- Chainlink showed signs of a bullish reversal despite being below key moving averages.

- The formation of an inverse head-and-shoulders pattern indicated rising trader interest.

After two weeks of dormant performance from Chainlink [LINK], the altcoin is seemingly starting to form a bullish reversal pattern, which is indicative of a potential rally.

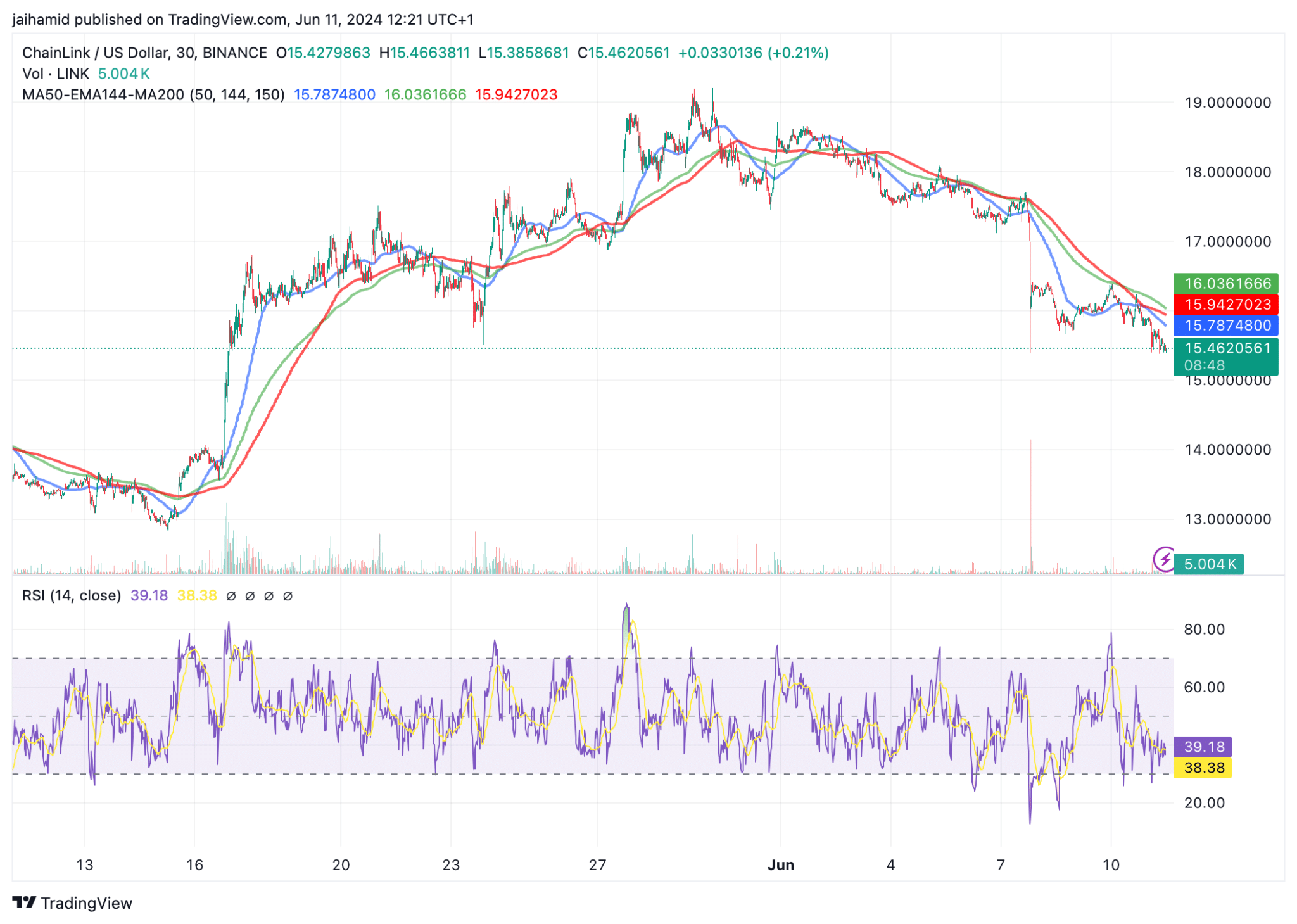

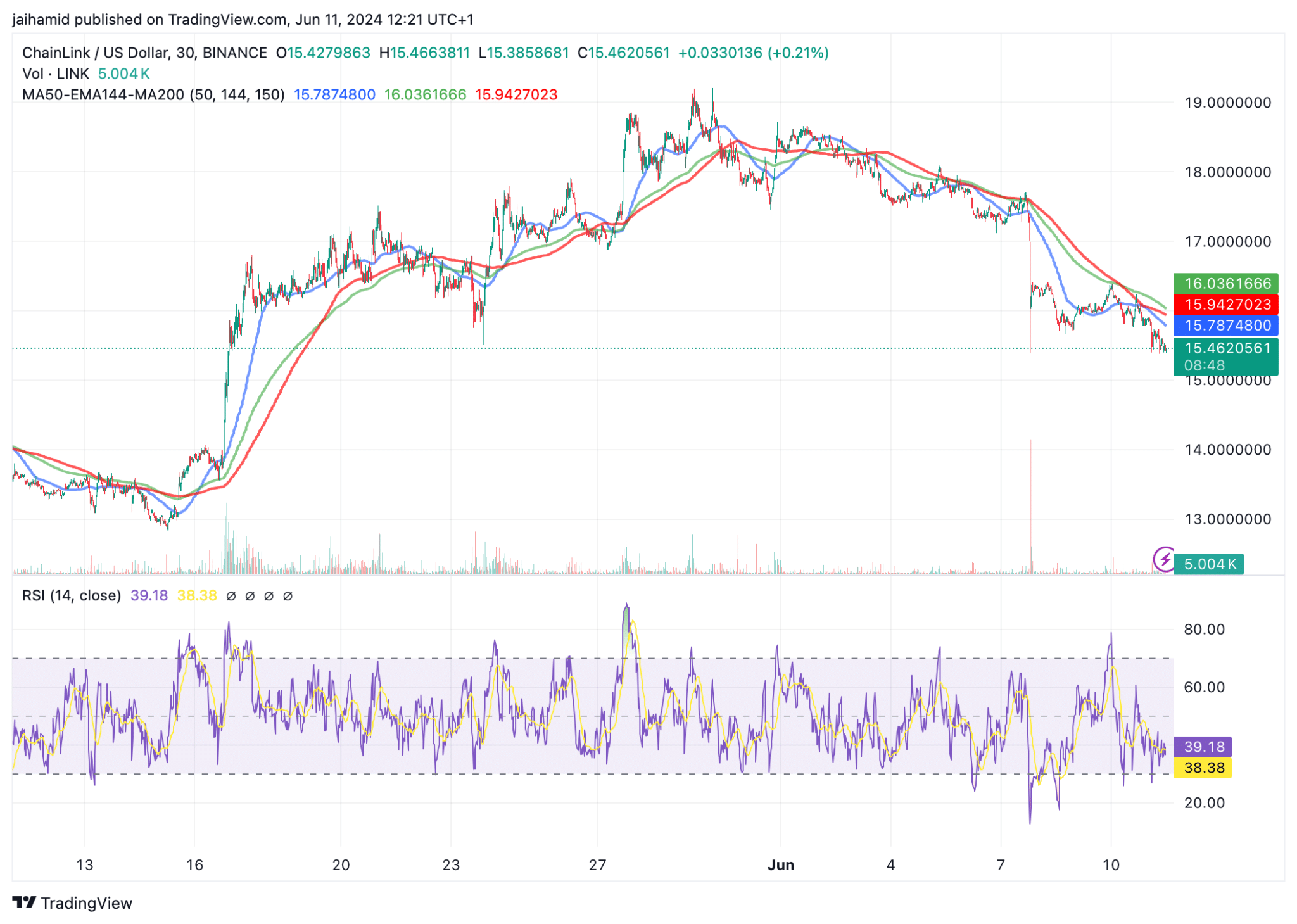

LINK’s price was below all three key moving averages at press time – the 50-day MA (blue line), the 144-day EMA (green line), and the 200-day MA (red line). This typically indicates a bearish trend.

Source: TradingView

The RSI is around 39.54, which is below the neutral 50 mark but above the oversold territory.

Given the recurrence of the inverse head-and-shoulders patterns and their positions relative to the moving averages, LINK appears to be attempting a recovery from its previous downtrends.

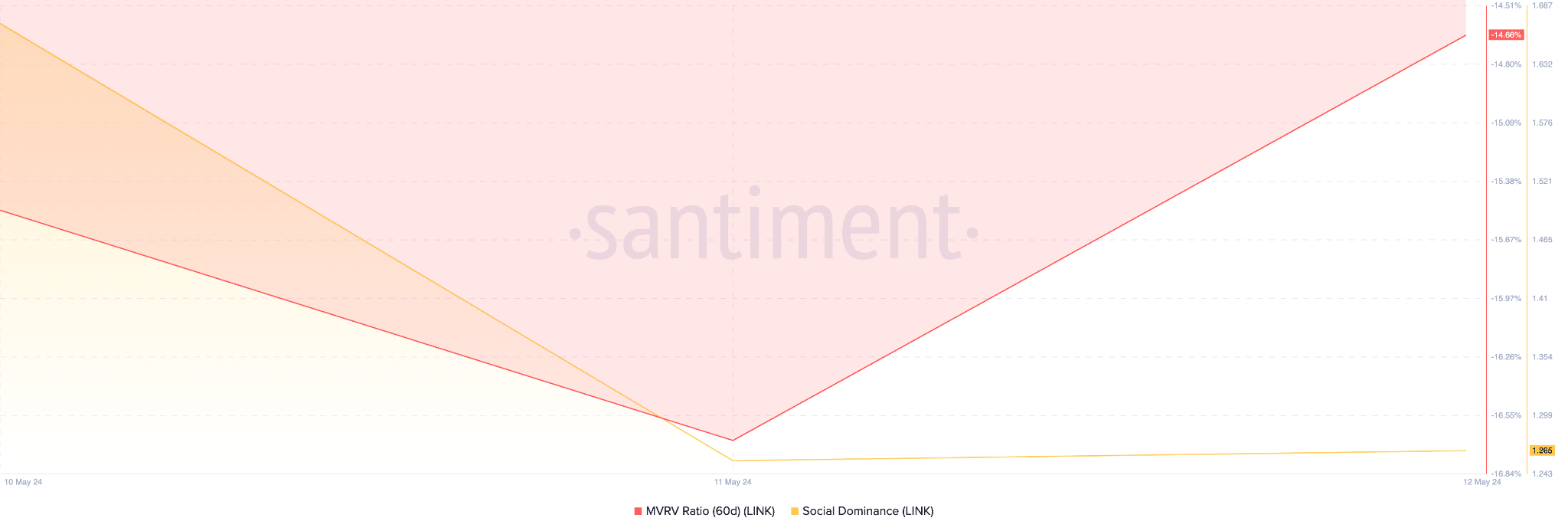

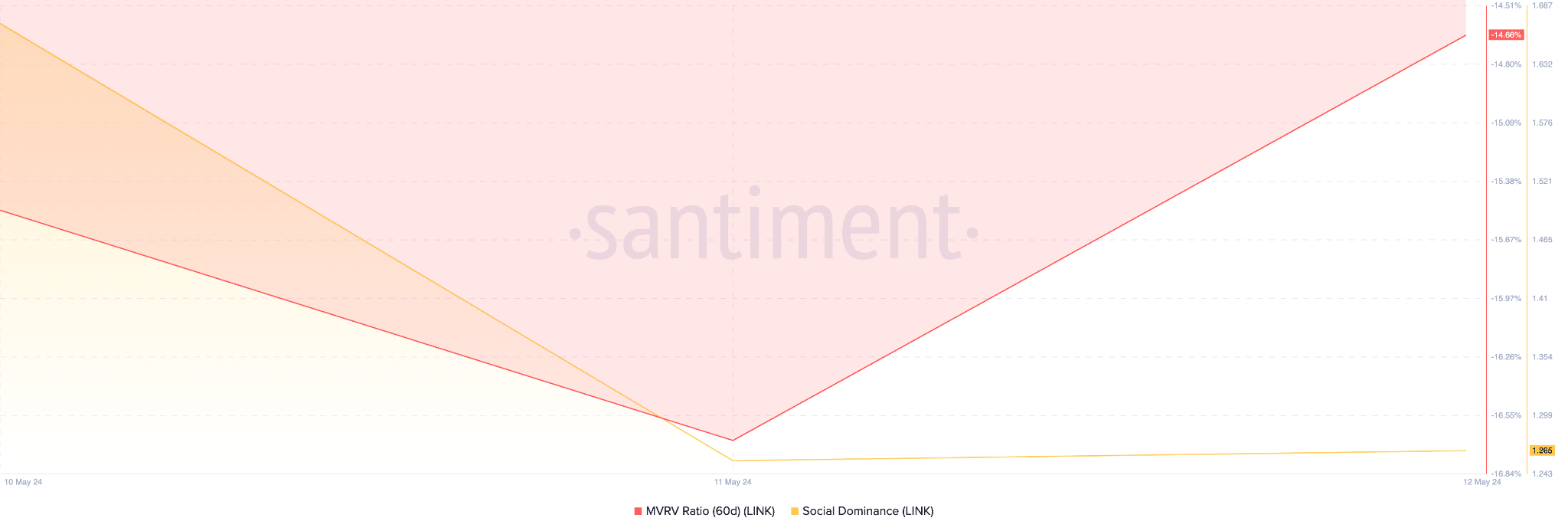

The descending trend in the MVRV ratio, currently nearing -16.84%, suggests that most holders who bought or moved LINK during the past two months are at a loss.

Source: Santiment

Typically, a lower MVRV ratio can indicate that a token is undervalued, which might suggest a potential buying opportunity if investors believe the price will rise soon.

And LINK might not be dominating social media conversations, but it maintains a consistent presence.

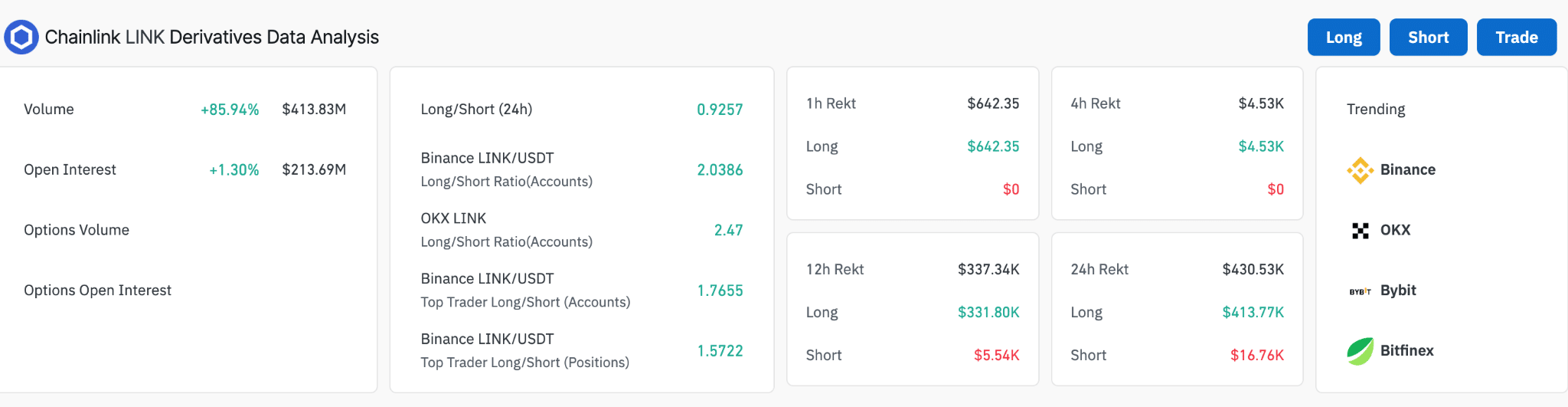

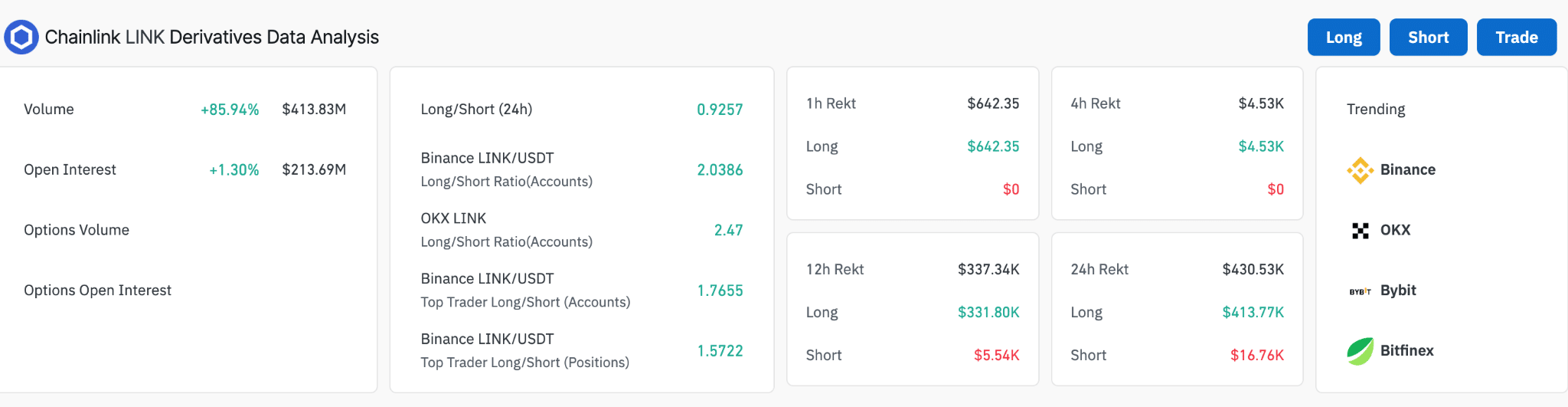

LINK’s derivatives trading volume has surged by 85.94%, suggesting a high level of activity and trader interest in anticipation of the bullish reversal.

As indicated by the Long/Short ratio of 0.9257, the overall market sentiment suggests a nearly balanced view among traders, though slightly leaning towards bullishness.

Source: Coinglass

Read Chainlink’s [LINK] Price Prediction 2024-25

Given the current setup and recent market behavior, Chainlink does appear to be on the cusp of a bullish reversal.

If the bullish sentiment as indicated by high long positions on platforms like Binance [BNB] and OKX holds, we may see a continued or strengthened recovery in Chainlink’s price.