- Memecoin’s price climbed by over 6% in the last 24 hours

- Technical indicators suggested a sustained bull rally may be possible

PEPE has showcased some impressive performance over the last few days, with the altcoin now steadily closing in on its all-time high. Does this mean the memecoin will soon breach its old ATH though? Well, let’s have a look at PEPE’s current state to see whether that’s a viable possibility.

PEPE bulls are pushing hard

Investors enjoyed profits last week as PEPE’s price surged by more than 10%. In fact, according to CoinMarketCap, in the last 24 hours alone, the memecoin’s value appreciated by over 6.5%.

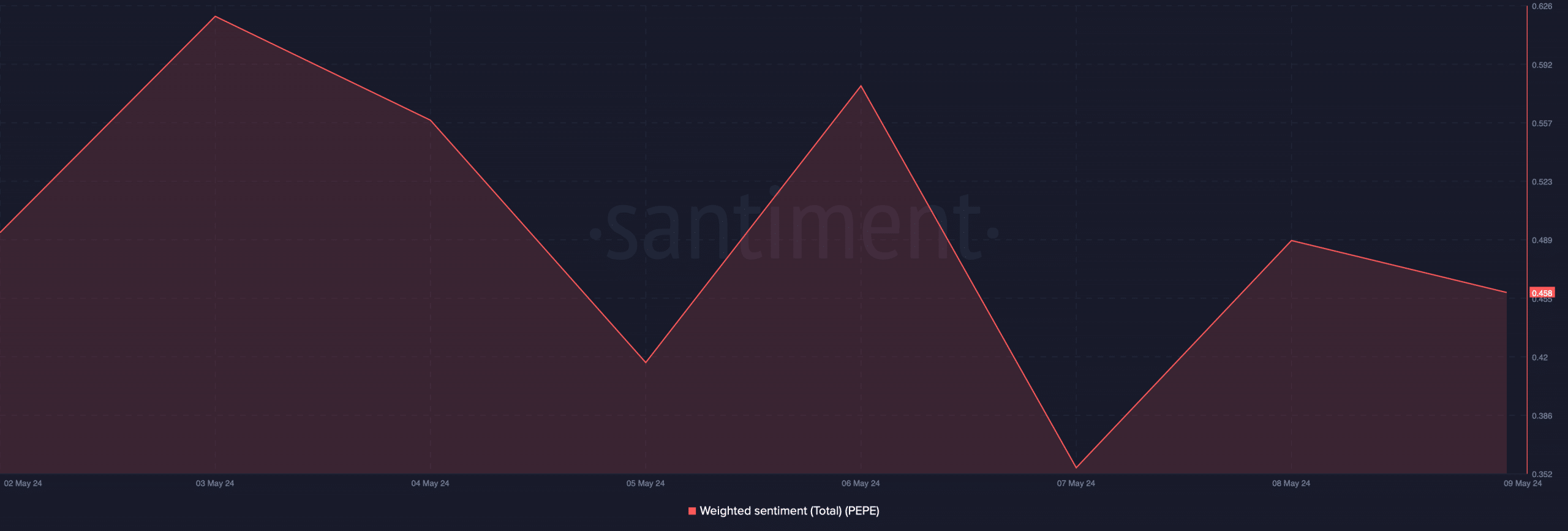

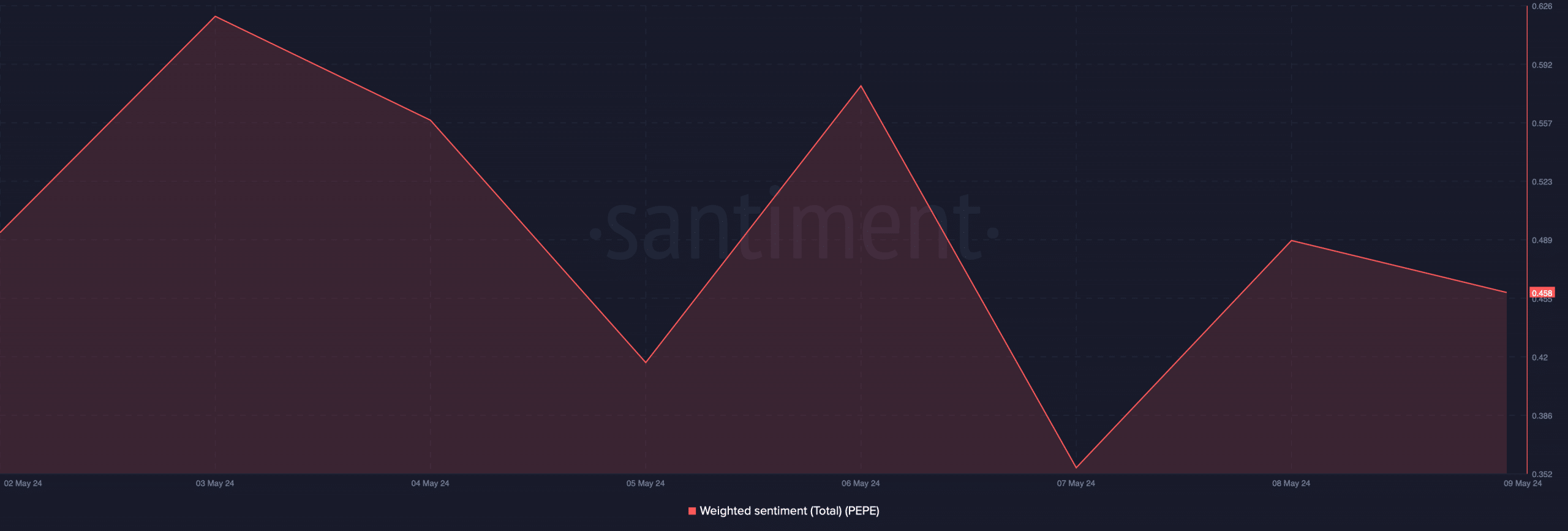

And yet, bullish sentiment around the memecoin declined slightly – With the same evidenced by the drop in its weighted sentiment.

Source: Santiment

However, according to one analysis, the drop in investors’ confidence might not affect PEPE adversely yet. Plazma, a popular crypto-analyst, is of this view, with the analyst tweeting that the memecoin is set to test its ATH.

To see whether that’s possible, AMBCrypto analyzed PEPE’s on-chain metrics. As per our analysis of Santiment’s data, PEPE’s MVRV ratio had a value of 16.26%. Whale activity around the memecoin was also high last week.

Following a deeper look at the same, we found that the memecoin’s supply held by top addresses hiked too. This clearly meant that whales were buying PEPE – A sign that they expect the memecoin’s price to surge in the coming days.

Source: Santiment

PEPE to hit new highs soon?

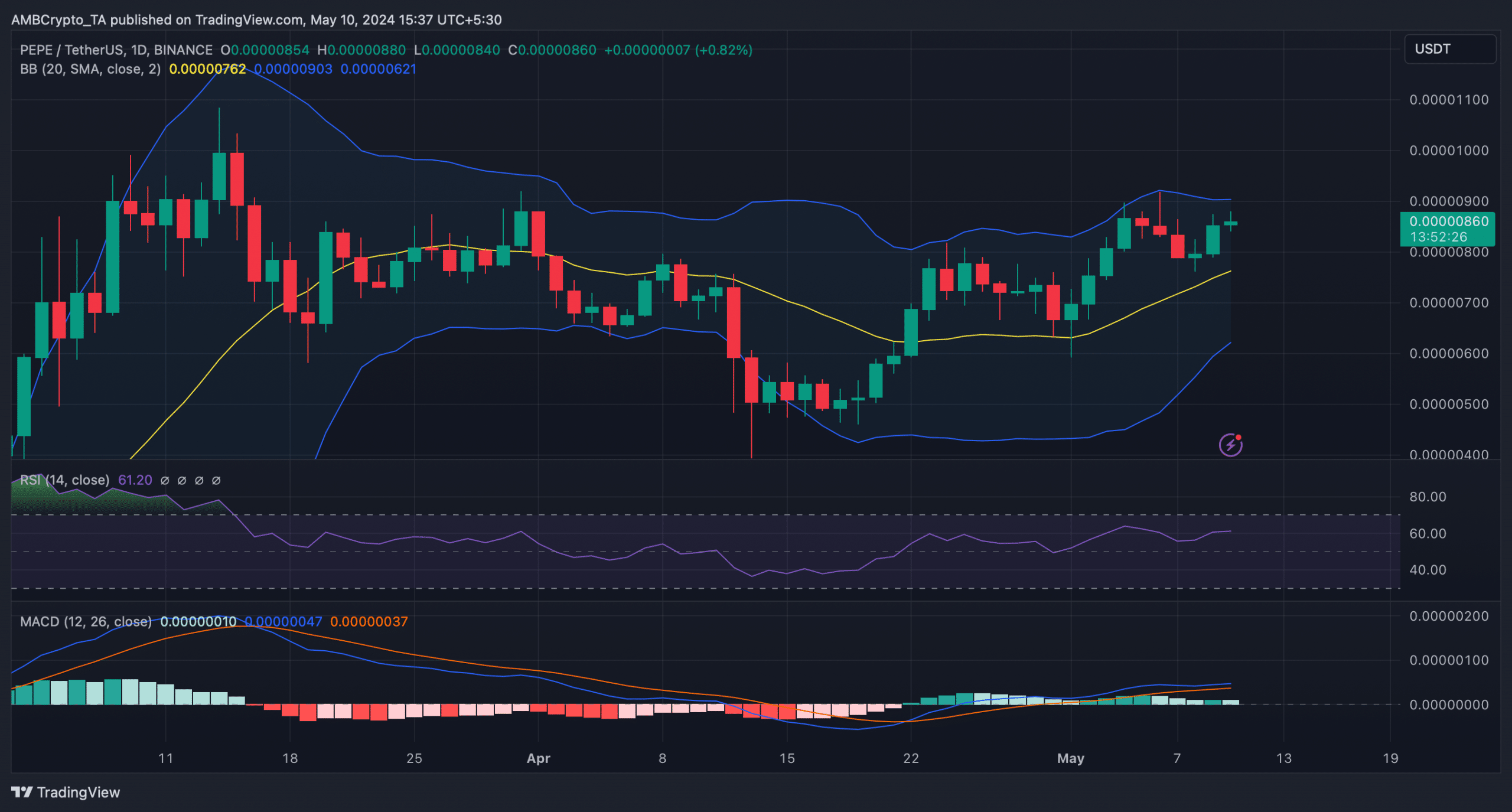

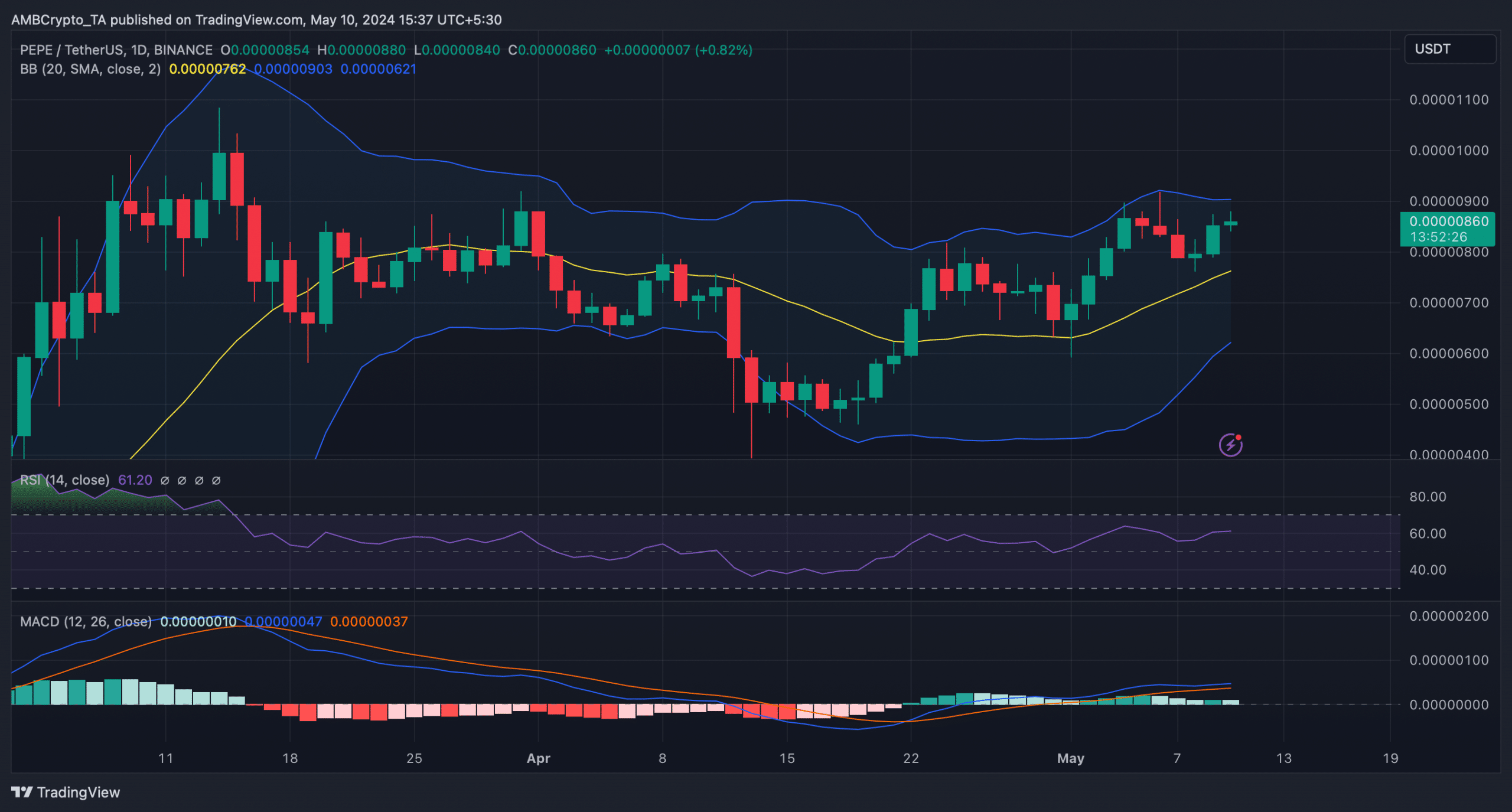

AMBCrypto then checked the memecoin’s daily chart to see how likely it is for the coin to touch its ATH again.

The MACD projected a bullish advantage in the market, while the Relative Strength Index (RSI) was resting above neutral. Additionally, the Bollinger Bands implied that PEPE’s price was well above its 20-day Simple Moving Average (SMA), meaning a sustained rally would be possible.

Source: TradingView

To see whether there were any other resistance zones before the ATH, we then took a look at Hyblock Capital’s data. We found that PEPE’s liquidation would rise sharply near the $0.00000928-mark. A rise in liquidations often results in price corrections.

Therefore, it’ll be crucial for the memecoin to go above that level. A successful breakout above it would clear its path towards testing its ATH.

Source: Hyblock Capital

Is your portfolio green? Check the PEPE Profit Calculator

However, nothing can be said with certainty, as IntoTheBlock’s data revealed that only 1% of PEPE investors are out of money right now. This can motivate investors to sell their holdings. This can also increase selling pressure and in turn, put an end to the memecoin’s rally.