- Dogecoin and Shiba Inu were pretty evenly matched across the metrics compared.

- Shiba Inu was stuck in a range, while Dogecoin might pose risks to short-term holders.

The memecoin market has slumped over the past week following Bitcoin’s [BTC] hesitance to break past the $70k resistance.

CoinMarketCap data showed that only dogwifhat [WIF] had a positive price performance over the past week among the top five memecoins by market capitalization.

Dogecoin [DOGE] and Shiba Inu [SHIB] saw a similar price performance, but the latter was trading within a range. The former has been more volatile in May but has trended higher slightly more consistently.

Heading into June, which token is likely to see better returns?

Comparing the social metrics

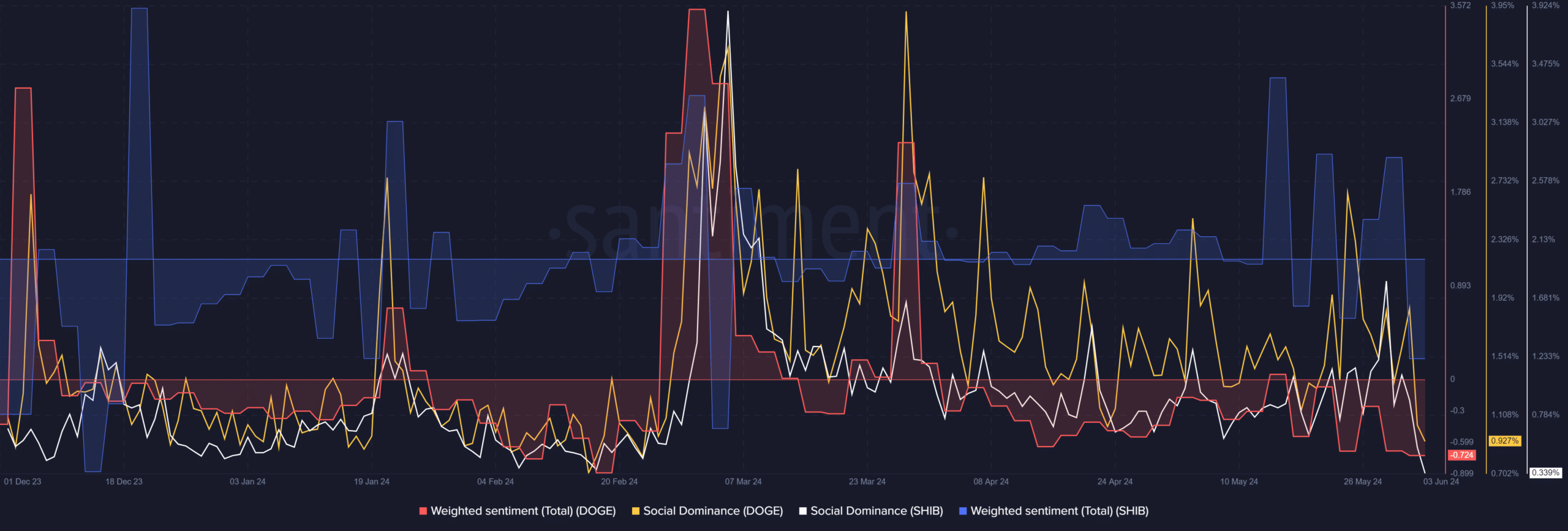

The weighted sentiment gave an idea of whether the social media engagement was skewed bullish or bearish. The 3-day interval values for DOGE and SHIB were -0.72 and -0.74 respectively. This showed that engagement was similarly bearish for both coins.

However, looking at the trends, we can see Dogecoin has been consistently bearish since April. Meanwhile, Shiba Inu was more often positive over the past two months. This might be because Dogecoin witnessed more volatility.

The social dominance of DOGE was 0.927% compared to 0.339% for SHIB. This is also understandable since Dogecoin is the face of the meme coin sector and has been for years.

According to this metric, Dogecoin might witness more volatility soon

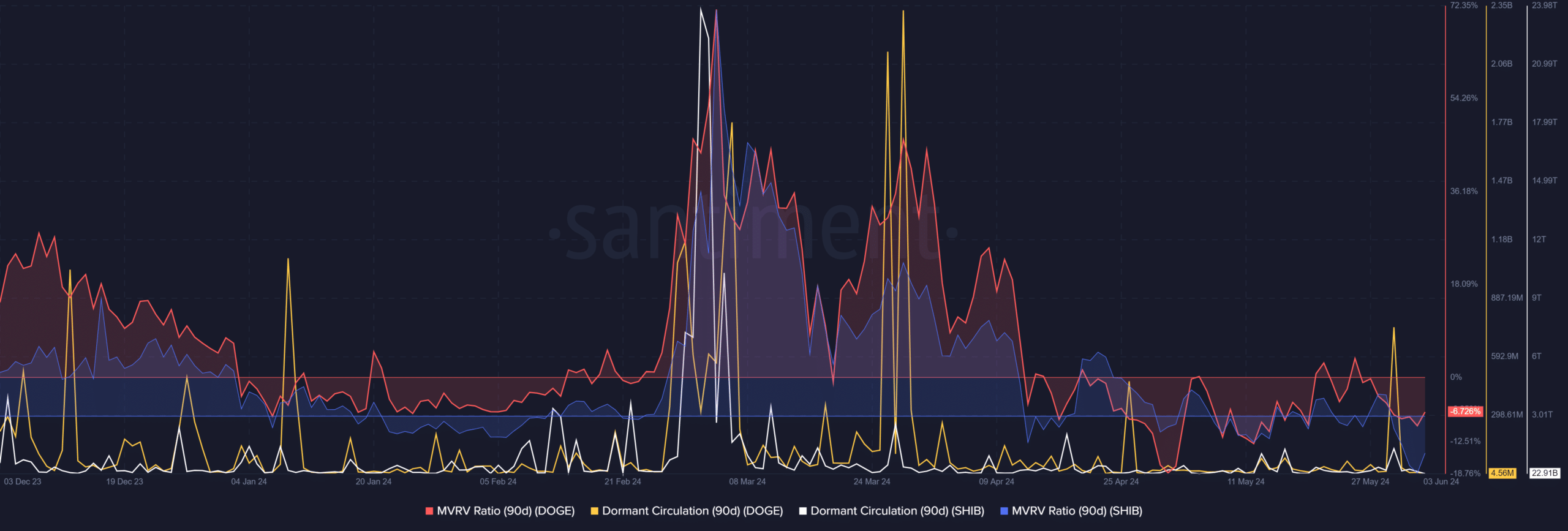

On the 30th of May, the dormant circulation of DOGE saw a massive spike. This indicated a flurry of tokens moving between wallets and is generally a sign of selling pressure.

DOGE prices have only slipped 3% since then, and at press time recovery was underway.

However, the potential wave of selling could be a concern.

On the other hand, Shiba Inu saw fewer tokens move on-chain in the past two months, highlighting a stronger HODL mentality.

Comparing the MVRV ratios, we see that DOGE was more negative over the past six weeks than SHIB. This meant DOGE holders faced greater losses, especially in early May.

At press time, it was the SHIB holders who were sitting on greater unrealized losses.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Overall, the social metrics were pretty similar. The MVRV ratios showed that DOGE holders were more willing to sell when the metric pushed above zero.

Combined with the dormant circulation spike, Dogecoin could see greater volatility than Shiba Inu.