- Solana surpassed Bitcoin and Ethereum in gains, marking a strong Q3 start.

- VanEck and 21Shares filed for Solana ETFs, influencing market sentiment.

The crypto market kicked off the first day of Q3 on a positive note, with Bitcoin [BTC] and various altcoins on a bullish trajectory.

Solana in the limelight

Solana [SOL], in particular, stole the spotlight with a remarkable 7.50% increase in the past 24 hours at press time. This surge outpaced both BTC and Ethereum [ETH]. SOL prices rose by 18% over the last seven days as well.

Interestingly, the Solana memecoin market also displayed strong bullish momentum. According to CoinGecko, the market cap of Solana memecoins on the 1st of July stood at $7.73 billion, reflecting a 10.4% increase in the last 24 hours.

Remarking on the same, an X user – Borovik (formerly Twitter) noted,

“Welcome to the Solana cycle.”

Solana ETF in the pipeline

This coincides with recent filings by two asset management firms, VanEck and 21Shares, who both filed to launch a spot Solana ETF last week.

According to reports, on 27th June, VanEck made a significant move by filing for a Spot Solana ETF with the U.S. Securities and Exchange Commission (SEC).

The following day, on 28th June, 21Shares also filed for their own Spot Solana ETF, increasing hope among investors for an upcoming SOL ETF.

Impact on the upcoming US election

This news was met with much appreciation, especially in the context of the upcoming presidential election, with the two candidates having opposing views on crypto.

Former President Donald Trump has been quite vocal about his pro-crypto stance, often expressing his support for the industry. In contrast, President Joe Biden has shown a comparatively anti-crypto viewpoint, with fewer instances of favoring digital currencies.

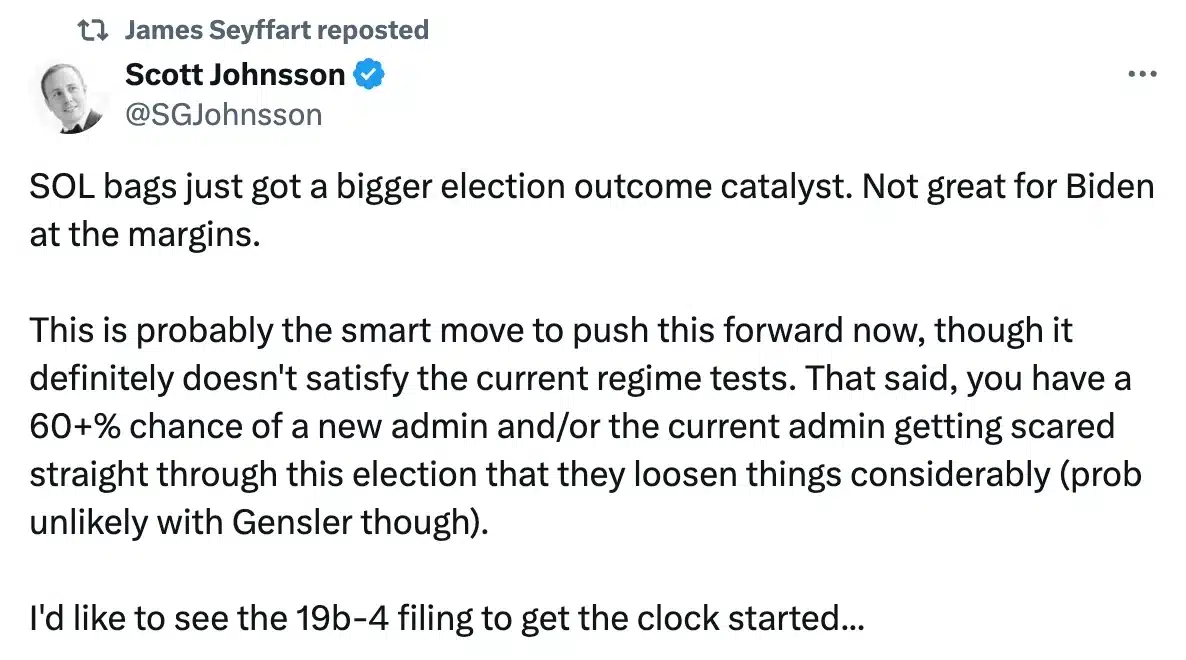

Remarking on this, Van Buren Capital’s general partner, Scott Johnsson, noted that the news of an upcoming Solana ETF might not be favorable for President Biden’s chances in the election, particularly among undecided or marginal voters. He said,

Source: Scott Johnsson/X

However, not everyone was on the same page, as James Seyffart, ETF analyst at Bloomberg Intelligence, said during an interview conducted before 21Shares became the second Solana applicant.

“I think VanEck’s filing is a sort of call option on the November election.”

He added,

“Under the current SEC administration – based on years of prior approval and denial orders for crypto ETFs – a solana ETF should be denied because there is no federally regulated futures market. But a new admin in the White House and a new SEC admin that’s more amenable to crypto policies could change that calculus.”

SOL’s price action

Despite mixed sentiments, the news about a potential Solana ETF boosted SOL’s price gains into double digits.

Current data trends also indicate that SOL’s future remains promising, supported by Bollinger Bands signaling reduced volatility and sustained bullish sentiment.

Moreover, the RSI above the neutral level and trending upwards further confirmed this trend.

Source: TradingView