- US spot ETH ETFs could hit $15 billion in net flows in the next 18 months

- Despite the high chances of the ETF launch next week, more traders have shorted ETH.

Despite some analysts’ overwhelming low expectations for the US spot Ethereum [ETF], Bitwise CIO Matt Hougan projected that the products will succeed.

Hougan estimated the products could hit $15 billion in net flows in less than two years.

“Ethereum ETPs will attract $15 billion in net flows in their first 18 months on the market.”

Ethereum ETF: Why flows could hit $15B in 2025

Hougan’s argument was based on Bitcoin [BTC] vs. ETH market share and ETFs’ AUM (assets under management) across Europe and Canada.

As of press time, Bitcoin’s [BTC] market cap was $1.19 trillion, while ETH’s was $405 billion. However, per Hogan, at the time of his analysis, BTC had $1,266 billion (74% of the market), while ETH had $432 billion (26%).

Hougan established a similar demand pattern across ETPs (Exchange-traded products) across Canada and Europe.

Notably, for Europe’s AUM, Bitcoin ETPs had €4,601 (78%), while Ethereum ETPs had €1,305 (22%). In Canada, Bitcoin ETPs’ AUM stood at $4,942 CAD (77%), while Ethereum ETPs’ had $1,475 CAD (23%).

As such, Hougan concluded that the above figures captured the ‘normal’ demand for ETPs between BTC and ETH investors.

According to Hougan, if US spot BTC ETFs’ AUM hits $100 billion by the end of 2025, ETH ETFs could hit $35 billion, based on ETH’s 26% market share.

As of this writing, Soso Value data revealed that BTC ETFs had amassed $52 billion in AUM.

However, Hougan added,

“This doesn’t mean $35 billion in flows, of course. Remember: ETHE will convert with $10 billion in assets. Subtract that, and you’re left with $25 billion.”

ETHE is Grayscale’s Ethereum Trust, which some analysts believe could see outflows similar to those of its GBTC upon conversion to an ETF.

However, Huogan noted that when adjusted for the EU’s 22% market share, the $25B decreases to $18B.

Additionally, factoring likely lesser flows from carry trade seen in BTC ETFs, Hougan noted,

“The carry trade is not reliably profitable in ETH for non-staked assets, so I do not expect the same carry-trade flow for the new ETH ETFs. Removing carry-trade assets from our model cuts our flow estimate from $18 billion to $15 billion.”

Such a target would make the ETH ETPs a ‘big success,’ wrote Hougan.

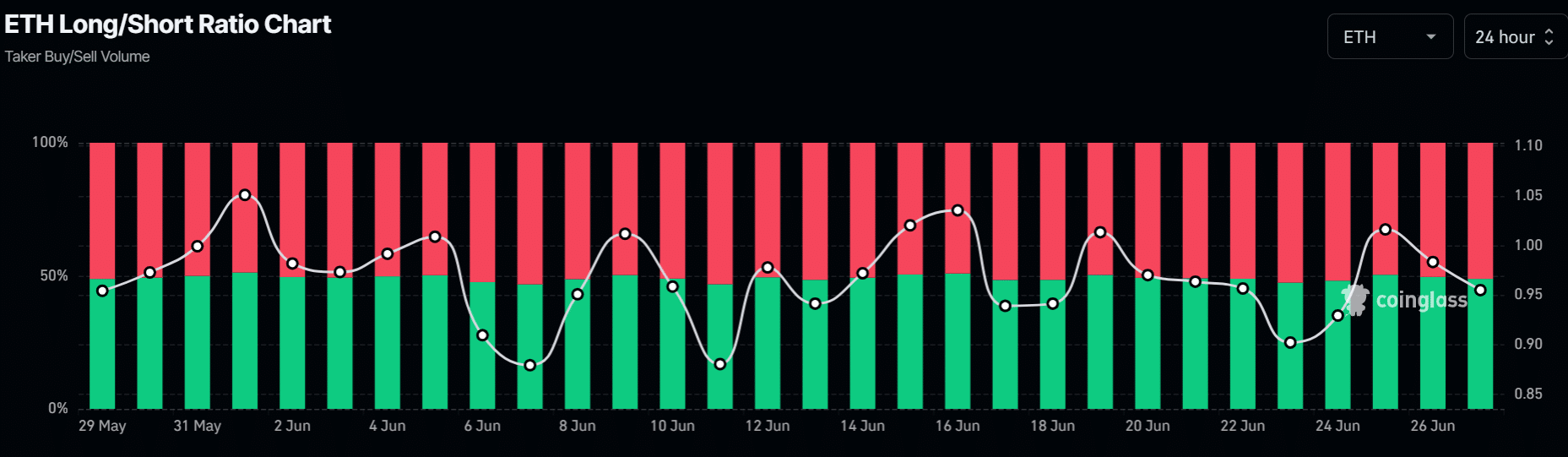

How are ETH traders positioned for ETFs?

As of press time, the second-largest digital asset was trading at $3.3k, down 15% from a high of $3.9k hit after the partial ETH ETF approvals in late May.

Will it reverse the losses, as the market expects the ETF to launch next week?

Per Polymarket’s prediction market, the odds of the ETH ETF launch next week jumped to 75% as of press time.

However, despite the upcoming ETF, traders have shorted the asset, with short positions rising from 49% to 51% in the past three days.

Source: Coinglass