- PEPE has a bullish market structure on the higher timeframes.

- Futures traders were likely sidelined and waiting for a consolidation phase.

Pepe [PEPE] tried to breach a local resistance last week but was pushed backward. It has lost 20% since the 15th of May, but the trend remained bullish on the higher timeframes.

Prices would likely surge higher once again.

But when and where would this bullish reversal begin? Conversely, with most holders in profit, a wave of profit-taking might drag PEPE to April’s lows.

Which scenario is more likely, and how should traders respond?

Technical indicators remained bullish despite the dip

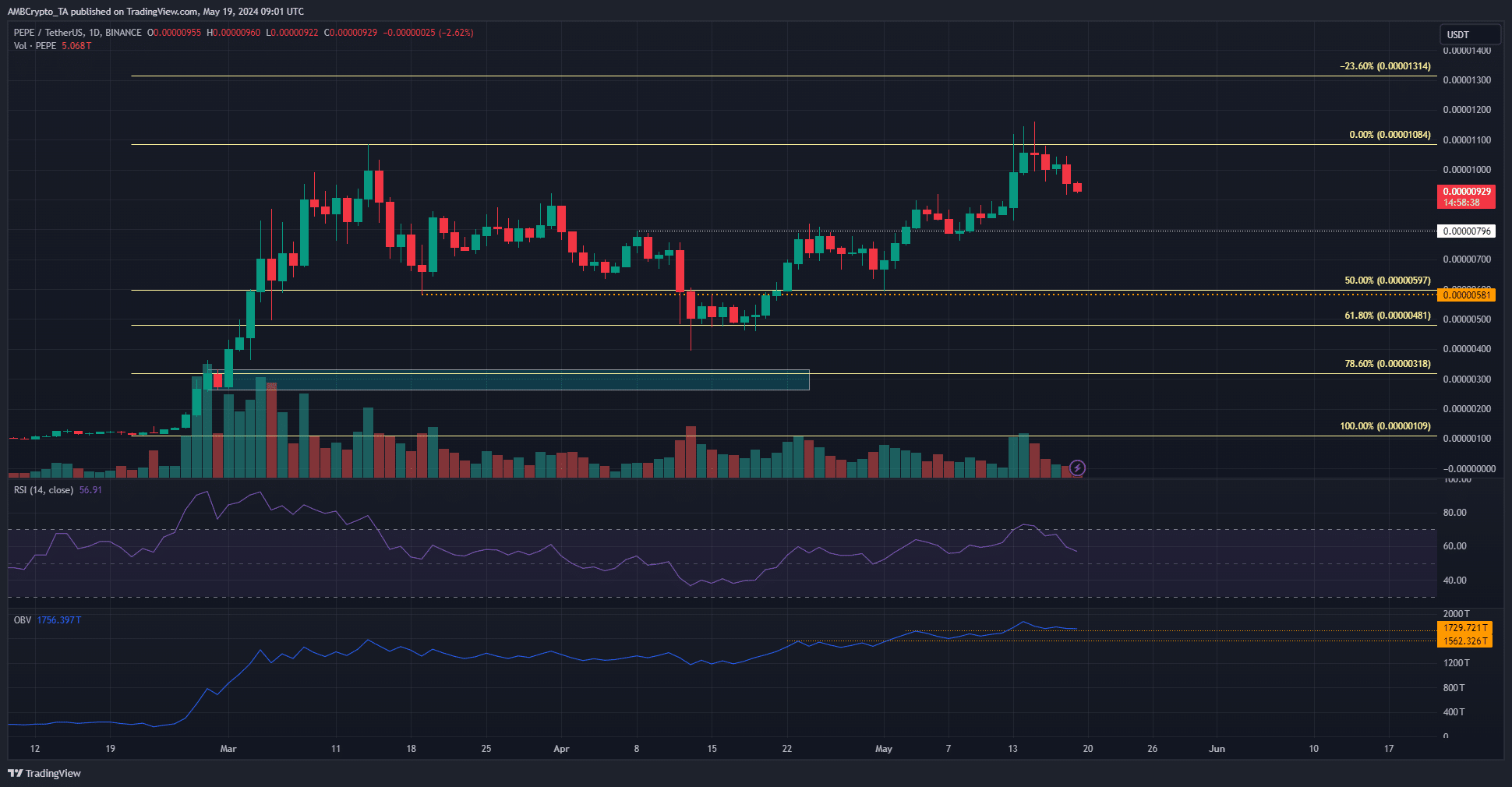

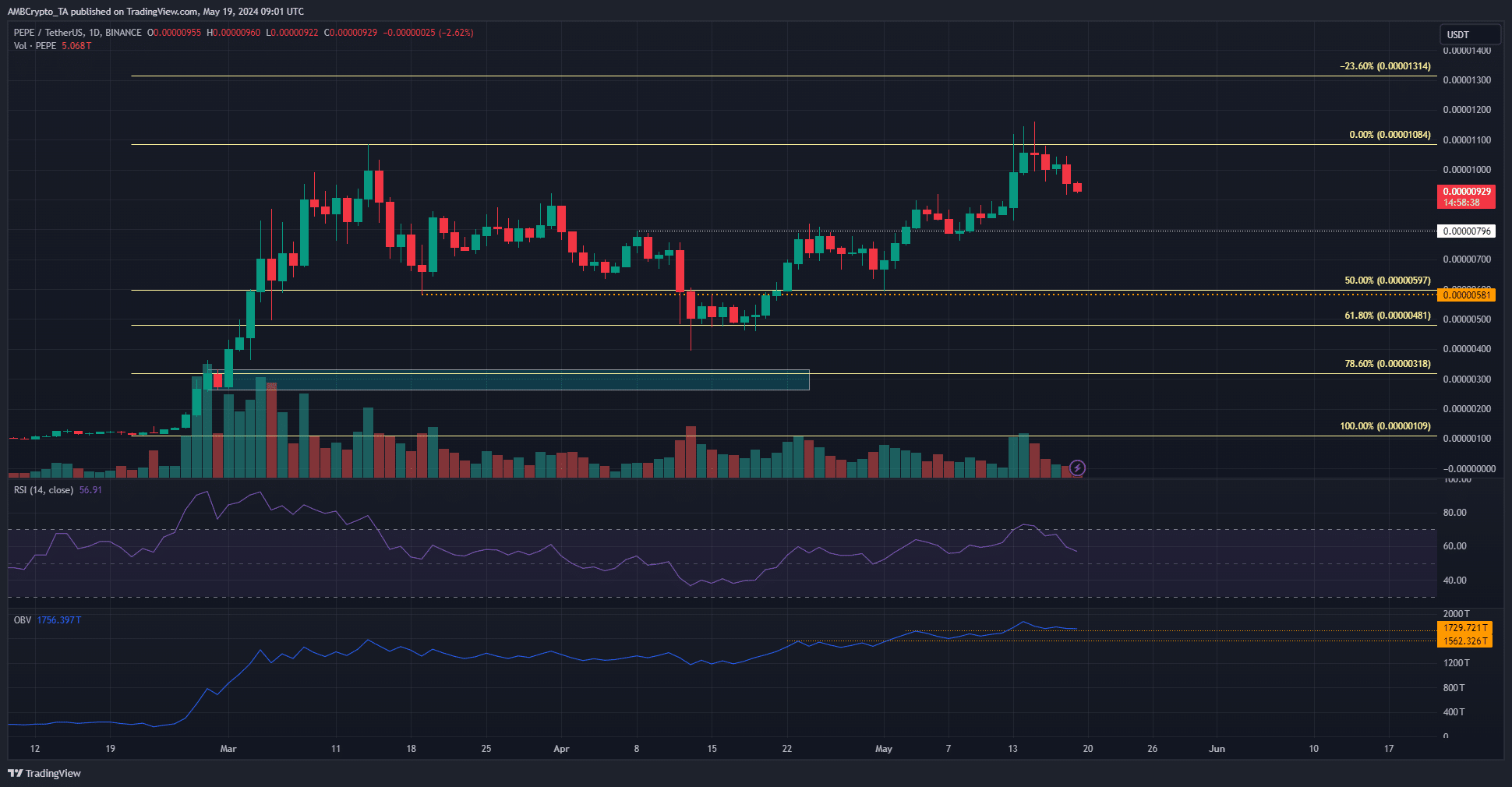

Source: PEPE/USDT on TradingView

PEPE reached the local high at $0.0000108, but was unable to close a daily session above this level. It was the same resistance from March that impeded the bulls yet again.

However, some factors were in bullish favor.

The OBV was in an uptrend and above two key short-term levels. This indicated that selling pressure was not yet dominant and further gains could materialize. The market structure on the 1-day chart was also bullish.

The RSI fell from 72 to 56 within a week as the prices dipped, but the momentum on the daily timeframe was also in favor of the buyers.

Hence, despite the recent dip, PEPE is likely to advance toward the 23.6% Fibonacci extension level at $0.0000131.

The $0.0000087 and $0.0000078 short-term support levels could be the place where a reversal occurs. If Bitcoin [BTC] begins to falter and retreat from $67k, PEPE can be expected to retrace deeper.

Sentiment has been weak recently

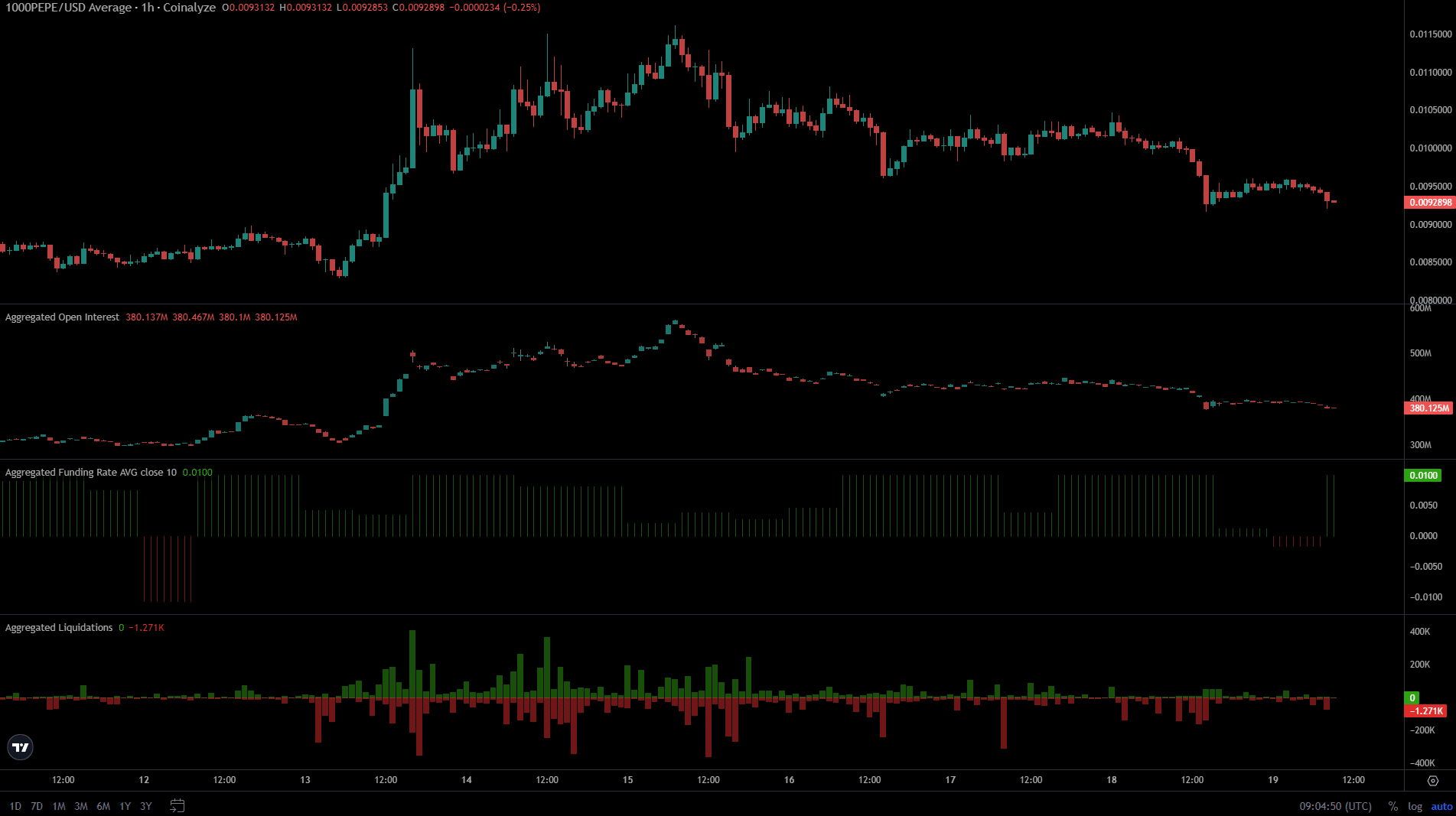

Since the 15th of May, when PEPE reached the local highs and faced rejection, the Open Interest has trended downward. The price has also slipped lower.

The Funding Rate was at +0.01% with occasional dips that reflected increased short positions.

The liquidations of the past 48 hours have been from bullish traders. This forced selling added to the bearish pressure.

Read Pepe’s [PEPE] Price Prediction 2024-25

However, it was not as volatile as the 15th, when both long and short positions of greater size got eliminated.

Hence, the local bottom might be nearby and a period of consolidation could follow. Traders could watch out for this and keep an eye on the lower timeframe charts for a revival.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.