- Bitcoin’s current retracement is seen as a precursor to a potential major rally towards $73,000.

- Market metrics and analysis indicate strong foundations for BTC, despite a drop in active addresses.

Bitcoin [BTC] has recently exhibited significant bullish behavior, marking a notable rise of nearly 10% from last week’s low of $65,000 to a high of $71,000 this week.

However, the cryptocurrency has seen a slight retreat, currently trading at $68,659. This pause in the upward momentum is viewed by analysts as a precursor to a potential major rally.

A return to $73,000 could signal the start of what is termed as the “escape velocity” phase for Bitcoin, indicating a possible acceleration away from current price levels into new highs.

Analyzing market metrics and investor behavior

Crypto analyst James Check, in a recent market report dated 21st May, described this $73,000 price point as crucial for Bitcoin’s trajectory.

The term “escape velocity,” borrowed from astrophysics, is used here to denote the minimum speed Bitcoin would need to break free from its current range and start a more aggressive price climb without additional push.

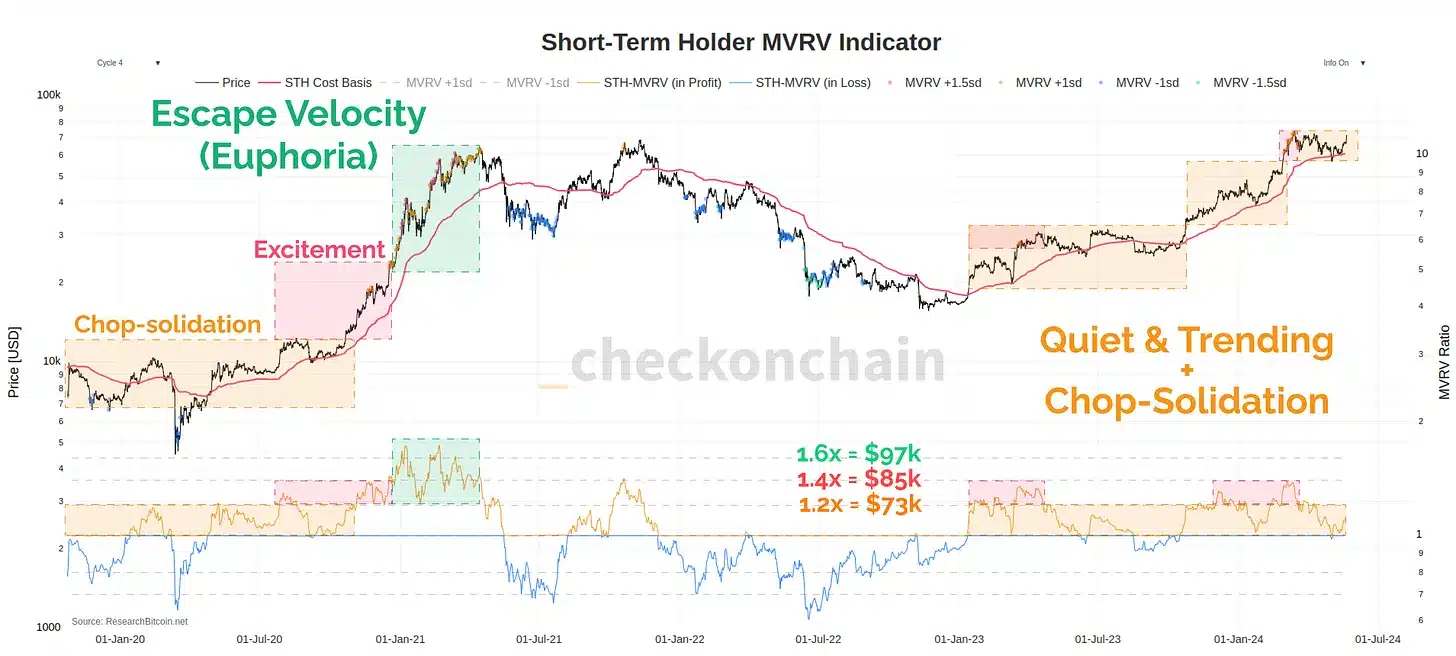

James Check points out the importance of the Short-Term Holder (STH) Market Value to Realized Value (MVRV) metric, which he believes shows the market is not yet “overstretched, overbought, and oversaturated.”

Source: Checkonchain newsletter

Check suggests that while the market is enthusiastic, it has not yet entered a phase of euphoria that often precedes a significant pullback.

The analyst disclosed that the market is building strong foundations for a rally, with $73,000 being a critical point that could set off a more substantial rise in Bitcoin’s price.

However, there is also caution around this price level. Short-term holders, defined as wallets that have held Bitcoin for less than 155 days, are in “sufficient profit” at this point, which might lead to some resistance due to potential selling pressure.

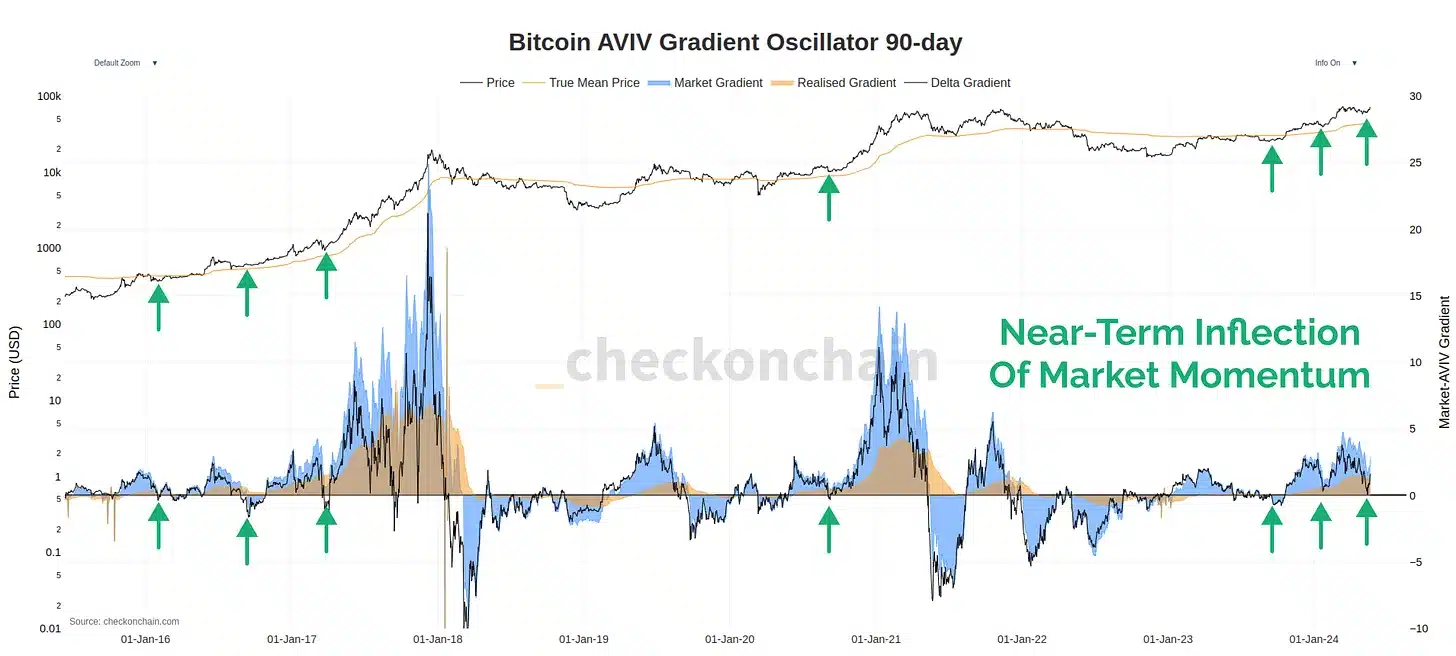

The AVIV momentum oscillator, particularly over a 90-day period, has been supportive, showing that price movements relative to on-chain capital inflows are recovering strongly, typical of a bull market phase.

Source: Checkonchain newsletter

Key observations from on-chain data

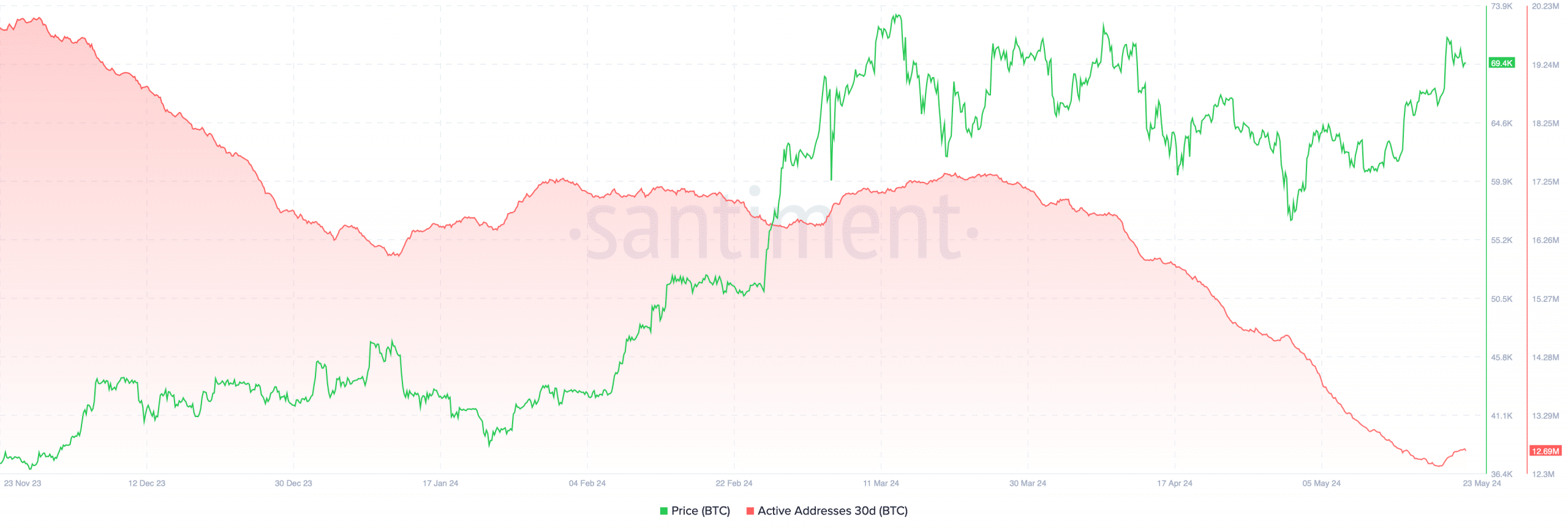

AMBcrypto’s analysis, supported by data from Santiment, indicates a decline in Bitcoin’s active addresses from over 17 million in March to below 13 million currently.

Source: Santiment

Despite this decrease, Bitcoin has continued to show bullish moves, breaking through multiple resistance levels. This suggests that while the network’s activity is reducing, the price is still being driven upwards by other factors.

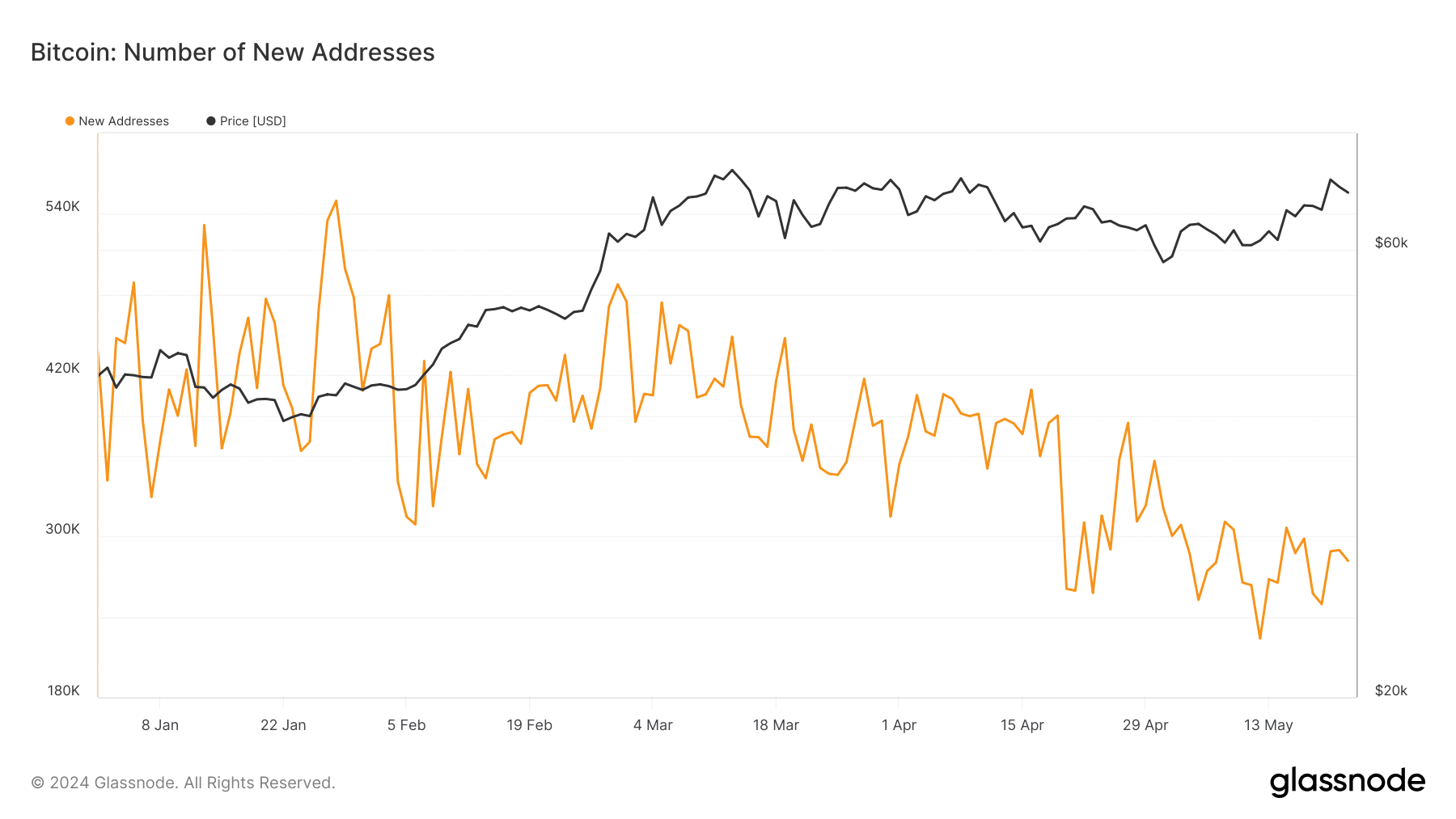

Glassnode’s data further showed that the number of new addresses has also been declining, creating a pattern of lower highs and lows. This supports Check’s view that the Bitcoin market has not reached a state of euphoria, which typically signals an overheated market.

Source: Glassnode

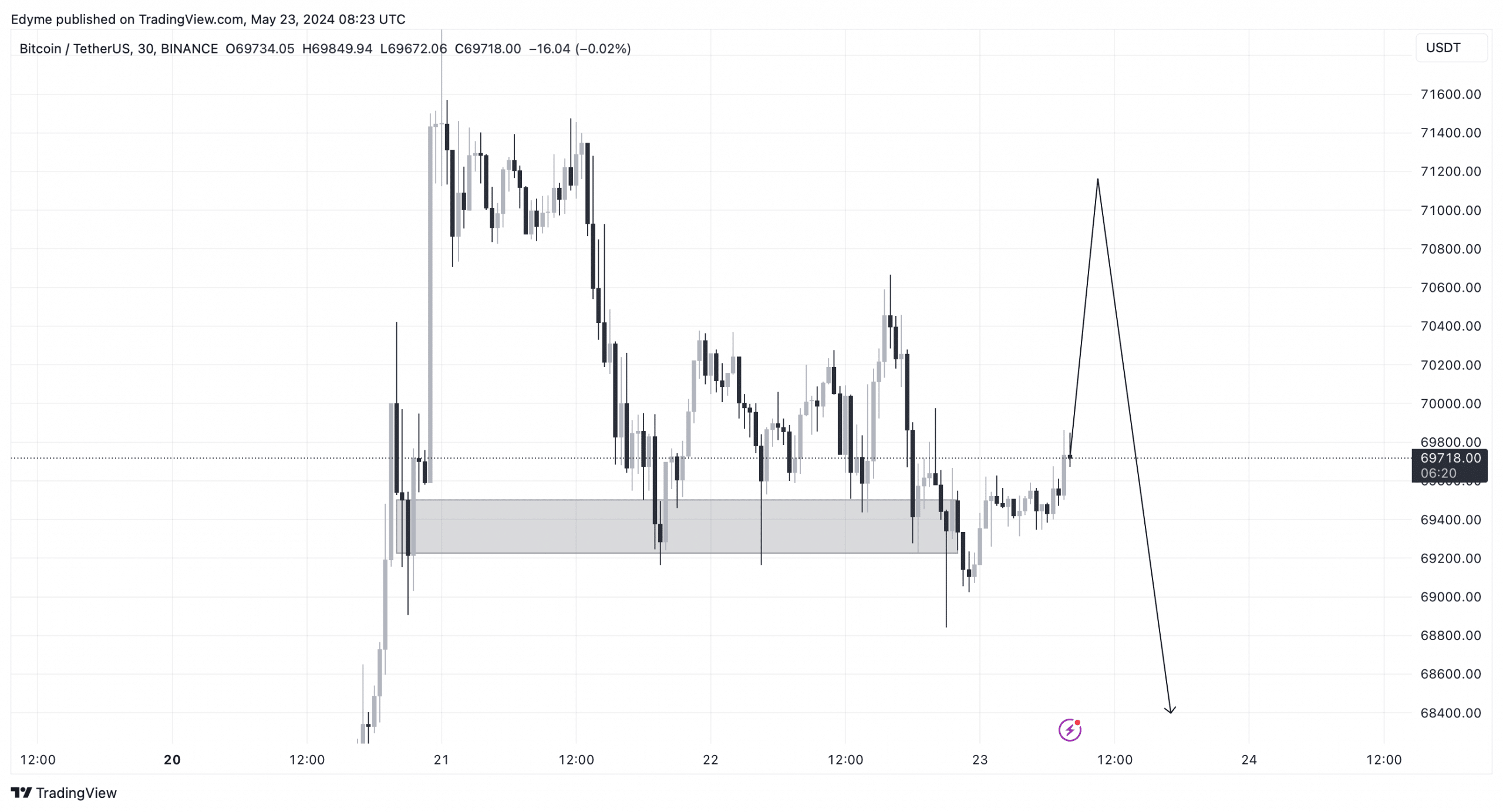

On the 30-minute chart, Bitcoin has recently broken through a crucial demand zone, hinting that the asset might retrace further to gather more liquidity before resuming its uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Source: TradingView

A key level to watch, as per AMBCrypto’s recent report, is around $71,500. A weekly candle close above this mark could be the trigger for Bitcoin to break out from its current re-accumulation range.

This level aligns with Check’s analysis that a push past $73,000 could initiate the escape velocity phase, marking a potentially explosive next stage in Bitcoin’s market cycle.