- Polygon has beaten Ethereum in terms of gas usage and overall activity.

- The price of MATIC fell considerably over the last few days.

Polygon [MATIC] witnessed a massive uptick in activity over the last few months and has slowly and steadily garnered attention from multiple users.

Polygon races to the top

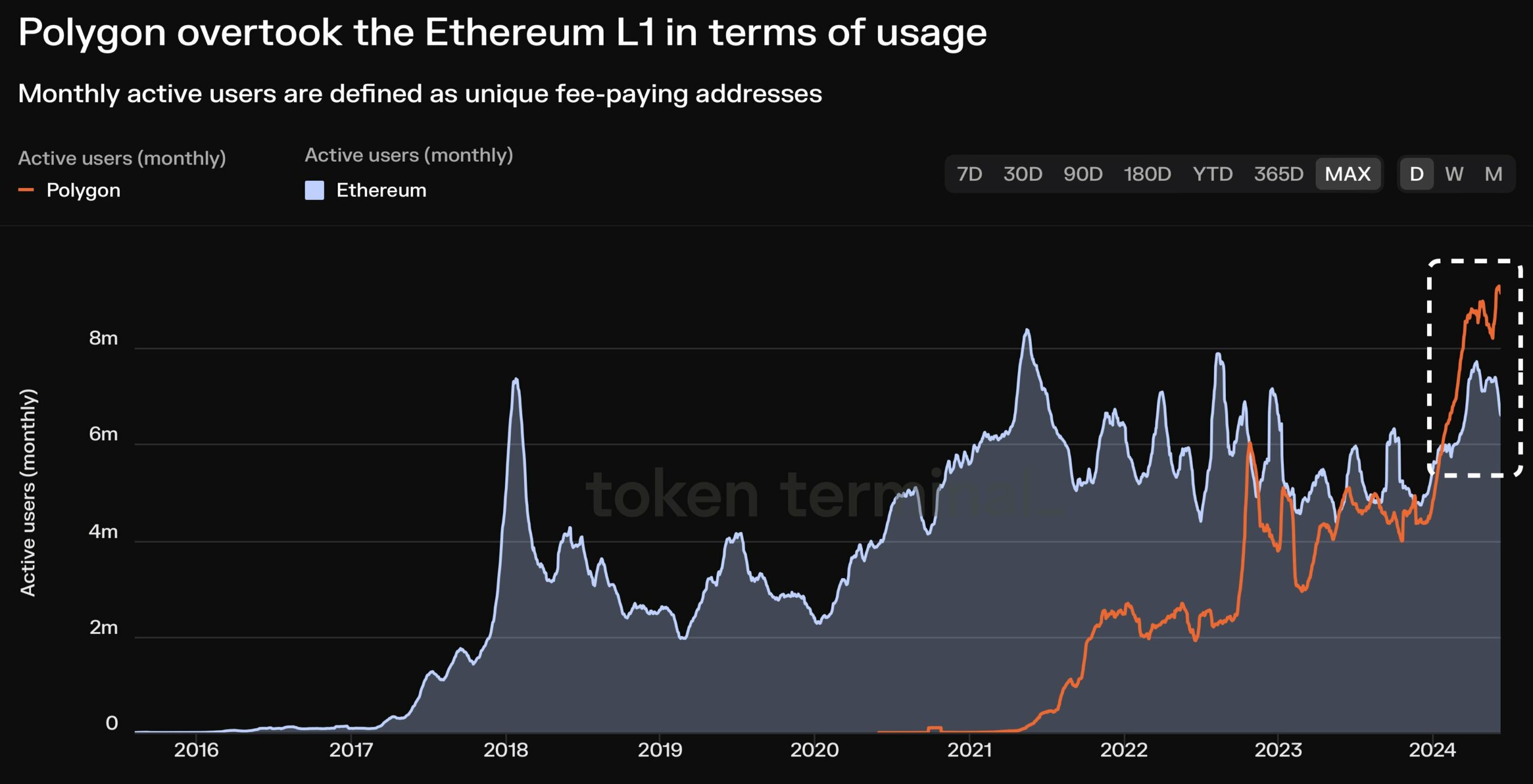

Due to the growing popularity of Polygon, it outperformed Ethereum in terms of gas usage. Moreover, Polygon had outdone Ethereum in terms of monthly active users.

Source: token terminal

If users are flocking to Polygon for its lower fees and faster transactions, it could slow down Ethereum’s adoption rate.

However, it’s important to remember that Polygon isn’t a direct competitor, but rather a Layer-2 scaling solution built on top of Ethereum. In the long run, a thriving Polygon ecosystem could actually benefit Ethereum.

What about MATIC?

Even though the Polygon network made significant progress, MATIC wasn’t able to see green.

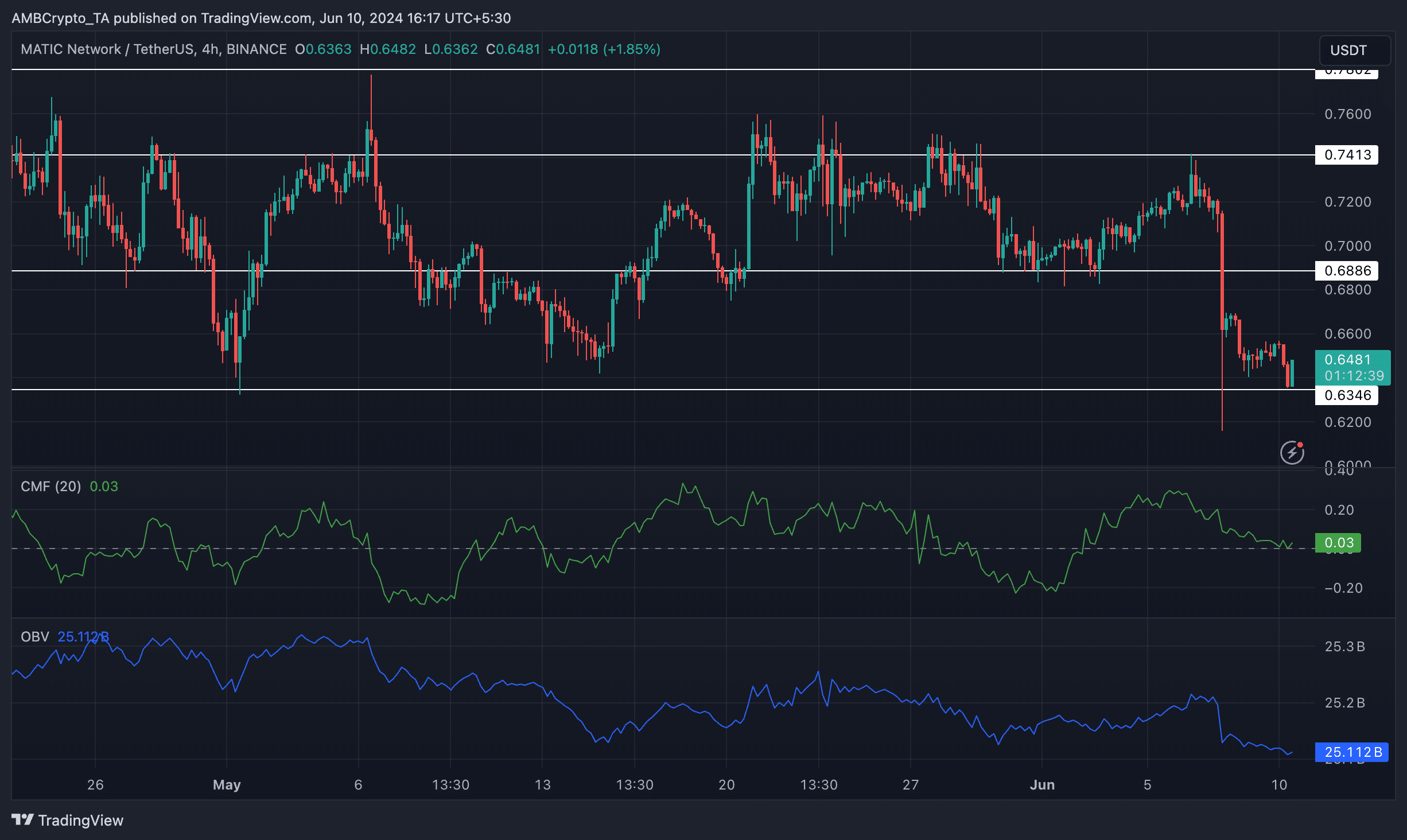

Even though the price of MATIC moved sideways for the most part, there was a steep decline observed when the price hit the $0.7413 level on the 6th of June.

The OBV (On Balance Volume) for MATIC declined materially during this period. A declining OBV during this period suggested that selling pressure outweighed buying pressure for MATIC.

A positive CMF, even at a low value like 0.03, indicates that there might still be some money flowing into MATIC despite the OBV decline.

A positive CMF with a lower trading volume could suggest larger investors or whales accumulating MATIC despite the short-term price dip.

Source: Trading View

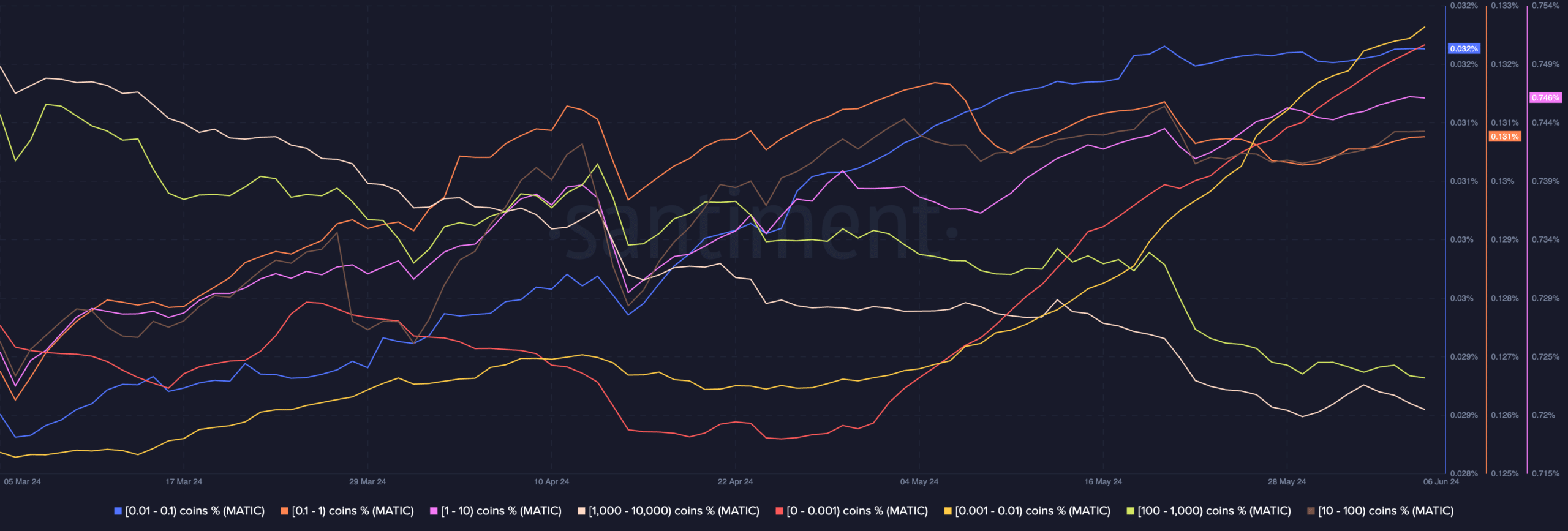

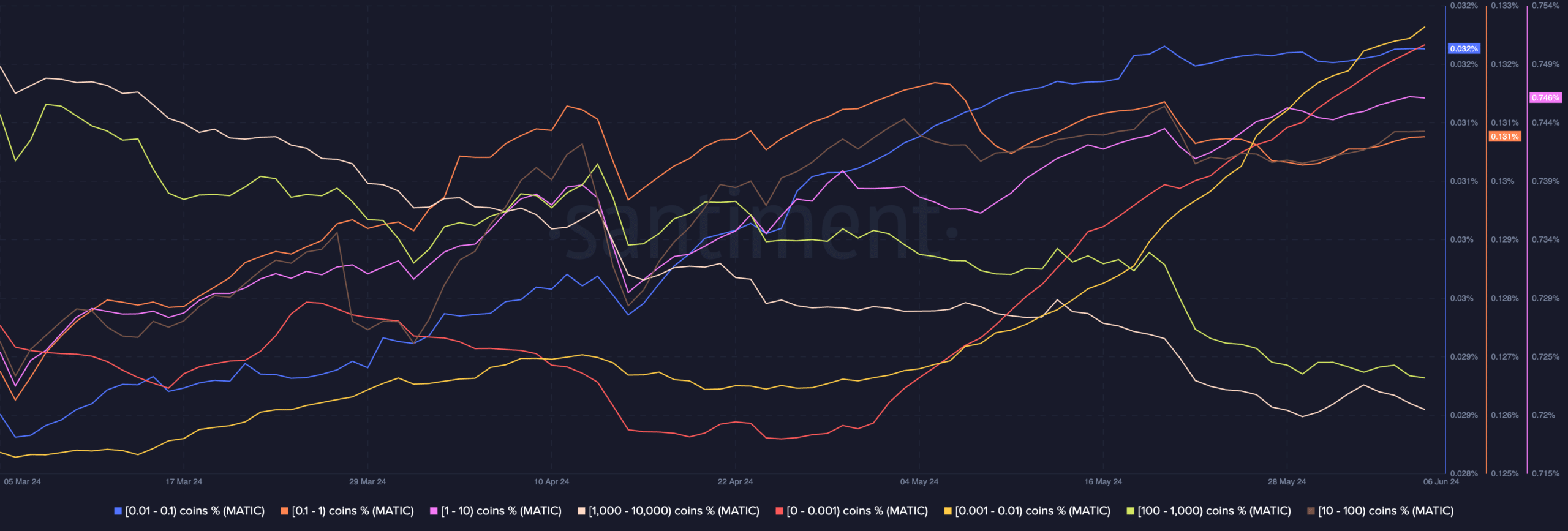

Apart from whale interest, there was retail interest in MATIC observed as well.

AMBCrypto’s analysis of Santiment’s data indicated that the addresses holding anywhere between 0 and 100 coins had increased their rate of accumulation.

The rise in the accumulation of MATIC suggests that many traders are looking at the recent price dip of MATIC as an opportunity to buy the token at a discount.

Source: Santiment

Realistic or not, here’s MATIC’s market cap in ETH’s terms

Despite MATIC struggling to see growth in terms of price, Polygon managed to do really well in the DeFi sector.

Notably, Polygon’s Proof-of-Stake (PoS), zero-knowledge Ethereum [ETH] Virtual Machine (zkEVM), and Coconut Development Kit (CDK) have become the go-to options for DeFi developers.