- The token was oversold, suggesting a reversal to the north.

- DAA fell more than XRP’s price, indicating that $0.50 could be a good entry.

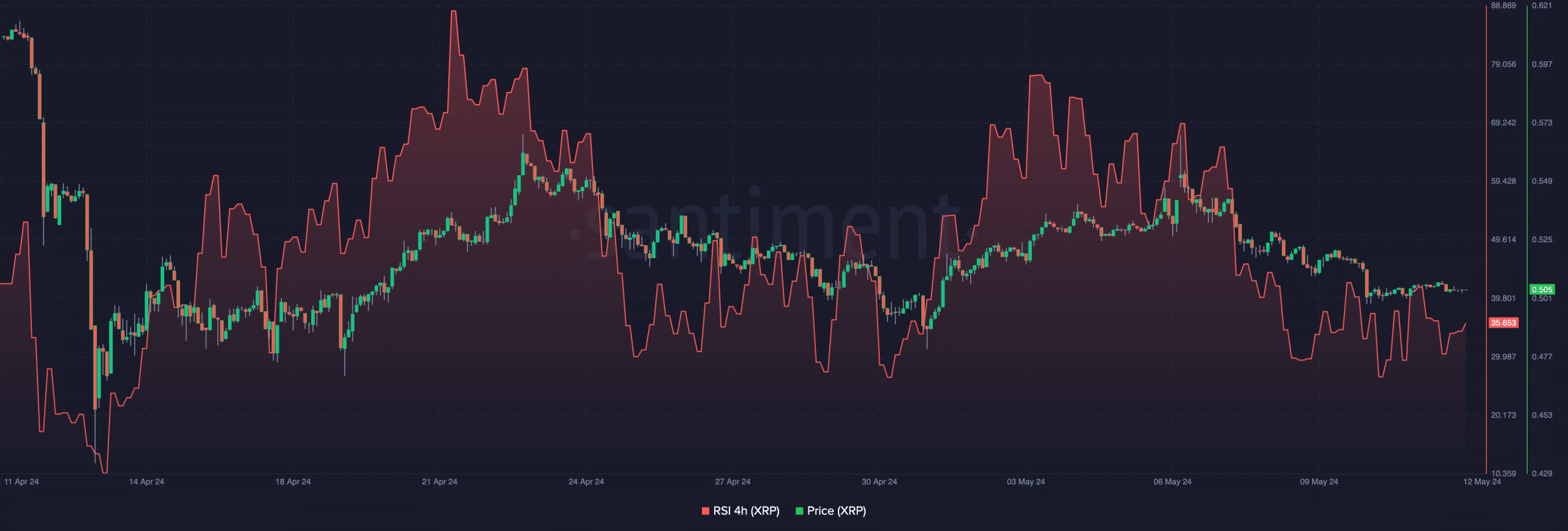

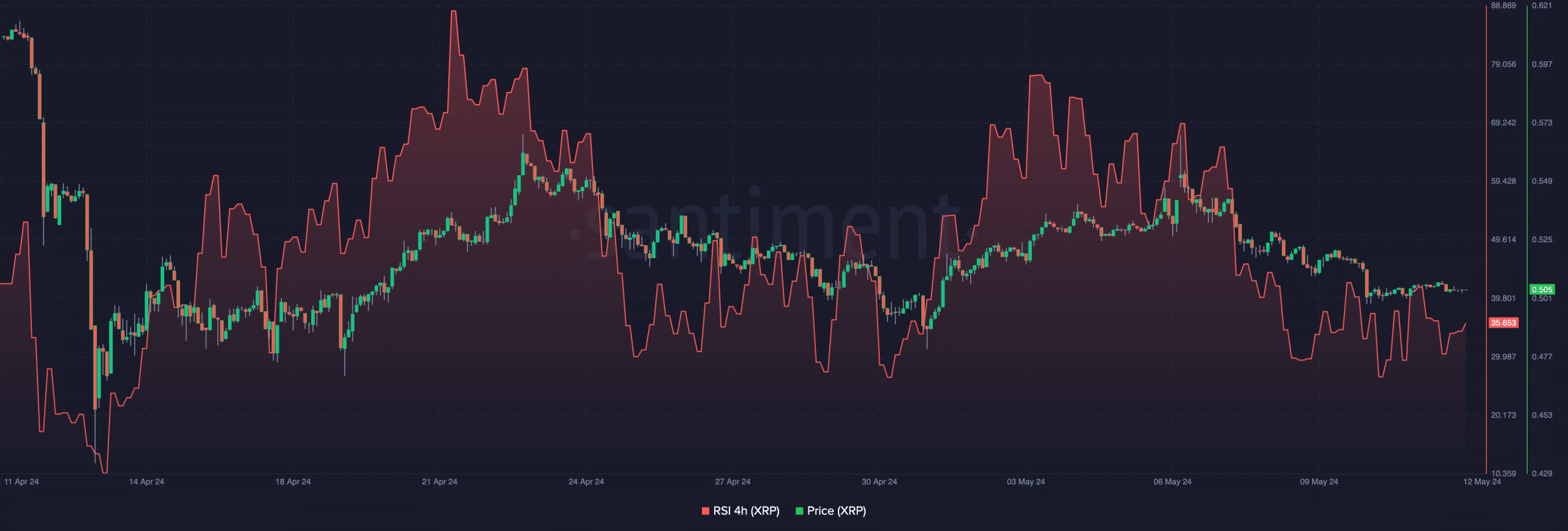

XRP, the native token of the XRP Ledger, became oversold on the 12th of May. This was the signal the Relative Strength Index (RSI) on the 4-hour chart indicated.

The RSI is a technical indicator that shows if a cryptocurrency’s momentum is bullish or bearish. Reading at 70 and above suggests that a token is overbought.

The door is open for buyers

However, when the RSI is at 30 or below, it means the asset is oversold.

On the said data, the indicator went low to 30.09 before the press time reading of 35.65, which inferred that a significant bounce could be in motion.

The last time XRP was in a situation like that, the price jumped. Days later, the value of the token tapped $0.56 before another retracement.

Therefore, if the pattern comes to life again, the price of XRP might be on its way to the aforementioned price.

Source: Santiment

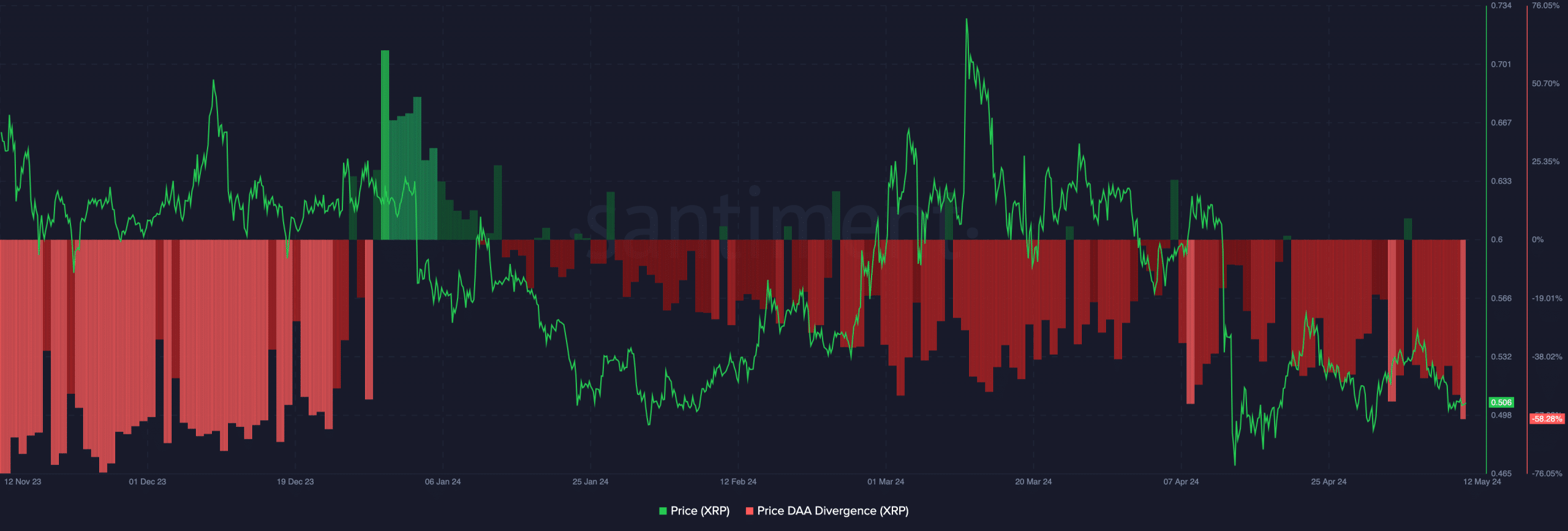

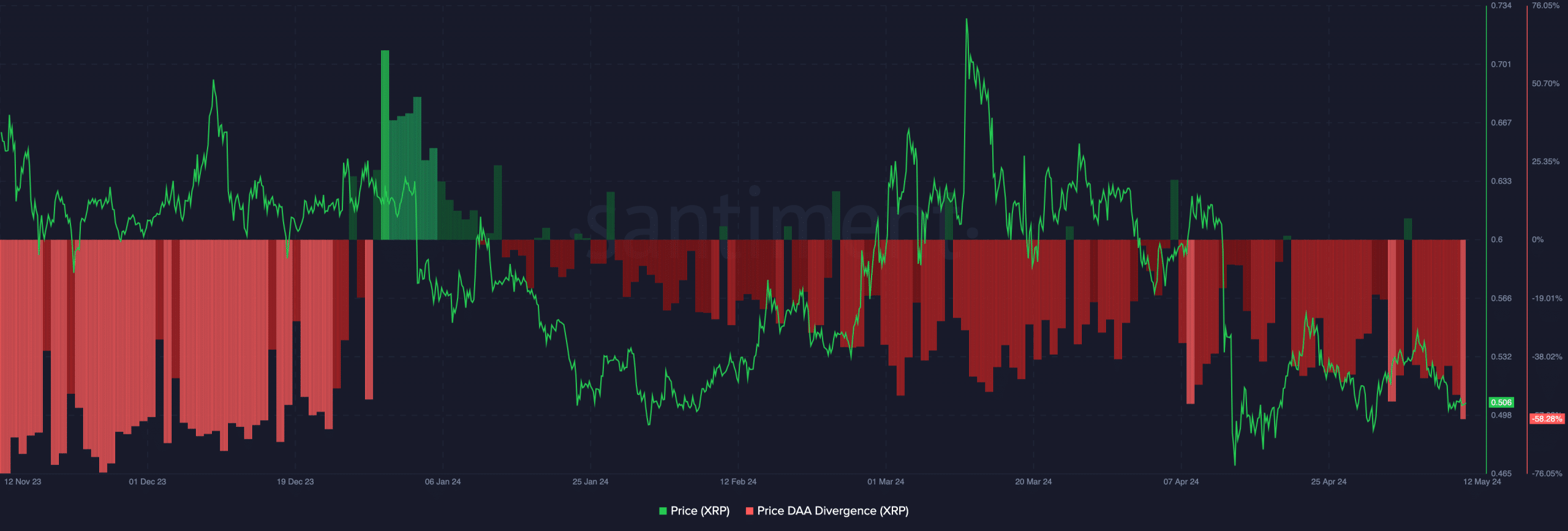

But momentum alone cannot determine the next price direction. As a result of this, AMBCrypto evaluated other metrics. The first on-chain metric considered was the price-DAA divergence.

DAA is an acronym for Daily Active Addresses and tracks the level of user interaction on the network. With the price-DAA divergence, traders can find entry and exit points.

For the uninitiated, this indicator is extremely valuable. This is because higher prices can attract more people to buy XRP, thereby, leading to an increase in network activity.

But in most cases, prices hit a local top when this occurs. On the other hand, an unusual increase in active addresses might force growth in the price of the token.

XRP does not need BTC this time

Therefore, if the price grows more than the DAA, then it could be a sign to buy. On the other hand, a situation where the price declines more than the DAA is a solid exit signal.

As of this writing, the cryptocurrency’s price-DAA was -58.28%, indicating that activity on the XRP Ledger has been unimpressive.

Though XRP has lost 14.66% of its value in the last 30 days, the decrease in active addresses was more.

Source: Santiment

As such, buying XRP at $0.50 might be a good idea. Also, $0.56 looks like a possible short-term target. But this might not necessarily depend on Bitcoin’s [BTC] movement.

As of this writing, BTC’s correlation coefficient with XRP was 0.56. Values of the correlation coefficient range between -1 and +1 where the former indicates divergence while the latter a strong similar movement.

Realistic or not, here’s XRP’s market cap in BTC terms

Therefore, XRP’s correlation with the number one cryptocurrency per market cap was weak.

Therefore, if the price of Bitcoin fails to move northward, that might not stop XRP from rising in the $0.56 direction. Still, traders should not rely on these indicators alone.