- Whales began to accumulate AI tokens as Nvidia saw profits.

- Declining network growth could impact these tokens negatively in the long run.

Interest in the AI tokens in the crypto space has grown significantly over the last few days. One of the main reasons for the surge in price for the AI tokens would be the behaviour of whales.

Whales move in

Santiment’s recent data revealed a notable increase in whale activity within the AI sector, and Render [RNDR] has been a significant part of this trend.

A prominent whale made a substantial move on the 23rd of May by transferring 4.89 million RNDR, valued at $52.1 million, to an unknown wallet. This transaction occurred amidst a period of price correction.

Source: Santiment

Nvidia comes to the rescue

One of the reasons for the surge in price for AI tokens such as RNDR was the success of NVDIA.

Chip-making tech giant Nvidia recently announced its Q1 earnings, revealing a record quarterly revenue of $26 billion, surpassing market expectations by 5.5%.

The rise in AI token prices coincides with investor anticipation for Nvidia’s quarterly earnings report. The success of Nvidia is perceived as the AI sector making progress. Hence, AI tokens have gained significantly after the Nvidia earnings call.

But it wasn’t just RNDR that had benefited from this. Other tokens such as Fetch.ai [FET] and Bittensor[TAO] also witnessed a massive surge in interest and surged by 20% and 5% respectively over the last week.

Read Render’s [RNDR] Price Prediction 2024-25

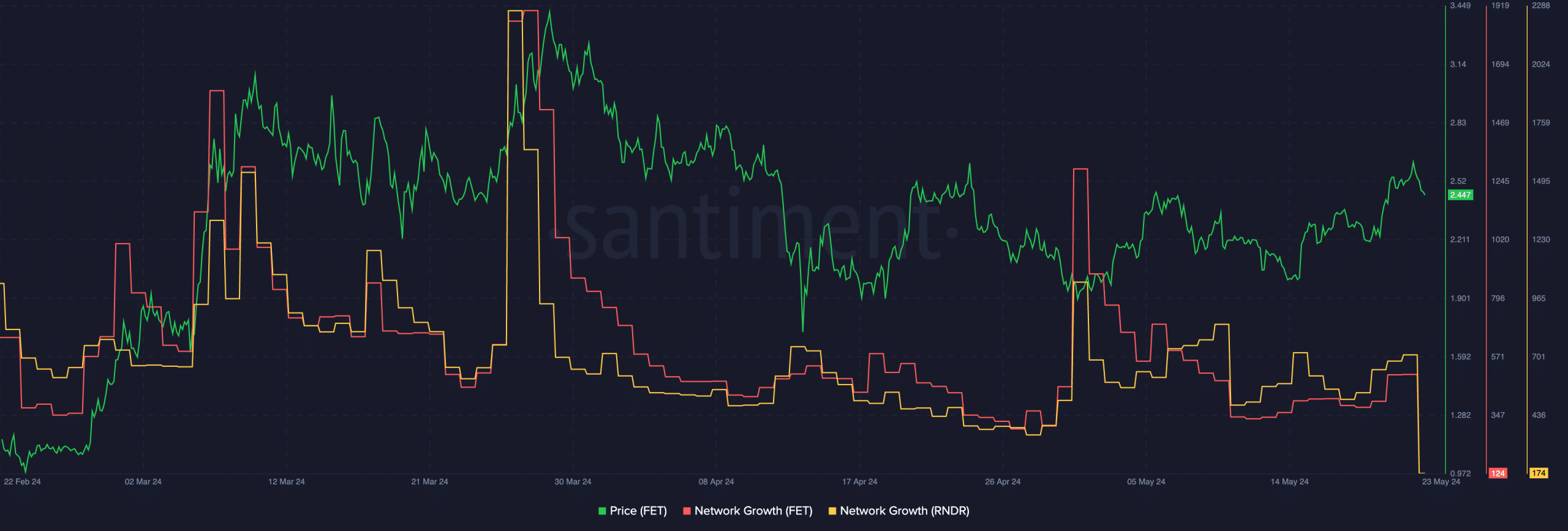

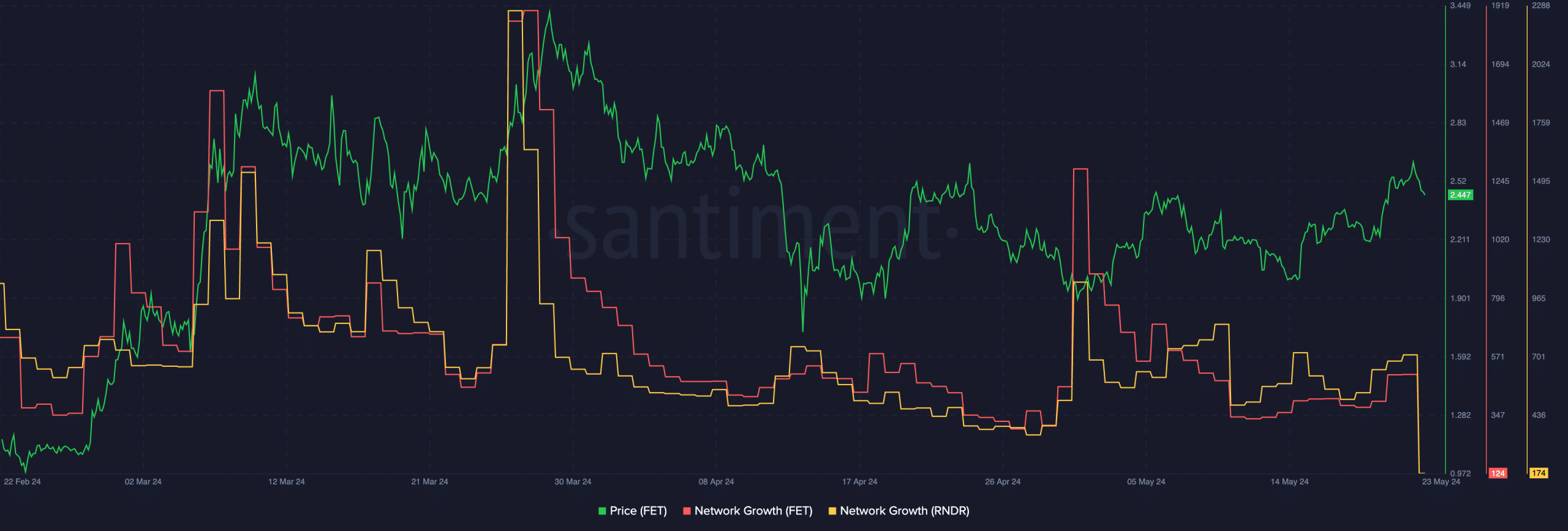

Even though the price of these tokens surged, there were some problems that persisted. AMBCrypto’s analysis of Santiment’s data indicated that the network growth for FET and RDNR fell significantly.

This meant that the number of new addresses interacting with these tokens had plummeted. If the trend continues it can cause major price corrections for these tokens in the future.

Source: Santiment