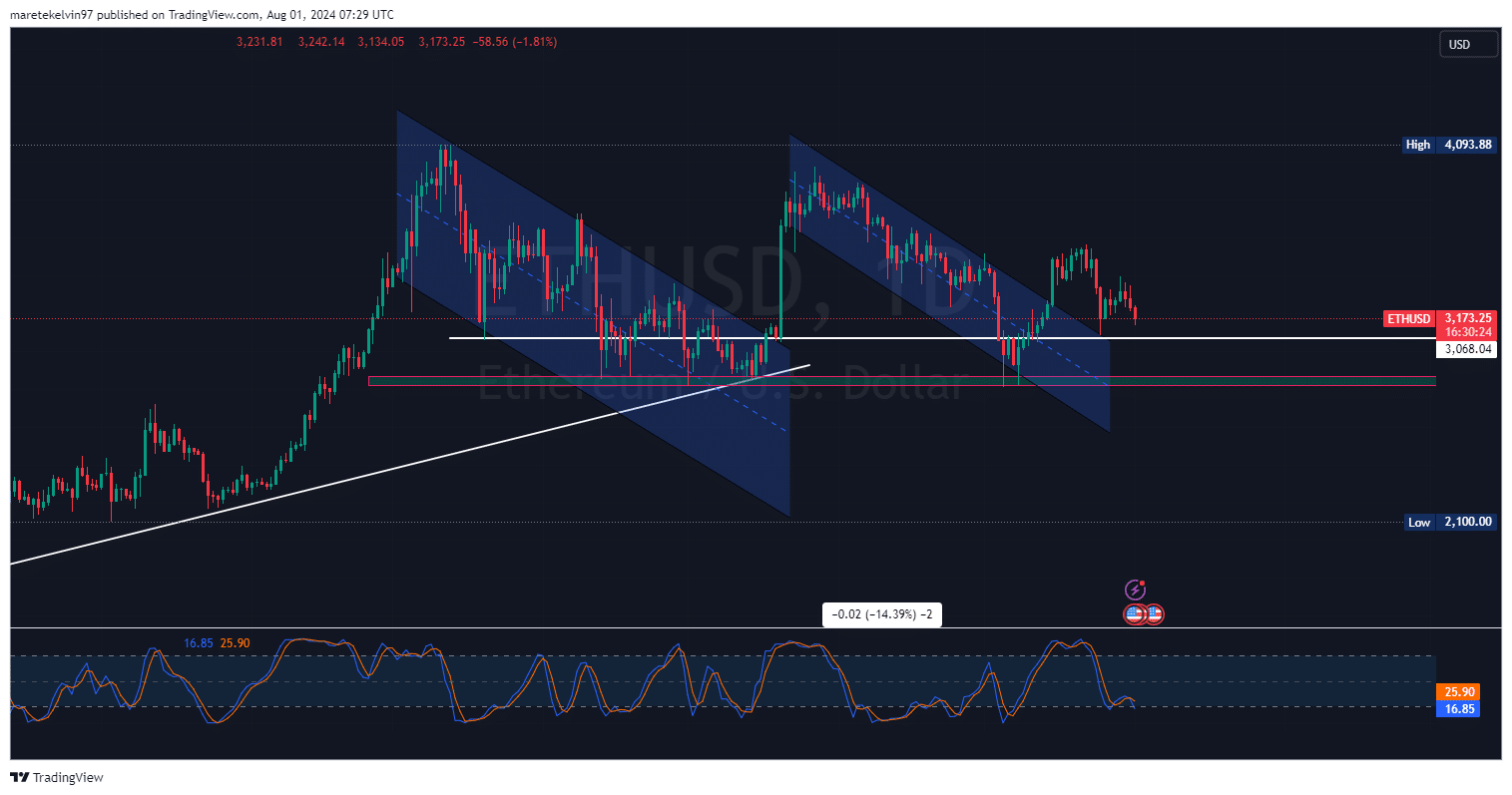

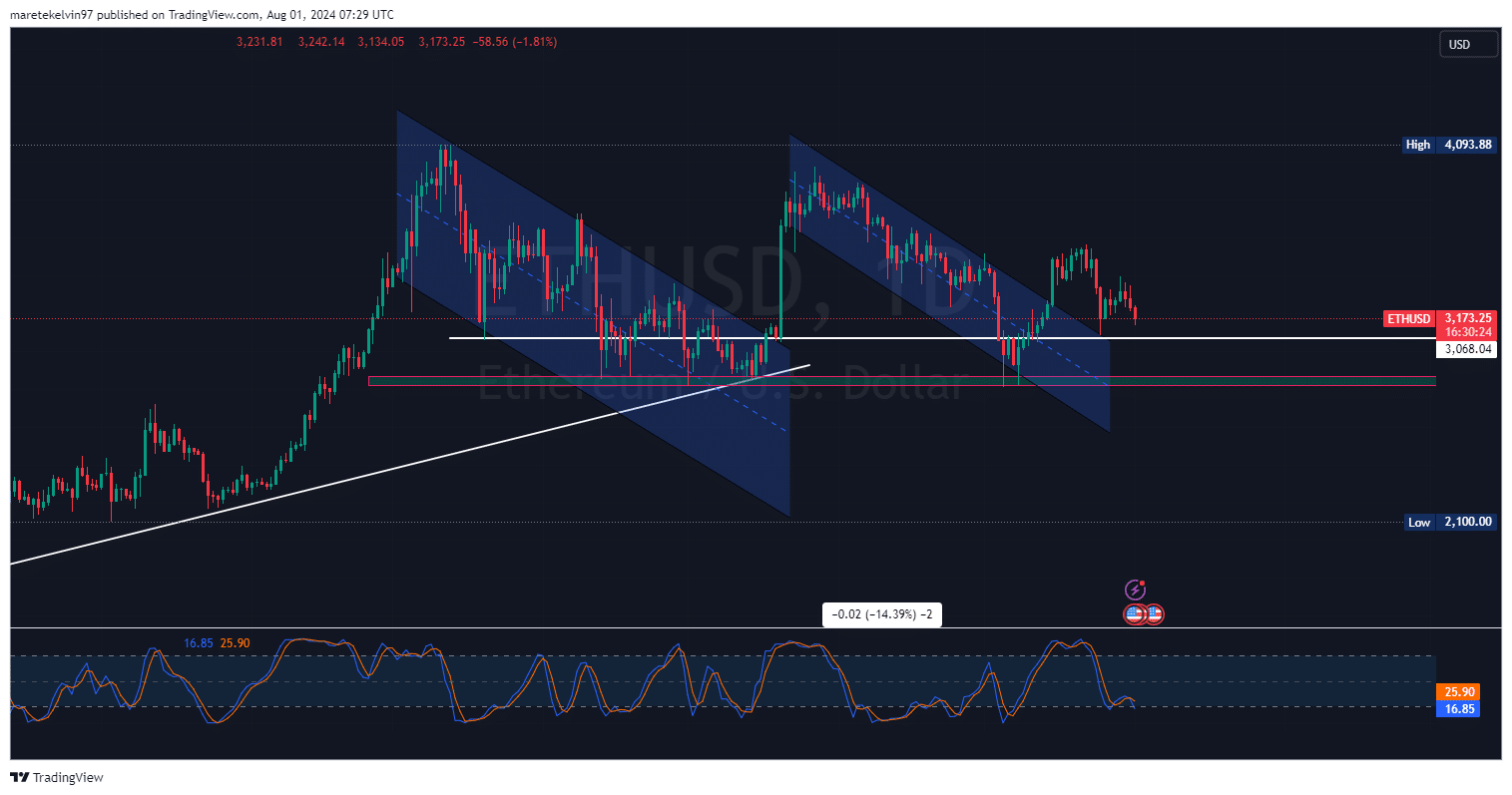

Despite Ethereum’s significant whale accumulation, its price has yet to make a substantial surge. Since the 10% surge on its ETF approval week, ETH has plummeted by 6.83% to the press time price of $31.73.

Recently, ETH was approaching a key support level of $3068. The bearish pressure was easing up as it approached this level. This indicated a reversal, as big players may push the prices up for a bullish rally.

The RSI (Relative Strength Index) indicator was 16.85 at press time, approaching oversold territory. This is a potential signal for a price reversal to be bullish.

Source: TradingView

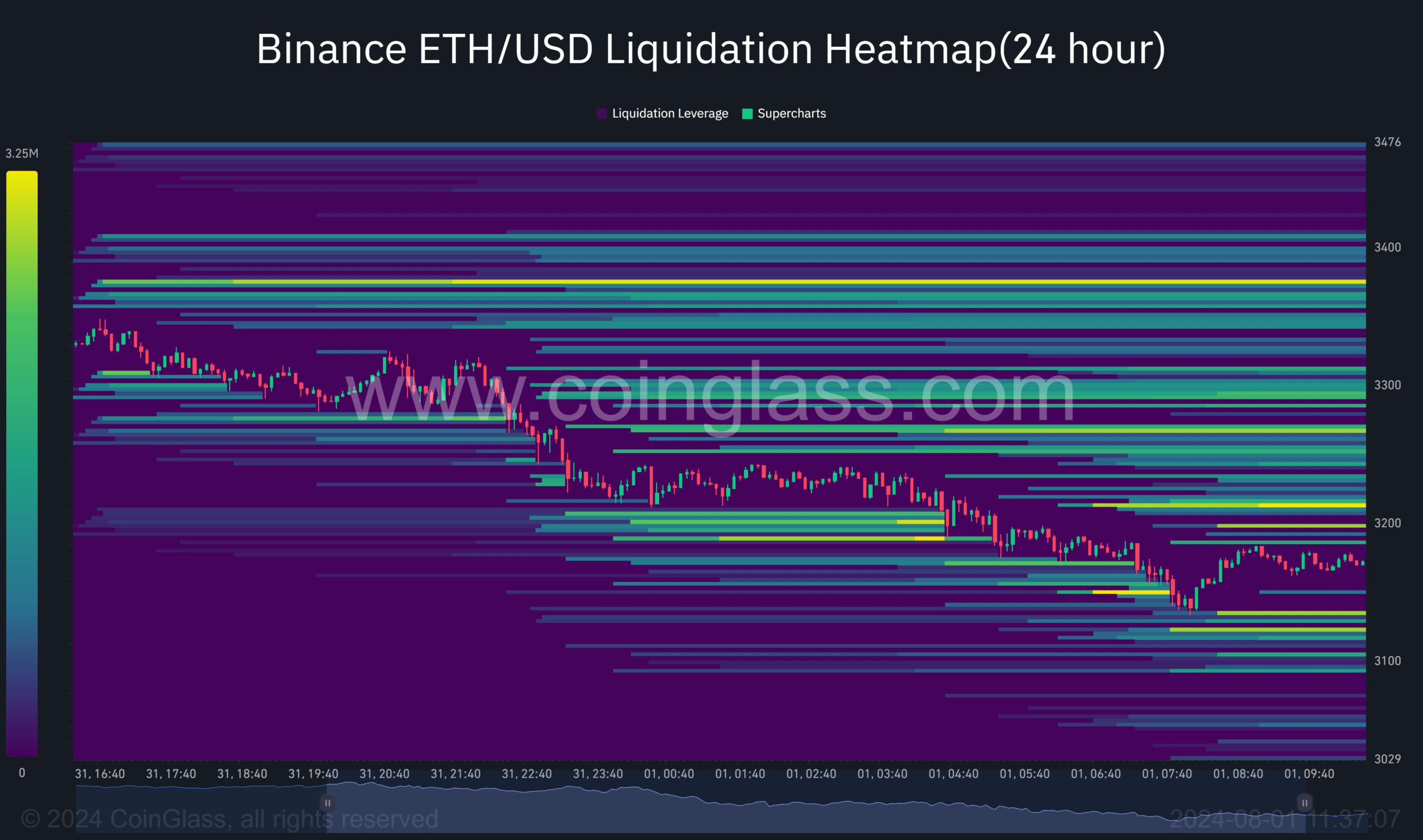

AMBCrypto’s analysis of the liquidity heatmap data from Coinglass indicated clusters of liquidity pools above and below the key support level.

A sudden price movement in either direction could trigger a chain of liquidations, potentially fueling price movement.

Source: Coinglass

Will whale activity spark a rally?

From historical data, a significant accumulation of whales often comes before a price rally. However, market dynamics are also intricate.

Read Ethereum’s [ETH] Price Prediction 2024-25

Increased trading activity on exchanges might indicate that smaller investors are taking profits. This may neutralize the bullish pressure caused by whale buyers.

While the substantial buying pressure from large holders correlates well with the price action, the market outlook in the coming days will be vital in determining whether the whale activity will fuel a bull run.