- Solana’s TPS remained stable as activity on the network increased.

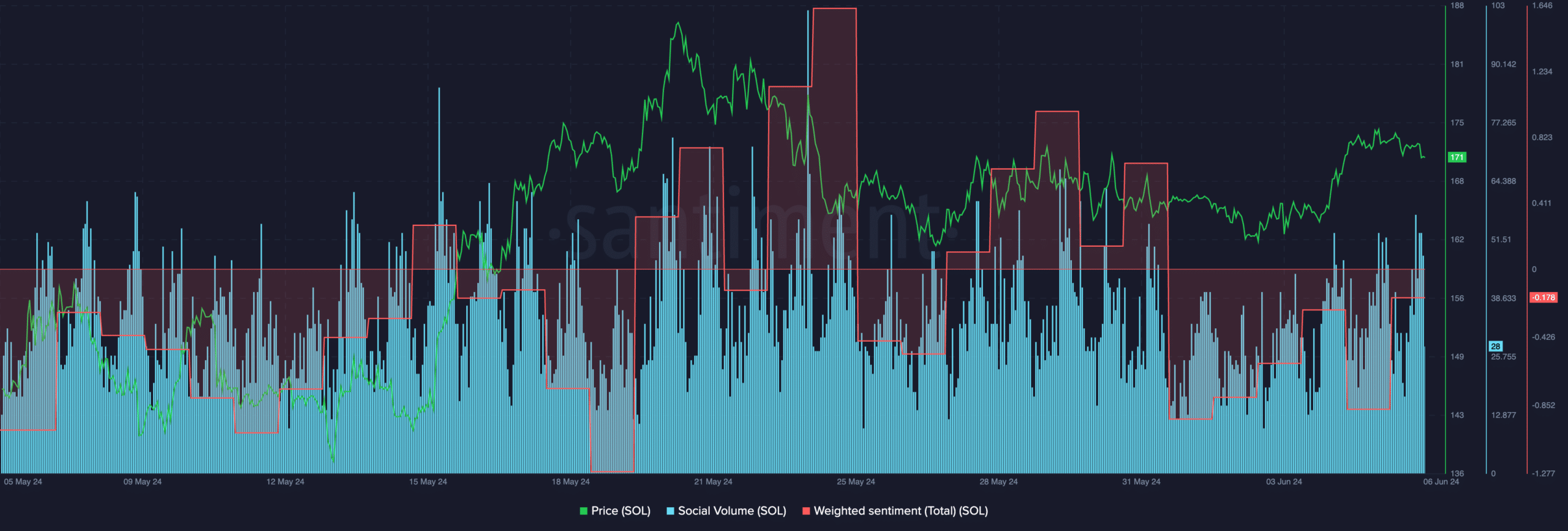

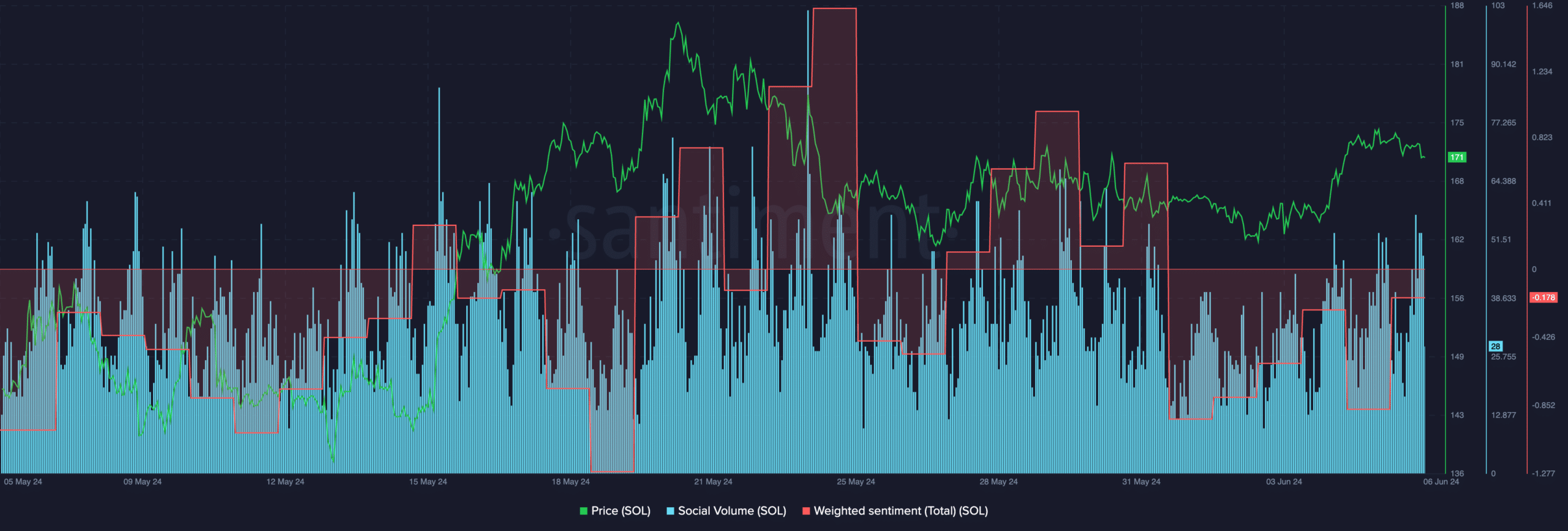

- Social volume around SOL grew, overall sentiment around the token declined.

Solana [SOL] was one of the networks that dominated the bull run which the market saw recently.

Solana sees a rise in transactions

However, one of the main criticisms of the Solana network has been the downtime that Solana faced over the last few years.

A recent upgrade to the Solana network, version 1.18, has yielded significant performance improvements.

While some known limitations within the transaction processing pipeline persist, current benchmarks indicate Solana is nearing a processing throughput of 2,000 transactions per second (tps) in real-world conditions.

Projecting future performance based on current advancements, helius CEO mert held an optimistic view. He stated that Solana has the potential to surpass 10,000 tps by the start of the new year.

Source: X

Looking at price movement

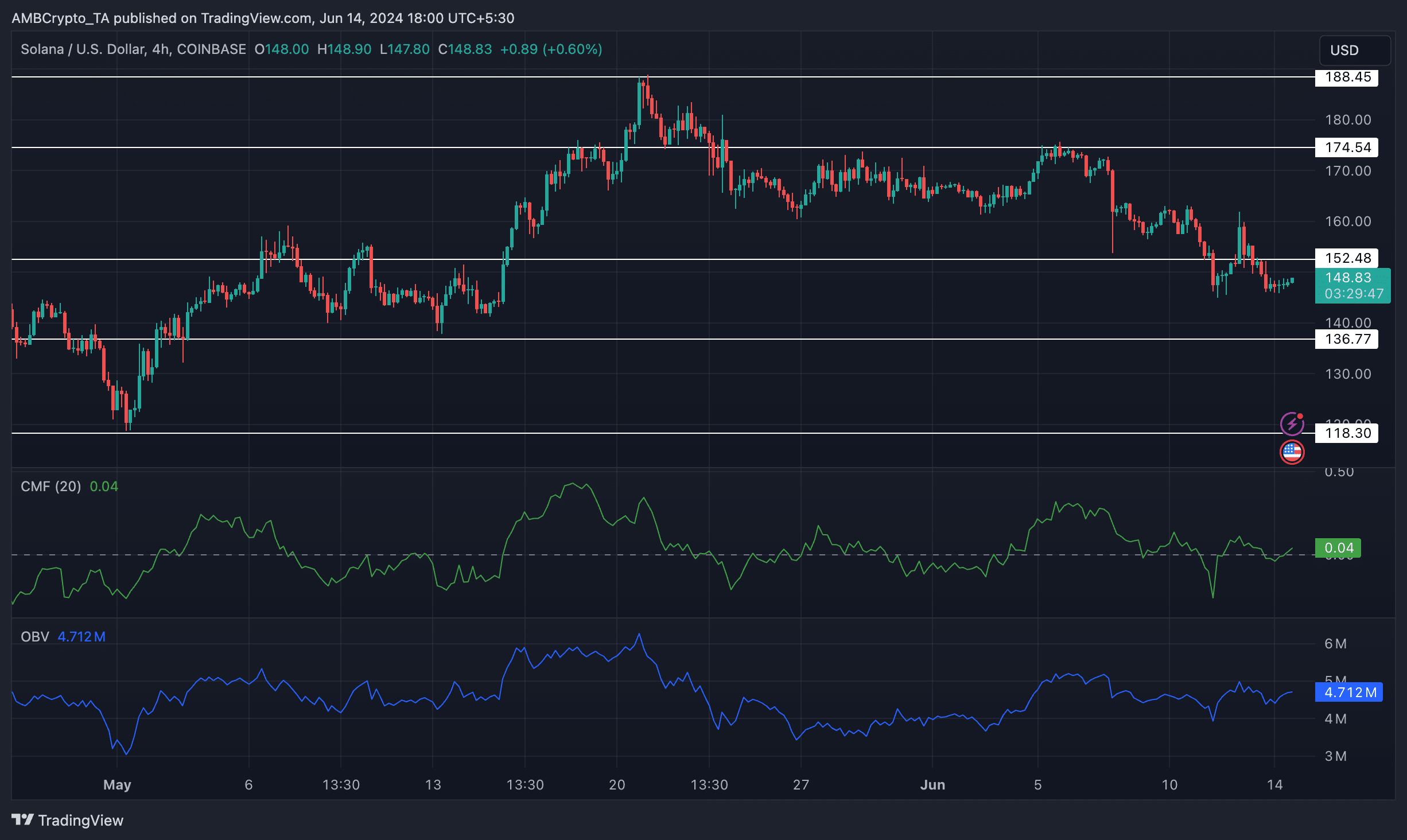

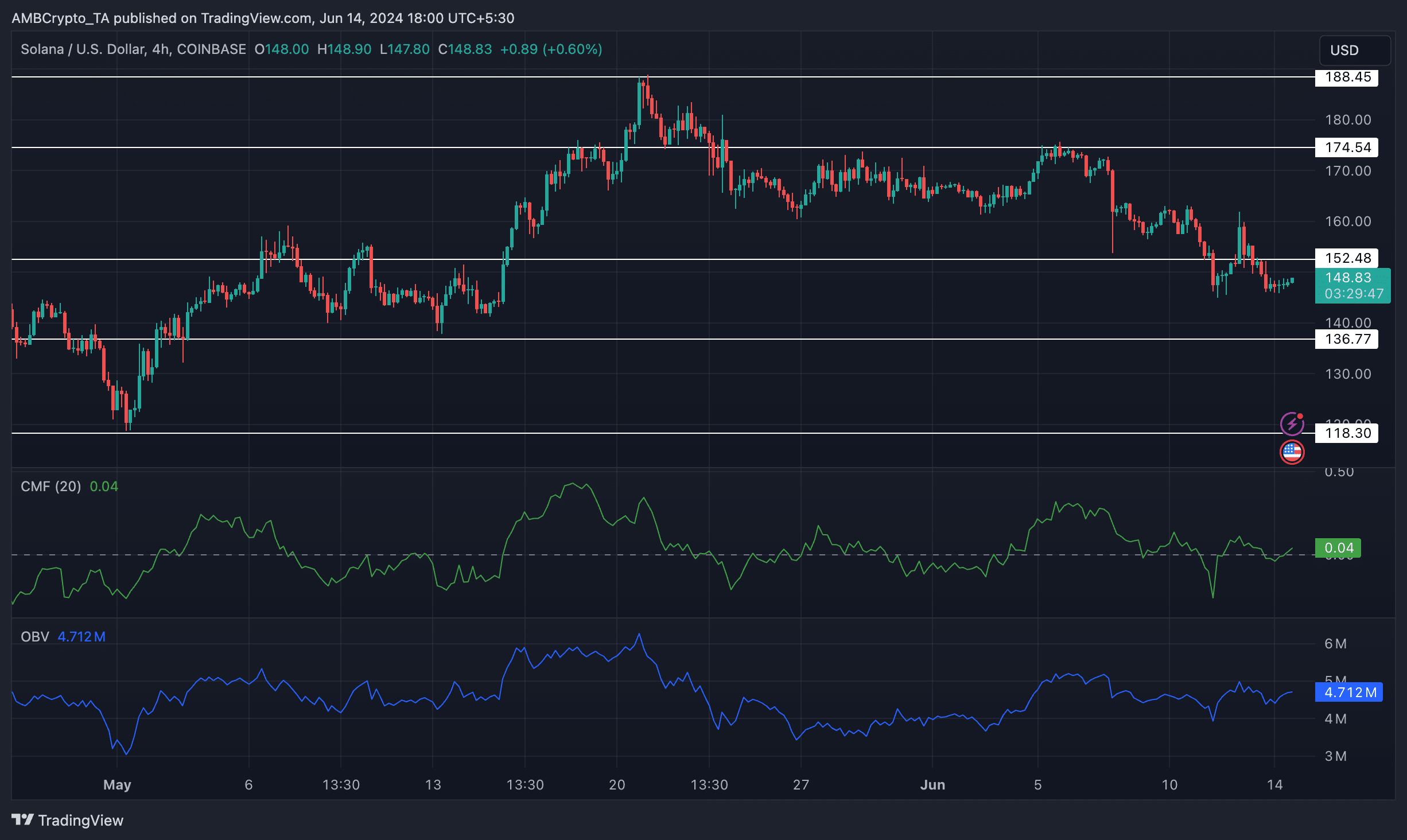

Despite the progress made by the network, SOL’s price continued to see red. At press time, SOL was trading at $148.77 and its price declined by 1.87% in the last 24 hours.

Since the 20th of May, the price of SOL has fallen significantly. During this decline, the price of SOL exhibited lower lows and lower highs, indicative of a bearish trend.

Even though the overall trend of SOL had turned bearish, the CMF (Chaikin Money Flow) for SOL remained positive. This meant that there was money flowing into SOL at the time of writing.

Moreover, the OBV (On Balance Volume) for SOL also surged which was another positive indicator for the token. If things continue to move in a positive direction, a reversal could be expected and SOL could attain the $174.54 levels yet again.

Source: Trading View

Volumes for SOL surged

The popularity of the SOL token was also on the rise. AMBCrypto’s analysis of Santiment’s data revealed that the social volume for SOL remained consistent over the last few days.

The rising popularity of SOL can help improve the price movement of SOL in the long run. However, the sentiment around SOL can also affect the token.

Data showed that the weighted sentiment around the SOL token fell materially. This meant that the number of negative comments around SOL had grown and outnumbered the positive ones.

Is your portfolio green? Check out the SOL Profit Calculator

The prevalence of these negative comments may hinder the chances of growth for SOL in the future.

Source: Santiment