- Polymarket, a crypto-prediction market, recorded a surge in activity owing to the upcoming U.S elections

- Despite dApps on its network doing well, activity across Polygon fell

A popular dApp on the Polygon network known as Polymarket has witnessed significant growth over the last few days. For context, Polymarket is a predictions market that allows users to bet on real-world events using cryptos.

Make your bets

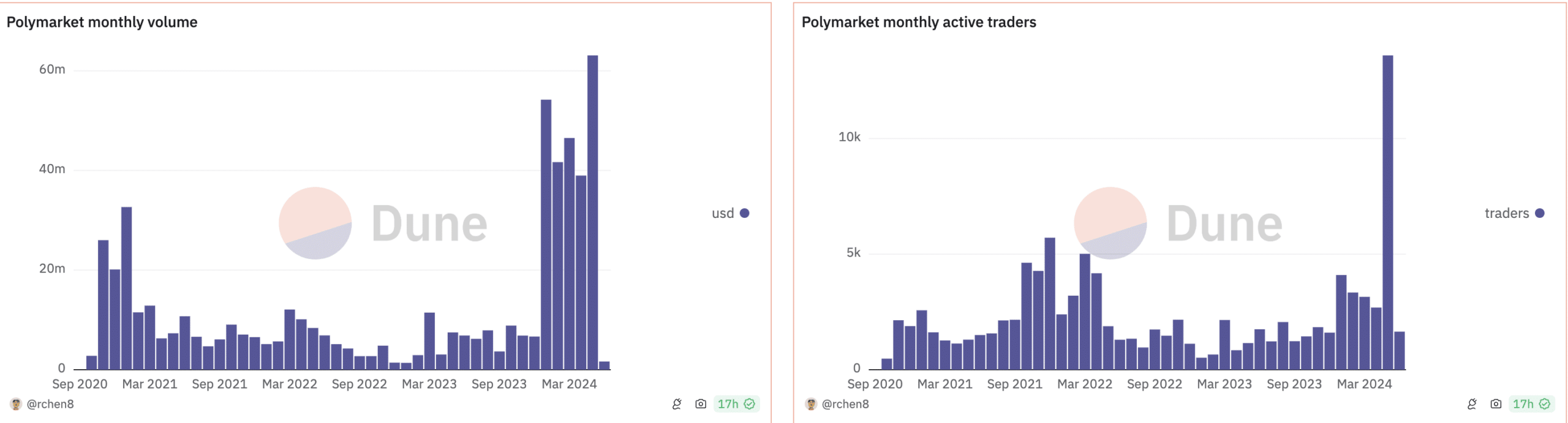

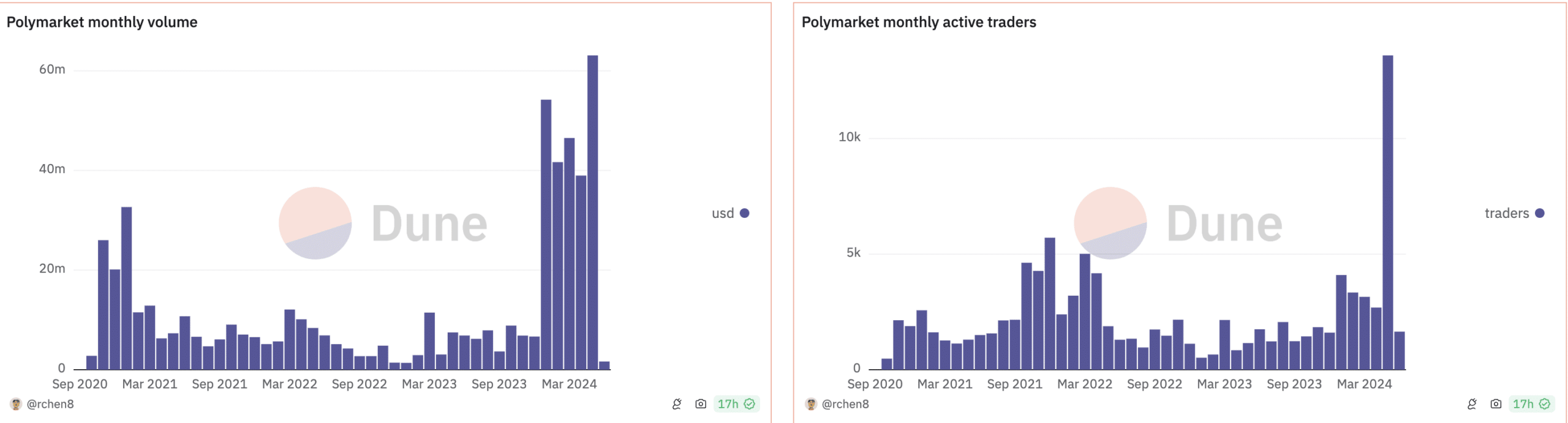

Fueled by speculation surrounding the 2024 Presidential elections in the United States, the predictions platform Polymarket has seen record-breaking monthly levels in both trading volume and active traders.

Source: Dune Analytics

In fact, recent data revealed that Polymarket recorded a trading volume of $63 million from over 13,597 traders in May. Throughout 2024, the monthly trading volume has fluctuated significantly, ranging from $38.9 million in April to a peak of $63 million in May.

This marked a significant increase, compared to Polymarket’s volumes in each month of 2023. These new records underline the heightened interest and activity on Polymarket, particularly in the five most liquid markets on the platform – All of which are directly linked to outcomes rooted in the U.S political system.

Speculators have placed a total of $234.1 million in wagers on Polymarket across these five markets. These bets include predictions on who will be the 2024 presidential election winner, the 2024 popular vote winner, the Democratic party nominee, the Republican vice-presidential nominee, and the electoral college margin of victory.

A large amount of bets, amounting to $143.8 million, are concentrated on predicting the presidential election winner.

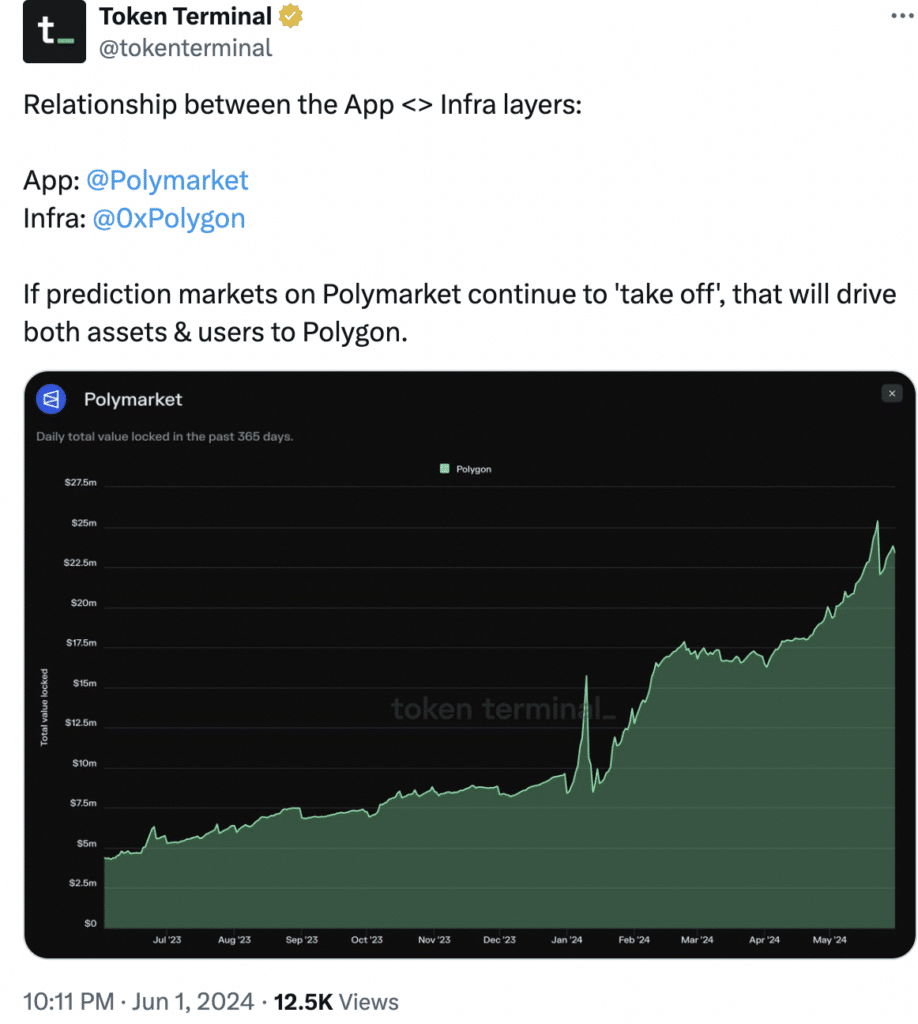

The popularity of Polymarket can improve the state of Polygon as well and can bring more users to the network in the future.

Source: X

How is Polygon doing?

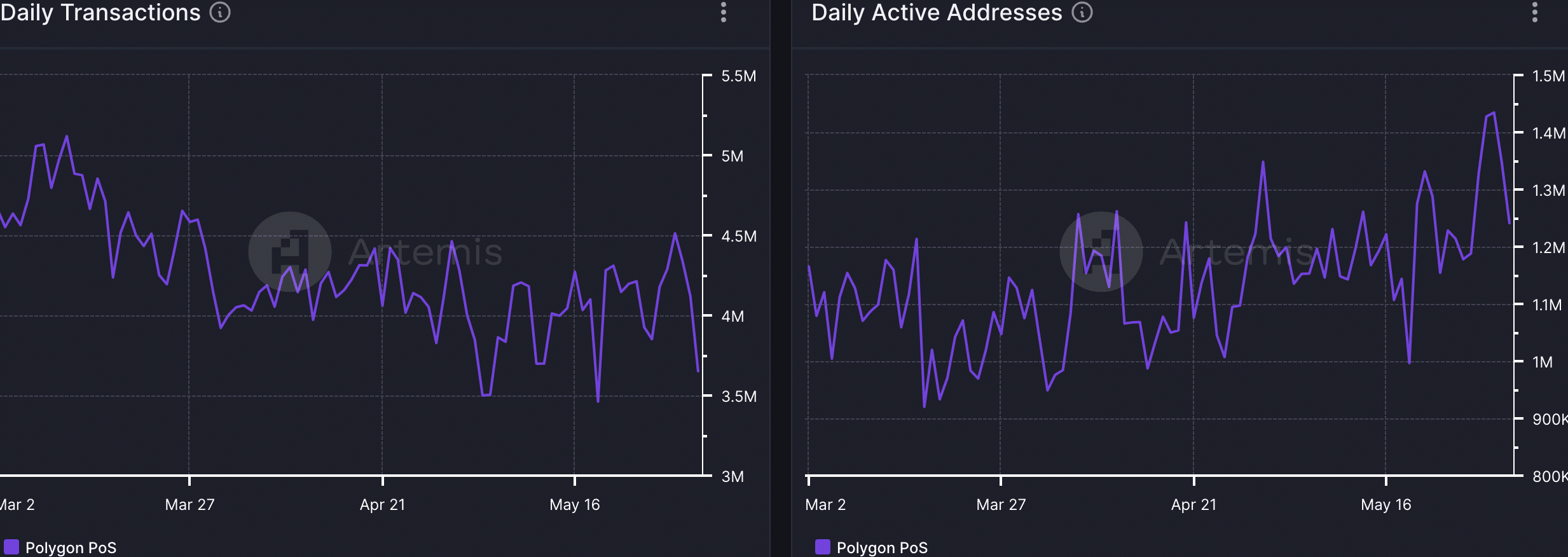

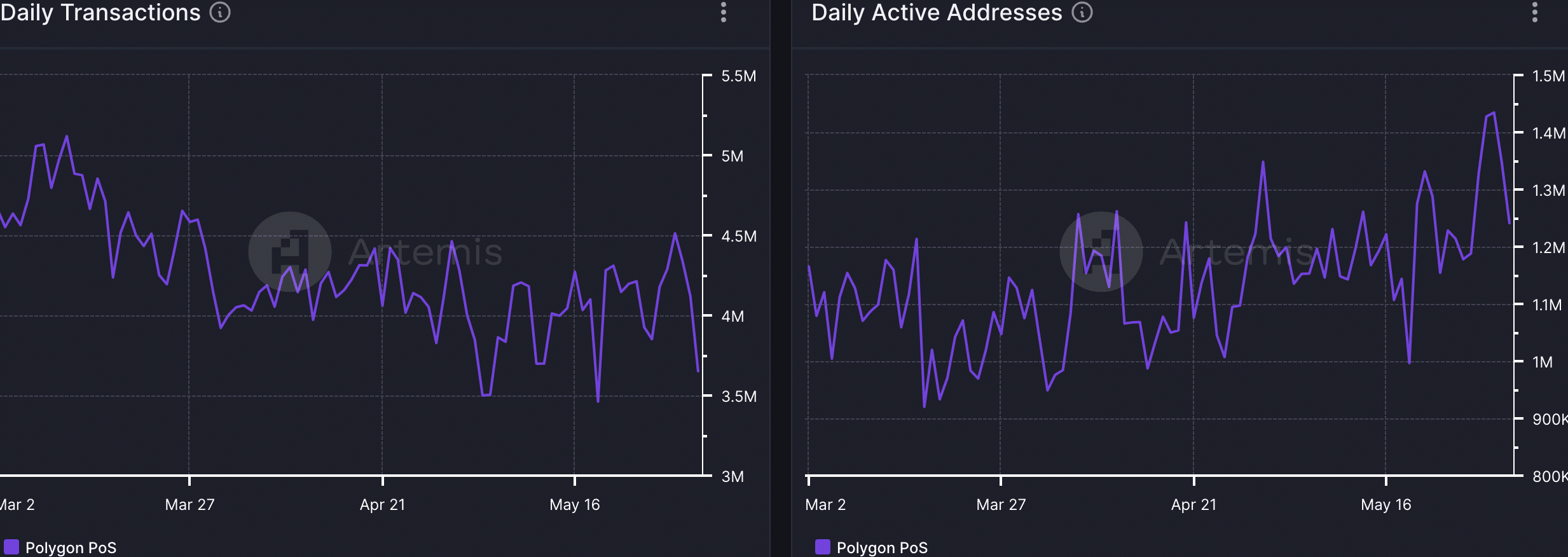

However, at the time of writing, things weren’t looking too positive for Polygon. In terms of daily transactions on the network, Polygon recorded a material decline.

AMBCrypto’s analysis of Artemis’ data revealed that the number of transactions occurring on the network had fallen from 4.5 million to 3.5 million. Coupled with that, the number of daily active addresses on the network also declined from 1.4 million to 1.2 million.

Source: Artemis

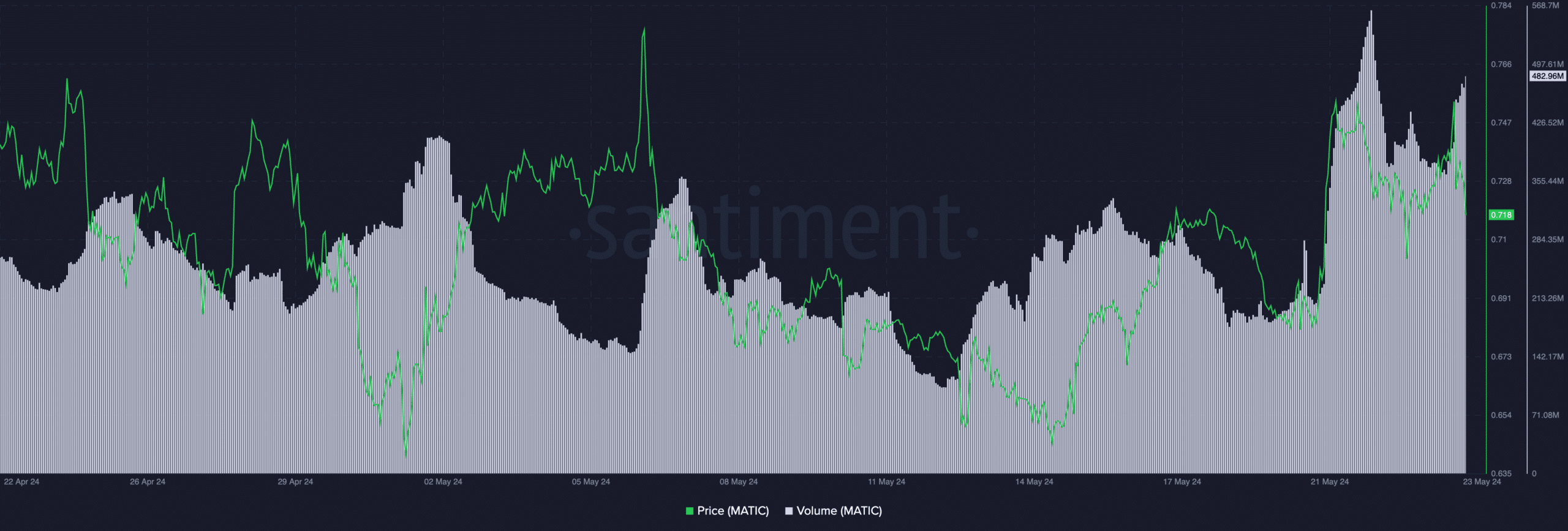

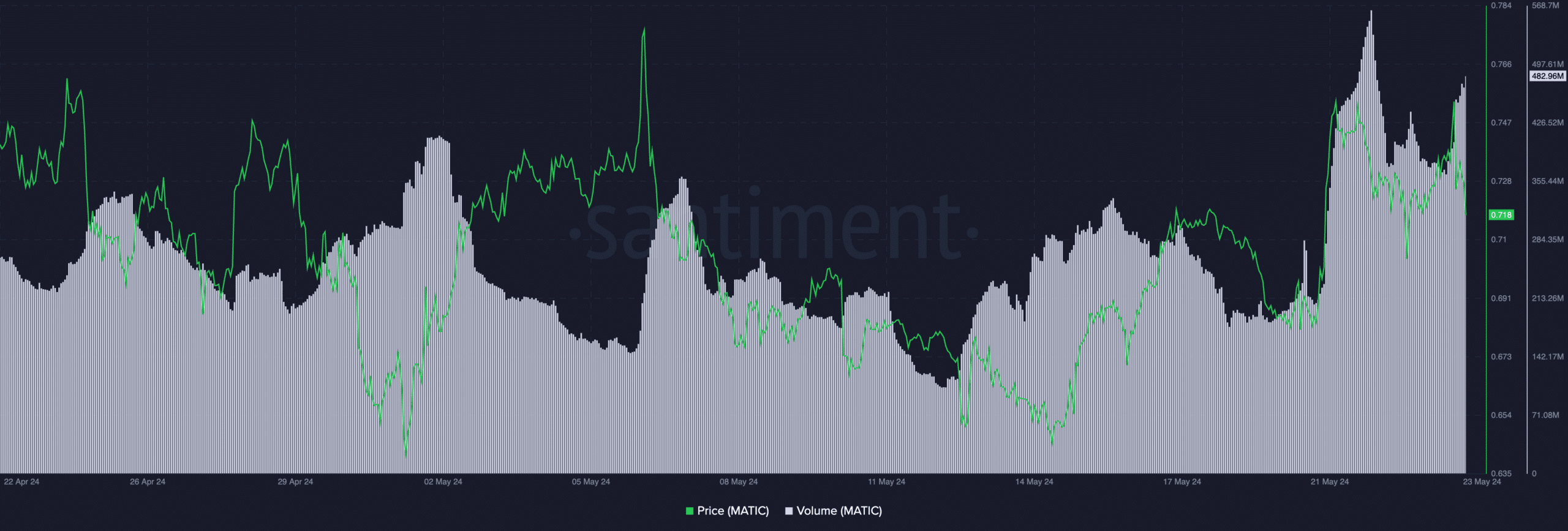

For its part, MATIC wasn’t having a good time either. In the past week alone, the altcoin’s price has declined by 3.38%. At press time, MATIC was trading at $0.697.

Realistic or not, here’s MATIC’s market cap in ETH terms

Source: Santiment