Macro strategist Jim Bianco is blowing up the narrative that institutions and high-net-worth investors are the ones heavily accumulating shares in Bitcoin (BTC) exchange-traded funds (ETFs).

Bianco tells his 398,400 followers on the social media platform X that new mandatory 13F filings with the U.S. Securities and Exchange Commission (SEC) reveal the breakdown of investor types in the spot BTC ETFs for the first quarter of 2024.

“Anyone with over 5% beneficial ownership or at least $100 million in assets must file a 13F within 45 days of the end of the quarter. This was May 15th. ~7,000 were filed.

What did we learn from the spot BTC ETF filings?

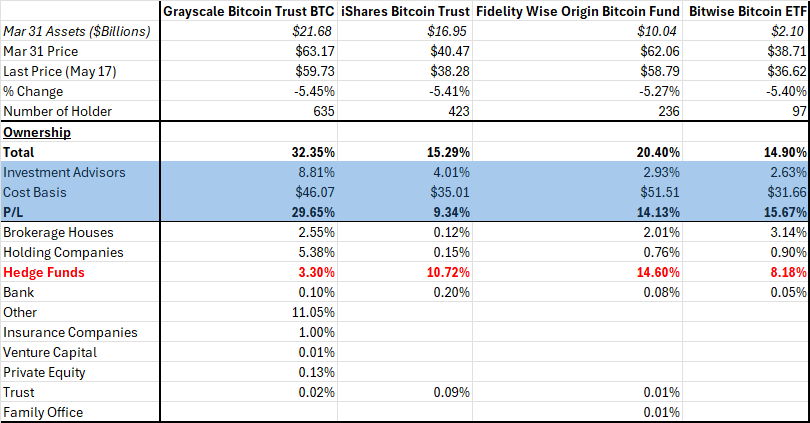

The table below shows some top-line results.

The shaded blue area shows the investment advisors’ holdings. They are very small, between 2.5% and 4% (and 8.81% for GBTC). A recent Citi report says the average ETF is about 35% owned by investment advisors. Throughout the quarter, we were confidently told boomers were calling their wealth managers and telling them to get into BTC. This is not the case for 95+% of the spot BTC ETF holdings.“

He says the forms reveal that about 85% of investors in the spot Bitcoin ETFs are retail investors as of the first three months of the year.

“I feared the spot BTC ETFs were effectively ‘orange FOMO poker chips.’ The Q1 13F filings only further convinced me this was the case.

Only ~3% of the outstanding ETF market cap was held by investment advisors, completely blowing up the narrative that ‘the Boomers are coming.’ They might over time (as in years) but did not in Q1. ~10% is held by hedge funds, and ~85% by non-institutional investors (read: retail).”

At time of writing, Bitcoin is trading for $70,947, up over 7% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3