- XRP whales have increased their accumulation of the token over the last 14 days

- However, this failed to affect the altcoin’s price positively

XRP’s price has maintained a downtrend on the charts lately. This, despite the spike in whale activity over the past two weeks.

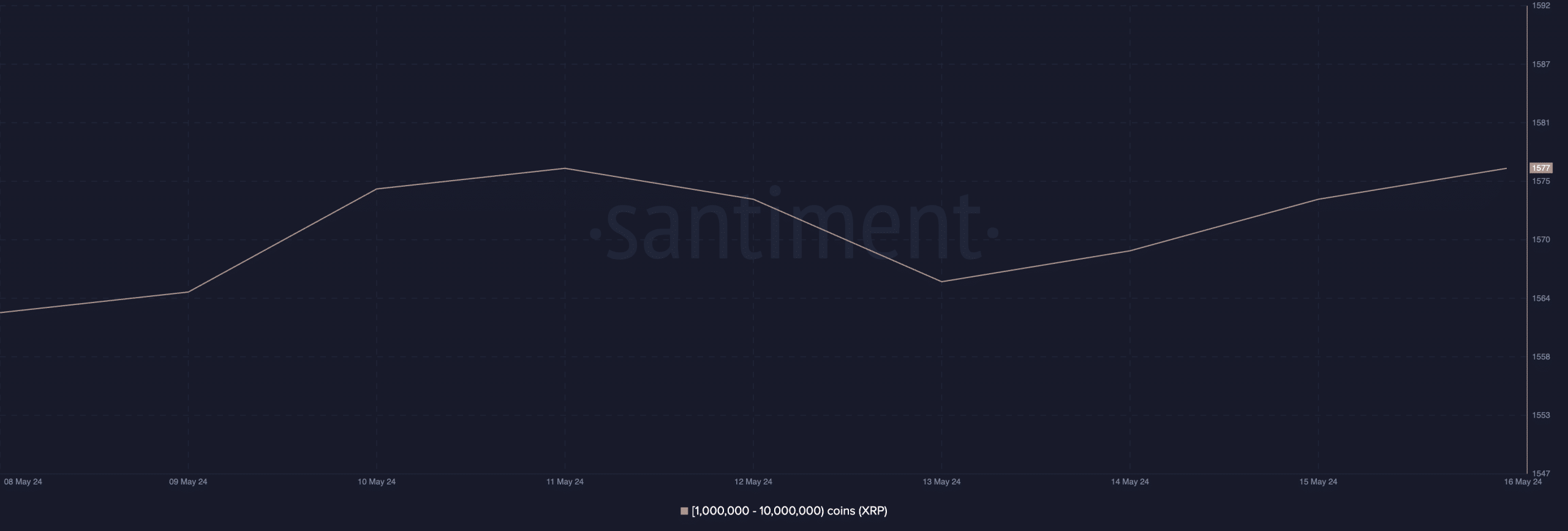

In fact, on-chain data from Santiment revealed that XRP whales that hold between 1,000,000 and 10,000,000 tokens acquired 110 million XRP worth around $55 million over this period.

Source: Santiment

Contrary to expectations though, after the altcoin’s price peaked at $0.56 on 6 May, it has since declined by 9%. At press time, XRP was trading at $0.51 on the charts.

XRP’s on-chain demand has cratered

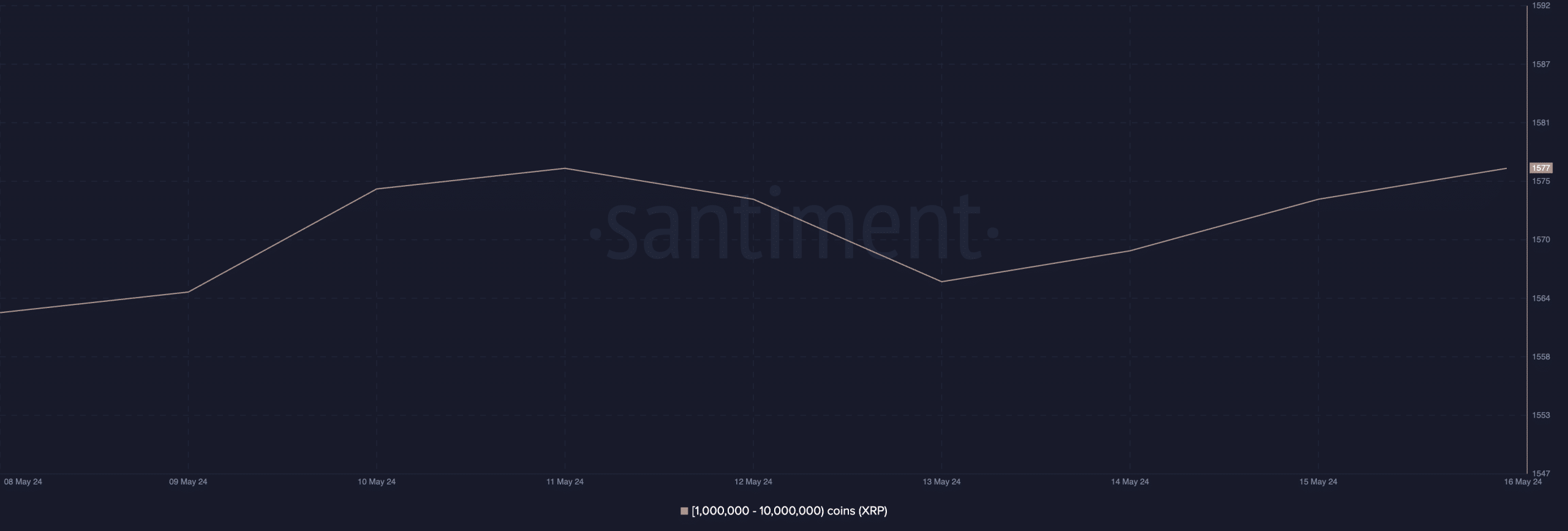

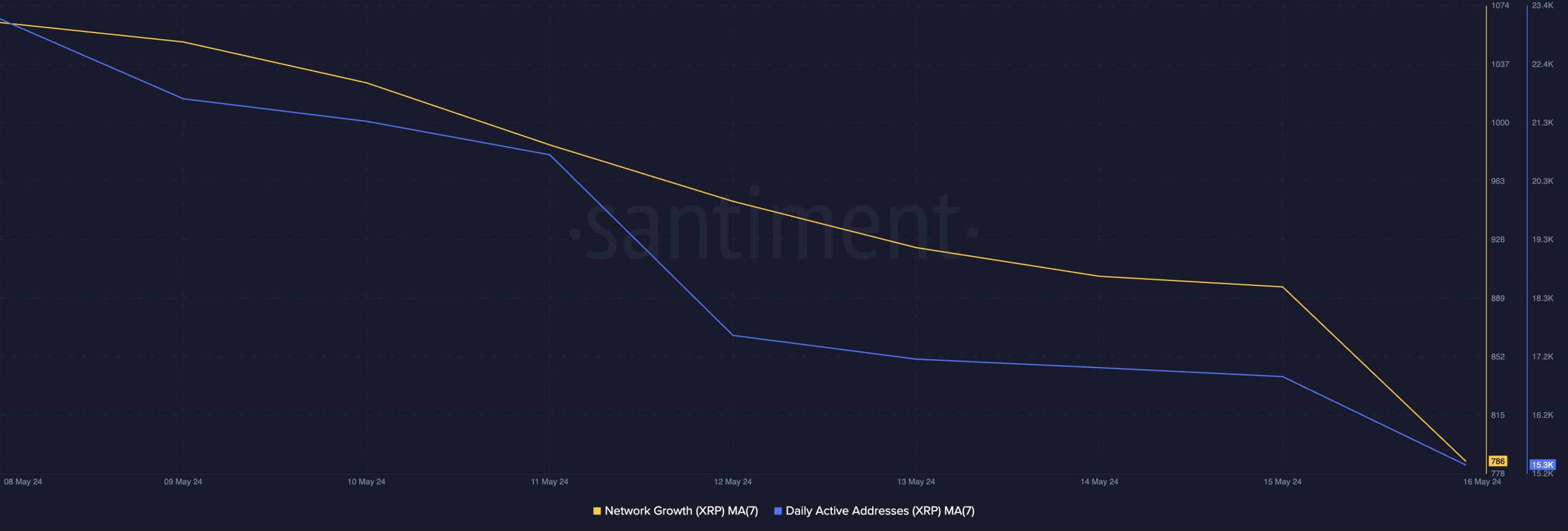

While a cohort of XRP whales has intensified accumulation, the market has seen a general decline in demand for the altcoin. For instance, according to Santiment’s data, XRP’s daily active address count observed using a seven-day moving average (MA) fell by 27% in the last week.

Likewise, new demand for XRP plummeted during the same period. Also observed using a seven-day MA, the daily count of new addresses involved in XRP trades over the past week dropped by 16%.

Source: Santiment

The reason for this is plausible. Amid the general market uptick over the last seven days, XRP investments have mostly returned losses.

AMBCrypto assessed the daily ratio of XRP transaction volume in profit to loss (7-day MA) and found that in the last week, for every transaction involving the altcoin that ended in a loss, only 0.91 transactions returned a profit. This means that XRP investors have recorded more losses than they have made a profit in the last seven days.

As a result, the negative sentiment trailing the altcoin gained momentum. At the time of writing, the token’s weighted sentiment had reading of just -0.56.

Read Ripple’s [XRP] Price Prediction 2024-25

Futures traders remain focused

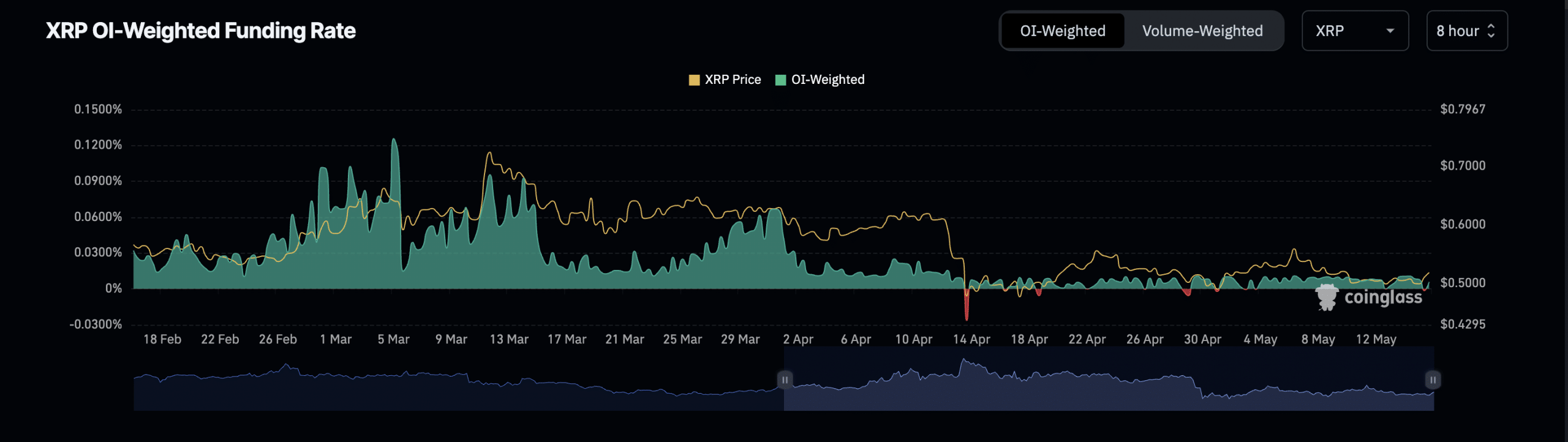

Interestingly, despite XRP’s low price action over the past week, its Futures traders have maintained a bullish outlook.

The token’s open interest has been on an uptrend since the beginning of May. With figures of $583 million at press time, it has since hiked by 9%, according to Coinglass data.

Furthermore, the token’s funding rate across cryptocurrency exchanges remains positive too. Here, funding rates are a mechanism used in perpetual Futures contracts to ensure the contract price stays close to the spot price.

Source: Coinglass

When an asset’s funding rate is positive, its contract price is higher than its spot price. This is a sign that more traders are holding long positions and are expecting a price rally on the charts.