- Grayscale’s latest report suggested U.S voters are more likely to buy ETH after ETF approval

- While ETH’s value surged on the charts, its network growth fell

The recent market drawdown has affected a host of cryptocurrencies over the last few days. Needless to say, Ethereum [ETH] was no exception, with its price struggling to break past the $3,000-level, at the time of writing.

Will Ethereum finally see green?

However, there may be some hope for Ethereum maximalists, despite the altcoin’s falling prices. A new survey by Grayscale has painted a bullish picture for Ethereum’s future.

According to the same, when the long-awaited Spot Ethereum ETF goes live, nearly a quarter of potential U.S voters would be more likely to invest in the altcoin. This surge in interest would be in line with the broader trend of crypto adoption too.

The survey also found that nearly half of all voters, 47% to be precise, now expect to include cryptocurrencies in their investment portfolios – A significant hike from 40% just six months ago. The large scale interest from people in adding crypto to their portfolios could further help ETH in the long run.

Similar to Bitcoin’s ETF launch, an Ethereum ETF would provide a familiar, regulated way for new investors to enter the market. This influx of capital, particularly from institutions, could drive up Ethereum’s price due to increased demand. This was seen with Bitcoin, where the ETF approval coincided with a significant price rally.

A U.S-approved Ethereum ETF would be a major vote of confidence from regulators, potentially easing institutional concerns about the cryptocurrency’s legitimacy.

How is ETH doing?

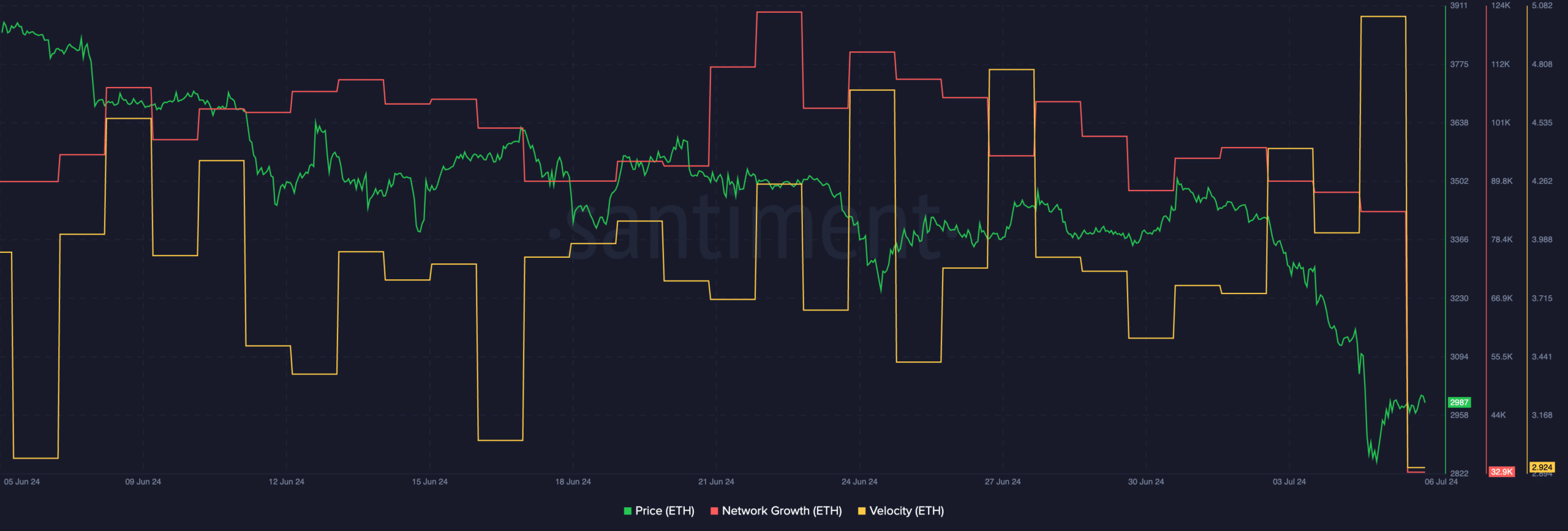

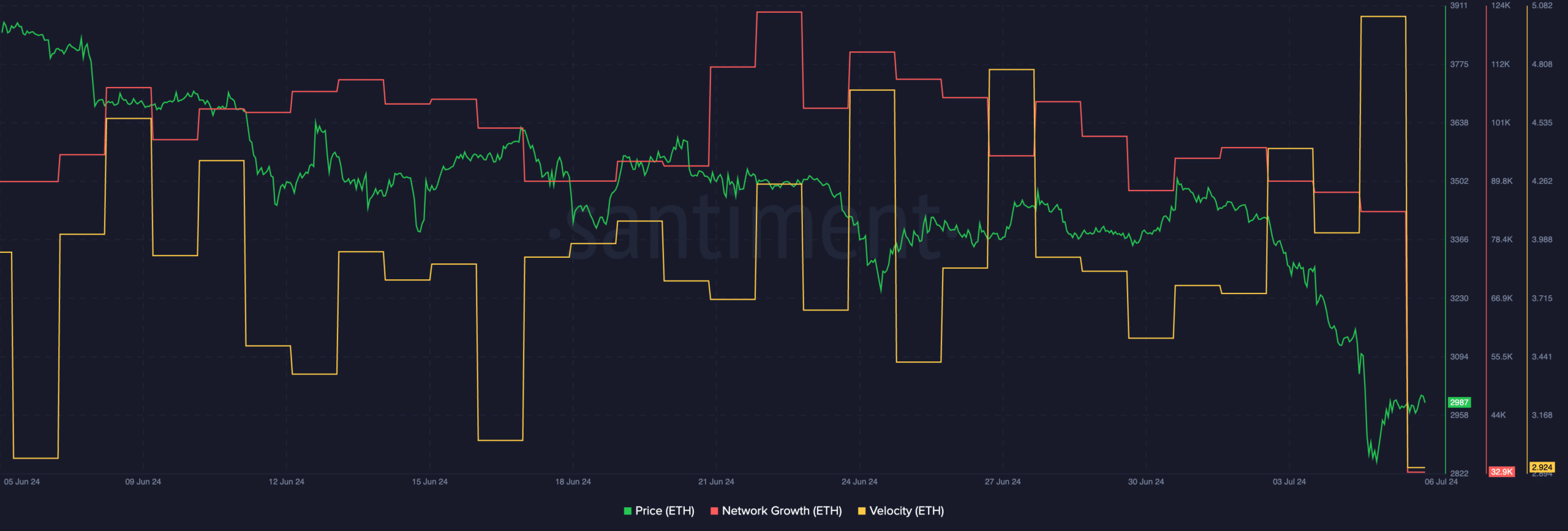

At press time, ETH was trading at $2,987.46 following a 4.19% hike over the last 24 hours. The network growth for ETH declined materially over the period. This indicated that despite low prices, most new investors have been unwilling to buy ETH.

Additionally, the velocity around the token also fell, implying reduced frequency of trading for ETH.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Hence, it’s worth anticipating what the final launch of Spot Ethereum ETFs will mean for the altcoin’s price in the future.

Source: Santiment

On the other side of the world, it would seem that Hong Kong might soon welcome Ethereum staking ETFs, and within just 6 months too. This, according to Hashkey Capital’s Vivien Wong. In fact, Wong also claimed that local regulators are now talking to industry insiders over the said proposal.