- Bitcoin shows signs of bullishness, moving out of the post-halving “danger zone.”

- Strong support at around $60,000 suggests upward momentum could resume.

Bitcoin [BTC], the leading cryptocurrency, has recently exhibited slight bullish signs, pushing its trading price above the $63,000 mark before settling at around $62,013.

This movement suggested a tentative recovery from previous lows and a potential shift in market dynamics.

An end of Bitcoin’s riskiest phase?

Crypto market analyst Rekt Capital recently highlighted that Bitcoin might have navigated through the most hazardous phase post-halving, a period typically marked by significant corrections.

According to historical data, such “danger zones” are often followed by phases of re-accumulation, and Bitcoin’s recent bounce from key support levels might indicate the start of this trend.

Bitcoin’s journey post-halving has been fraught with volatility. After peaking in mid-March, the cryptocurrency experienced a 23% drop, reaching a low of $56,800 on the 1st of May.

This price point could potentially represent the bottom of the post-halving downturn, marking a pivotal moment for investors and traders alike.

Rekt Capital noted,

“If $56,000 was not the bottom then this current pullback will have officially equalled the longest retrace in this cycle at 63 days. History however suggests that this current pullback ended at $56000 and 47 days.”

This observation aligned with the asset recent bounce back to over $63,000 yesterday, suggesting a return to a re-accumulation phase.

Future projections and technical insights

While historical trends offer a roadmap, they don’t guarantee future outcomes. Market fluctuations and sideways movements are still possible. Yet, RektCapital noted,

“Bitcoin is showing early-stage signs of slowing down in its sell-side momentum, slowly developing a curl against the ~$60000 support.”

For a sustainable recovery, this support must hold. If successful, Bitcoin could target a return to higher levels, potentially reaching $68,000.

This projection is underpinned by technical analyses and current market sentiment.

Source: RektCapital/X

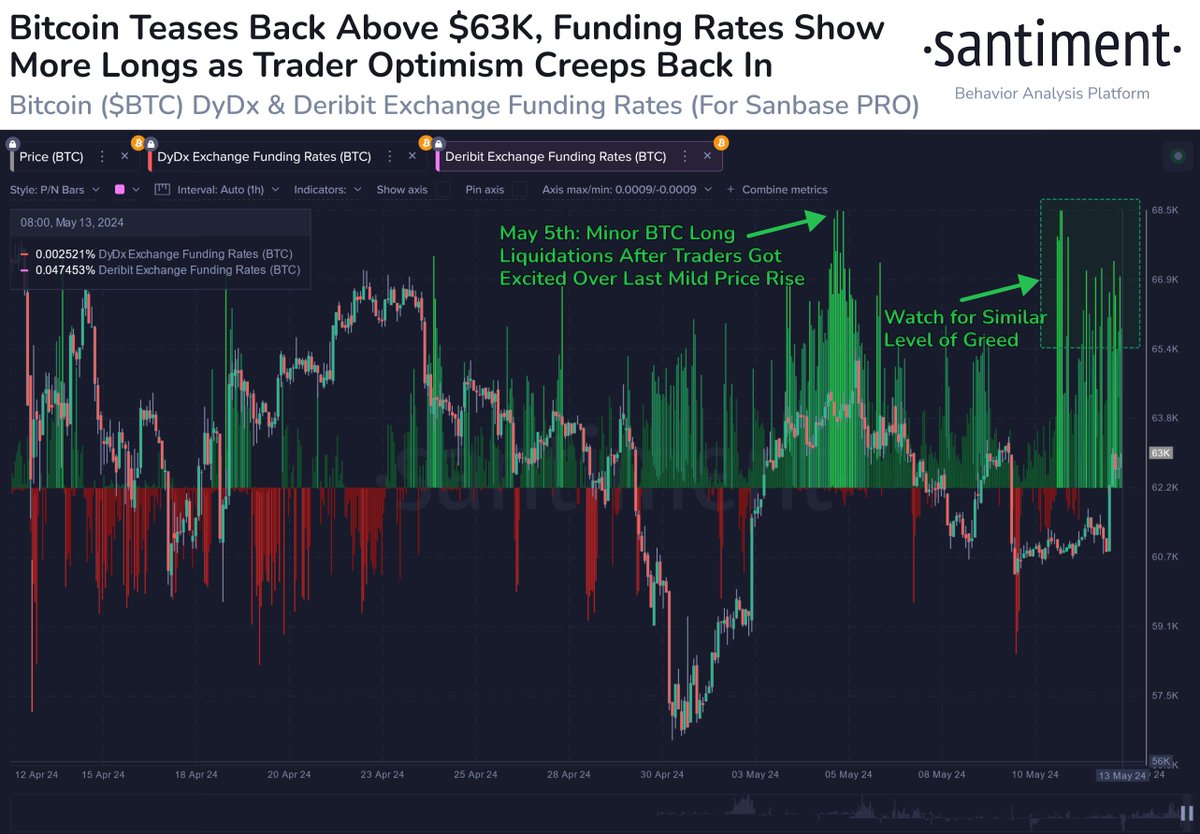

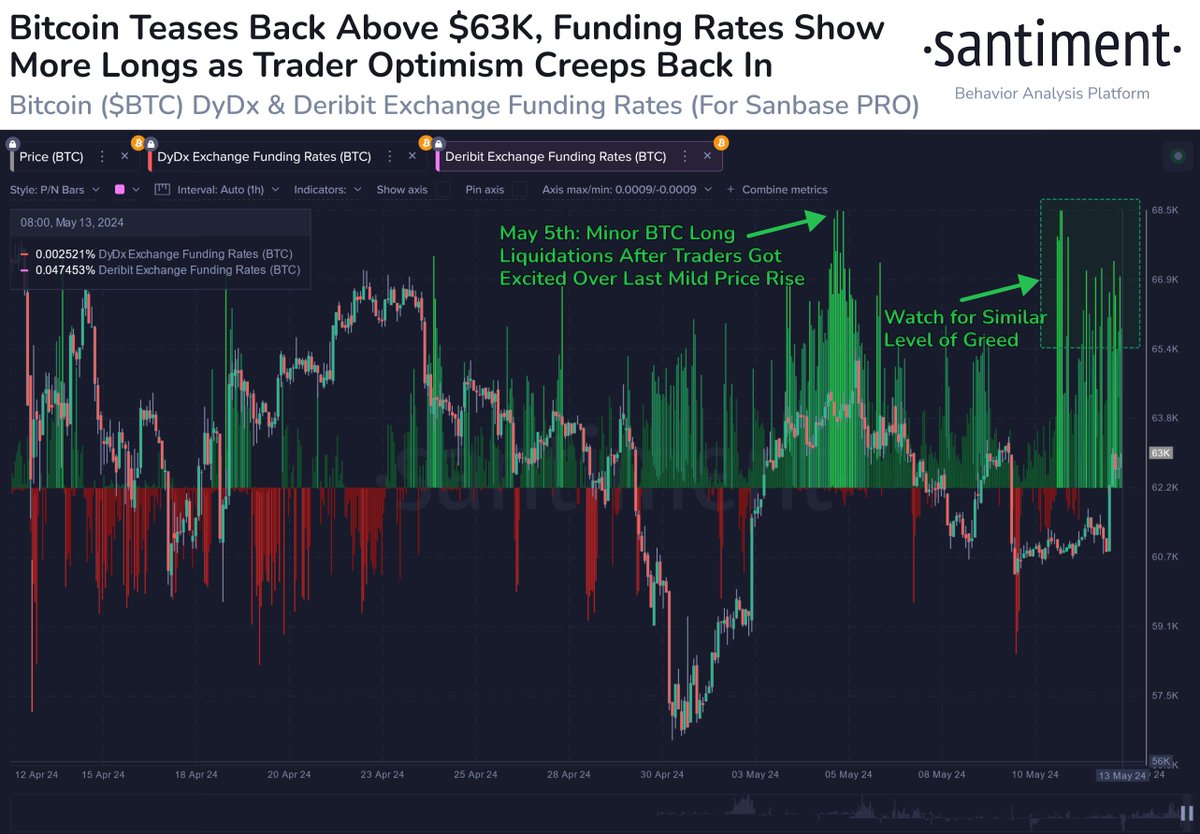

Santiment, a prominent analytics platform, has observed a rise in Bitcoin’s Funding Rate on exchanges like DyDx and Deribit.

This increase can be a double-edged sword, indicating growing interest but also the risk of repeating past market tops.

Santiment disclosed that to avoid a repeat of last week’s downturn, it’s crucial for bullish momentum to be moderate, with an equal or higher rate of short positions compared to longs.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

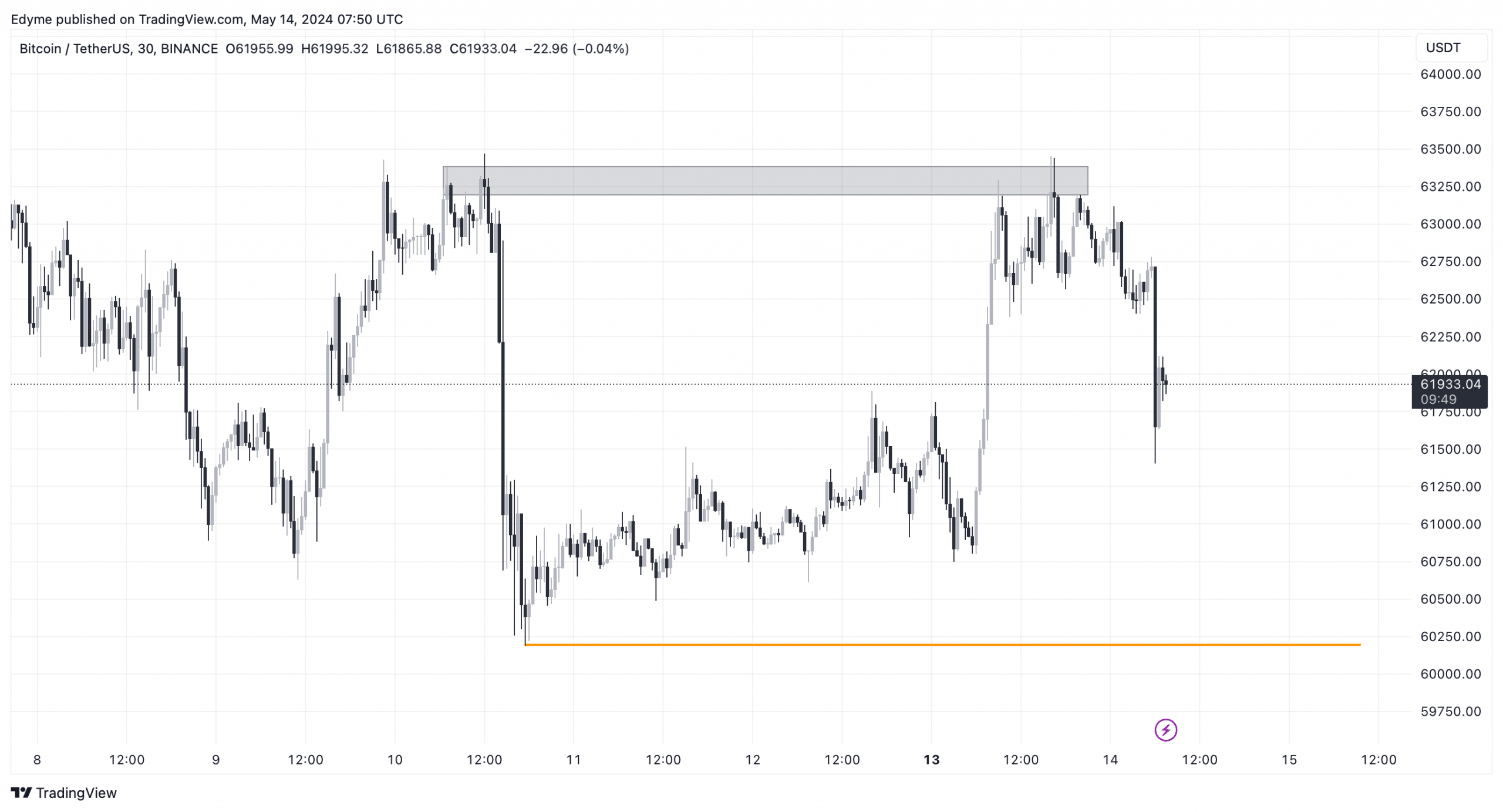

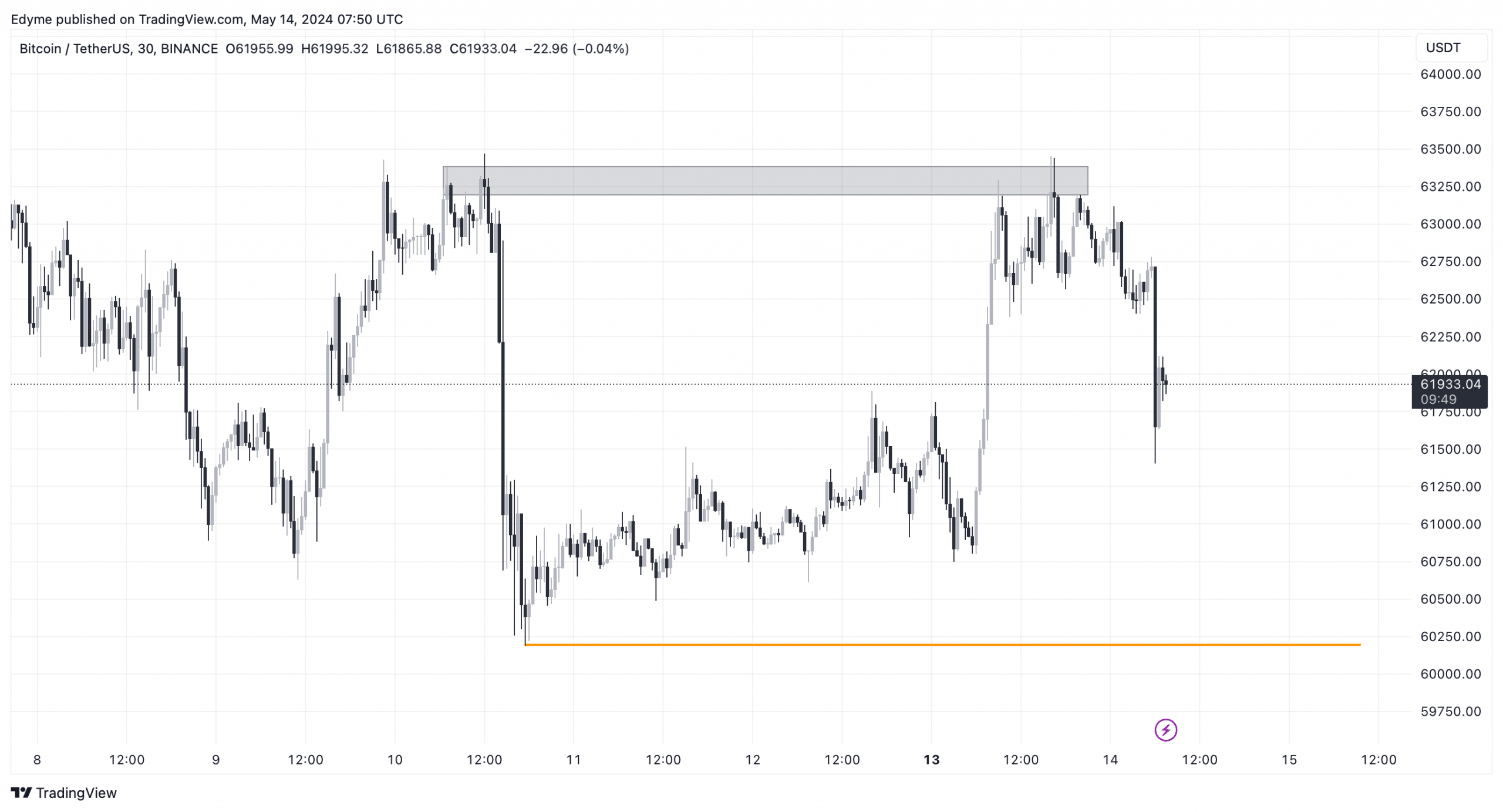

On the technical front, Bitcoin’s daily chart suggested short-term bearish pressure due to recent lower lows.

However, a zoom into the 30-minute chart shows Bitcoin tapping into liquidity at the $63,000 region, hinting at a potential short term sell-off towards the $60,000 swing low before any major bullish reversal.

Source: TradingView