- KARRAT extended its early week rally and tucked +30% on 4th June after a major partnership.

- However, the gains could be at risk if BTC reverses recent gains.

KARRAT crypto rallied +40% in the past 24 hours before press time on 5th June.

The gaming and AI token saw a massive upswing following the announcement of a partnership between AMGI Studios and AI and Data powerhouse– Palantir Technologies.

‘First NVIDIA, now AMGI x Palantir. Founded by Peter Thiel, co-founder of Paypal, Palantir is an AI & Big Data powerhouse. AMGI Studios is employing the Foundry architecture in products and applications. AI, Gaming & Entertainment $KARRAT’

AMGI Studio will unveil a social-action game called ‘My Pet Hooligan,’ and the KARRAT token will be part of the ecosystem for in-game purchases, payments, and rewards, among other things.

KARRAT crypto pullback – Key levels to watch

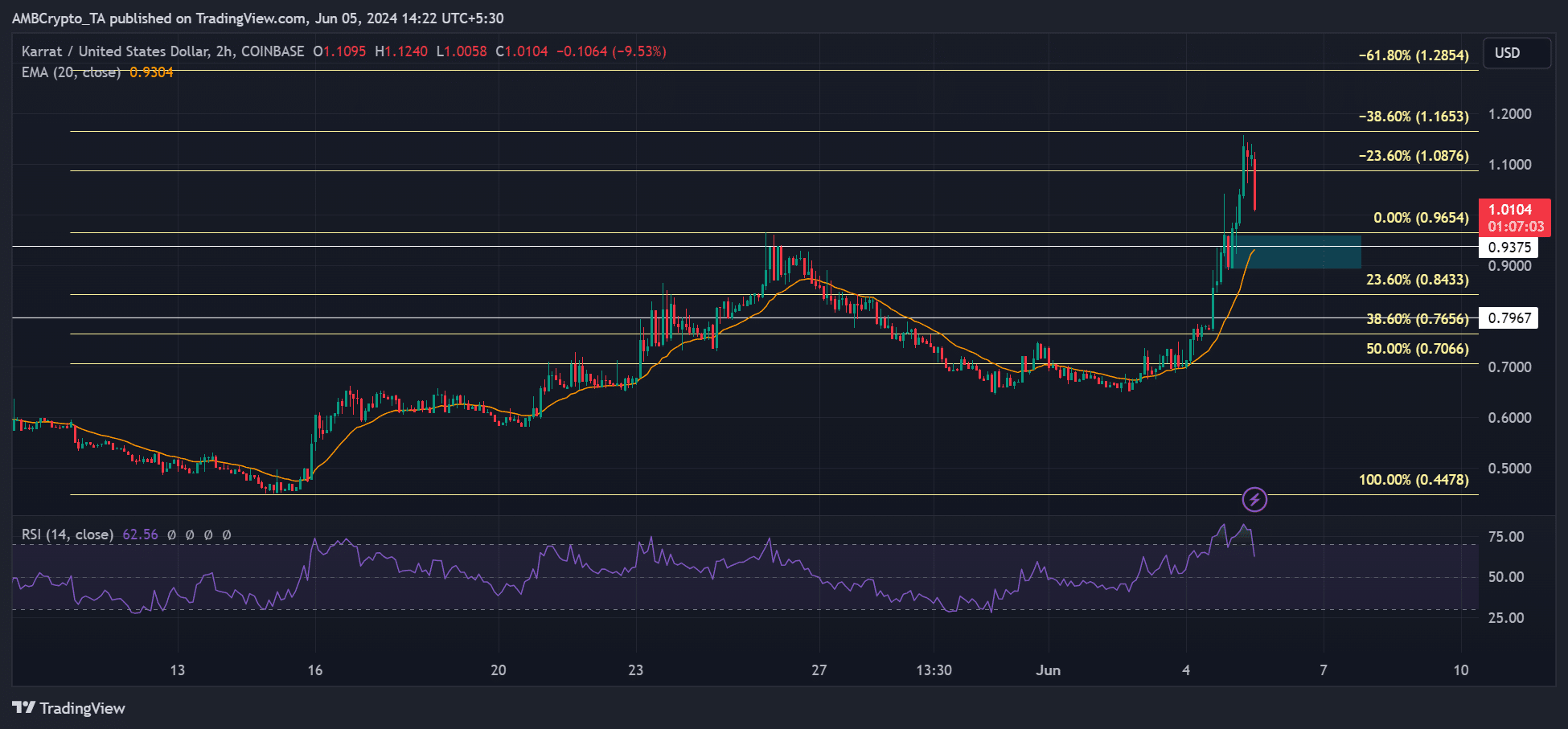

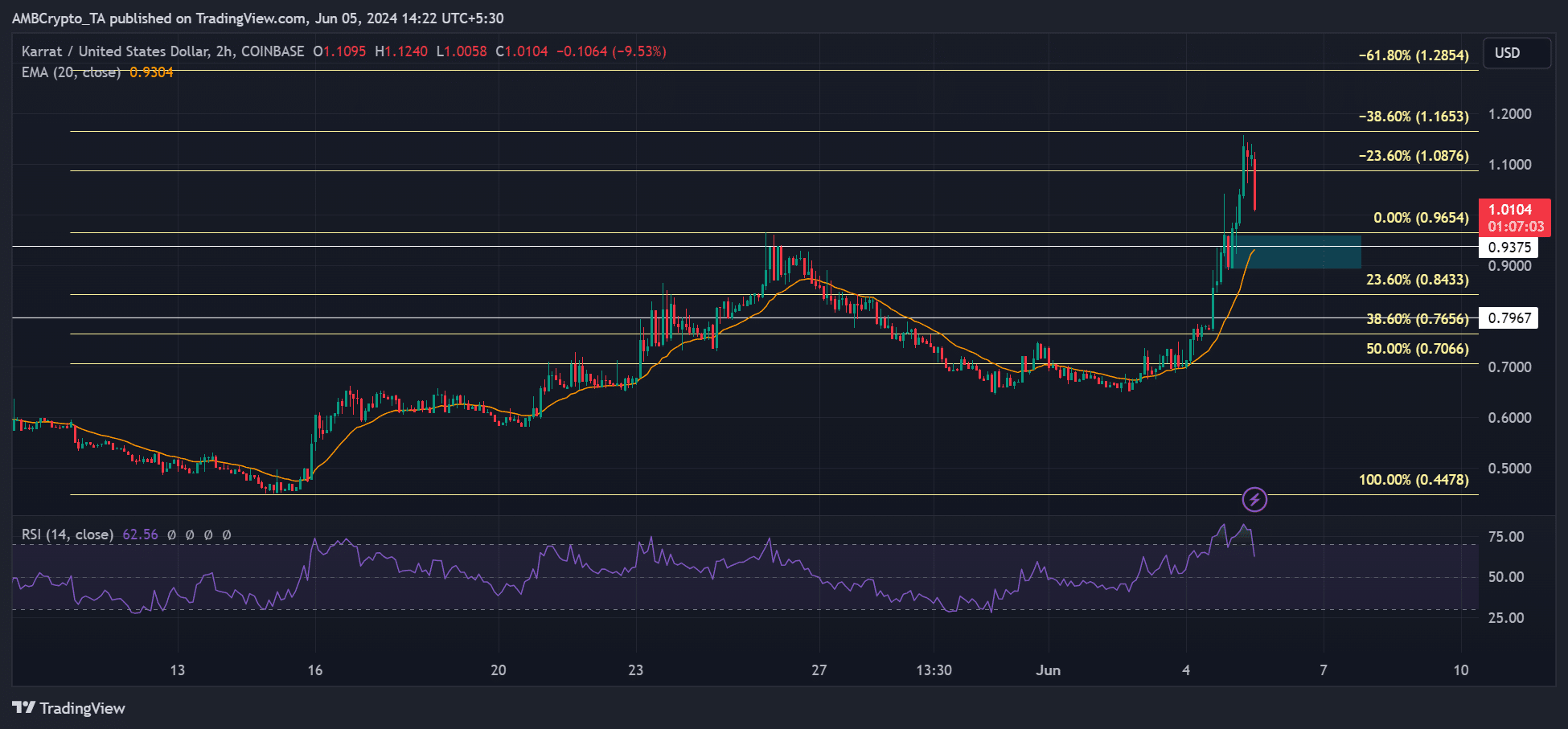

Source: KARRAT/USDT, TradingView

It’s worth noting that KARRAT’s rally started way earlier, on 2nd June, after it secured the golden pocket at the 50% Fib level. On 4th June, the AI and gaming narrative token exploded +30%, after the partnership with Palantir.

However, at press time, the rally had cooled off a bit and could hit the confluence area around $0.93, marked cyan.

The price level was a bullish order block, a previous resistance-cum-support, and had a 20-EMA (Exponential Moving Average). A strong demand at the above zone could see KARRAT rebound and target $1.16 or $1.2.

However, further Bitcoin [BTC] losses could drag it down below $0.93, with $084 being the immediate bearish target in such a scenario.

But some market watchers were more optimistic about upside potential, stating that the token could hit a price discovery territory soon.

“$KARRAT partnered with Nvidia & Palantir for developmental growth of AI. Listed immediately on Coinbase & sold off. Chart looks absolutely primed for price discovery soon’

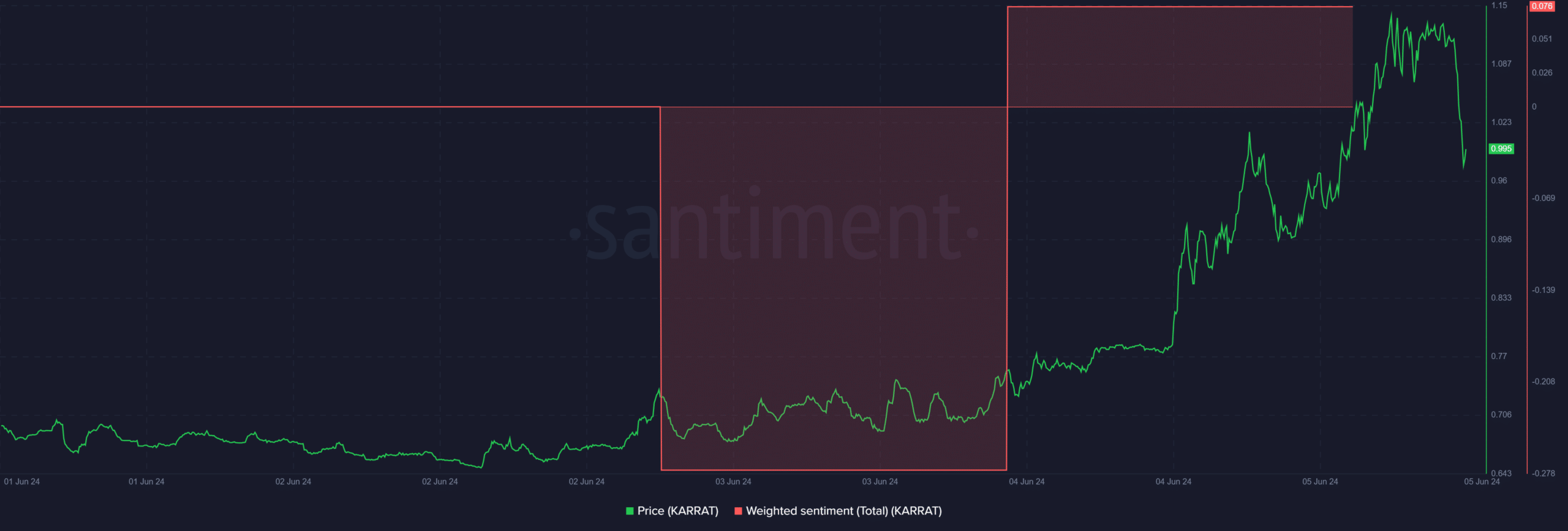

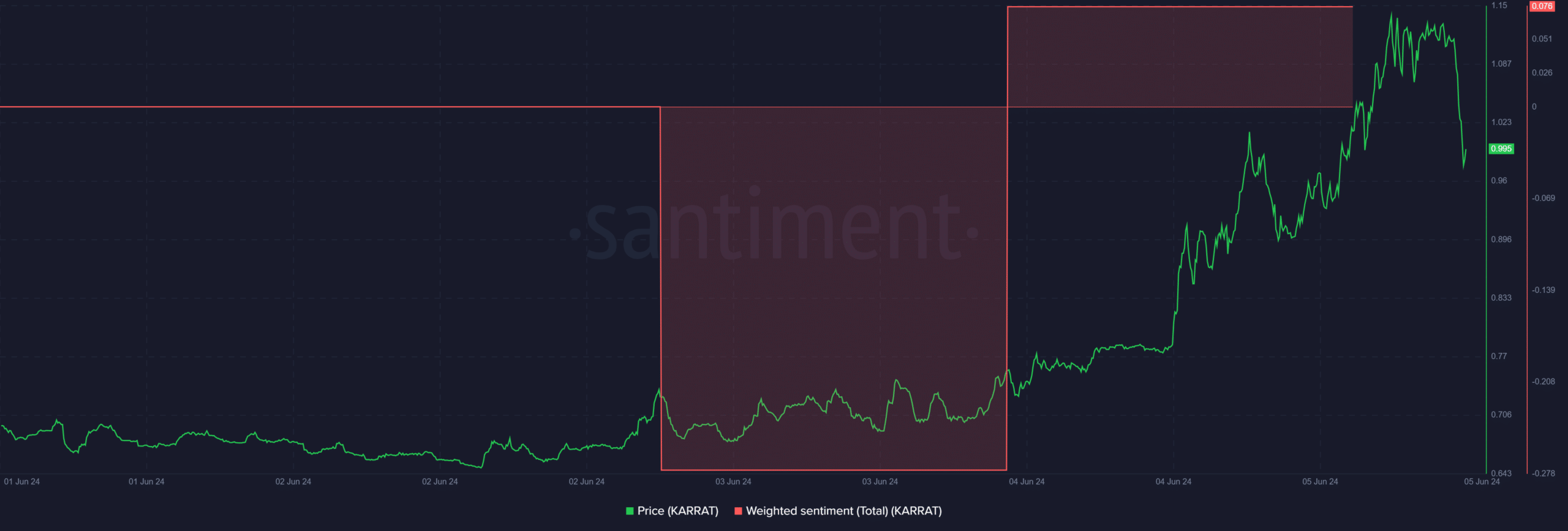

Source: Santiment

The positive Weighted Sentiment showed that market participants were bullish on the token’s future potential.

So, a rebound above $0.93 was likely, but staying above the level was dependent on BTC’s further rally.