Crypto short sellers are weathering liquidations following Bitcoin’s (BTC) sudden surge beyond the $63,000 mark.

According to data from CoinGlass, the crypto markets have experienced more than $134 million in liquidations in the last 24 hours alone, mostly from short sellers.

Binance, the world’s largest crypto exchange platform by volume, hosted the largest amount of liquidations at $52.05 million, followed by $35.56 million on OKX, $19.15 million on Bybit and $14.39.06 million on Huobi.

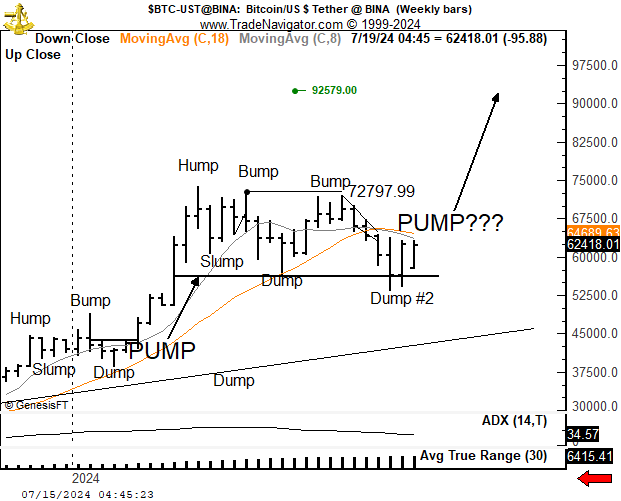

Veteran trader Peter Brandt believes that Bitcoin’s big gain on Monday has now confirmed the correction to the $50,000 range was a “bear trap” and that price may now be heading to more than $90,000. A “bear trap” is when a price goes low enough to convince bears to sell or go short before quickly reversing in the opposite direction of their positions.

Says Brandt,

“Bitcoin BTC could be unfolding its often-repeated Hump…Slump…Bump…Dump…Pump chart construction. July 5th attempt at double top was bear trap, confirmed by July 13th close. Most likely scenario now is that bears are trapped. Close below $56,000 negates this interpretation.”

Pseudonymous analyst Bluntz also believes Bitcoin is heading even higher after the top digital asset by market cap appears to have completed a multi-month ABC correction after ending the previous week above $60,000.

Bluntz practices Elliott Wave theory, which states that an asset tends to witness an impulsive five-wave surge after concluding a three-wave ABC correction.

“OK this price action starting to look like accumulation now.

If BTC takes out $60,000 again, I think it’s off to the races and a new impulse up may have begun.”

Bitcoin is trading for $63,033 at time of writing, up nearly 5% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE-3