- The rise in difficulty propelled a hike in daily miners’ revenue

- A lot of miners cashed out their BTC, suggesting the coin’s price might fall

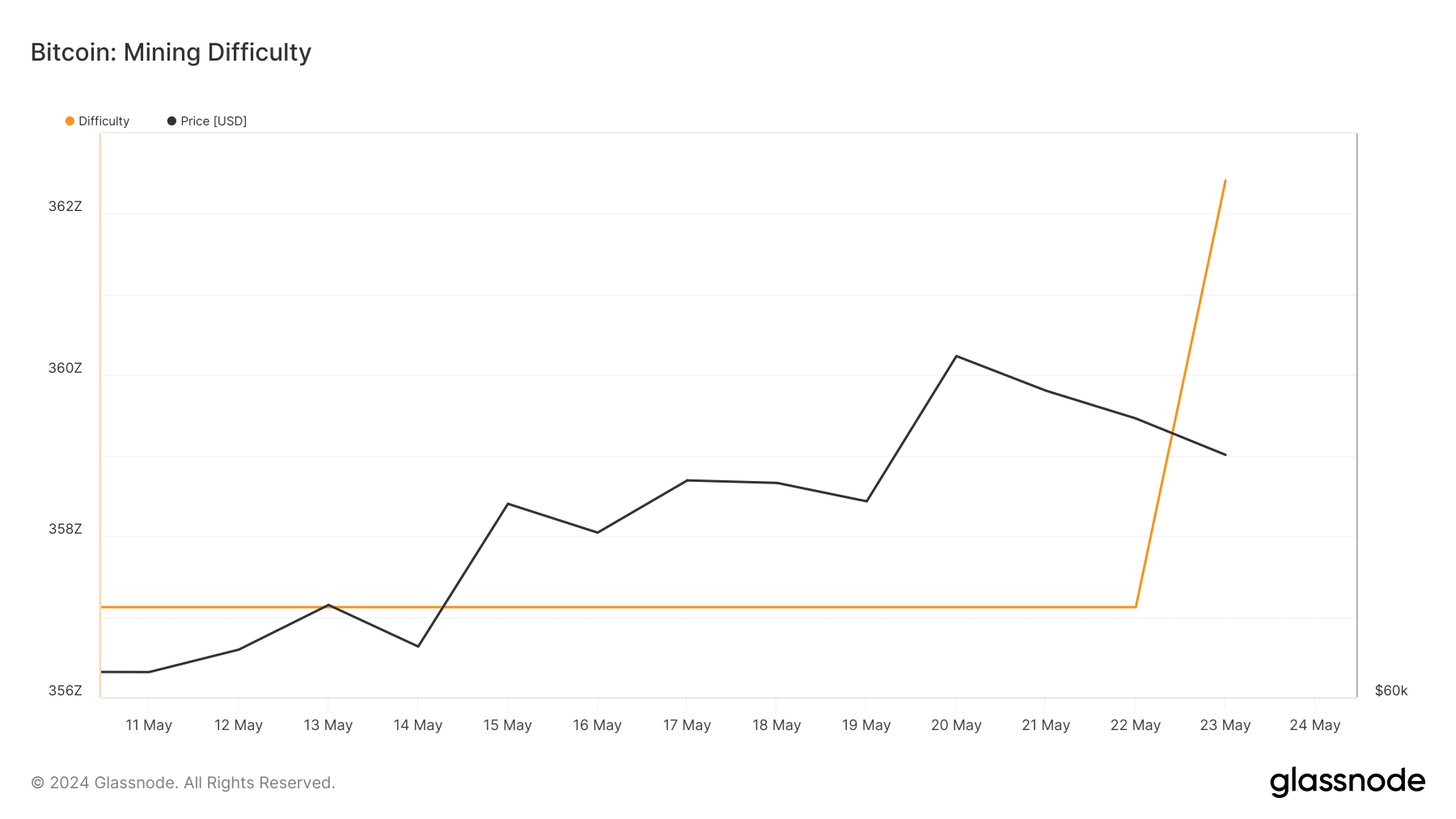

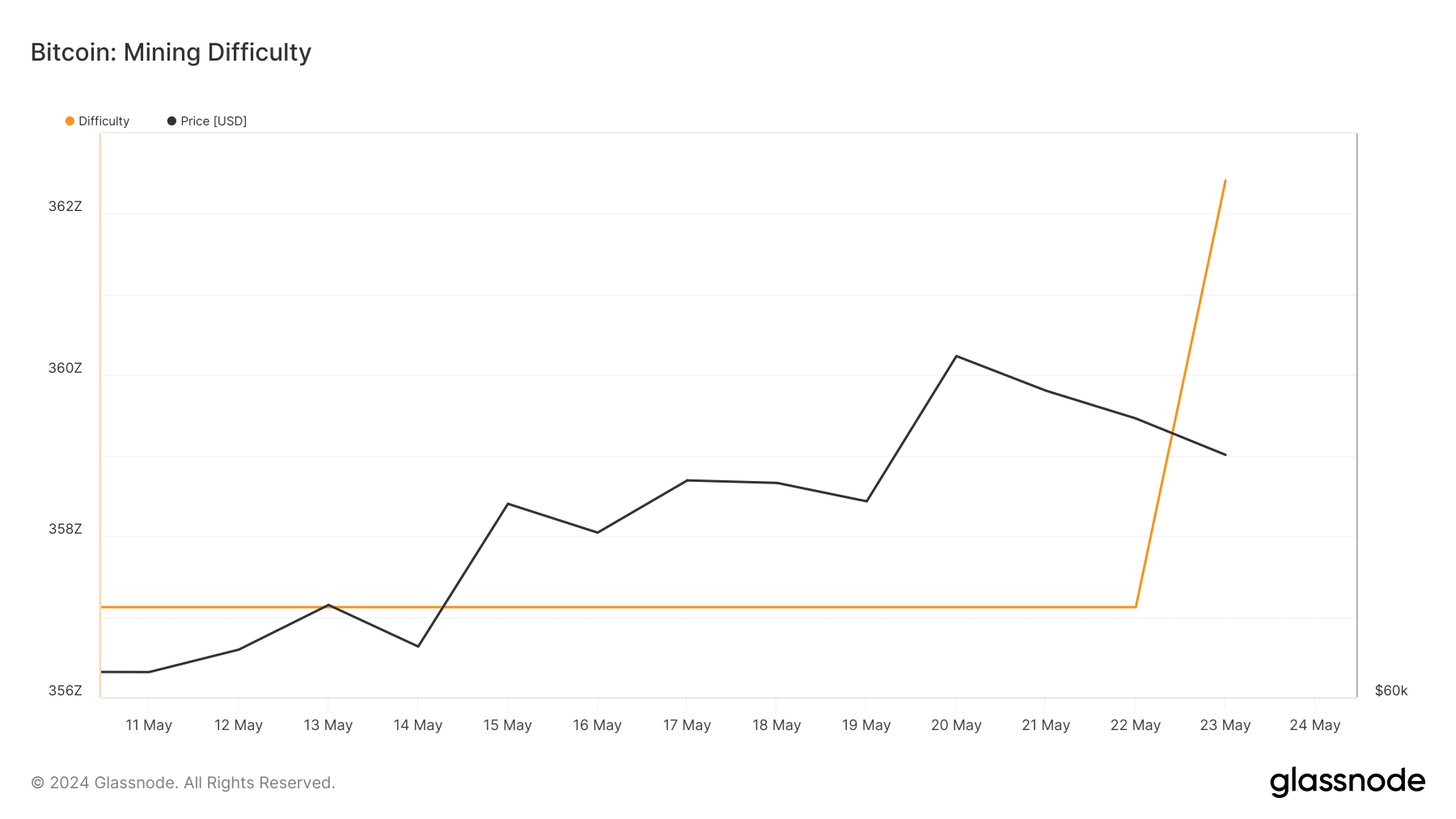

According to on-chain data from Glassnode, Bitcoin’s [BTC] mining difficulty spiked to a significant high from its lows of 22 May. Bitcoin mining difficulty measures how challenging and time-consuming it is to find the right hash for each block.

Mining difficulty does not always affect the value of BTC. However, it impacts its perceived value and scarcity. An increase in difficulty implies a surge in hash power. In turn, blocks might not be solved faster and the block time could be as high as 10 minutes.

In terms of the price, an increase in this metric could be bullish. This, because miners might be attracted to validate more transactions on the network.

Source: Glassnode

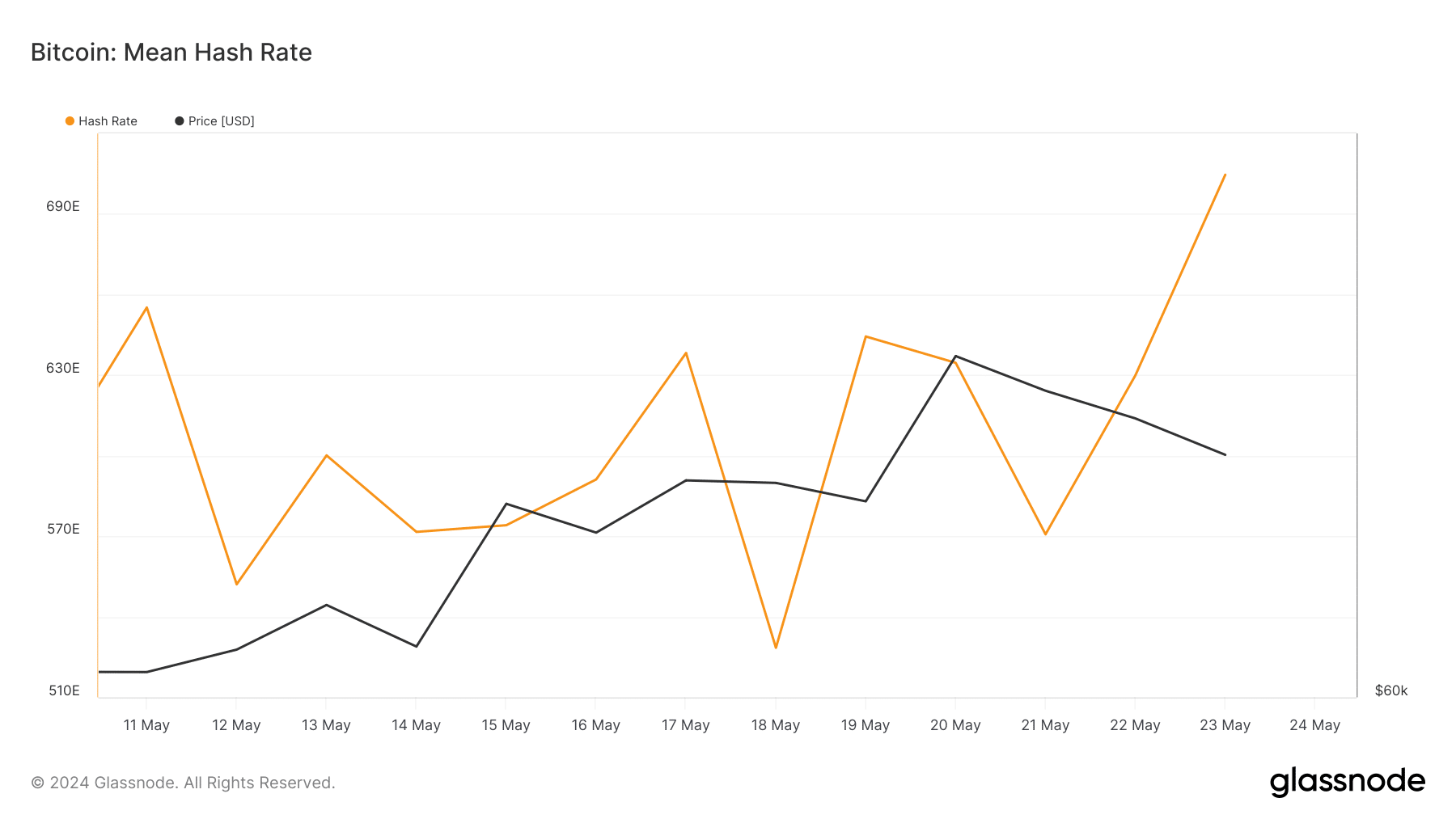

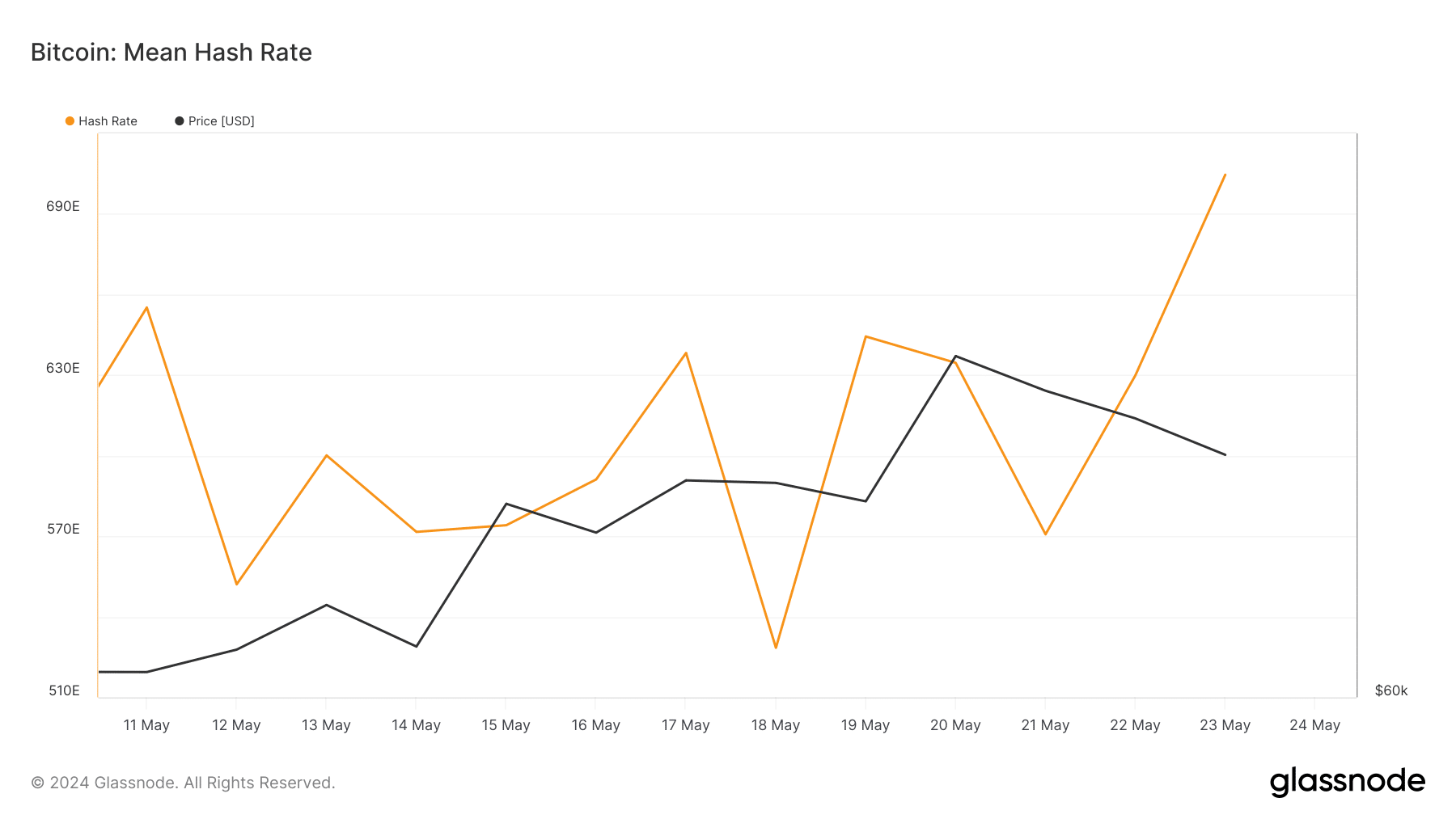

However, mining difficulty was not the only metric to skyrocket on the network. In fact, another metric that followed suit was Bitcoin’s hash rate.

As the difficulty rises, so does revenue

If Bitcoin’s hash rate is high, it indicates that the network is secure and healthy. For investors, this hike serves as a reassurance that buying BTC could be profitable in the long term. However, this condition only works if the market condition is in a bull phase.

On the other hand, a major decline in hash rate indicates changes or risks to the network. In situations like these, miners might find it difficult to generate profits from their operations.

Source: Glassnode

As expected, the impact of the hike in mining difficulty and the hash rate was reflected in miners’ revenue. In fact, at the time of writing, on-chain data revealed that miners’ revenue had a figure of 558.057 BTC

This seemed to indicate that operators have worked towards confirming more new transactions on the block, compared to how it was on 21 May.

Not everyone is HODLing

AMBCrypto also looked at the Miner Net Position Change. At press time, the metric had a reading of -2.748.69 BTC. Miner Net Position Change tracks the 30-day change of the Bitcoin supply held in miner addresses.

When this metric is positive, it means that miners are accumulating more coins. However, the recent decrease which has been happening for the last two weeks means that miners are cashing out their holdings.

As such, there is a chance that Bitcoin mining might become more difficult. For the price action, this could force another decline for the cryptocurrency.

At press time, BTC was valued at $68,291, having appreciated by under 1% in 24 hours after a lot of sideways movement. The price action is worth keeping an eye on since Bitcoin holders might look for other opportunities to cash out going forward.

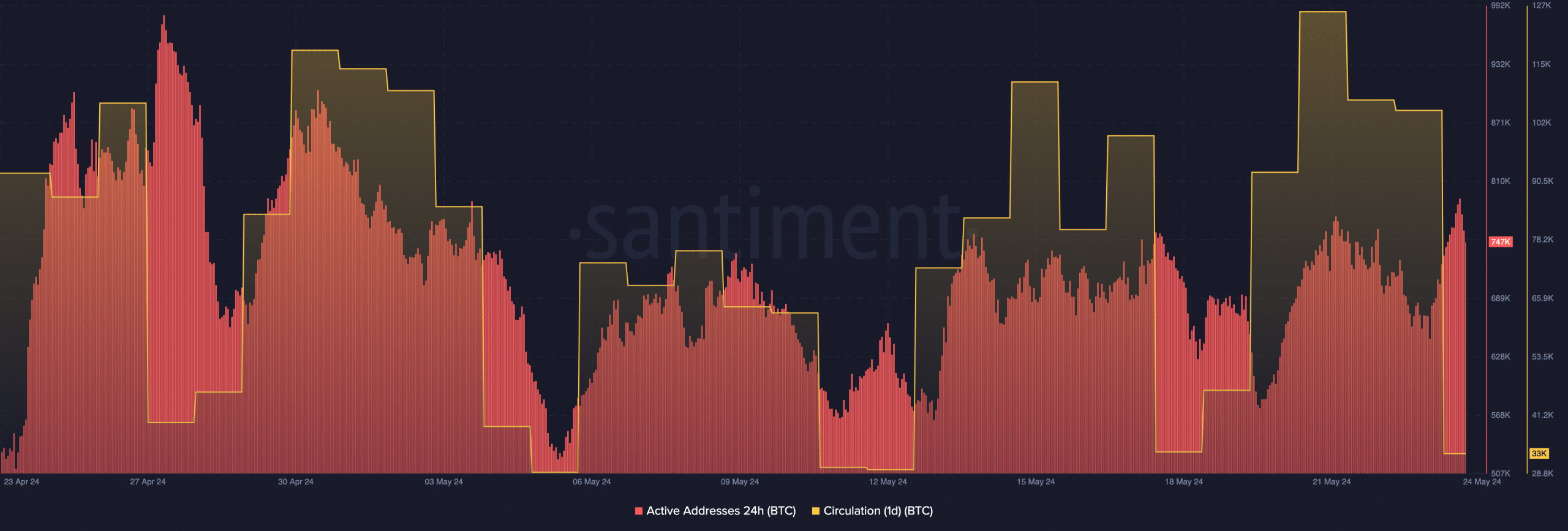

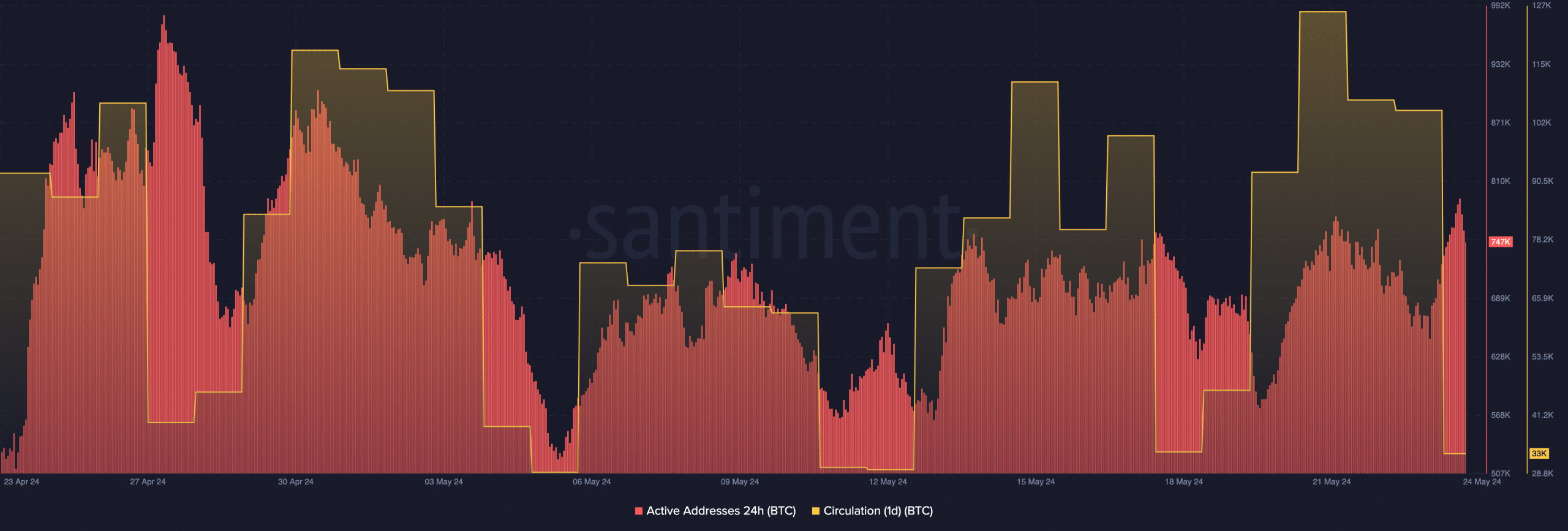

BTC in circulation drops

From an on-chain perspective, AMBCrypto also looked at the 24-hour active addresses. According to Santiment, the 24-hour active addresses on Bitcoin’s network were 747,000.

This alluded to a significant hike from where the metric was on 23 May. Active addresses measure the daily interaction of users on a blockchain, meaning that the number of Bitcoin transactions has since risen.

For the price, the hike in activity could spur price appreciation for the coin. However, that metric alone cannot determine BTC’s next direction. Hence, it’s worth considering the circulation too.

Source: Santiment

At press time, the one-day circulation was down to 33,000, meaning that the number of coins engaged in transactions had fallen.

Is your portfolio green? Check the Bitcoin Profit Calculator

Considering the hike in Bitcoin mining difficulty and the activity on the network, the crypto’s price could note an increase in the mid-term. On the targets front, the value could rebound towards $73,000.