- BNB’s price action remained less volatile over the last seven days.

- Most metrics looked bullish on BNB, but a few suggested otherwise.

Binance Coin’s [BNB] momentum declined over the last week as the coin didn’t showcase much volatility.

However, this might be the prelude to a massive rally, as BNB’s price was sitting at a crucial level that could allow it to reach a new all-time high.

BNB to break out soon?

The last week remained relatively less volatile, as the coin’s price moved down by just 1.5%. In fact, in the last 24 hours, the coin didn’t move much.

According to CoinMarketCap, at the time of writing, BNB was trading at $580.59 with a market capitalization of over $85.6 billion.

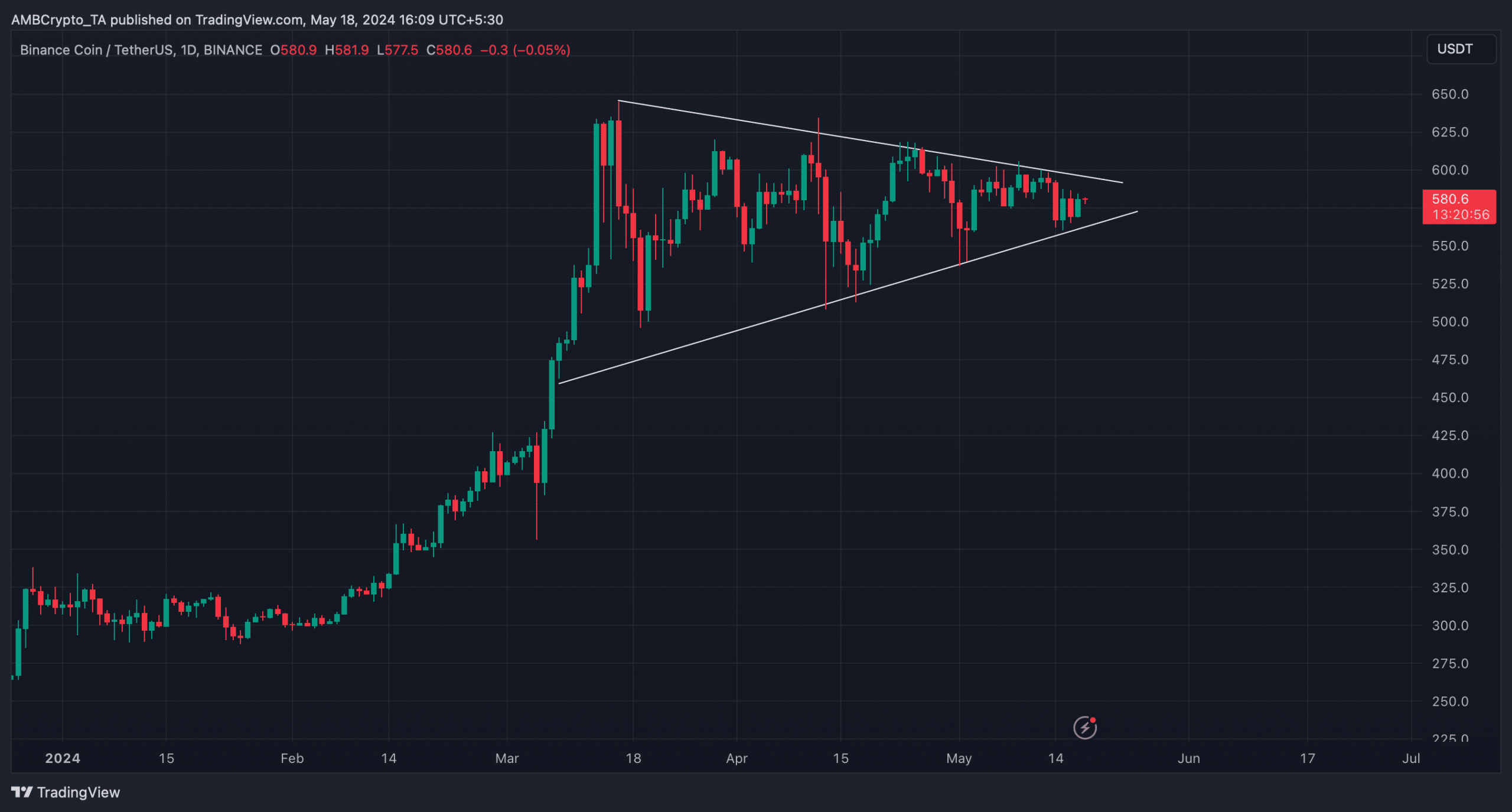

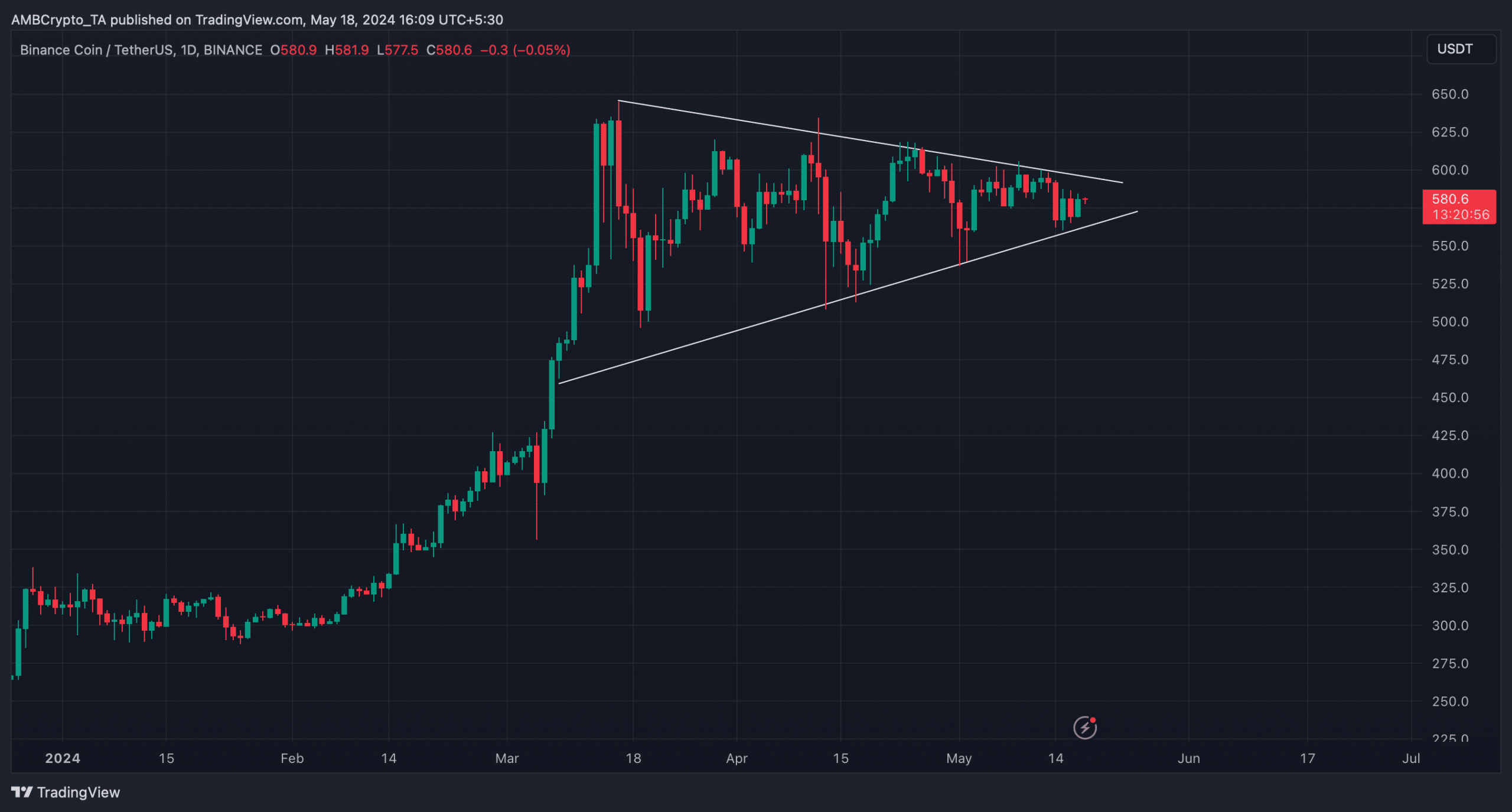

But investors must not lose hope, as the coin has a trick up its sleeve. AMBCrypto’s analysis of the coin’s price chart revealed a bullish pennant pattern.

BNB entered the pattern in mid-March and, since then, has consolidated inside it.

At press time, the coin was close to breaking out of the bull pattern. A successful breakout could translate into a massive bull rally, allowing it to go above its March highs.

If things fall into place, then the coin might as well go above its ATH of $661 in the coming weeks or months.

Source: TradingView

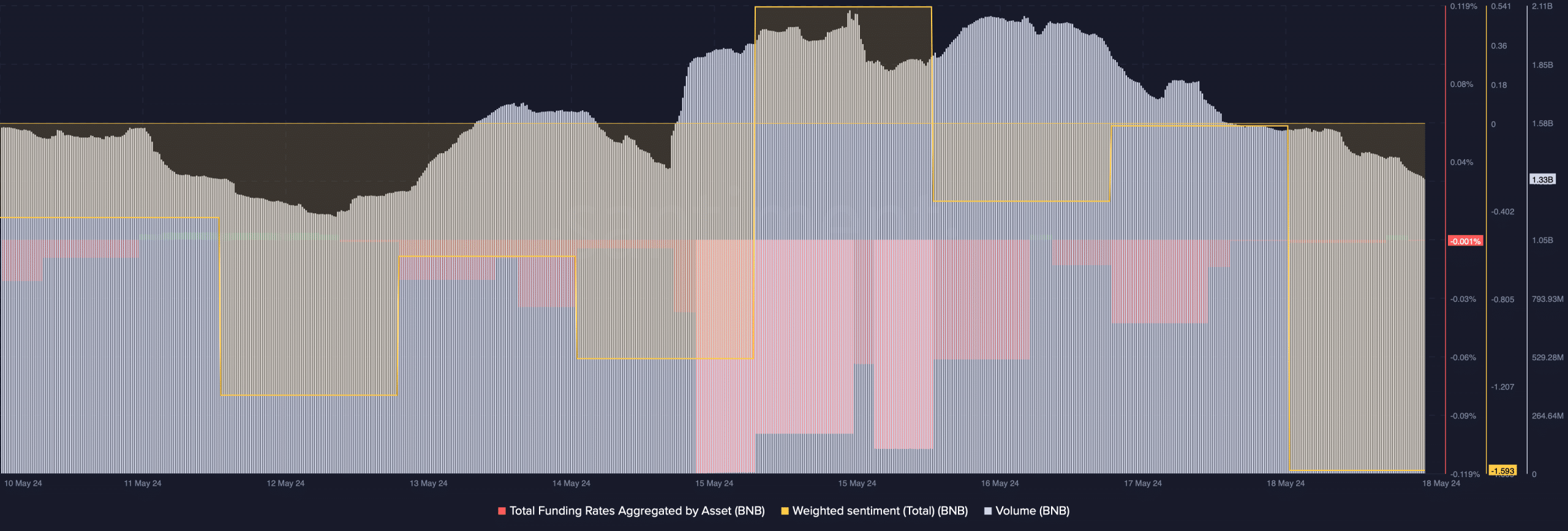

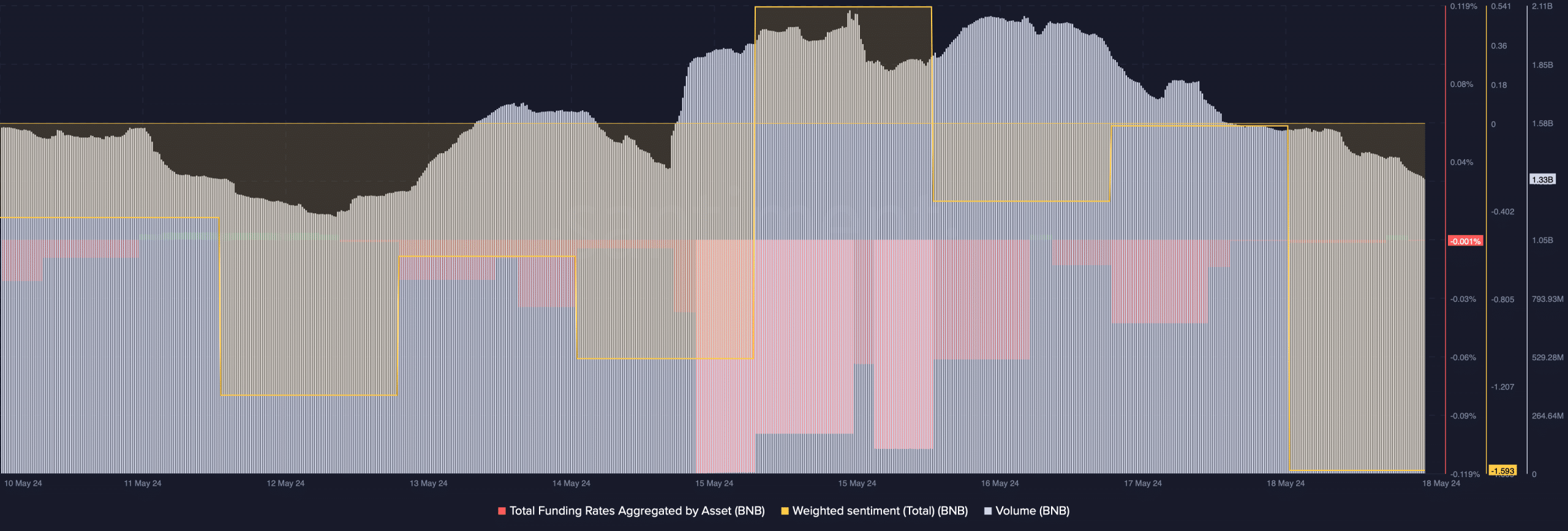

A few of the on-chain metrics also looked pretty optimistic for the coin, as they supported the possibility of a breakout of the bullish pattern.

For instance, BNB’s Funding Rate remained low. Generally, prices tend to move the other way than Funding Rates, hinting at a price uptick in the coming days.

Source: Santiment

Another good news was that the coin’s trading volume declined over the last few days, while its price action remained bearish.

This meant that investors were not actively trading BNB, suggesting that the bearish trend might last longer. However, sentiments around BNB remained bearish, as evident from its low Weighted Sentiment.

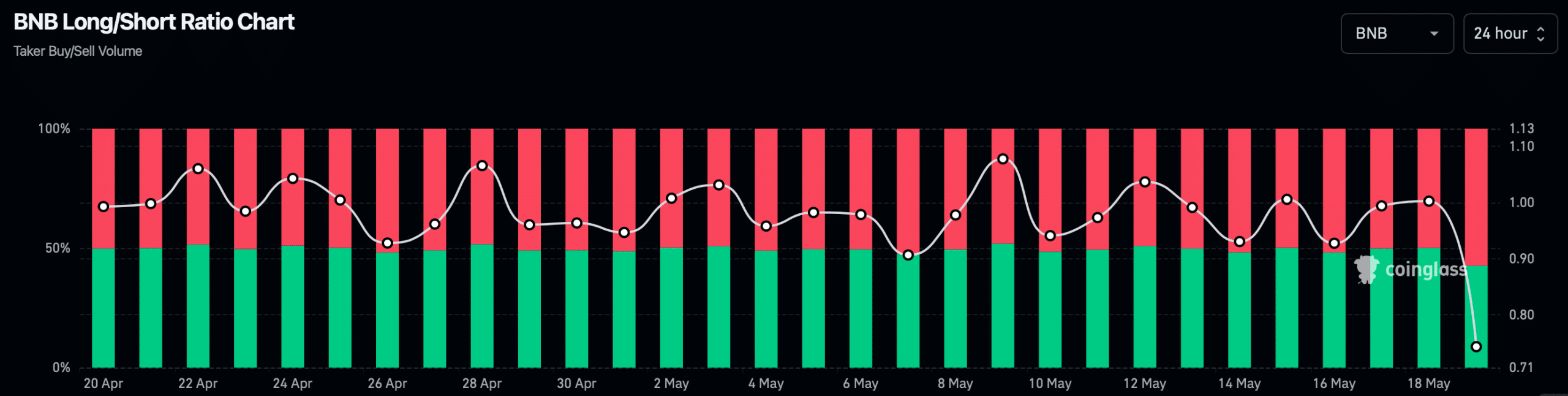

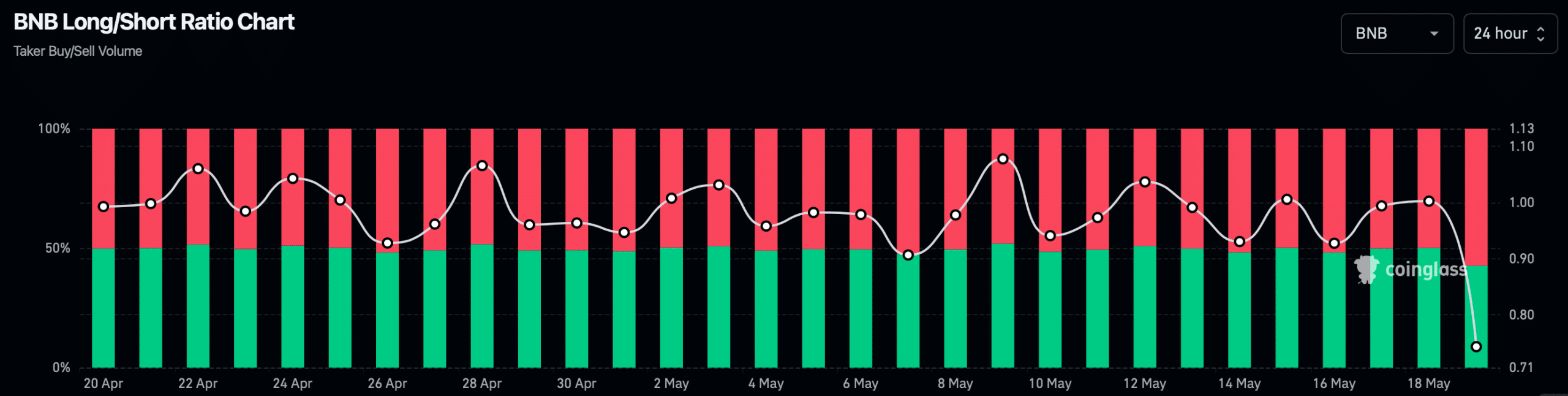

Another concerning metric was the coin’s Long/Short Ratio, which dropped at press time. A low ratio denotes a bearish sentiment, in which there is a greater inclination to short or sell assets.

Source: Coinglass

BNB tests a resistance

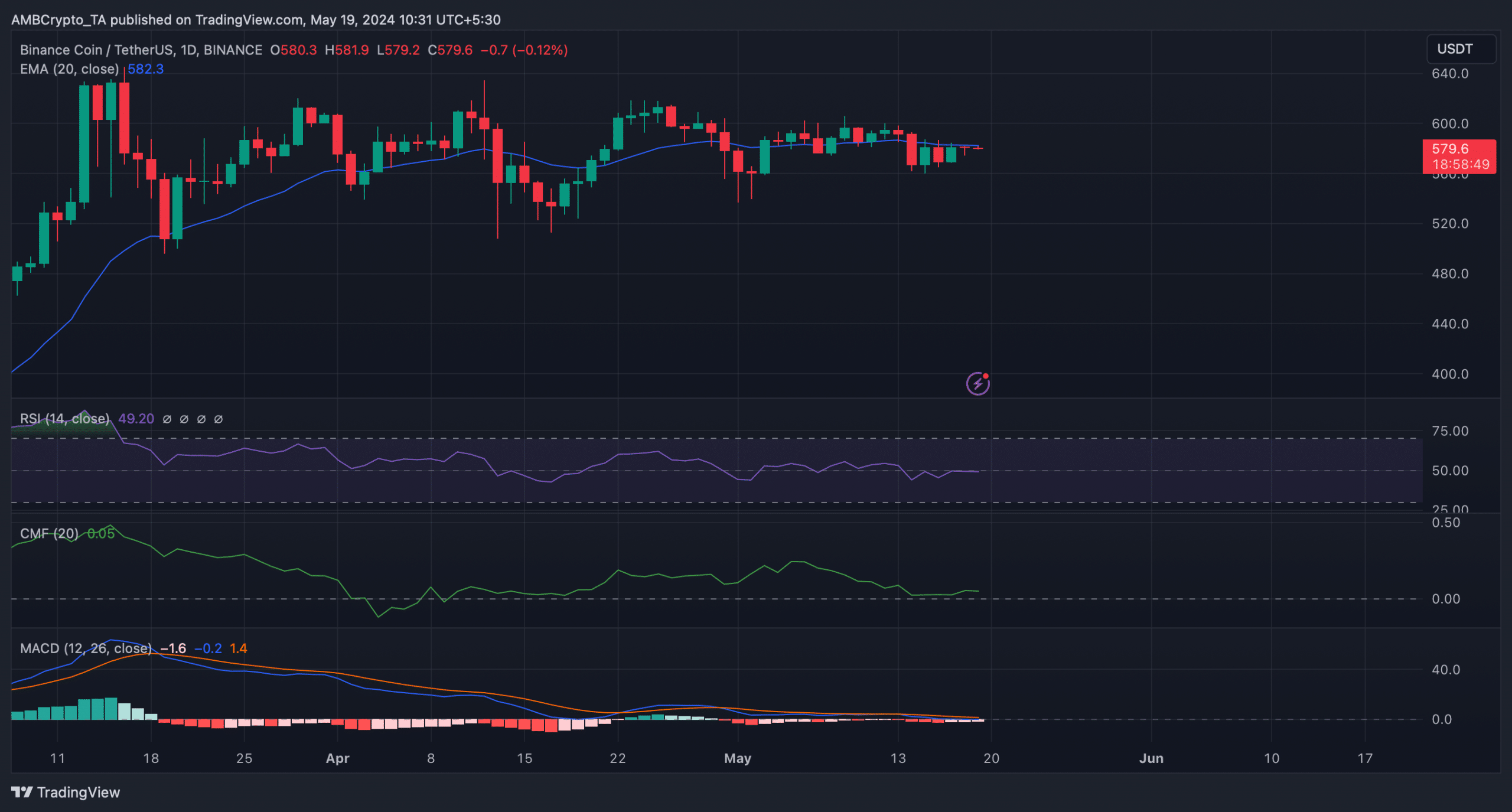

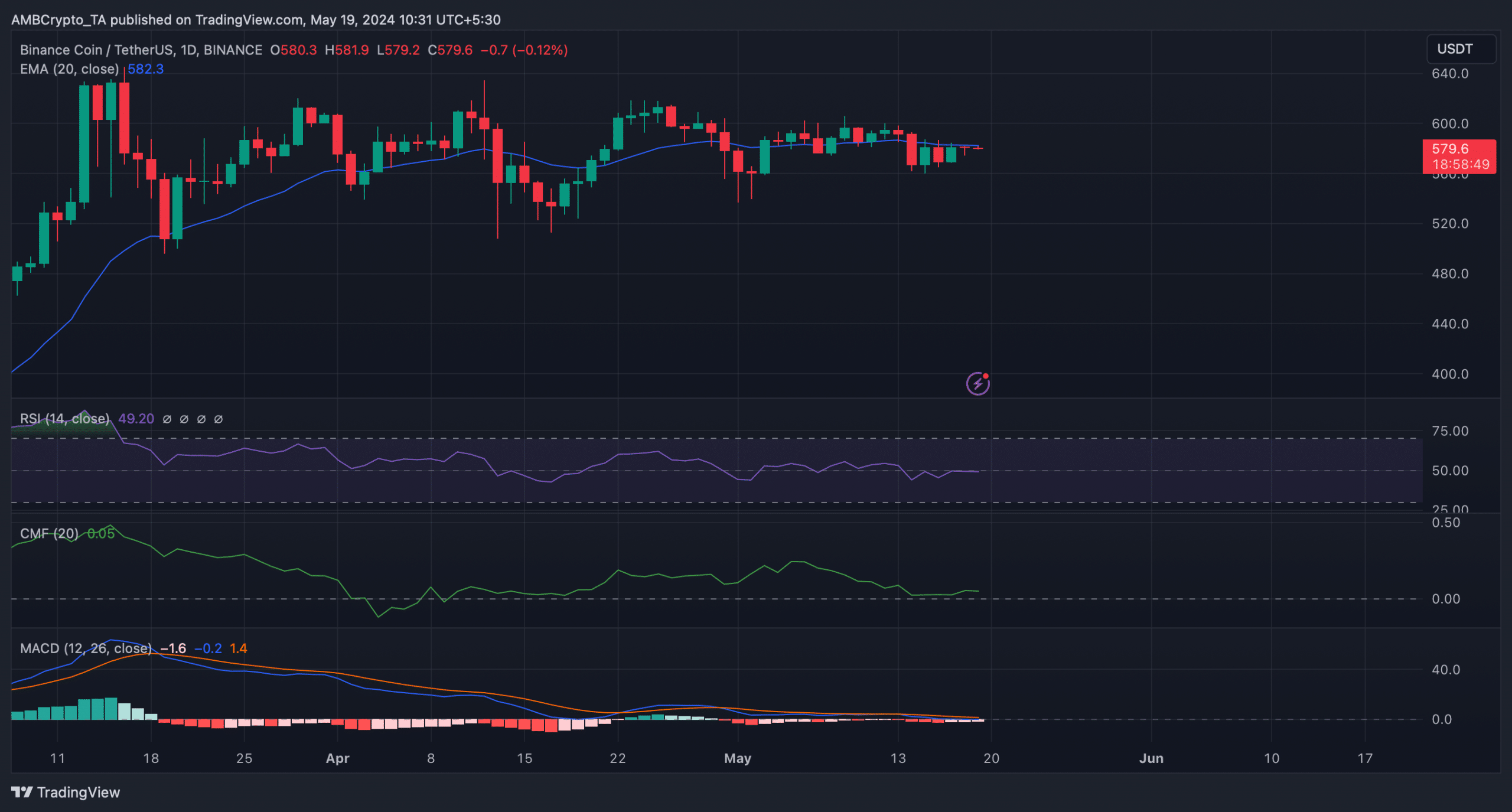

AMBCrypto then analyzed BNB’s daily chart to better understand whether the coin is expecting a breakout. As per our analysis, BNB’s Relative Strength Index (RSI) moved sideways near the neutral mark.

The Chaikin Money Flow (CMF) also followed a similar trend.

Is your portfolio green? Check out the BNB Profit Calculator

Similarly, the coin tested its 20-day Exponential Moving Average (EMA) at press time.

If BNB manages to go above its 20-day EMA, then the chances of a successful breakout from the bullish pattern would increase substantially.

Source: TradingView