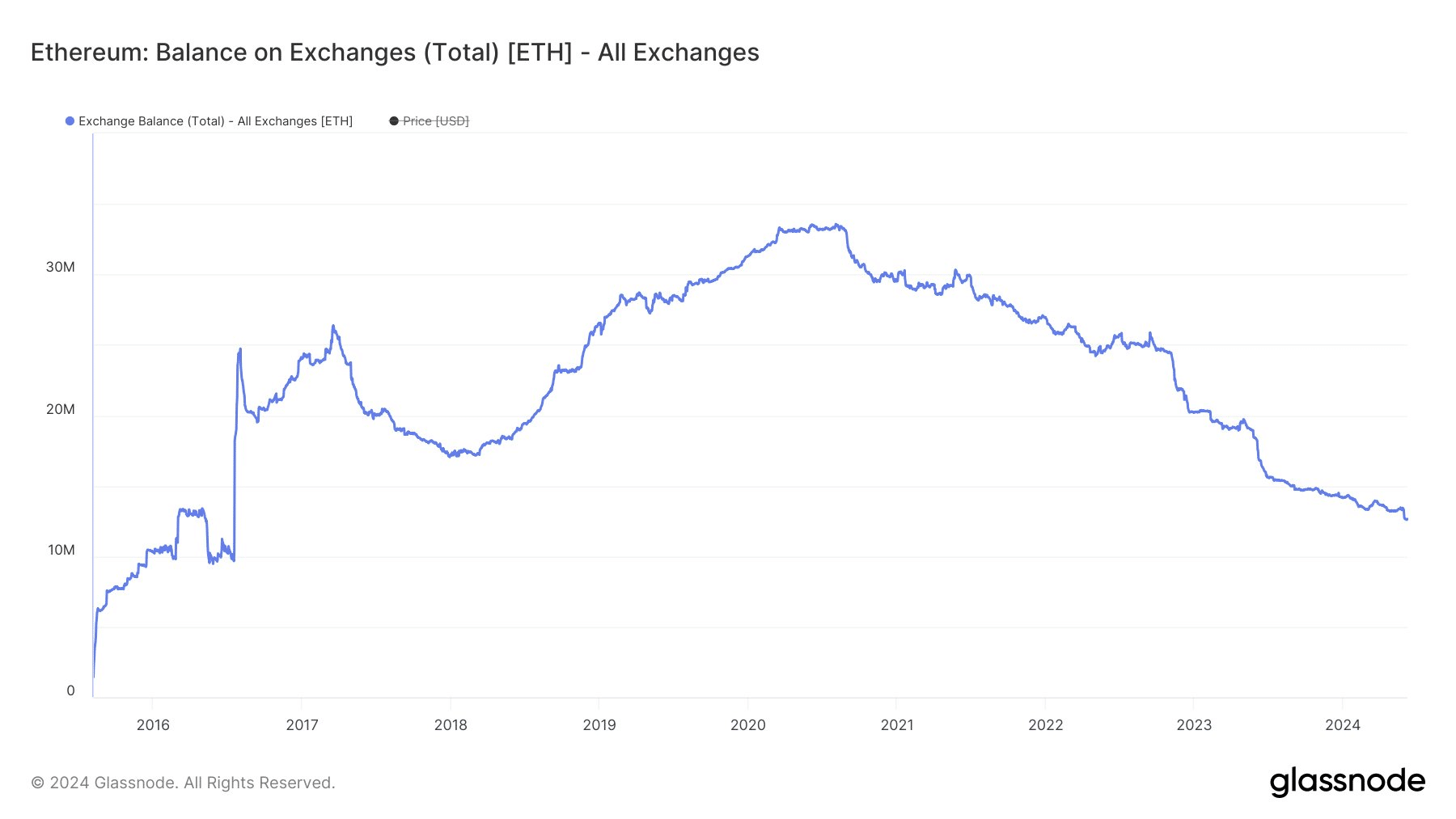

- Ethereum reserves on exchanges are at an eight-year low, setting the stage for a price surge.

- Current bearish indicators suggest there might be room for further decline before a rebound.

The amount of Ethereum [ETH] held on exchanges has reached its lowest point in eight years. With the imminent launch of its spot ETFs, we could see a huge supply shock, and it might lead to a dramatic increase in Ethereum’s price.

But let’s check out what the data is telling us.

Source: Glassnode

Ethereum ETFs to cause a stir?

If the spot ETFs garner the huge interest everyone expects, the initial rush to buy Ether could drive prices up rapidly, followed by possible corrections as the market adjusts to the new demand and supply dynamics.

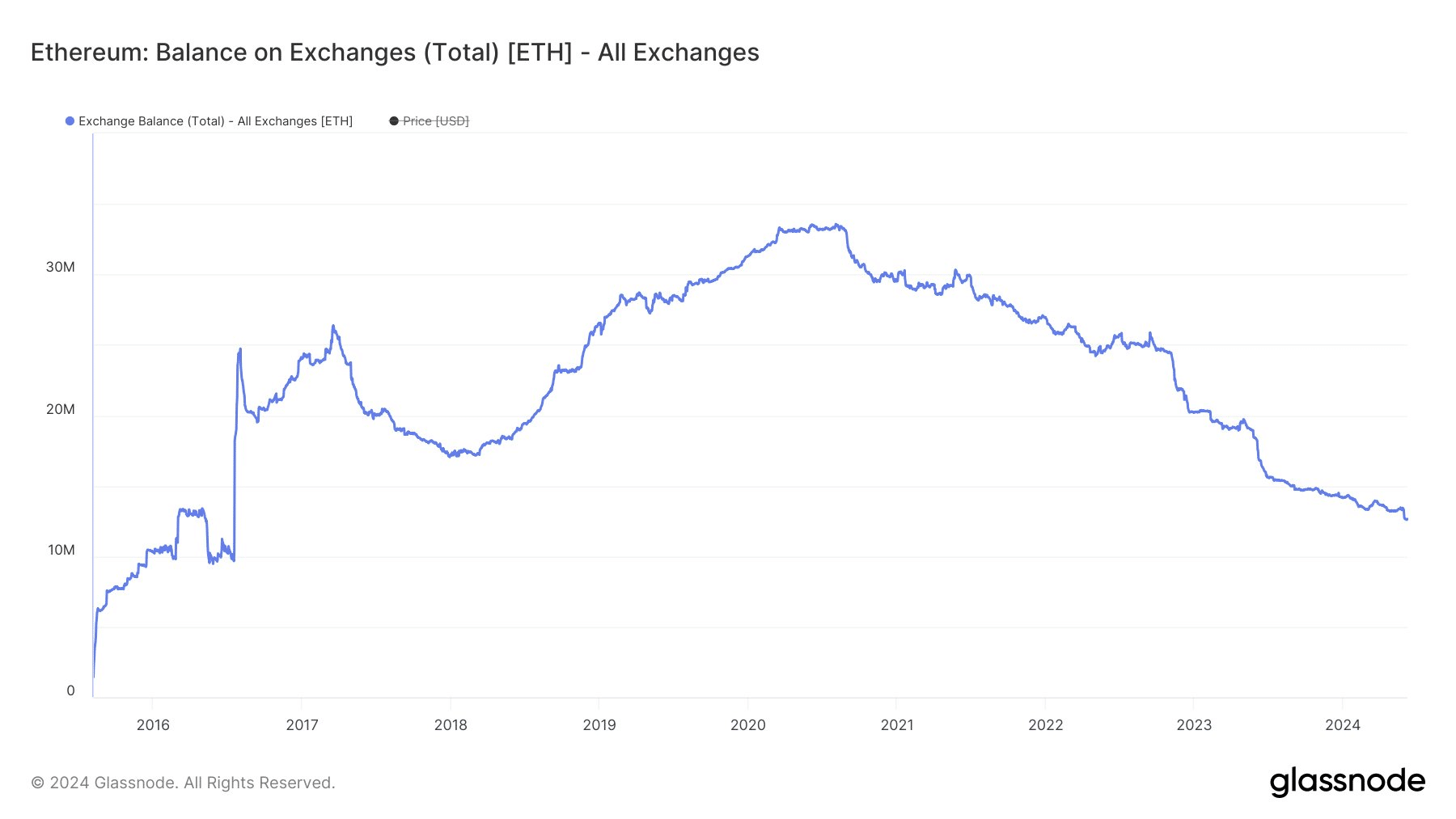

Ethereum’s price is below both the 50-period and the 200-period moving averages, trending downward. This alignment generally indicates a bearish sentiment.

Source: TradingView

The RSI is around 43, which is below the neutral 50 mark but not yet in oversold territory (below 30).

This means the price could decline a little more before reaching oversold conditions, which often come right before a price rebound.

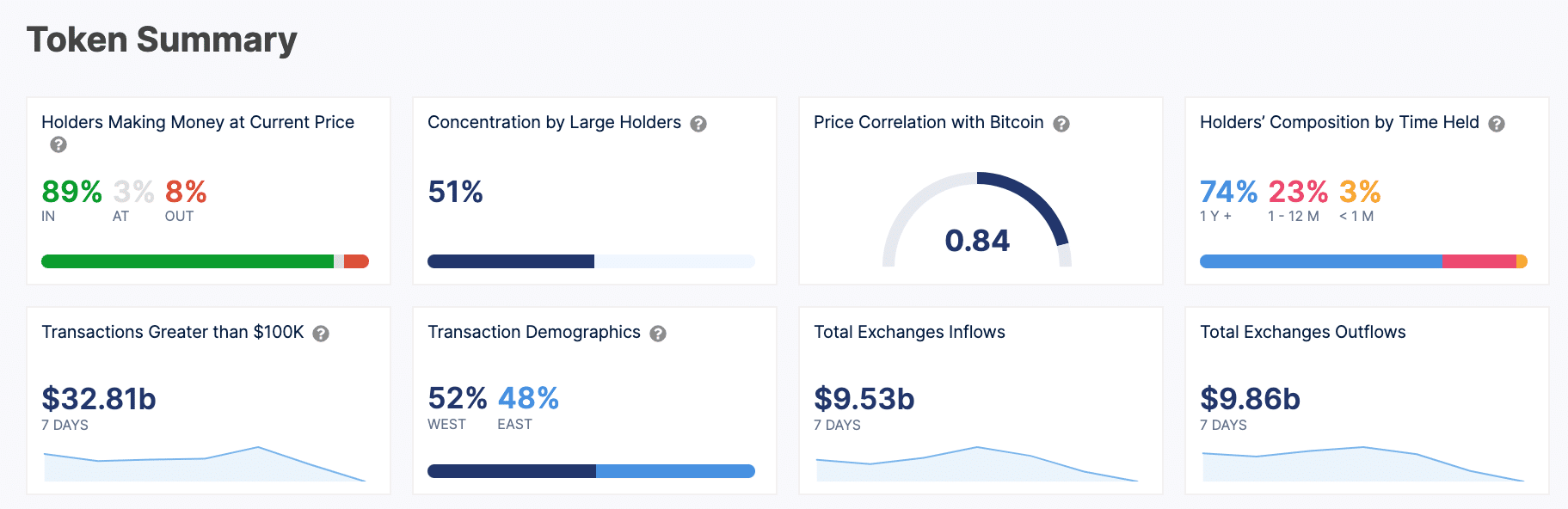

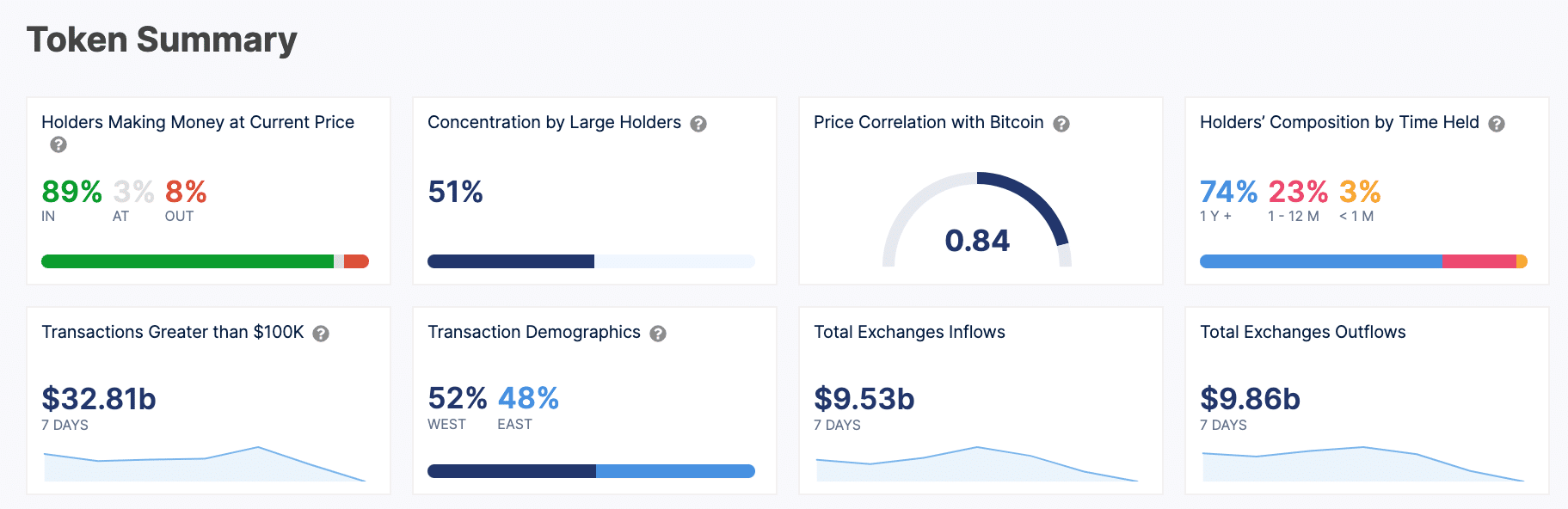

A significant 89% of Ethereum holders are in profit at the current price, which is a strong indicator of a healthy market.

With 51% of Ethereum held by whales, there’s a huge concentration of Ethereum in the hands of a relatively small number of wallets.

Source: IntoTheBlock

There has been a large volume of transactions exceeding $100K, totaling $32.81 billion over the last seven days, highlighting massive institutional or large-scale investor activity. In other words, investors of all kinds are currently bullish on Ether.

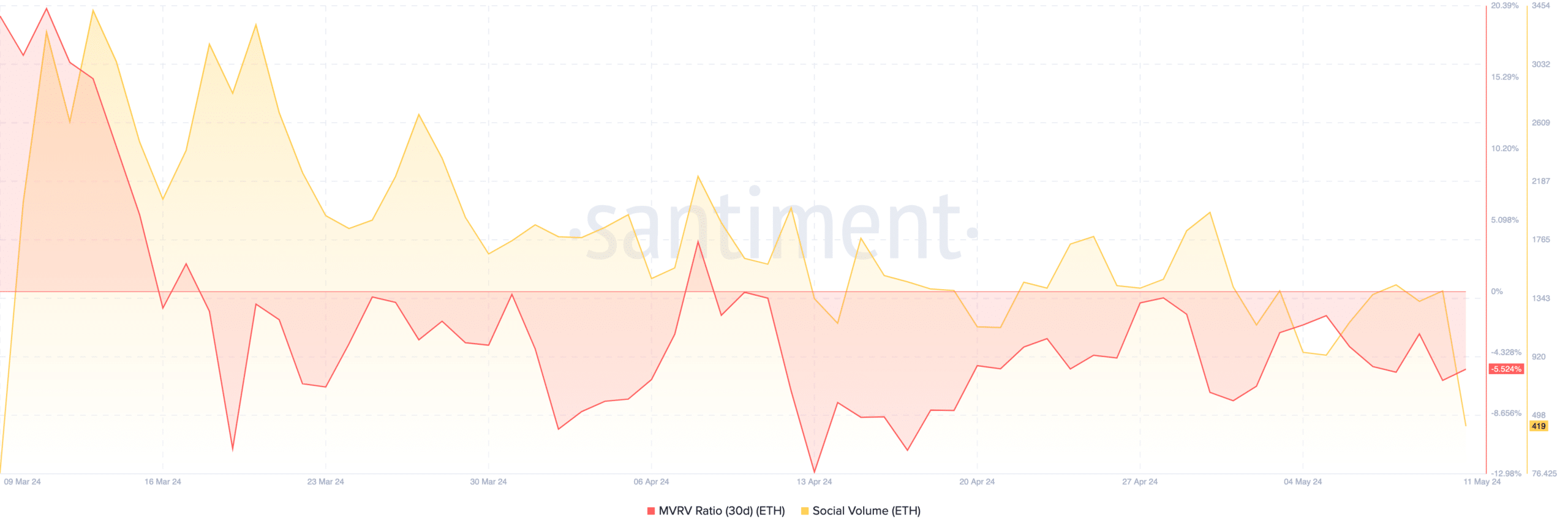

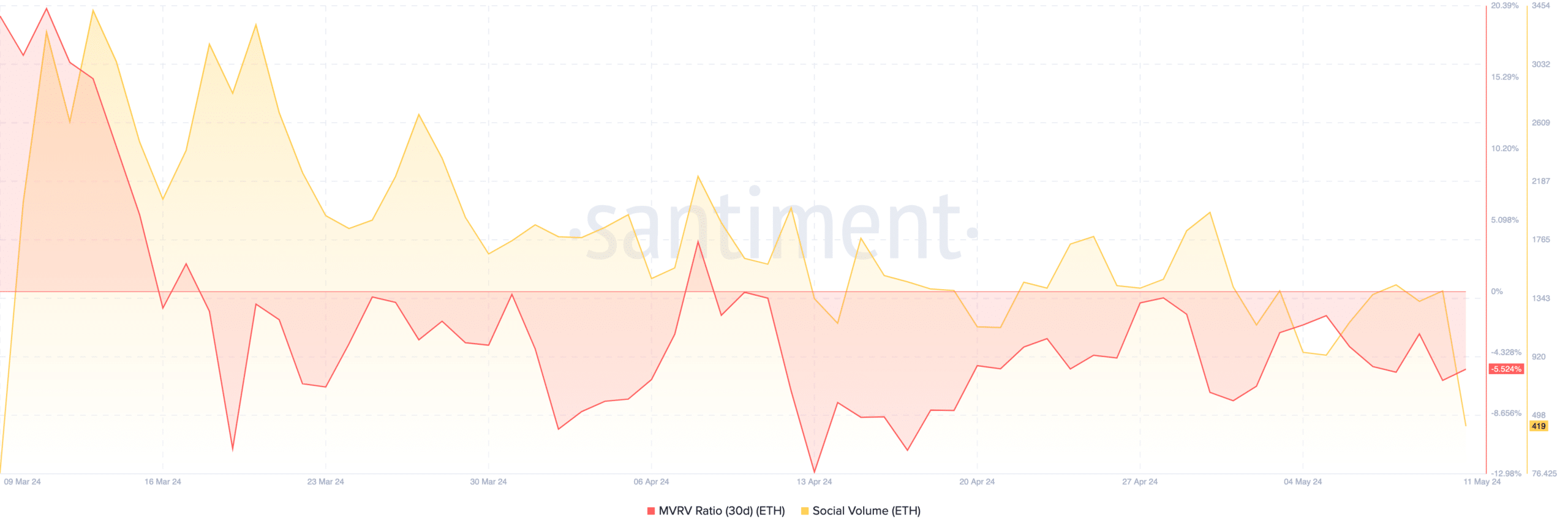

Recent downward trends in the MVRV ratio might suggest that Ethereum is entering a zone where it is less overvalued, aligning with a potentially more sustainable price level or even undervaluation.

This cooling-off could be a healthy market correction, providing a more stable foundation for the bull run.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

As it stands, if Ethereum can sustain above the recent support at $3,670, it might attempt to break the $3,733 resistance.

A successful breach above this could push the price towards the next psychological barrier at $3,800.