- Ethereum whales accumulated large amounts of ETH in the last few days.

- Developments for Ethereum ensued, price remained stagnant.

Ethereum’s [ETH] price has remained stagnant over the last few days, despite this, whales have shown interest in the ETH token.

Ethereum whales move in

The number of Ethereum wallets holding significant amounts of ETH has been on the rise.

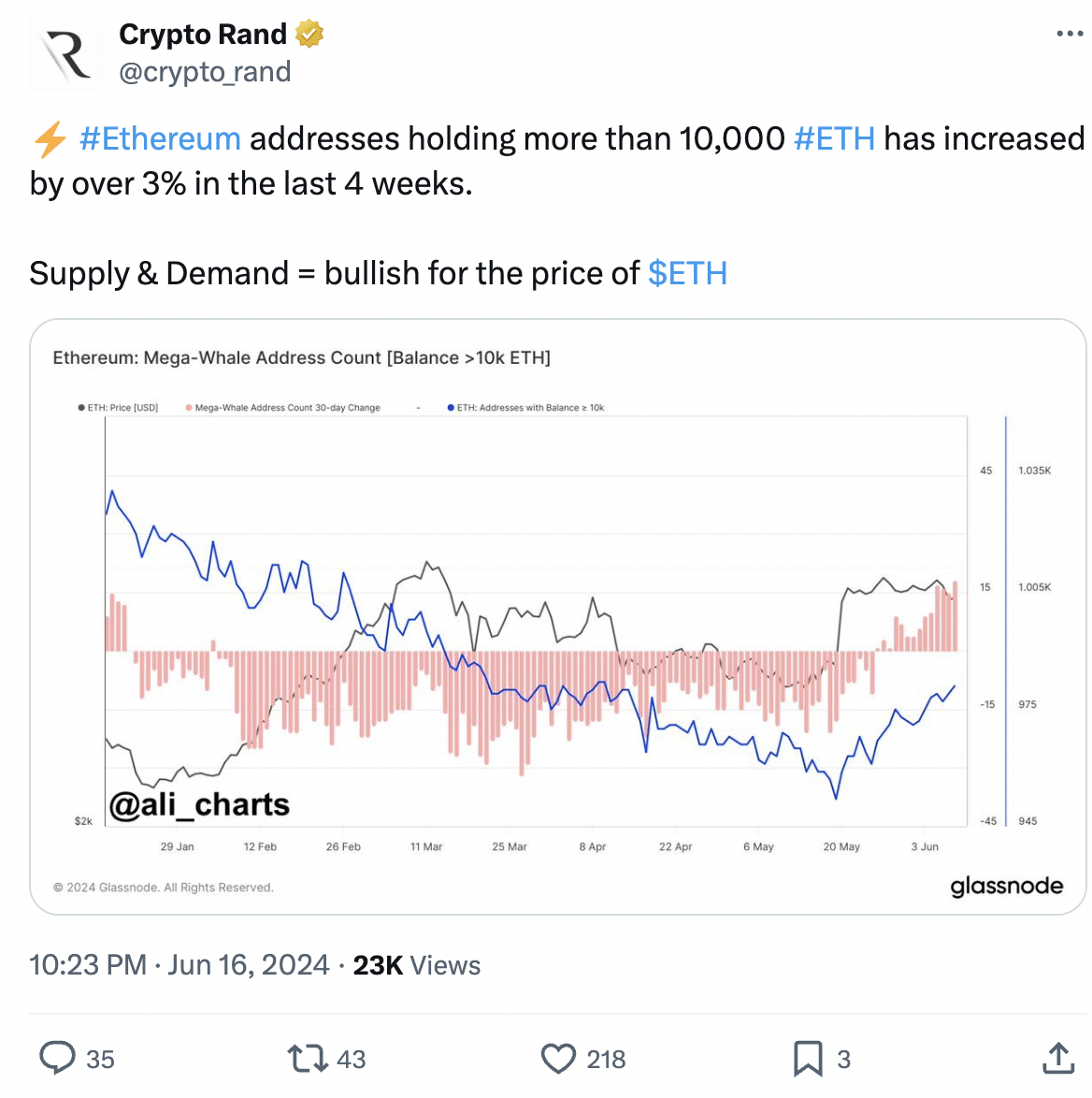

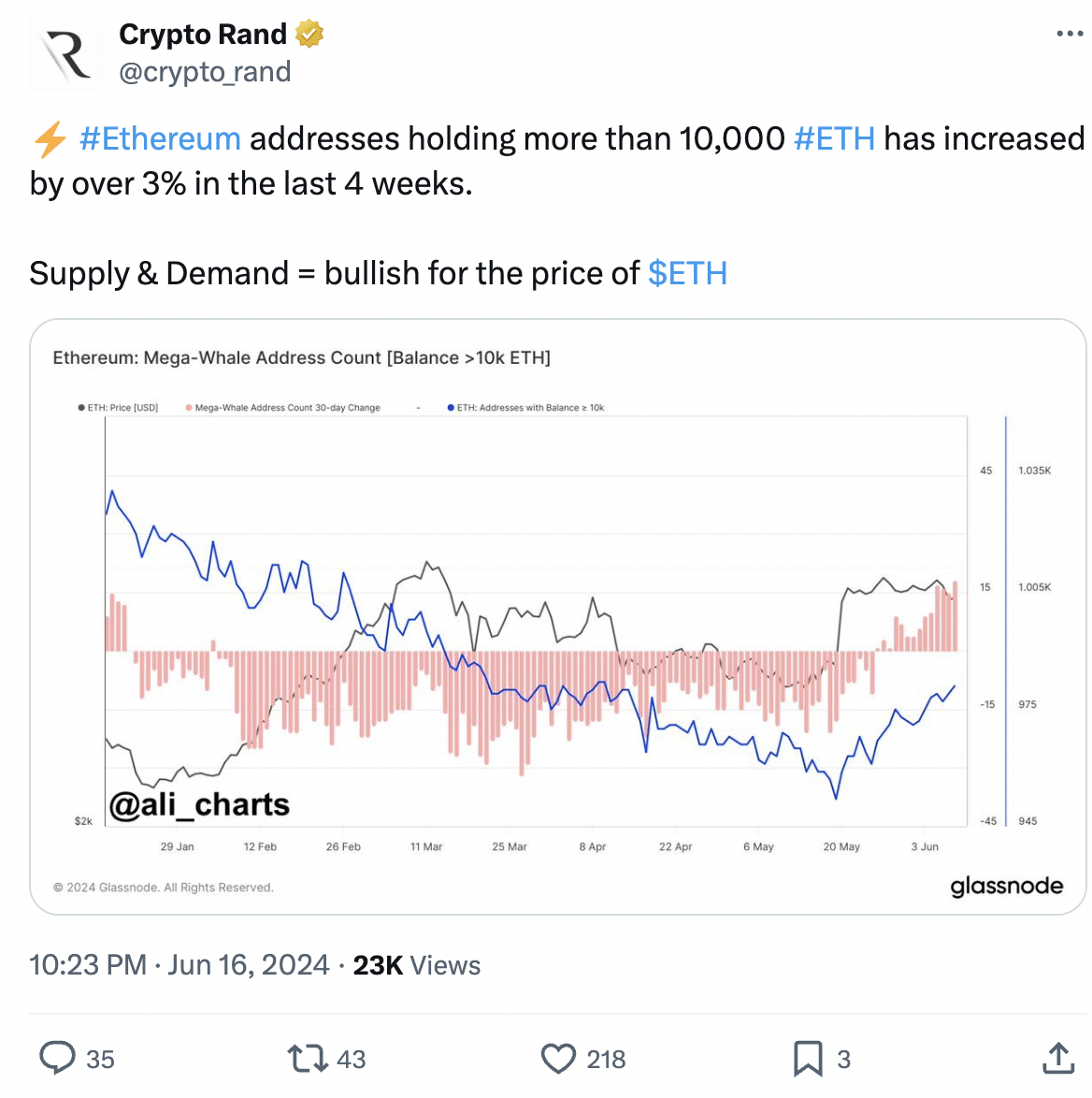

According to Santiment’s data, over the past four weeks, there’s been a massive increase of over 3% in Ethereum addresses that hold more than 10,000 ETH.

Whales hold a substantial amount of ETH, and their buying activity can significantly influence market sentiment. If they continue accumulating, it can drive up demand for ETH, potentially leading to a price increase.

This can attract further investment, creating a positive feedback loop and propelling the price even higher.

While whales can contribute to price appreciation, their actions can also introduce volatility.

If these large holders decide to sell a significant portion of their ETH holdings in a coordinated manner, it could trigger a sudden price drop, causing panic among smaller investors

Source: X

New developments on the network

Apart from whale interest, another factor that could impact Ethereum significantly would be the developments occurring on the network. In the most recent developer call, multiple aspects of the Ethereum network were discussed.

This meeting of Ethereum developers addressed upcoming advancements to the Ethereum blockchain. The discussions centered on three primary areas Electra, PeerDAS, and SSZ-related improvements.

Electra is the name for a series of upgrades to the Ethereum consensus layer, which coordinates validators on the network. The call addressed the nearing completion of code for the next Electra version and upcoming testing phases.

PeerDAS refers to a planned modification to the Ethereum network’s communication system. This would allow nodes to process and validate larger amounts of user data.

Developers are planning separate testing phases for PeerDAS to ensure its stability before integrating it into the main network.

Finally, the call touched upon SSZ, a technical specification for data encoding. Several improvements related to SSZ are being developed, and their potential inclusion in a future major upgrade is being explored.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Looking at the price

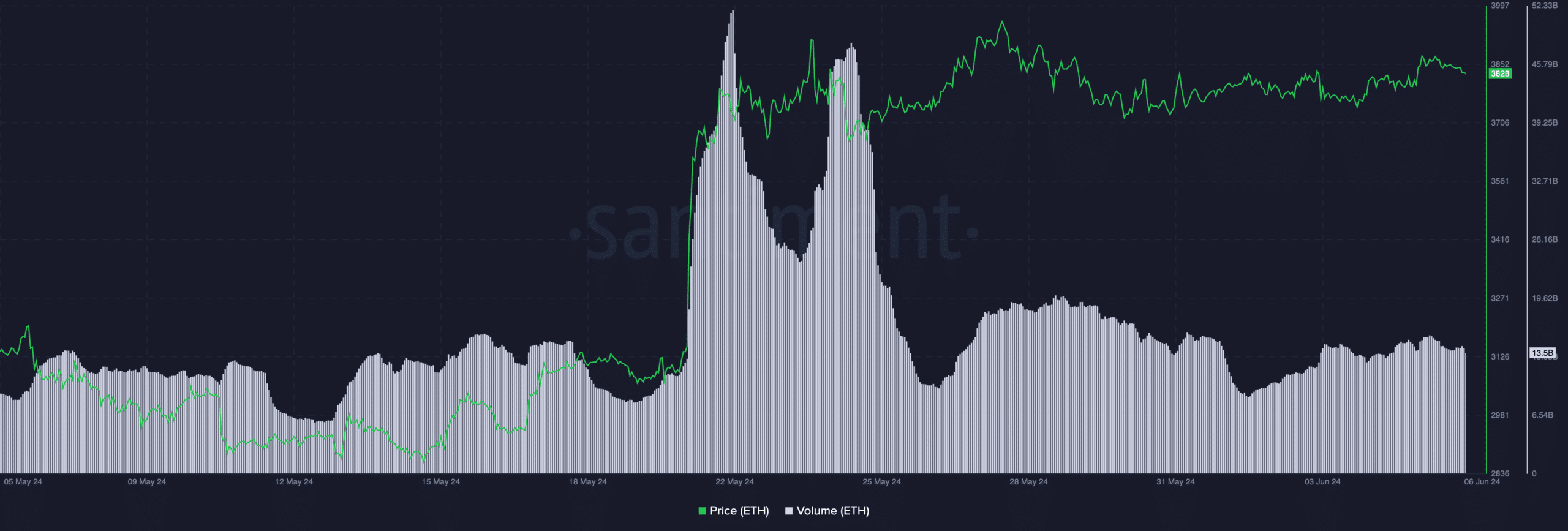

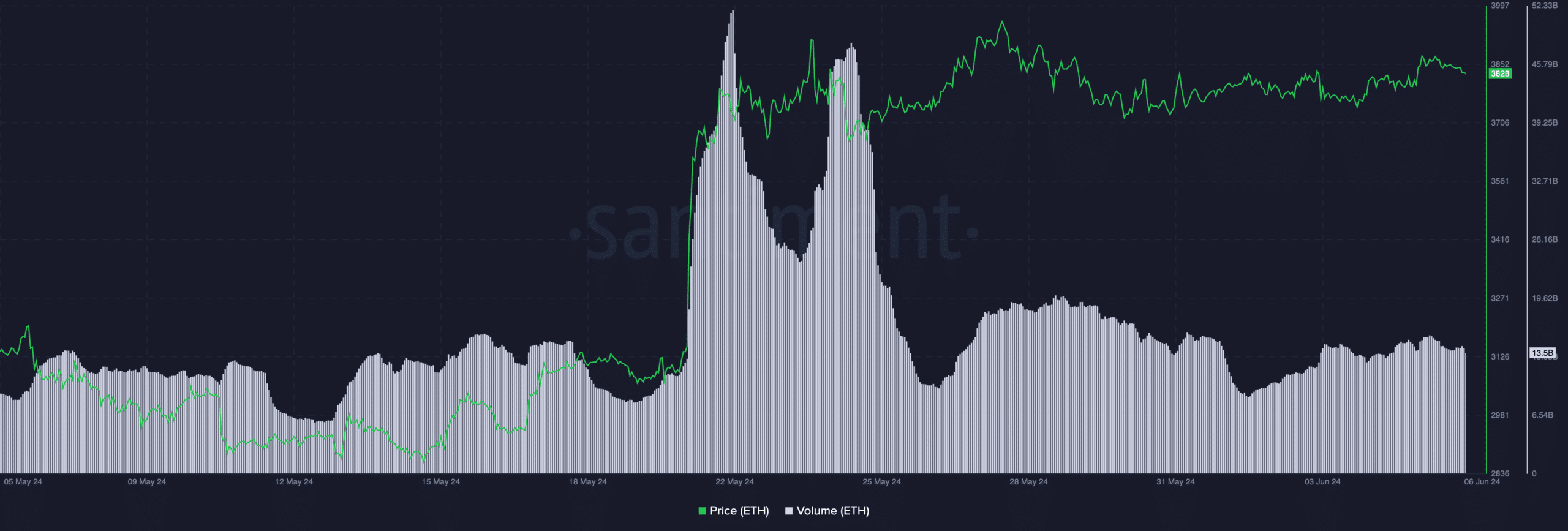

At press time, ETH was trading at $3,524.08 and its price had declined by 1.08% in the last 24 hours.

Despite the dip in price, the volume at which ETH was trading at had surged by 30%.

Source: Santiment