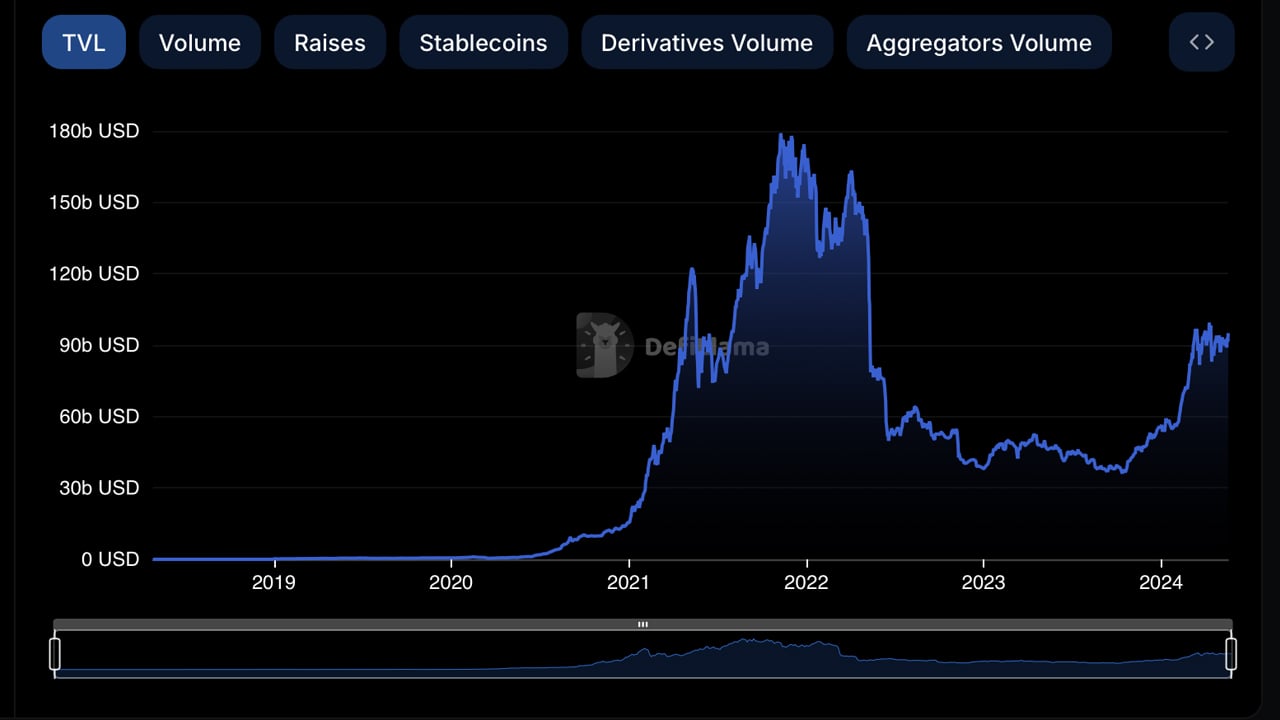

Over the past 35 days, the total value locked in decentralized finance (defi) protocols has expanded by $11.89 billion, recovering from a low of just over $83 billion on April 13. Although it has not yet reached the $100 billion mark, the value locked in defi is approaching that milestone after hovering just below it.

Defi Protocols See $11.89B Boost

As of May 18, 2024, the total value locked (TVL) in defi stands at $94.93 billion, according to stats from defillama.com. This is an increase of $11.89 billion from the $83.04 billion low recorded 35 days prior. Among the top five protocols by TVL, Eigenlayer experienced the largest 30-day increase, with TVL rising by 19.67%.

Total value locked in defi on May 18, 2024, according to defillama.com metrics.

Lido Finance, the largest defi protocol by TVL size, saw a modest increase of 1.49% over the 30-day run. Bitcoin.com News has reported on liquid staking derivatives applications witnessing significant withdrawals in recent weeks.

Still, Lido dominates the TVL of $94.93 billion by holding $29.21 billion in value on May 18, 2024. Eigenlayer’s TVL today is $15.39 billion and between both Lido and Eigenlayer, the duo’s TVL represents 46.98% of the entire TVL in defi. The rest of the top five members saw 30-day increases as Aave’s TVL spiked by 9.21%, Makerdao’s locked value increased by 7.95% and the lending protocol Justlend increased by 4.96%.

Other notable gainers included Etherfi with 28.91%, and Zircuit Staking with 74.61%. Jito saw a 31.84% increase and Marinade Finance expanded by 16.37%. Perfectswap saw a debilitating 30-day reduction of 100% as did eight other defi protocols. While defi continues its steady recovery, with the total value locked inching closer to the significant $100 billion milestone, it may reflect renewed confidence in this dynamic sector of the cryptocurrency ecosystem.

What do you think about the recent action in the world of defi and the TVL inching its way toward $100 billion? Share your thoughts and opinions about this subject in the comments section below.