- Saudi Arabia explores alternatives to the petrodollar deal by participating in a China-led CBDC initiative.

- Saudi joins mBridge to reduce dollar dependence.

The U.S. has significantly increased its unconventional oil production in recent years, strengthening its global oil market presence and the supremacy of the U.S. dollar in oil trade.

However, things might not go in its favor for too long as the longstanding petrodollar agreement between Saudi Arabia and the United States is also approaching its conclusion.

Saudi Arabia’s paradigm shift

Moreover, Saudi Arabia’s participation in a China-led digital currency trial indicates a possible shift away from reliance on the dollar for global oil transactions.

Remarking on the same, as per Reuters, Josh Lipsky, who runs a global CBDC tracker, at the U.S.-based Atlantic Council said,

“The most advanced cross-border CBDC project just added a major G20 economy and the largest oil exporter in the world.”

He further elaborated,

“This means in the coming year you can expect to see a scaling up of commodity settlement on the platform outside of dollars – something that was already underway between China and Saudi Arabia but now has new technology behind it.”

Saudi Arabia’s joins mBridge: Here’s why?

This coincides with, the Bank for International Settlements (BIS) announcement that Saudi Arabia’s central bank will now be a “full participant” in Project mBridge.

Furthermore, the BIS has announced that Project mBridge has progressed to its minimum viable product (MVP) stage, marking a global expansion.

The initiative is focused on creating a multi-CBDC platform using distributed ledger technology (DLT) to facilitate instant cross-border payments.

Launched in 2021, the mBridge initiative involved collaboration among the central banks of China, Hong Kong, Thailand, and the UAE.

The project aimed at building a CBDC platform backed by multiple central and commercial banks, to enable instant cross-border payments and settlement. If successful, this could potentially reduce the world’s reliance on the U.S. dollar for oil transactions.

Now, as Saudi Arabia’s central bank joins as the sixth full participant, the project continues to garner international attention, with over 26 global entities.

This includes the IMF, World Bank, and ECB, participating as observers to monitor its progress and potential impact on global financial systems.

US chooses a different route

These developments come in sharp contrast to the US’s attitude towards CBDC, as the U.S. House of Representatives passed a bill (CBDC Anti-Surveillance State Act) preventing the Federal Reserve from issuing a CBDC.

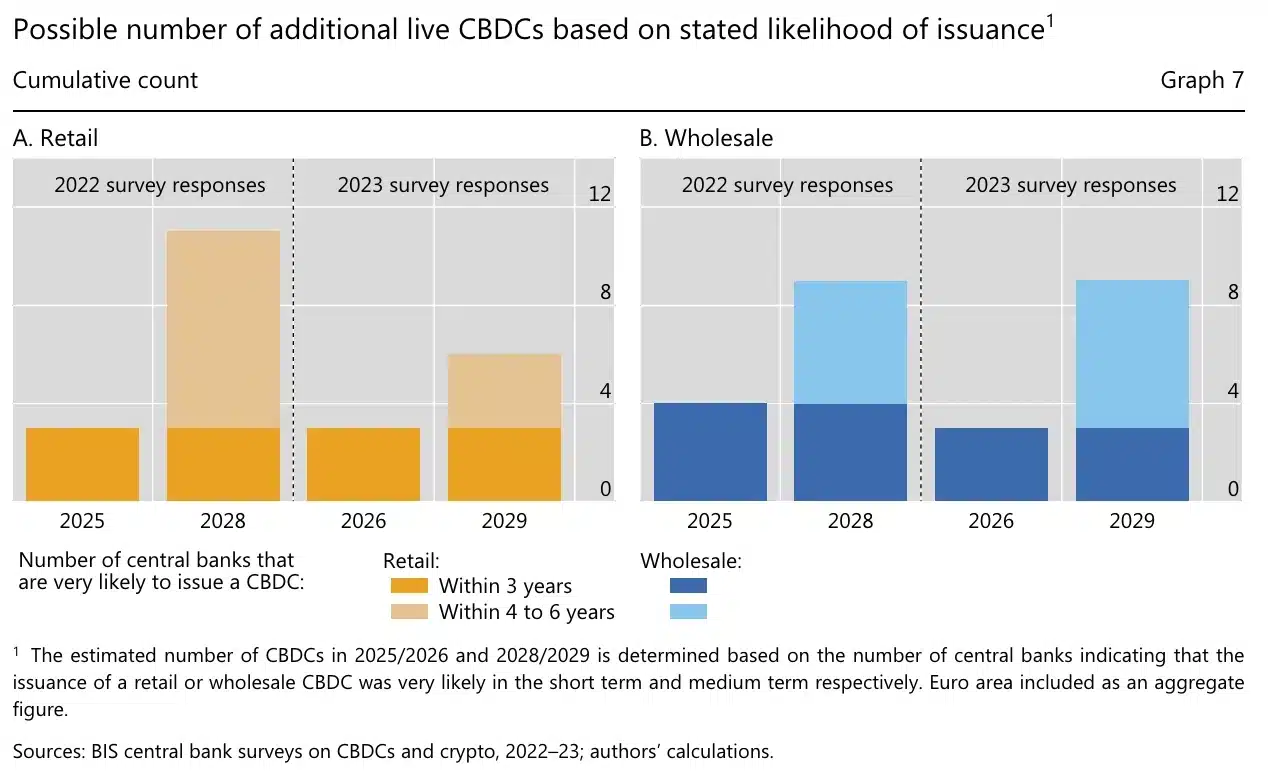

In fact, a survey conducted by the BIS revealed that 94% of central banks, up from 90% in 2021, are actively exploring CBDCs.

The survey, involving 86 banks, underscores a preference for wholesale CBDCs over retail variants in upcoming years.

Source: bis.org